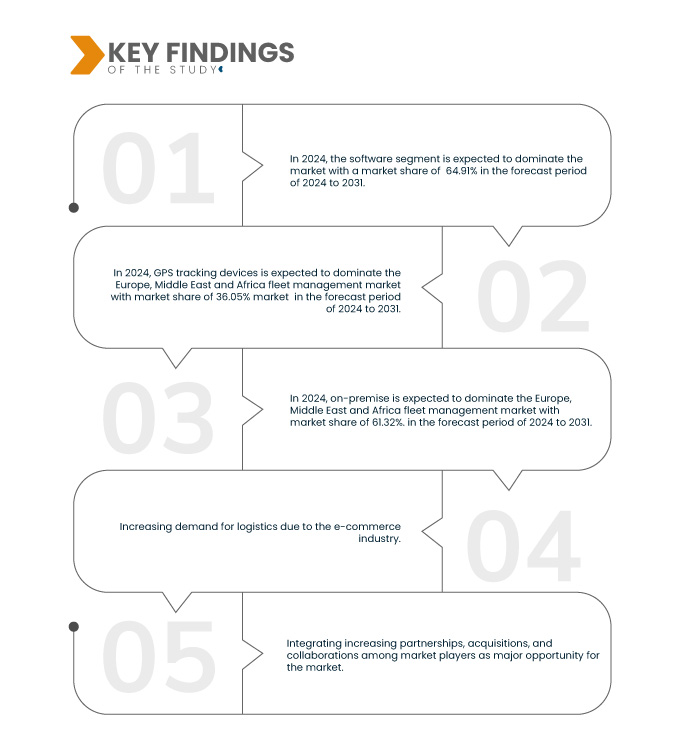

電子商務產業對物流的需求不斷增加。透過車隊管理,組織可以管理和協調運輸車輛,以實現最佳效率並降低成本。此做法用於監控和記錄快遞員和送貨人員。它需要一套技術系統,使車隊經理能夠更輕鬆地協調從燃料管理到規劃路線的活動,並且可以使用車隊管理軟體輕鬆管理。

Data Bridge Market Research 分析,歐洲、中東和非洲車隊管理市場預計將從 2023 年的 91.8579 億美元增至 2031 年的 195.2906 億美元,在 2024 年至 2031 年的預測期內,複合年增長率為 10.0%。電子商務行業的擴張對物流行業產生了重大影響。物流被認為是電子商務行業的支柱,因為它直接影響計劃營運、倉庫和生產網路組織。他們將越來越依賴重新評估來應對與互聯網業務部分發展相關的不斷增長的需求。無論是最後一哩的交付還是為了滿足客戶需求,採用這種方式都將使他們能夠確保交付的可預測性、可靠性、高效性和無失誤性。因此,這可以成為管理和擴大電子商務行業預期成長帶來的壓力的一個重要因素。

研究的主要發現

車隊快速採用燃料管理系統

燃料管理系統用於監控和控制車輛的燃料使用。這些系統可以與車隊管理軟體集成,幫助企業優化燃料使用、降低成本並提高整體效率。此外,電動和混合動力汽車等替代燃料的使用日益增多也推動了燃料管理系統的採用。車隊管理中快速採用燃料管理系統預計將推動歐洲、中東和非洲車隊管理市場的發展。

技術進步也推動了燃料管理系統的採用。先進感測器和遠端資訊處理技術的發展使得即時監控燃料使用情況並提供數據以幫助優化性能變得更加容易。此外,預測分析軟體的發展使得預測燃料使用情況並在問題發生之前發現潛在問題成為可能。

報告範圍和市場細分

報告指標

|

細節

|

預測期

|

2024年至2031年

|

基準年

|

2023

|

歷史歲月

|

2022(可自訂為2016-2021)

|

定量單位

|

收入(百萬美元)

|

涵蓋的領域

|

產品(解決方案、服務)、租賃類型(租賃、非租賃)、硬件(GPS 跟踪設備、行車記錄儀、藍牙跟踪標籤、數據記錄器)、車隊規模(小型車隊(1-5 輛車)、中型車隊(5-20 輛車)、大型和企業車隊(20-50+ 輛車))、通信範圍(短距離通信、長距離通信)、部署模式(本地、雲、混合)、技術(GNSS、蜂窩系統、電子數據交換(EDI)、遙感、運算方法和決策、RFID 地理)、功能(資產管理、路線管理、油耗、即時車輛位置、交付時間表、事故預防、行動應用程式、監控駕駛員行為、車輛維護更新、ELD合規性)、營運(商業、私人)、業務類型(大型企業、小型企業)、車輛類型(內燃機、電動車)、運輸方式(乘用車、輕型商用車、重型商用車車輛)、最終用戶(汽車、運輸和物流、零售、製造、食品和飲料、能源和公用事業、採礦、政府、醫療保健、農業、建築等)

|

覆蓋國家

|

德國、法國、英國、義大利、西班牙、俄羅斯、波蘭、荷蘭、比利時、土耳其、瑞士、挪威、丹麥、芬蘭、瑞典、歐洲其他地區、沙烏地阿拉伯、阿拉伯聯合大公國、以色列、南非、埃及、卡達、科威特、阿曼、巴林及其歐洲其他地區

|

涵蓋的市場參與者

|

Ayvens Group(法國)、Arval(美國)、Alphabet(德國)、TÜV SÜD(德國)、HERE(荷蘭)、TATA Consultancy Services Limited(印度)、SAP SE(德國)、Zain(利雅德)、Webfleet Solutions Sales BV(荷蘭)、STILL GmbH(德國)、Free2mTECet、Aclon)(荷蘭)、Aflon) Corporation(美國)、LocoNav(美國)、Frotcom International(葡萄牙)、Easyfleet(英國)、Fleetroot(阿聯酋)、Falcon Trackers、GoFleet Tracking(美國)、V Zone International LLC(阿聯酋)、Ecofleet(伊朗)、Ramco Systems(印度)、V Zone International LLC(阿聯酋)、Ecofleet(伊朗)、Arcocan(印度)、ArT 作為沙烏地阿拉伯) KSA(沙烏地阿拉伯)和 DETASAD Cloud(沙烏地阿拉伯)等

|

報告涵蓋的數據點

|

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析

|

細分分析

歐洲、中東和非洲車隊管理市場分為十三個顯著的細分市場,這些細分市場基於產品、租賃類型、硬體、車隊規模、通訊範圍、部署模式、技術、功能、營運、業務類型、車輛類型、運輸方式和最終用戶

- 根據產品供應情況,歐洲、中東和非洲車隊管理市場細分為解決方案和服務

預計到 2024 年,該解決方案將主導歐洲、中東和非洲車隊管理市場

到 2024 年,由於對提供全面高效車隊最佳化的整合遠端資訊處理、進階分析和物聯網技術的需求不斷增加,解決方案部門預計將主導歐洲、中東和非洲車隊管理市場,市場份額達到 64.91%。

- 根據租賃類型,歐洲、中東和非洲車隊管理市場分為租賃和非租賃

預計到 2024 年,租賃將主導歐洲、中東和非洲的車隊管理市場

- 到 2024 年,由於全方位服務租賃的需求不斷增加,租賃預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市場份額達到 69.48%。

- 在硬體基礎上,歐洲、中東和非洲車隊管理市場細分為 GPS 追蹤設備、行車記錄器、藍牙追蹤標籤、數據記錄器等。 2024 年,GPS 追蹤設備預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市場佔有率為 36.05%

- 根據通訊範圍,歐洲、中東和非洲車隊管理市場分為短距離通訊和長距離通訊。 2024 年,小型車隊(1-5 輛車)預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市佔率為 47.24%

- 根據部署模式,歐洲、中東和非洲車隊管理市場分為本地、雲端和混合。預計到 2024 年,本地部署將佔據歐洲、中東和非洲車隊管理市場的主導地位,市佔率為 61.32%

- 根據技術,歐洲、中東和非洲車隊管理市場細分為 GNSS、蜂窩系統、電子資料交換 (EDI)、遙感、運算方法和決策、RFID 等。 2024 年,GNSS 預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市佔率達到 42.10%

- 根據功能,歐洲、中東和非洲車隊管理市場細分為資產管理、路線管理、燃油消耗、即時車輛定位、交付計劃、事故預防、行動應用程式、監控駕駛員行為、車輛維護更新、ELD 合規性等。預計 2024 年,資產管理將主導歐洲、中東和非洲車隊管理市場,市佔率 20.54%

- 根據營運情況,歐洲、中東和非洲車隊管理市場分為商業和私人。預計 2024 年,商業將主導歐洲、中東和非洲車隊管理市場,市佔率為 67.78%。

- 根據業務類型,歐洲、中東和非洲車隊管理市場分為大型企業和小型企業。 2024年,大型企業預計主導歐洲、中東和非洲車隊管理市場,市場佔有率達64.55%

- 根據車輛類型,歐洲、中東和非洲車隊管理市場分為內燃機和電動車。 2024 年,內燃機預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市佔率為 78.05%

- 依運輸方式,歐洲、中東和非洲車隊管理市場分為乘用車、輕型商用車、重型商用車。根據類型,乘用車進一步細分為卡車、拖車、堆高機、專用車輛。 2024 年,乘用車預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市佔率達到 67.84%

- 根據最終用戶,歐洲、中東和非洲車隊管理市場細分為汽車、運輸和物流、零售、製造、食品和飲料、能源和公用事業、採礦、政府、醫療保健、農業、建築等。 2024 年,汽車產業預計將佔據歐洲、中東和非洲車隊管理市場的主導地位,市場佔有率為 22.92%

主要參與者

Data Bridge Market Research 分析了 Ayvens Group(法國)、Arval(美國)、Alphabet(德國)、TÜV SÜD(德國)、HERE(荷蘭)、TATA Consultancy Services Limited(印度)、SAP SE(德國)和 Zain(利雅德)等在全球工業自動化市場運營的主要公司。

市場開發

- 2024 年 7 月,Ayvens 與比亞迪建立新的合作夥伴關係,以推動歐洲電動車隊的普及。此次合作促進了電動乘用車和輕型商用車的推廣。對 Ayvens 而言,這一發展增強了他們在歐洲電動車市場的影響力,拓寬了他們的可持續移動解決方案,並增強了他們為雙方提供環保車隊選擇的能力;企業和零售客戶

- 2022 年 3 月,LocoNav 致力於透過提供經濟實惠的人工智慧驅動的車隊管理解決方案,實現發展中國家車隊技術的民主化。這些解決方案旨在利用先進的物聯網、人工智慧和視訊遠端資訊處理技術來提高車輛安全性、優化操作並降低成本。這項策略使 LocoNav 成為新興市場的領導者,滿足了價格敏感的需求,並透過即時數據和高效的車隊管理增強了競爭優勢

- 2022 年 3 月,V Zone International LLC 在阿聯酋推出了其創新的 GPS 自動駕駛 FO-ERP 技術,將 4G LTE 遠端資訊處理與人工智慧和物聯網相結合,實現先進的車隊和燃料管理。這項發展提升了 V Zone International 的車隊管理能力,提供了尖端的追蹤和成本節約解決方案,並鞏固了其在全球 GPS 追蹤領域的領導地位

- 2024 年 6 月,ALD Automotive 和 Northe 宣佈建立策略合作夥伴關係,旨在促進電動車的普及。此次合作使 ALD Automotive 能夠利用 Northe 的平台提供全面的電動車租賃和充電解決方案,將家庭、辦公室和公共充電整合到統一的服務中。此次合作為 ALD 的客戶提供了無縫充電體驗和合併計費。此次合作透過簡化電動車租賃和充電解決方案增強了歐洲、中東和非洲的車隊管理市場。綜合充電基礎設施和計費系統的整合促進了向電動車隊的過渡,促進了市場成長,並支持這些地區更廣泛地採用永續交通解決方案

- 2024 年 11 月,Ayvens 與 Stellantis 達成了一項價值數十億歐元的協議,該協議將為 Ayvens 的歐洲車隊提供 50 萬輛汽車,包括城市轎車、SUV、多用途貨車和電動車。此次合作顯著擴大了 Ayvens 的車輛庫存,增強了其提供多樣化車型的能力,並與 Ayvens 的 PowerUP 2026 戰略相契合,鞏固了其在歐洲車隊管理市場的地位。

區域分析

從地理上看,歐洲、中東和非洲車隊管理市場報告涵蓋的國家包括德國、法國、英國、義大利、西班牙、俄羅斯、波蘭、荷蘭、比利時、土耳其、瑞士、挪威、丹麥、芬蘭、瑞典、歐洲其他國家、沙烏地阿拉伯、阿聯酋、以色列、南非、埃及、卡達、科威特、阿曼、巴林和歐洲其他國家。

根據 Data Bridge 市場研究分析:

預計歐洲將佔據主導地位,成為歐洲、中東和非洲車隊管理市場成長最快的地區

到 2024 年,歐洲預計將憑藉其先進的技術基礎設施、對車隊管理的大量投資以及可持續運輸實踐的廣泛採用,在歐洲、中東和非洲的車隊管理中佔據主導地位。此外,強而有力的政府支持和完善的運輸及商業公司生態系統也為該地區的領導地位做出了貢獻。

有關歐洲車隊管理市場的更多詳細信息,請點擊此處 - https://www.databridgemarketresearch.com/reports/europe-middle-east-and-africa-fleet-management-market