Middle office outsourcing has received huge popularity among enterprises for numerous benefits such as improved customer satisfaction and services, decreased overhead costs, and improved operational efficiency. Middle office outsourcing provides outsourcing to all activities such as portfolio management, liquidity management, foreign exchange and trade management, and asset class servicing. Several market players heavily invest in developing technology to shift the focus from traditional and physical operations towards digitizing business processes.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-middle-office-outsourcing-market

Data Bridge Market Research analyses that the Global Middle Office Outsourcing Market was valued at USD 6274.68 million in 2021 and is expected to reach USD 14048.58 million by 2029, registering a CAGR of 10.60% during the forecast period of 2022-2029. The increasing demand for middle office outsourcing across different sectors will provide potential market growth opportunities in the forecast period.

Increasing adoption of middle office outsourcing solutions is expected to drive the market's growth rate

Several industries are widely adapting and reshaping themselves to meet the growing needs and changing demands of advanced technology and innovation. It typically manages risk and also calculates profits and losses. It allows customers to outsource all these activities. There has been growing adoption and utilization of middle office outsourcing because of its numerous benefits offered and vendors' capabilities, further pressure to minimize costs and improve bottom-lines, and competitive pressures.

For instance,

- In 2020, as per the report by HSBC Bank, there is an increasing growth of middle office outsourcing in Asia because of the growth in the Asian asset management industry boosted by sustained economic growth, a burgeoning middle class, and a rising need for retirement savings

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Offering (Foreign Exchange and Trade Management, Portfolio Management, Investment Operations, Liquidity Management, Asset Class Servicing and Others), Deployment Model (Cloud, On Premises), End User (Investment Banking and Management Firms, Asset Management Companies, Stock Exchanges, Broker- Dealers, Banks and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Accenture (Ireland), BNP Paribas (France), JPMorgan Chase & Co. (India), SS&C Technologies, Inc. (U.S.), Royal Bank of Canada (Canada), State Street Corporation (U.S.), Citigroup Inc. (U.S.), THE BANK OF NEW YORK MELLON CORPORATION (U.S.), CACEIS (France), Apex Group Ltd. (U.S.), Northern Trust Corporation (U.S.), Linedata (France), Empaxis Data Management, Inc. (India), Indus Valley Partners. (India), BROWN BROTHERS HARRIMAN (U.S.), and Genpact (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The middle office outsourcing market is segmented on the basis of offering, deployment model and end user.

- On the basis of offering, the global middle office outsourcing market has been segmented into foreign exchange and trade management, portfolio management, investment operations, liquidity management, asset class servicing and others.

The foreign exchange and trade management segment of offering type is anticipated to dominate the middle office outsourcing market

The foreign exchange and trade management segment is expected to dominate the global middle office outsourcing market with a CAGR of 10.6% in the forecast period of 2022 to 2029 due to factors such as the need to save costs, access to continuous trade support, satisfy regulatory demands, managing remote working of asset management operations successfully and to minimize financial and operational pressure.

- On the basis of deployment model, the global middle office outsourcing market has been segmented into cloud and on premises

The premises segment of deployment model type is anticipated to dominate the middle office outsourcing market

The premises segment is expected to dominate the global middle office outsourcing market with a CAGR of 9.5% in the forecast period of 2022 to 2029 because of the preference of asset managers to manage data on premise deployment model and security issues relating to investment and finance operations.

- On the basis of end user, the global middle office outsourcing market has been segmented into investment banking and management firms, asset management companies, stock exchanges, broker- dealers, banks, industry and others.

The investment banking and management firms segment is expected to dominate the global middle office outsourcing market with a CAGR of 11.0% in the forecast period of 2022 to 2029 because of the rising demand for outsourcing of investment operations, wide ability to concentrate on complex tasks, minimized costs of outsourcing services and to increase the pace of growth.

Major Players

Data Bridge Market Research recognizes the following companies as the major middle office outsourcing market players in middle office outsourcing market are Accenture (Ireland), BNP Paribas (France), JPMorgan Chase & Co. (India), SS&C Technologies, Inc. (U.S.), Royal Bank of Canada (Canada), State Street Corporation (U.S.), Citigroup Inc. (U.S.), THE BANK OF NEW YORK MELLON CORPORATION (U.S.), CACEIS (France), Apex Group Ltd. (U.S.), Northern Trust Corporation (U.S.), Linedata (France)

Market Development

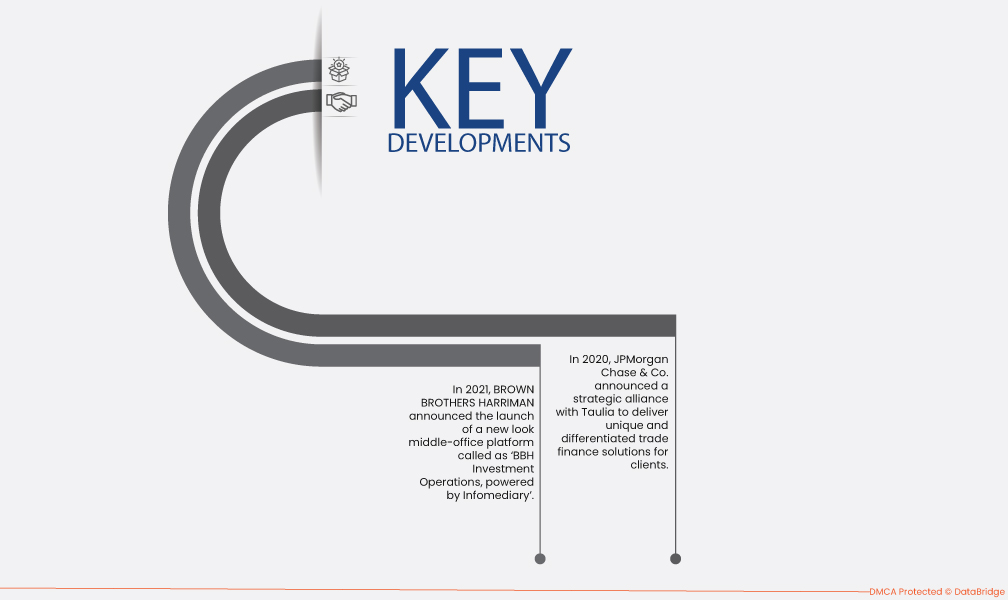

- In 2021, BROWN BROTHERS HARRIMAN announced the launch of a new look middle-office platform called as 'BBH Investment Operations, powered by Infomediary'. This newly launched platform has a goal to transform how asset manager clients utilize data for front-, middle- and back-office processes. This will aid the company in improving its offerings in the market

- In 2020, JPMorgan Chase & Co. announced a strategic alliance with Taulia to deliver clients unique and differentiated trade finance solutions. This has aided JPMorgan's clients for the long term, permitting them to inject and redeploy liquidity to their suppliers, assuring continued operations. This has helped the company leverage Taulia's industry-leading technology platform, data, and analytics to improve and optimize corporate supply chains

Regional Analysis

Geographically, the countries covered in the middle office outsourcing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

As per Data Bridge Market Research analysis:

North America is the dominant region in middle office outsourcing market during the forecast period 2022 to 2029

North America dominates the middle office outsourcing market because of the wide presence of asset management providers and the increasing adoption of technological innovations in middle office outsourcing.

Asia-Pacific is estimated to be the fastest growing region in middle office outsourcing market the forecast period 2022 to 2029

Asia-Pacific is expected to grow from 2022 to 2029 due to the large number of middle office outsourcing suppliers and providers and the rising adoption of automation for business processes.

For more detailed information about middle office outsourcing market report, click here – https://www.databridgemarketresearch.com/reports/global-middle-office-outsourcing-market