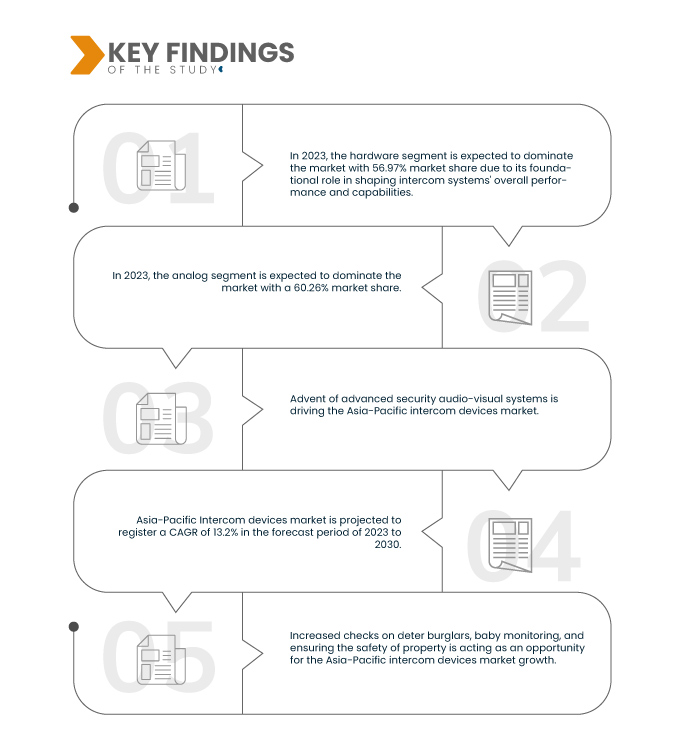

The advent of advanced security audio-visual systems has significantly transformed the landscape of the market, ushering into a new era of enhanced communication, surveillance, and security capabilities. This technological evolution has spurred remarkable innovations in intercom devices, driving their demand across diverse industries and regions. Traditional intercom systems primarily focused on audio communication. However, the integration of advanced security audio-visual systems has brought about a revolutionary shift by combining both audio and video elements. This convergence has empowered users with the ability to not only hear but also see the individuals they are communicating with. In security contexts, this translates to improved verification processes, as personnel can visually confirm the identity of visitors before granting access. This heightened level of verification augments security protocols, making intercom devices an integral component of modern access control and surveillance systems.

Access Full Report @ https://www.databridgemarketresearch.com/reports/asia-pacific-intercom-devices-market

Data Bridge Market Research analyses that the Asia-Pacific Intercom Devices Market is expected to grow at a CAGR of 13.2% in the forecast period of 2023 to 2030 and is expected to reach USD 16,148.03 million by 2030. Digital transformation often involves rapid changes in IT infrastructure and applications. Data centers provide a scalable and flexible solution, allowing businesses to easily adapt to changing demands.

Key Findings of the Study

Increase in Robbery, Burglary, and Thief Cases across the Globe

A robbery is an act of robbing or stealing, especially by brute force or through threats of violence. In robbery, one robs a person or a place, such as a house or business. On the other hand, burglary is an act of breaking and sometimes housebreaking or entering a building or other areas without permission. The surge in criminal activities has underscored the need for comprehensive and proactive security measures and intercom devices are poised to play a significant role in deterring, detecting, and responding to such threats.

The mere presence of intercom devices, prominently displayed at entry points, acts as a deterrent to potential criminals. These devices signify that the premises are under surveillance and that any suspicious activity will be observed and recorded. The ability to communicate with visitors before granting access offers a layer of scrutiny that discourages unauthorized individuals from attempting criminal activities, such as break-ins or thefts. This preventive aspect makes intercom devices an essential tool in reducing the opportunity for criminal incidents. Intercom devices equipped with audio and video capabilities provide real-time surveillance and monitoring, even from remote locations. This heightened level of oversight empowers property owners, security personnel, or residents to visually verify the identity of visitors before granting access. In cases of package deliveries or unexpected visitors, users can assess the situation without exposing themselves to potential risks. The visual information gathered by intercom systems aids law enforcement agencies in investigating incidents and identifying suspects, thereby contributing to a safer environment.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 – 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

System Type (Wired and Wireless), Component (Hardware, Software, and Services), Device Type (Door Entry Systems, Handheld Devices, and Video Baby Monitors), Material (Aluminum, Stainless Steel, Tempered Glass, Plastic, and Others), Power Supply (Less than 20 W, More than 20 W), Access Control (Cards, Fingerprint Readers, Proximity Cards, Password Access, Face Recognition, and Others), Technology (Analog and IP Based), Keypad (Mechanical Button and Touchpad), Communication Type (Only Audio and Audio/Video), Pricing Category (Low (Below USD 100), Medium (USD 100- USD 500), High (Above USD 500)), Communication ((Push-to-Talk, and Hands-Free or Handset (Duplex)), Application (Indoor and Outdoor), Installation (Flush and Surface), End User (Commercial, Residential, Industries, and Government), Distribution Channel (Online and Offline)

|

|

Countries Covered

|

China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Vietnam, Taiwan, and Rest of the Asia-Pacific

|

|

Market Players Covered

|

Hangzhou Hikvision Digital Technology Co., Ltd (China), SAMSUNG ELECTRONICS CO., LTD. (South Korea), Panasonic Holdings Corporation (Japan), Schneider Intercom GmbH (A Subsidiary of TKH GROUP) (Austria), Siedle (Germany), Zicom (India), ABB (Switzerland), Aiphone Corporation (Japan), Godrej & Boyce Manufacturing Company Limited (India), Axis Communications AB (A Subsidiary of Canon Group) (China), Gira (Germany), Zenitel (Norway), The Akuvox Company (China), Hager Group (Germany), GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD (China), Schneider Electric (France), Alpha Communications, COMELIT S.p.A.(Italy), FERMAX ELECTRÓNICA, S.A.U. (Spain), TCS TürControlSysteme AG (Germany), TOA Corporation (Japan), Honeywell International Inc.(U.S.), Dahua Technology Co., Ltd (China), Legrand Group (France), Xiamen Leelen Technology Co.,Ltd. (China), and COMMAX (South Korea), among others.

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The Asia-Pacific intercom devices market is segmented into fifteen notable segments which are based on system type, component, device type, material, power supply, access control, technology, keypad, communication type, price category, communication, application, installation, end user, and distribution channel.

- On the basis of system type, the market is segmented into wired and wireless

In 2023, the wired segment is expected to dominate the Asia-Pacific intercom devices market

In 2023, the wired segment is expected to dominate the market with 72.65% market share due to its unparalleled reliability and consistent performance.

- On the basis of component, the market is segmented into hardware, software, and services

In 2023, the hardware segment is expected to dominate the Asia-Pacific intercom devices market

In 2023, the hardware segment is expected to dominate the market with 56.97% market share due to its foundational role in shaping intercom systems' overall performance and capabilities growing.

- On the basis of device type, the market is segmented into door entry systems, handheld devices, and video baby monitors. In 2023, the door entry system is expected to dominate the market with a 72.26% share.

- On the basis of material, the market is segmented into aluminum, Stainless Steel, tempered glass, plastic, and others. In 2023, the aluminum segment is expected to dominate the market with a 41.73% share.

- On the basis of power supply, the market is segmented into less than 20 W and more than 20 W. In 2023, the less than 20 W segment is expected to dominate the market with a 58.95% share.

- On the basis of access control, the market is segmented into cards, fingerprint readers, proximity cards, password access, face recognition, and others. In 2023, the cards segment is expected to dominate the market with a 35.58% share.

- On the basis of technology, the market is segmented into analog and IP-based. In 2023, the analog segment is expected to dominate the market with a 60.26% share.

- On the basis of keypad, the market is segmented into mechanical button and touch pad. In 2023, the mechanical button segment is expected to dominate the market with a 67.37% share.

- On the basis of communication type, the market is segmented into audio/video and only audio. In 2023, the audio/video segment is expected to dominate the market with a 79.92% share.

- On the basis of price category, the market is segmented into low (below USD 100), medium (USD 100- USD 500), and high (above USD 500). In 2023, the low (below USD 100) segment is expected to dominate the market with a 53.12% share.

- On the basis of communication, the market is segmented into push-to-talk and hands-free or handset (duplex). In 2023, the push-to-talk segment is expected to dominate the market with a 71.36% share.

- On the basis of application, the market is segmented into outdoor and indoor. In 2023, the outdoor segment is expected to dominates the market with a 65.39% share.

- On the basis of installation, the market is segmented into flush and surface. In 2023, the flush segment is expected to dominate the market with a 69.44% share.

- On the basis of end user, the market is segmented into commercial, residential, industries, and government. In 2023, the commercial segment is expected to dominate the market with a 49.74% share.

- On the basis of distribution channel, the market is segmented into offline and online. In 2023, the offline segment is expected to dominate the market with a 69.07% share.

Major Players

Data Bridge Market Research analyses Hangzhou Hikvision Digital Technology Co., Ltd (China), SAMSUNG ELECTRONICS CO., LTD. (South Korea), Panasonic Holdings Corporation (Japan), Aiphone Corporation (Japan), and Legrand Group (France) as the major players in the Asia-Pacific intercom devices market.

Market Development

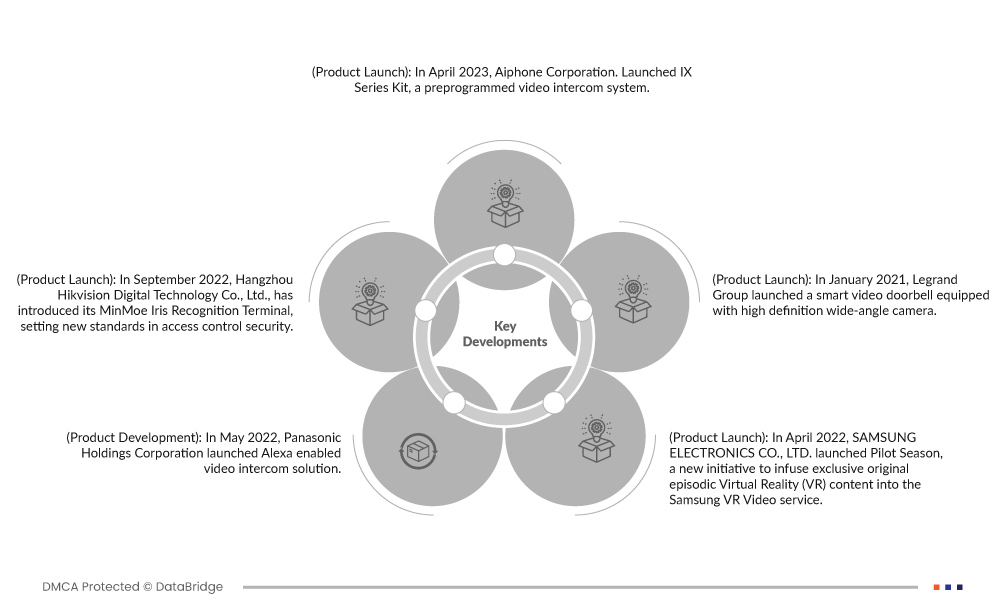

- In April 2023, Aiphone Corporation. Launched IX Series Kit, a preprogramed video intercom system. The IX Series kit is ideal for plug-and-play analog-based systems with IP systems. This video intercom system that is ready to install type includes various features such as a video door station, a video master station, PoE switch, and a USB drive with instructions and videos regarding the system installation, making it ideal for advanced analog-based IP systems. This product launch has strengthened the company’s portfolio of video intercom systems.

- In September 2022, Hangzhou Hikvision Digital Technology Co., Ltd. introduced its MinMoe Iris Recognition Terminal, setting new standards in access control security. Leveraging the unique and stable iris patterns of individuals, this innovative terminal ensures precise identification and differentiation within just one second, even at a distance of up to 70cm. Its incorporation of color imaging and video anti-counterfeiting further guarantees accuracy. The terminal's multi-method authentication, including iris recognition, face recognition, fingerprint, and cards, enhances flexibility and security for access control solutions. This advancement reinforces Hikvision's position as a trailblazer, catering to industries requiring stringent security, such as finance, healthcare, and research, and embracing the touchless and hygienic benefits of biometric access control.

- In May 2022, Panasonic Holdings Corporation launched Alexa enabled video intercom solution. The main objective behind this was to offer secure & quality solutions for its consumer. Enabling a video intercom with Alex will allow the product to be interactive and strengthen the security system for the consumer. Through this company further strengthened its portfolio.

- In April 2022, SAMSUNG ELECTRONICS CO., LTD. launched Pilot Season, a new initiative to infuse exclusive original episodic Virtual Reality (VR) content into the Samsung VR Video service. Pilot Season adds to the company’s efforts in expanding VR content offerings while driving growth within the independent VR filmmaker community. This product launch improved product sales due to its applications in aerospace and defense.

- In January 2021, Legrand Group launched a smart video doorbell equipped with high high-definition wide-angle camera. It is equipped with a full HD 1080p camera, and the diagonal 140° wide-angle lens is able to show a head-to-toe image of visitors at the door and delivers optimum quality regardless of lighting levels. This helped the company improve its product portfolio.

Regional Analysis

Geographically, the countries covered in the Asia-Pacific intercom devices market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Thailand, Indonesia, Philippines, Vietnam, Taiwan, and Rest of the Asia-Pacific.

As per Data Bridge Market Research analysis:

China is the dominant and fastest growing country in the Asia-Pacific Intercom Devices Market

China is expected to dominate in the Asia-Pacific intercom devices market as the country experienced a rise in Advent of advanced security audio-visual systems. Also China the fastest-growing country in Asia-Pacific intercom devices market due to the growing importance of smart homes and smart buildings and increase in cloud based-AI aided intercom devices.

For more detailed information about the Asia-Pacific intercom devices market report, click here – https://www.databridgemarketresearch.com/reports/asia-pacific-intercom-devices-market