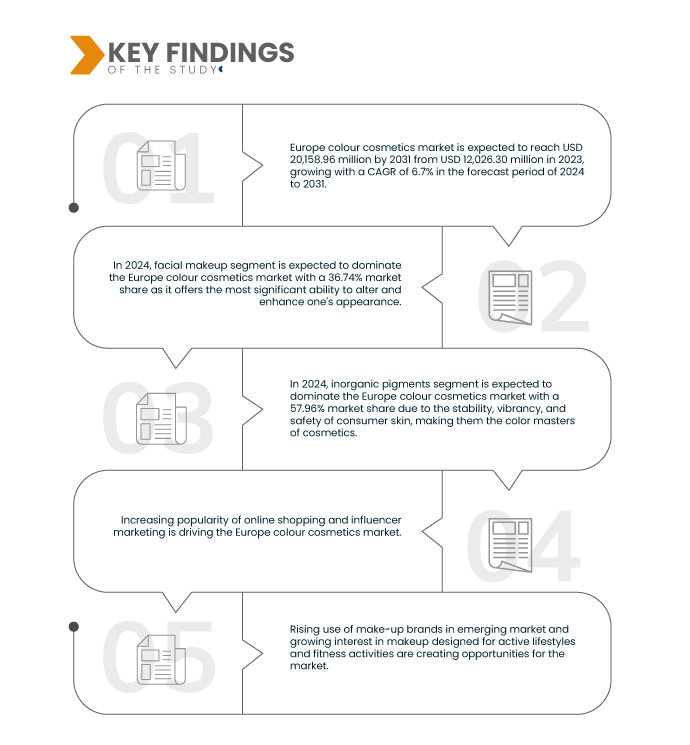

The convenience and availability of online platforms have reshaped consumer behaviors, allowing for a seamless and personalized shopping experience. Numerous of options are available for all those consumers and customers, who are exploring and purchasing cosmetics virtually, and influencing the market growth significantly. Brands have leveraged this digital shift by enhancing their online presence, offering interactive and user-friendly interfaces, and providing a wide range of products tailored to diverse consumer needs. This shift expanded the market reach and allowed for direct engagement with consumers, fostering a deeper understanding of preferences and driving innovation in product offerings.

The rise of influencer marketing has been pivotal in steering consumer choices and shaping beauty trends. Social media influencers, beauty bloggers, and content creators wield immense influence over their followers, impacting purchasing decisions and product preferences. Through authentic and relatable content, influencers endorse and recommend colour cosmetics, showcasing their efficacy and desirability. Their endorsements and reviews serve as a bridge between brands and consumers, fostering trust and integrity in the expanding digital landscape. As a result, influencer marketing has appeared as an influential tool for brands to amplify their presence, generate brand awareness, and drive the market growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-colour-cosmetics-market

Data Bridge Market Research analyzes that the Europe Colour Cosmetics Market is expected to reach USD 20.16 billion by 2031, from USD 12.03 billion in 2023, growing with a substantial CAGR of 6.7% in the forecast period of 2024 to 2031.

Key Findings of the Study

Rising Disposable Incomes and Urbanization

This synergy creates a fundamental shift in consumer behavior, as increased disposable incomes afford individuals greater purchasing power, especially within urban centers where lifestyle aspirations often prioritize self-care and beauty enhancement. Urbanization accelerates, creating densely populated areas and fostering a more interconnected community, the demand for cosmetics surges, driven by heightened consumer awareness, evolving beauty standards, and a desire for self-expression.

The expanding middle-class population, particularly in urban regions across emerging economies, plays a pivotal role in driving the demand for color cosmetics. This demographic shift, coupled with evolving consumer preferences, results in a heightened inclination toward beauty and grooming products. Individuals embrace urban living and adopt modern lifestyles, the inclination towards self-presentation, wellness, and grooming becomes a prominent aspect, catalyzing the growth of the Europe color cosmetics market. This trend is expected to persist and intensify as urbanization and economic growth continue to shape consumer aspirations and preferences.

The symbiotic influence of rising disposable incomes and accelerating urbanization stands as a formidable driver for the Europe color cosmetics market. This dynamic duo fuels a burgeoning demand for diverse beauty products, reshaping consumer behavior and preferences, particularly in urban areas. Rising disposable incomes and urban lifestyles prioritize self-presentation, the color cosmetics market experiences sustained growth, presenting an opportune landscape for industry players to innovate and meet the evolving demands of cosmopolitan consumers.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Product (Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Products, and Others), Pigment Type (Inorganic Pigments and Organic Pigments), Target Market (Mass Products and Prestige Products), Packaging (Bottles & Jars, Tubes, Containers, Pouches, Dispenser, Sticks, and Others), Form (Liquid, Powder, and Spray), Distribution Channel (E-Commerce, Supermarket/Hypermarkets, Direct Sales/B2B, Specialty Stores, and Others), End-User (Parlour, Household, Modelling & Fashion Industries, Media Houses, and Others)

|

|

Countries Covered

|

Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Turkey, Belgium, Denmark, Norway, Finland, and Rest of Europe

|

|

Market Players Covered

|

L’Oréal GROUPE (France), Unilever PLC (U.K), Henkel AG & Co. KGaA (Germany), Shiseidio Company, Limited (Japan), The Estée Lauder Companies Inc. (U.S.), Coty Inc (U.S.)., Mary Kay Inc (U.S.)., KOSÉ Corporation (Japan), CHANEL (U.K.), Oriflame Cosmetics AG (Switzerland), Natura & Co (Brazile), AMOREPACIFIC US, INC. (Korea), Clarins (France), LVMH (France), CHANTECAILLE BEAUTE (U.S.), and Kryolan (Germany), among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and consumer behaviour

|

Segment Analysis

The Europe colour cosmetics market is segmented into seven notable segments based on product, pigment type, target market, packaging, form, distribution channel, and end-user.

- On the basis of product, the Europe colour cosmetics market is segmented into facial makeup, eye makeup, lip products, nail products, hair products, and others

In 2024, the facial makeup segment is expected to dominate the Europe Colour Cosmetics Market

In 2024, facial makeup segment is expected to dominate the Europe colour cosmetics market with a 36.74% market share as to it offers the most significant ability to alter and enhance one's appearance.

- On the basis of pigment type, the Europe colour cosmetics market is segmented into inorganic pigments and organic pigments

In 2024, the inorganic pigments segment is expected to dominate the Europe Colour Cosmetics Market

In 2024, inorganic pigments segment is expected to dominate the Europe colour cosmetics market with a 57.96% market share due to stability, vibrancy, and safety of consumer skin, making them the color masters of cosmetics.

- On the basis of target market, the Europe colour cosmetics market is segmented into mass products and prestige products. In 2024, mass products segment is expected to dominate the Europe colour cosmetics market with 63.72% market share

- On the basis of packaging, the Europe colour cosmetics market is segmented into bottles & jars, tubes, containers, pouches, dispenser, sticks, and others. In 2024, the bottles & jars segment is expected to dominate the market with 29.07% market share

- On the basis of form, the Europe colour cosmetics market is segmented into liquid, powder, and spray. In 2024, the liquid segment is expected to dominate the market with 46.78% market share

- On the basis of distribution channel, the Europe colour cosmetics market is segmented into e-commerce, supermarket/hypermarkets, direct sales/B2B, specialty stores, and others. In 2024, the e-commerce segment is expected to dominate the market with 38.27% market share

- On the basis of end-user, the Europe colour cosmetics market is segmented into parlour, household, modelling & fashion industries, media houses, and others. In 2024, the parlour segment is expected to dominate the market with 38.26% market share

Major Players

Data Bridge Market Research analyzes L’Oréal GROUPE (France), Unilever PLC (U.K), Henkel AG & Co. KGaA (Germany), The Estée Lauder Companies Inc. (U.S.), and Coty Inc (U.S.) as the major players operating in the Europe colour cosmetics market.

Market Developments

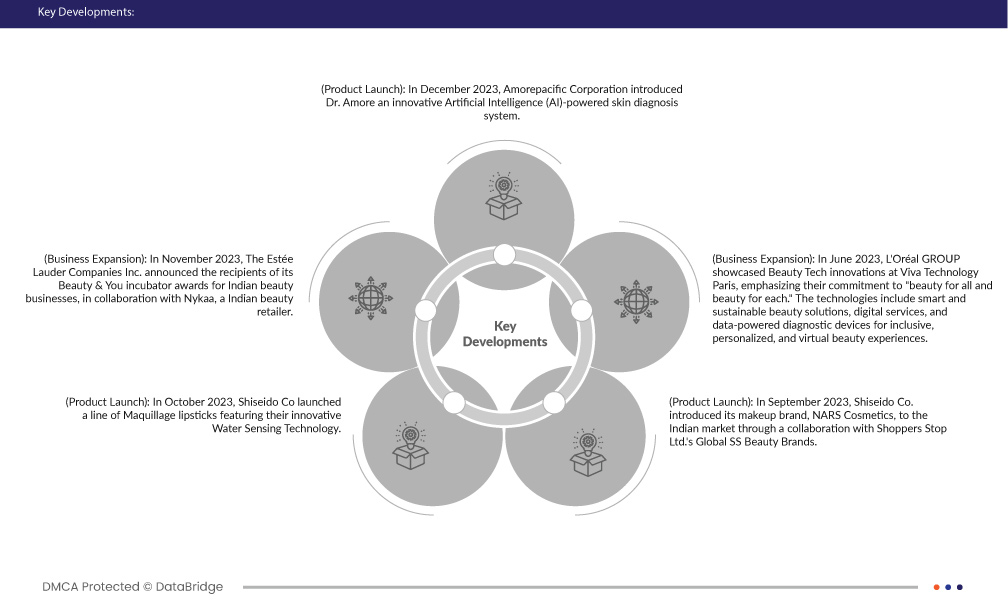

- In December 2023, Amorepacific Corporation introduced Dr. Amore an innovative artificial intelligence (AI)-powered skin diagnosis system. The company's recent breakthrough was documented in a paper published in the International Journal of Cosmetic Science. The system utilizes advanced AI algorithms to provide accurate and personalized skin analyses. This technological advancement is expected to enhance the company's product development and formulation processes, enabling a more targeted approach to skincare solutions. By leveraging AI, Amorepacific aims to better understand individual skin needs, ensuring that its cosmetic products are tailored to meet diverse customer requirements. This scientific leap reinforces Amorepacific's commitment to staying at the forefront of skincare research and development

- In November 2023, The Estée Lauder Companies Inc. announced the recipients of its Beauty & You incubator awards for Indian beauty businesses, in collaboration with Nykaa, an Indian beauty retailer. The second edition of these awards, unveiled earlier this year, recognized outstanding achievements in various sectors of the beauty industry, spanning active ingredients, perfumery, sustainability, and brand communities. This initiative spotlighted the innovative contributions of Indian beauty brands and creators and fostered a collaborative platform for the industry to thrive. By considering the diverse aspects of the beauty sector, the Beauty & You incubator awards have played a vital role in nurturing and promoting the growth of the Indian beauty business ecosystem

- In October 2023, Shiseido Co launched a line of Maquillage lipsticks featuring their innovative Water Sensing Technology. This technology seamlessly blends transfer-resistant color and comfort, marking a significant advancement in the cosmetics industry. The introduction of this unique lipstick range is expected to contribute to Shiseido's competitive edge by offering consumers a long-lasting and comfortable lip color experience. The incorporation of Water Sensing Technology reflects the company's commitment to research and development, positioning Shiseido as a leader in beauty innovation

- In September 2023, Shiseido Co. introduced its makeup brand, NARS Cosmetics, to the Indian market through a collaboration with Shoppers Stop Ltd.'s Global SS Beauty Brands. This marks Shiseido's first foray into the Indian makeup market in nearly a decade. The move aims to tap into the flourishing consumer market by making the popular NARS Cosmetics line readily available in local beauty shops. This strategic expansion reflects Shiseido's commitment to diversifying its global presence and capturing a share of the growing demand for cosmetics in India

- In June 2023, L'Oréal GROUP showcased Beauty Tech innovations at Viva Technology Paris, emphasizing their commitment to "beauty for all and beauty for each." The technologies include smart and sustainable beauty solutions, digital services, and data-powered diagnostic devices for inclusive, personalized, and virtual beauty experiences. These innovations contribute to the company's technological development and improve its dedication to making beauty

As per Data Bridge Market Research analysis:

Geographical Analysis

Geographically, the countries covered in the Europe colour cosmetics market are Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Turkey, Belgium, Denmark, Norway, Finland, and rest of Europe.

Germany is expected to be the dominant and fastest growing country in the Europe Colour Cosmetics Market

Germany is expected to be the dominant and fastest growing country due to evolving lifestyles, along with social media and influencer culture, are driving trends in colour cosmetics.

For more detailed information about the Europe Colour Cosmetics Market report, click here – https://www.databridgemarketresearch.com/reports/europe-colour-cosmetics-market