The global high-integrity pressure protection system (HIPPS) market is witnessing substantial growth driven by increasing emphasis on industrial safety and the rising demand for efficient pressure management systems. HIPPS are advanced safety solutions designed to prevent overpressure scenarios in critical processes, ensuring the integrity of pipelines and equipment. Geographically, the market is experiencing notable traction across regions with robust industrial infrastructure. Overall, the global HIPPS market is poised for sustained growth as industries prioritize operational safety and regulatory compliance in their processes

Access Full Report at https://www.databridgemarketresearch.com/reports/global-high-integrity-pressure-protection-system-hipps-market

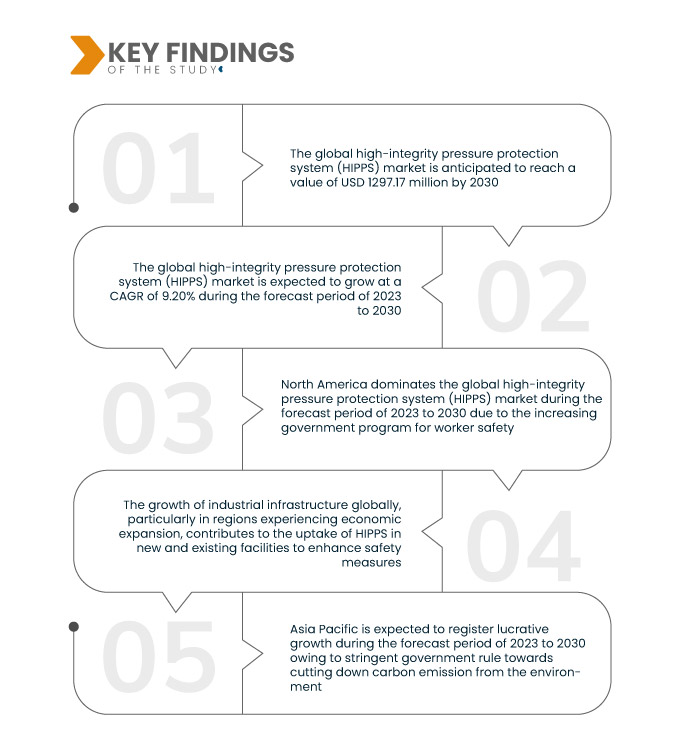

Data Bridge Market Research analyses that the Global High-Integrity Pressure Protection System (HIPPS) Market was valued at USD 641.53 million in 2022 and is expected to reach the value of USD 1,297.17 million by 2030, at a CAGR of 9.20% during the forecast period of 2023 to 2030. The surge in industrial process automation is fueling the adoption of high-integrity pressure protection systems (HIPPS). These systems seamlessly integrate with automated control systems, providing a robust solution for comprehensive process management. This trend aligns with the industry's pursuit of heightened efficiency and safety in high-pressure environments.

Key Findings of the Study

Expanding oil and gas exploration is expected to drive the market's growth rate

The ongoing global increase in energy demand propels the expansion of oil and gas exploration, driving a parallel surge in demand for high-integrity pressure protection systems (HIPPS). These systems play a pivotal role in safeguarding critical processes and equipment within the oil and gas industry. As exploration activities expand, the need for robust pressure protection solutions grows, positioning HIPPS as essential components to ensure operational safety and integrity in the dynamic and demanding field of oil and gas exploration.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

Type (Electronics HIPPS, Hydraulic/Mechanical HIPPS), Offering (Component, Services), Industry (Oil and Gas, Power Generation, Chemical, Water and Wastewater, Food and Beverages, Pharmaceutical, Metal and Mining, Paper and Pulp and Others)

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America

|

Market Players Covered

|

Ems Security Group Ltd (U.K.), Electro Detectors Ltd (U.K.), Sterling Safety Systems (U.K.), Honeywell International, Inc. (U.S.), Siemens AG (Germany), Wagner Group Gmbh (Germany), Hochiki Corporation (Japan), Halma Plc. (U.K.), Apollo Fire Detectors Limited (U.K.), Robert Bosch Gmbh (Germany), EUROFYRE LTD. (U.K.), Detectomat Gmbh (Germany), Ceasefire Industries Pvt. Ltd (India), Johnson Controls (Ireland), Napco Security technologies, Inc. (U.S.), Zeta Alarm ltd (U.K.), Libelium Comunicaciones Distribuidas S.L (Spain), Attentis (Australia), and Vigilys, Inc (U.S.)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global high-integrity pressure protection system (HIPPS) market is segmented based on the type, offering and industry.

- On the basis of type, the global high-integrity pressure protection system (HIPPS) market is segmented into electronics HIPPS, and hydraulic/mechanical HIPPS

- On the basis of offering, the global high-integrity pressure protection system (HIPPS) market is segmented into component, and services

- On the basis of industry, the global high-integrity pressure protection system (HIPPS) market is segmented into oil and gas, power generation, chemical, water and wastewater, food and beverages, pharmaceutical, metal and mining, paper and pulp, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major global high-integrity pressure protection system (HIPPS) market players in global high-integrity pressure protection system (HIPPS) market are Robert Bosch Gmbh (Germany), EUROFYRE LTD. (U.K.), Detectomat Gmbh (Germany), Ceasefire Industries Pvt. Ltd (India), Johnson Controls (Ireland), Napco Security technologies, Inc. (U.S.), Zeta Alarm ltd (U.K.), Libelium Comunicaciones Distribuidas S.L (Spain), Attentis (Australia), and Vigilys, Inc (U.S.)

Market Developments

- In June 2020, Bel Valves completed the sale of its Milan, Italy operations to OMB Valves SpA. This strategic move involved transferring the company, its business, assets, and employees to OMB Valves, a globally recognized manufacturer of forged steel valves for energy industries. OMB Valves, a family-owned group, operates manufacturing facilities in Europe, North America, Asia, and the Middle East, supported by a robust worldwide distribution network

- In February 2020, Emerson introduced the ASCO Series 158 Gas Valve and Series 159 Motorized Actuator, specifically designed for burner-boiler applications. These newly developed ASCO valves provide OEMs, distributors, contractors, and end-users with an enhanced combustion safety shutoff valve option. The innovative products prioritize safety and reliability, improving both flow and control in combustion processes, thereby offering a valuable solution to the industry

Regional Analysis

Geographically, the countries covered in the global high-integrity pressure protection system (HIPPS) market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America

As per Data Bridge Market Research analysis:

North America is the dominant region in the global high-integrity pressure protection system (HIPPS) market during the forecast period 2023-2030

North America dominates the global high-integrity pressure protection system (HIPPS) market in revenue growth, attributed to a surge in government initiatives promoting worker safety. Enforced regulations mandate manufacturing companies in the region to adopt electronic HIPPS systems, enhancing operational efficiency and ensuring worker safety. This regulatory push underscores the pivotal role HIPPS plays in elevating safety standards, making it a key contributor to the region's leadership in the HIPPS market.

Asia-Pacific is estimated to be the fastest-growing region in the global high-integrity pressure protection system (HIPPS) market for the forecast period 2023-2030

Asia-Pacific is expected to dominate the global high-integrity pressure protection system (HIPPS) market during 2023-2030, emerging as the fastest-growing region. Stringent government regulations aimed at reducing carbon emissions are a primary driver. Manufacturers in the region are notably shifting focus towards electronic HIPPS systems, replacing traditional ones. This strategic transition aligns with environmental policies and positions Asia-Pacific as a key contributor to the accelerated growth of the HIPPS market in the forecast period.

For more detailed information about the global high-integrity pressure protection system (HIPPS) market report, click here – https://www.databridgemarketresearch.com/reports/global-high-integrity-pressure-protection-system-hipps-market