The increasing push for fuel efficiency, emission reduction, and performance optimization is driving the widespread adoption of lightweight metals in the automotive and aerospace industries. Governments worldwide have introduced stringent fuel economy and carbon emission standards, such as the U.S. CAFE regulations, EU CO₂ targets, and similar mandates in China and India, encouraging manufacturers to reduce vehicle mass without compromising safety or performance. Lightweight metals, such as aluminum, magnesium, and titanium, offer the ideal balance of strength and weight reduction, making them key enablers of next-generation mobility.

In the automotive sector, the shift toward Electric Vehicles (EVs) has further accelerated demand for lightweight materials to offset battery weight and increase driving range. Leading automakers are increasingly integrating aluminum body panels, magnesium structural parts, and lightweight metal alloys in chassis, frames, and suspension systems. Meanwhile, the aerospace industry continues to rely on advanced aluminum-lithium alloys and titanium components to improve fuel economy, reduce takeoff weight, and extend aircraft lifespan. With global air travel and EV production both on the rise, demand for lightweight metals is expected to remain strong.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-lightweight-metals-market

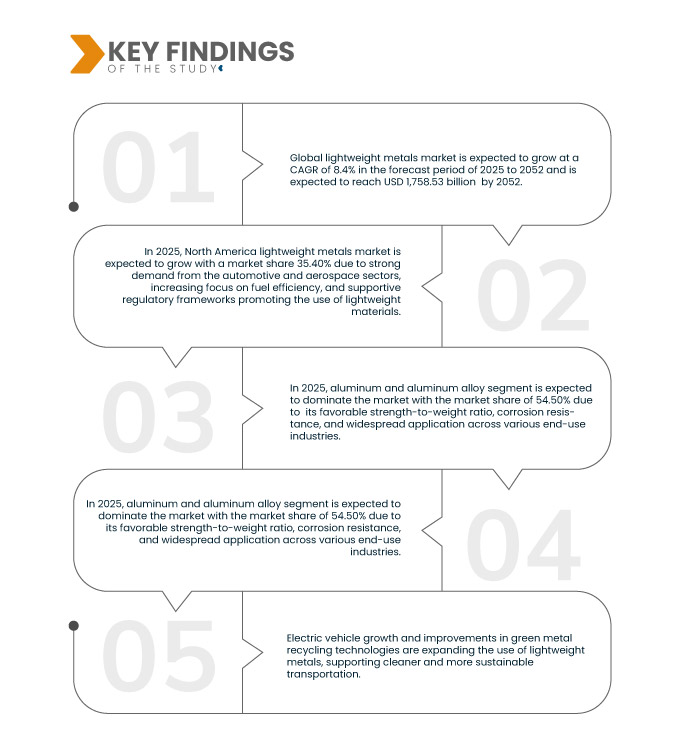

Data Bridge Market Research analyzes that the Global Lightweight Metals Market is expected to reach USD 1,758.53 billion by 2052, from USD 184.28 billion in 2024, growing at a CAGR of 8.4% in the forecast period of 2025 to 2052.

Key Findings of the Study

Growing adoption of consumer durables and appliances

The increasing demand for energy-efficient, durable, and lightweight consumer appliances is driving the adoption of lightweight metals, such as aluminum and magnesium, at a significant rate. As consumers seek appliances that offer better performance, longer lifespan, and reduced energy consumption, manufacturers are turning to these metals to meet evolving expectations.

Lightweight metals provide advantages such as corrosion resistance, improved heat dissipation, and enhanced design flexibility, making them ideal for use in refrigerators, washing machines, air conditioners, and cooking appliances. These metals also contribute to lowering the overall weight of appliances, which facilitates easier transportation and installation, while reducing shipping costs and carbon footprints.

In parallel, ongoing research and development in material science are driving innovations in alloy compositions and manufacturing processes. This enables brands to produce more reliable, energy-efficient, and aesthetically appealing products tailored to consumer preferences. Furthermore, government regulations and voluntary energy standards, such as ENERGY STAR certifications, are encouraging the use of lightweight metals to achieve higher efficiency benchmarks, thus fostering market growth and consumer trust.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2052

|

|

Base Year

|

2024

|

|

Historic Year

|

2018-2023 (Customizable 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Type (Aluminum and Aluminum Alloy, Titanium and Titanium Alloys, Magnesium and Magnesium Alloy, Beryllium and Beryllium Alloy, Steel and Steel Alloys, and Others), Application (Automotive & Transportation, Aerospace & Defense, Agriculture, Electronics & Consumer Goods, Marine, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, China, Japan, India, South Korea, Australia, Thailand, Indonesia, Taiwan, Malaysia, Vietnam, Philippines, Singapore, Rest of Asia-Pacific, Germany, France, U.K., Spain, Italy, Netherlands, Russia, Sweden, Belgium, Switzerland, Poland, Denmark, Finland, Turkey, Norway, Luxembourg, Rest of Europe, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, Qatar, Bahrain, Egypt, South Africa, Kuwait, Israel, Oman, and Rest of Middle East and Africa

|

|

Market Players Covered

|

China Hongqiao Group Limited (China), Hindalco Industries Ltd. (India), thyssenkrupp Steel Europe (Germany), AMETEK Inc. (U.S.), Vedanta Limited (India), Rio Tinto (U.K./Australia), Kaiser Aluminum (U.S.), Norsk Hydro ASA (Norway), AMAG Austria Metall AG (Austria), Tata Steel (India), Alcoa Corporation (U.S.), Corporation VSMPO-AVISMA (Russia), Precision Castparts Corp. (U.S.), Emirates Global Aluminium PJSC (U.A.E.), POSCO (South Korea), RusAL (Russia), Nucor (U.S.), SSAB (Sweden), US Magnesium LLC (U.S.), ICL (Israel), ATI, Inc. (U.S.), Constellium (Netherlands), ArcelorMittal (Luxembourg), Luxfer Holdings PLC (U.K.), Vulcan, Inc. (U.S.), Materion Corporation (U.S.), Toho Titanium Co., Ltd. (Japan), Clinton Aluminum (U.S.), Metalwerks (U.S.), TW Metals, LLC. (U.S.), Western Superconducting Technologies Co., Ltd. (China), DWA Aluminum Composites USA, Inc. (U.S.), and among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

|

Segment Analysis

The global lightweight metals market is segmented into two notable segments based on type and application.

- On the basis of type, the market is segmented into aluminum and aluminum alloy, titanium and titanium alloys, magnesium and magnesium alloy, beryllium and beryllium alloy, steel and steel alloys, and others

In 2025, the aluminum and aluminum alloy segment is expected to dominate the global lightweight metals market

In 2025, the aluminum and aluminum alloy segment is expected to dominate the market with a market share of 54.50% due to its superior strength-to-weight ratio, corrosion resistance, and recyclability. Its rising adoption in automotive, aerospace, and packaging sectors supports this growth.

- On the basis of application, the market is segmented into automotive & transportation, aerospace & defense, agriculture, electronics & consumer goods, marine, and others

In 2025, the automotive & transportation segment is expected to dominate the global lightweight metals market

In 2025, the automotive & transportation segment is expected to dominate the market with a market share of 39.98% due to the growing demand for lightweight materials that enhance fuel efficiency and reduce emissions. Increased adoption of electric vehicles further drives the use of advanced materials.

Major Players

Data Bridge Market Research analyzes China Hongqiao Group Limited (China), Hindalco Industries Ltd. (India), thyssenkrupp Steel Europe (Germany), AMETEK Inc. (U.S.), Vedanta Limited (India), as the major market players of the market.

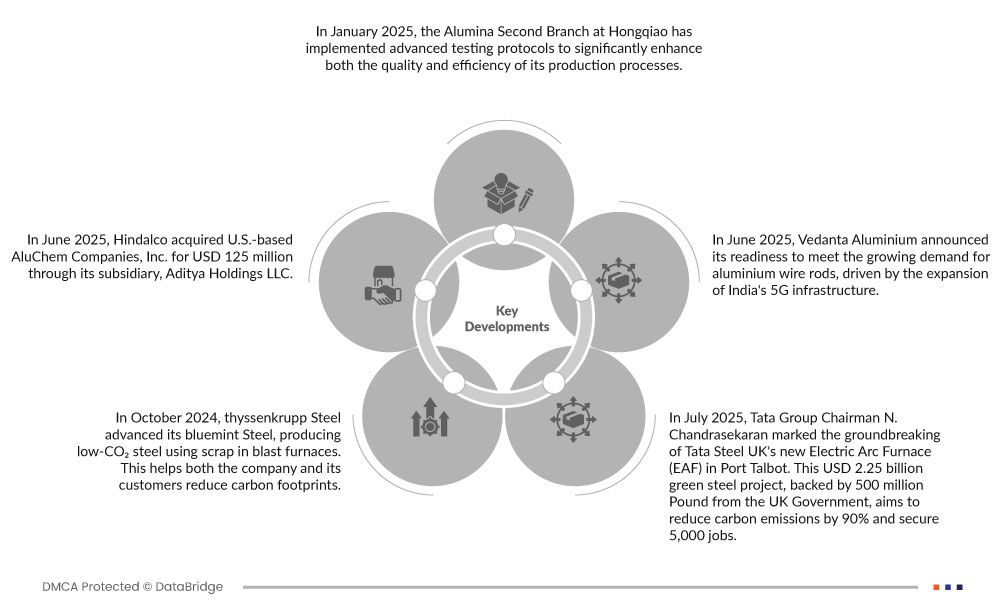

Market Development

- In January 2025, the Alumina Second Branch at Hongqiao has implemented advanced testing protocols to significantly enhance both the quality and efficiency of its production processes. The initiative focuses on stricter quality controls, faster data analysis, and improved equipment calibration. As a result, the branch has achieved greater consistency in product standards and minimized defects. This move reflects Hongqiao’s commitment to high performance, operational safety, and customer satisfaction. Continuous training and upgraded lab facilities are also key contributors to this improvement

- In June 2025, Hindalco acquired U.S.-based AluChem Companies, Inc. for USD 125 million through its subsidiary, Aditya Holdings LLC. AluChem, a producer of high-purity alumina, adds strategic value to Hindalco’s global expansion in the high-tech alumina segment. This move strengthens Hindalco’s focus on value-added products, supported by the strong growth and profitability of its existing specialty alumina business

- In October 2024, thyssenkrupp Steel advanced its bluemint Steel, producing low-CO₂ steel using scrap in blast furnaces. This helps both the company and its customers reduce carbon footprints. High-performance, ultra-high-strength steels are also being developed, enabling lighter, safer vehicles with better fuel efficiency and performance

- In July 2025, Tata Group Chairman N. Chandrasekaran marked the groundbreaking of Tata Steel UK's new Electric Arc Furnace (EAF) in Port Talbot. This USD 2.25 billion green steel project, backed by £500 million from the UK Government, aims to reduce carbon emissions by 90% and secure 5,000 jobs. The EAF will be one of the world’s largest, producing 3 million tonnes of low-carbon steel annually. The initiative marks a major step in Tata’s decarbonisation and UK industrial transformation strategy

- In June 2025, Vedanta Aluminium announced its readiness to meet the growing demand for aluminium wire rods, driven by the expansion of India's 5G infrastructure. The company's products are increasingly being used as an alternative to traditional copper in electrical applications due to their high conductivity, lighter weight, and superior strength-to-weight ratio

Regional Analysis

Geographically, the countries covered in the global lightweight metals market report are the U.S., Canada, Mexico, China, Japan, India, South Korea, Australia, Thailand, Indonesia, Taiwan, Malaysia, Vietnam, Philippines, Singapore, Rest of Asia-Pacific, Germany, France, U.K., Spain, Italy, Netherlands, Russia, Sweden, Belgium, Switzerland, Poland, Denmark, Finland, Turkey, Norway, Luxembourg, Rest of Europe, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, Qatar, Bahrain, Egypt, South Africa, Kuwait, Israel, Oman, and Rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global lightweight metals market

North America is the dominant region in the global lightweight metals market due to the strong presence of key automotive and aerospace manufacturers focusing on advanced lightweight material integration. The region benefits from substantial investments in electric vehicles, defense equipment, and sustainable construction practices. Technological advancements in metal processing and favorable government regulations promoting fuel efficiency also support market growth. Additionally, increasing R&D activities and strategic collaborations are enhancing the regional supply chain and production capabilities.

Asia-Pacific is estimated to be the fastest-growing region in the global lightweight metals market

Asia-Pacific is expected to be the fastest-growing region in the global lightweight metals market from 2025 to 2052, driven by rapid industrialization, expanding automotive and aerospace sectors, and increasing demand for electric vehicles across countries like China, India, Japan, and South Korea. The region also benefits from favorable government policies, low manufacturing costs, and a growing focus on infrastructure development. Moreover, rising investments in lightweight metal production facilities and technological innovations are accelerating market expansion in Asia-Pacific.

For more detailed information about the Global Lightweight Metals Market report, click here – https://www.databridgemarketresearch.com/reports/global-lightweight-metals-market