Currently, vehicles are increasingly becoming part of the internet of things (IoT) and the internet of vehicles, changing the vehicle into a seamless interface between our connected lives at work and home. However, new vehicle technologies need additional electrical wiring and other electronic components. Some modern vehicles comprise nearly 40 harnesses, roughly over 3000 wires, and 700 connectors. Hence, increasing demand for a vehicle wiring harness for automotive safety systems is likely to enhance the market growth in upcoming years

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-heat-shrink-tubing-for-automotive-market

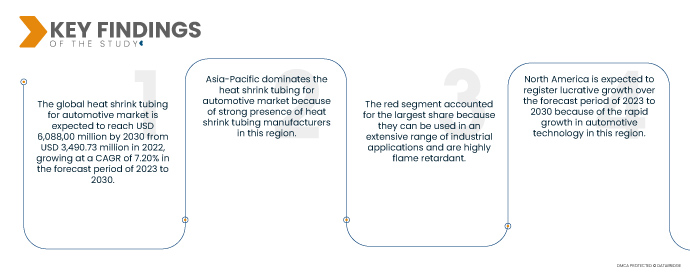

Data Bridge Market Research analyses a growth rate in the Global Heat Shrink Tubing for Automotive Market is expected to reach USD 6,088 million by 2030 from USD 3,490.73 million in 2022, growing at a CAGR of 7.20% in the forecast period of 2023 to 2030. The increasing involvement of automation in heat shrink tubing procedure will likely to increase the growth of the global heat shrink tubing for automotive market.

Increasing demand and sales for premium vehicle is expected to drive the market's growth rate

The increasing demand and sales for the premium vehicle is expected to drive the growth of the global heat shrink tubing for the automotive market. The surge in the sales of the companies is likely to drive by the growing sales of compact and utility vehicles during the forecast period. Few major automobile companies such as Hyundai and Maruti Suzuki had reported vigorous sales growth. For instance, according to the data of the China Association of Automobile Manufacturers, China's premium vehicle market continued to recover strongly in March 2021, with sales increasing by 75 percent to 2.53 million units from 1.44 million in 2020 based on commercial and passenger vehicle. Hence, the growth in the demand and sales for premium vehicle is likely to propel growth of the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015- 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Application (Hoses, Connectors, Ring Terminals, In-Line Splices, Brake Pipes, Diesel Injection Clusters, Under Bonnet Cable Protection, Gas Pipes, Miniature Splices), Material (Polyolefin, Polyvinyl Chloride, Polytetrafluoroethylene, Fluorinated Ethylene Propylene, Perfluoroalkoxy Alkane, Ethylene Tetrafluoroethylene, and Others), Color (Red, Yellow and Others), Type (Single Wall Shrink Tubing and Dual Wall Shrink Tubing), Voltage (Low, Medium and High), Fuel Type (Petrol, Diesel/CNG and Electric), Sales Channel (OEM and Aftermarket), Vehicle Type (Passenger Cars, LCV, HCV, and Electric Vehicles)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Molex (U.S.), TE Connectivity (Switzerland),, and Panduit (U.S.), ABB (Switzerland), 3M (U.S.), RADPOL S.A (Poland), The Zippertubing Company (U.S.), Dee Five (India), Insultab, PEXCO (U.S.), SHAWCOR (Canada), Sumitomo Electric Industries, Ltd. (Japan), Zeus Company Inc. (U.S.), HellermannTyton (U.K.), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (China), Techflex, Inc. (U.S.), Texcan (Canada), Alpha Wire (China)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The heat shrink tubing for automotive market is segmented on the basis of application, material, color, type, voltage, fuel type, sales channel and vehicle type.

- On the basis of application, the heat shrink tubing for automotive market is segmented into hoses, connectors, ring terminals, in-line splices, brake pipes, diesel injection clusters, under bonnet cable protection, gas pipes, miniature splices.

The hoses segment of application segment is anticipated to dominate the heat shrink tubing for automotive market

Hoses segment is expected to dominate the global heat shrink tubing for automotive market with 24.84% market share because they are used to carry fluids through fluid or air environments. Furthermore, these are normally used with flanges, clamps, spigots, and nozzles to control fluid flow.

- On the basis of material, the heat shrink tubing for automotive market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), polyvinyl chloreide (PVC), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (PEEK) and others.

The polyolefin segment of material segment is anticipated to dominate the heat shrink tubing for automotive market

The polyolefin segment is expected to dominate the global heat shrink tubing for automotive market with 31.30% market share because it has excellent chemical, physical and electrical characteristics and is resistant to flame and abrasion. Furthermore, polyolefin-based heat shrink tubing is suitable to the widest range of general purpose needs.

- On the basis of voltage, the heat shrink tubing for automotive market is segmented into low, medium and high. Low segment is expected to dominate the global heat shrink tubing for automotive market with 49.70% market share because of increasing utilization of heat shrink tubing, generally for sealing cables and insulation.

- On the basis of color, the heat shrink tubing for automotive market is segmented into red, yellow & others. Red is expected to dominate the global heat shrink tubing for automotive market with 32.54% market share because they can be used in an extensive range of industrial applications and are highly flame retardant.

- On the basis of type, the heat shrink tubing for automotive market is segmented into single wall shrink tubing & double wall shrink tubing. Single wall shrink tubing segment is expected to dominate the global heat shrink tubing for automotive market with 67.41% market share because it provides superior insulation and protection against mechanical damage and abrasion. Furthermore, it also offers protection and quick insulation.

- On the basis of fuel type, the heat shrink tubing for automotive market is segmented into petrol, diesel/CNG & electric. Petrol segment is expected to dominate the global heat shrink tubing for automotive market with 54.11% market share because it enables for the faster acceleration, quick starting and easy combustion of the fuel in automobiles.

- On the basis of sales channel, the heat shrink tubing for automotive market is segmented into OEM and aftermarket. OEM segment is expected to dominate the global heat shrink tubing for automotive market with 63.27% market share because there have superior transparency of product specifications and offer a better lucrative deals.

- On the basis of vehicle type, the heat shrink tubing for automotive market is segmented into passenger cars, LCV, HCV and electric vehicles. Passenger segment is expected to dominate the global heat shrink tubing for automotive market with 54.96% market share because of growing usage of private mobility currently.

Major Players

Data Bridge Market Research recognizes the following companies as the major heat shrink tubing for automotive market players in heat shrink tubing for automotive market Molex (U.S.), TE Connectivity (Switzerland),, and Panduit (U.S.), ABB (Switzerland), 3M (U.S.), RADPOL S.A (Poland), The Zippertubing Company (U.S.), Dee Five (India), Insultab, PEXCO (U.S.), SHAWCOR (Canada), Sumitomo Electric Industries, Ltd. (Japan), Zeus Company Inc. (U.S.), HellermannTyton (U.K.).

Market Development

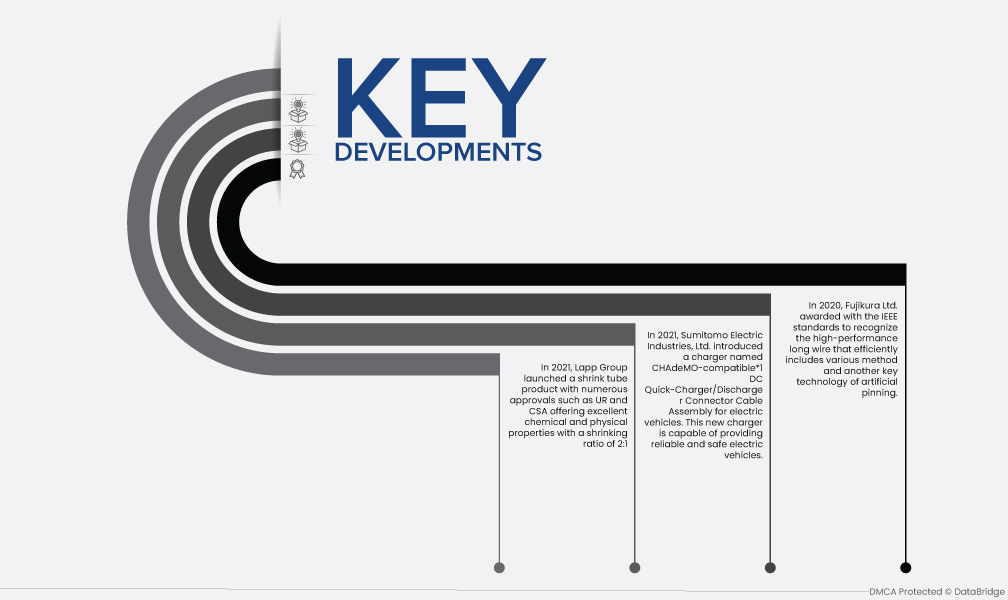

- In 2021, Lapp Group launched a shrink tube product with numerous approvals, such as UR and CSA, offering excellent chemical and physical properties with a shrinking ratio of 2:1

- In 2021, Sumitomo Electric Industries, Ltd. introduced a charger named CHAdeMO-compatible*1 DC Quick-Charger/Discharger Connector Cable Assembly for electric vehicles. This new charger is capable of providing reliable and safe electric vehicles. With this launch, the company improved its business portfolio.

- In 2020, Fujikura Ltd. was awarded the IEEE standards to recognize the high-performance long wire that efficiently includes various methods and another key technology of artificial pinning. The company improved its brand image by this award, creating more income for it.

Regional Analysis

Geographically, the countries covered in the heat shrink tubing for automotive market report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in heat shrink tubing for automotive market during the forecast period 2023 to 2030

Asia-Pacific dominates the heat shrink tubing for automotive market because of huge industrial infrastructure and strong presence of heat shrink tubing manufacturers in this region. Moreover, the government is strengthening its initiatives in this region to promote the custom of heat shrink tubes, which will further enhance the market growth in this region.

North America is estimated to be the fastest-growing region in heat shrink tubing for automotive market the forecast period 2023 to 2030

North America is expected to grow from 2023 to 2030 because of the rapid growth in automotive technology in this region. Additionally, high standards of cables and wires an increasing usage of quality based heat shrink tubing will further boost the market growth in this region.

For more detailed information about heat shrink tubing for automotive market report, click here – https://www.databridgemarketresearch.com/reports/global-heat-shrink-tubing-for-automotive-market