The global burden of chronic Non-Communicable Diseases (NCDs) is escalating rapidly, and this trend is playing a central role in expanding demand for branded generics. As populations age, adopt sedentary lifestyles, and experience shifts in diet and environment, the incidence and prevalence of long-term conditions such as diabetes, hypertension, cardiovascular disease, chronic respiratory diseases, and renal disorders are rising. Patients with chronic diseases require ongoing, lifelong medication regimens, often involving multiple therapies, dose adjustments, and combinations. This sustained consumption profile favors generic and lower-cost branded alternatives, especially in markets with constrained payer budgets or high out-of-pocket spending. This means that rising NCD prevalence expands the total addressable demand for chronic care medicines, incentivizes local production, fosters competition in mature generics markets, and encourages incremental innovation (e.g., fixed dose combinations, tailored formulations) to capture patient loyalty. In sum, the epidemic of chronic disease is a driver of growth for the branded generics sector globally.

For instance,

- In April 2023, the World Heart Federation released the World Heart Report 2023, documenting that cardiovascular diseases remain the leading cause of death globally, with risk factors and chronic disease burden rising in low- and middle-income countries

- In April 2025, the United States CDC reported that by 2023, 76.4% of U.S. adults reported having at least one chronic condition, and 51.4% had multiple chronic conditions

- In December 20243, UnitedHealth Group posted “America’s Health Rankings 2023” report noted that adult diabetes prevalence in the U.S. rose to 11.5%, affecting nearly 31.9 million adults

- In March 2024, the Nature article “The WHO Global report 2023 on hypertension” highlighted that over one billion people worldwide suffer from hypertension, underscoring its scale and trajectory

- In May 2025, a BMC Public Health study reported that hypertension prevalence in India was around 30.3% in men and 28.6% in women, while diabetes prevalence was around 19.7% in men and 17.4% in women

The instances above highlight the increasing global burden of chronic conditions such as cardiovascular diseases, hypertension, and diabetes, signaling a structural transformation in healthcare demand. The growing prevalence of these diseases is driving sustained and expanding demand for long-term therapies, positioning branded generics as a cost-effective and reliable alternative to originator drugs. Continuous medication usage ensures consistent revenue streams for manufacturers, while the rising burden in low- and middle-income countries creates new market opportunities. Overall, the increasing prevalence of chronic diseases is a key driver of steady growth in the global branded generics market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-branded-generics-market

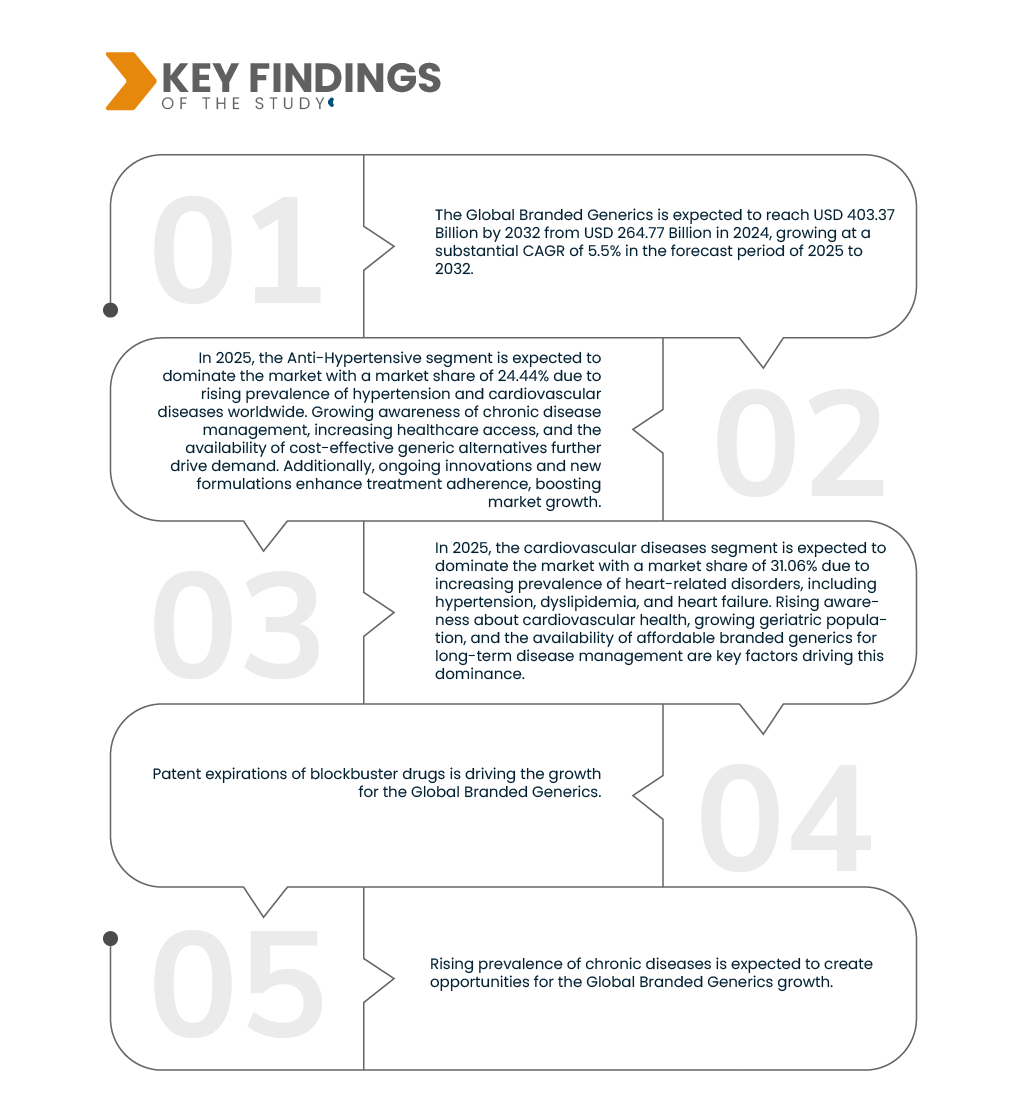

Data Bridge market research analyzes that Global Branded Generics Market is expected to reach USD 403.37 billion by 2032 from USD 264.77 billion in 2024, growing with a substantial CAGR of 5.5% in the forecast period of 2025 to 2032.

Key Findings of the Study

Expansion of Branded Generic Drug in Emerging Markets

Emerging markets offer a major opportunity for the global branded generics market due to several converging factors: increasing healthcare expenditure, expanding insurance coverage, population growth, and rising demand for affordable medicines. As many countries aim for Universal Health Coverage (UHC), governments are specifically supporting local production of generics and biosimilars, passing laws to promote access, offering incentives, and reforming regulation to encourage foreign and domestic investment. Moreover, emerging market consumers are becoming more quality conscious, creating a premium segment for trusted branded generics versus unbranded or non-regulated products. The combination of supportive policy environments, increasing disease burden, and rising income levels in emerging economies positions branded generics producers to scale rapidly, improve margins through local manufacturing, and capture large market share in underserved regions.

For instance,

- In July 2021, Generics and biosimilars Initiative reported that Government of Peru (via Supreme Decree No. 026-2019-SA) established regulations to promote access to lower-cost medicines by ensuring mechanisms for generic medicines, essential medicines, biological products, and medical devices are favored under law.

- In February 2024, Generics and biosimilars Initiative reported that COFEPRIS Government of Mexico launched the “Regulatory Certainty Strategy for the Pharmaceutical Sector: Biosimilars”, aimed at establishing a robust regulatory and operational framework (2024-2026) to align with international standards, support domestic biocomparable biologic development, and promote local manufacturing of biosimilars.

- In June 2024, Eurofarma revealed its expansion of the Genfar generics brand into Guatemala, Panama, Costa Rica and Honduras, relaunching the brand to increase access to quality pharmaceuticals across Central America.

These recent developments underscore the emerging region’s growing emphasis on self-sufficiency, affordability, and regulatory modernization in the pharmaceutical sector, creating substantial opportunities for the branded generics market. Collectively, these actions reflect a regional transformation where both policy and industry collaboration are driving accessibility, cost efficiency, and innovation positioning new emerging region as a high-growth frontier for branded generics manufacturers seeking sustainable and scalable market expansion.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Drug Class (Anti-Hypertensive, Hormones, Antimetabolites, Lipid Lowering Drugs, Anti-Epileptics, Alkylating Agents, Anti-Depressants, Anti-Psychotics, Others), By Application (Cardiovascular Diseases, Pain Management and Anti-inflammatory, Oncology, Diabetes, Neurology, Gastrointestinal Diseases, Dermatology, Others), By Route of Administration (Oral, Injectable, Topical Administration, Others), By Product Type (Value-Added Branded Generics, Trade Named Generics), By Patient Demographics (Adult, Geriatric, Pediatric), By End User (Hospitals, Clinics, Homecare, Academic & Research Institutes, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Direct Tenders, Others)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The Global Branded Generics Market is segmented into seven notable segments which are based on Drug class, Application, Route of administration, Product type, Patient Demographics, End User, and Distribution Channel.

- On the basis of Drug Class, the market is segmented into Anti-Hypertensive, Hormones, Antimetabolites, Lipid Lowering Drugs, Anti-Epileptics, Alkylating Agents, Anti-Depressants, Anti-Psychotics, and Others.

In 2025, the Anti-Hypertensive segment is expected to dominate the market

In 2025, the Anti-Hypertensive segment is expected to dominate the market with a market share of 24.44% due to rising prevalence of hypertension and cardiovascular diseases worldwide. Growing awareness of chronic disease management, increasing healthcare access, and the availability of cost-effective generic alternatives further drive demand. Additionally, ongoing innovations and new formulations enhance treatment adherence, boosting market growth.

- On the basis of Application, the market is segmented into Cardiovascular Diseases, Pain Management and Anti-Inflammatory, Oncology, Diabetes, Neurology, Gastrointestinal Diseases, Dermatology, and Others.

In 2025, the cardiovascular diseases segment is expected to dominate the market

In 2025, the cardiovascular diseases segment is expected to dominate the market with a market share of 31.06% due to increasing prevalence of heart-related disorders, including hypertension, dyslipidemia, and heart failure. Rising awareness about cardiovascular health, growing geriatric population, and the availability of affordable branded generics for long-term disease management are key factors driving this dominance.

- On the basis of Route of Administration, the market is segmented into Oral, Injectable, Topical Administration, and Others.

In 2025, the Oral segment is expected to dominate the market

In 2025, the Oral segment is expected to dominate the market with a market share of 56.97% due to its convenience, ease of administration, high patient compliance, and widespread availability. Oral formulations, including tablets, capsules, and liquids, are preferred for long-term treatments and chronic conditions, making them the primary choice for healthcare providers and patients globally.

- On the basis of Product Type, the market is segmented into Value-Added Branded Generics and Trade Named Generics

In 2025, the Value-Added Branded Generics segment is expected to dominate the market

In 2025, the Value-Added Branded Generics segment is expected to dominate the market with a market share of 67.70% due to its enhanced efficacy, improved safety profiles, and differentiated features compared to standard generics. These products offer added therapeutic benefits, patient-friendly formulations, and strong brand recognition, driving higher adoption among healthcare providers and patients worldwide.

- On the basis of Patient Demographics, the market is segmented into Adult, Geriatric, and Pediatric

In 2025, the Adult segment is expected to dominate the market

In 2025, the Adult segment is expected to dominate the market with a market share of 66.00% due to high prevalence of chronic diseases such as cardiovascular disorders, diabetes, and neurological conditions in the adult population. Growing healthcare awareness, increasing access to treatment, and rising demand for effective and affordable branded generics further drive this segment's market share.

- On the basis of end user, the market is segmented into Hospitals, Clinics, Homecare, Academic & Research Institutes, and Others.

In 2025, the hospitals segment is expected to dominate the market

In 2025, the hospitals cancer segment is expected to dominate the market with a market share of 52.73% due to their role as primary care providers for acute and chronic conditions, high patient footfall, and the availability of specialized treatment facilities. Hospitals also have established procurement systems and budgets that favor bulk purchases of branded generics, ensuring consistent demand and widespread product utilization.

- On the basis of distribution channel, the market is segmented into Retail Pharmacies, Hospital Pharmacies, Direct Tenders, and Others.

In 2025, the Retail Pharmacies segment is expected to dominate the market

In 2025, the Retail Pharmacies segment is expected to dominate the market with a market share of 53.70% due to their extensive accessibility, high patient convenience, and widespread presence in urban and rural areas. The growing preference for over-the-counter purchases, coupled with established relationships with pharmaceutical distributors, ensures consistent demand and drives the distribution and sales of branded generics across communities.

Major Players

Teva Pharmaceutical Industries Ltd. (Israel), Viatris Inc. (U.S.), Sandoz Group AG (Switzerland), Dr. Reddy’s Laboratories Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), among others.

Latest Developments in Global Branded Generics Market

- In October 2025, The U.S. FDA has approved an expanded indication for UZEDY (risperidone) extended-release injectable suspension. It is now approved for the treatment of schizophrenia in children and adolescents aged 13 to 17 years, in addition to adults. This provides a long-acting treatment option for younger patients managing this chronic condition

- In August 2025, Teva has received U.S. FDA approval for and launched the first generic version of Saxenda (liraglutide) injection. This generic GLP-1 receptor agonist is approved as a weight management tool for adults and pediatric patients, providing a more accessible option for chronic weight management.

- In August 2025, Viatris has received U.S. FDA approval for the first generic version of Iron Sucrose Injection, a medication used to treat iron deficiency anemia. This development provides a more affordable treatment option for patients and healthcare providers in the United States. The approval strengthens Viatris's portfolio of generic injectable medicines and enhances patient access to this critical therapy.

- In April 2025, Viatris has filed supplemental new drug applications with Japan's Ministry of Health, Labour and Welfare seeking approval for EFFEXOR (venlafaxine) for the treatment of Generalized Anxiety Disorder. This regulatory step aims to expand the therapeutic use of this medication in the Japanese market. If approved, it would provide a new treatment option for patients in Japan suffering from this condition.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Global Branded Generics Market report are North America, Euorpe, Asia-Pacific, Middle East and Africa, South America. Europe is further segmented into Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Denmark, Norway, Finland, Sweden, Rest of Europe. The Asia-Pacific is further segmented into China, Japan, South Korea, India, Thailand, Singapore, Malaysia, Hong Kong, Indonesia, Australia, New Zealand, Philippines, Taiwan, rest of Asia-Pacific. The North America is further segmented into U.S., Canada, and Mexico. The South America is further segmented into Brazil, Argentina, Bolivia, Chile, Columbia, Ecuador, Paraguay, Peru, Uruguay, Venezuela, and rest of South America. The Middle East and Africa is further segmented into South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Bahrain, Kuwait, Oman, Qatar, Rest of Middle East and Africa.

Asia-Pacific is the dominating country in Global Branded Generics Market

Asia-Pacific is the Global Branded Generics Market, driven by the its rapidly growing population, rising prevalence of chronic and lifestyle-related diseases, expanding healthcare infrastructure, and increasing adoption of branded generics. Additionally, supportive government initiatives, rising awareness of advanced therapies, and cost-effective treatment options further drive market growth in the region.

North America is expected to be the fastest growing country in Global Branded Generics Market

North America is expected to witness significant growth in the Global Branded Generics Market, driven by to increasing healthcare expenditure, patent expiries of major drugs, and rising demand for affordable branded alternatives.

For more detailed information about the Global Branded Generics Market report, click here – https://www.databridgemarketresearch.com/reports/global-branded-generics-market