The enhancement and up-gradation of old equipment provide an attractive opportunity for many power plants. As the majority of the power plants across the globe are decades old and quite outdated, with the emergence of various restrictions and regulations imposed to cut short the carbon emission, many power plants are under the radar of such organizations in monitoring the emission levels. In a power plant, boilers are essential pieces of equipment; without a fully-functional boiler the plant's power generation capabilities are reduced.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-power-plant-boiler-market

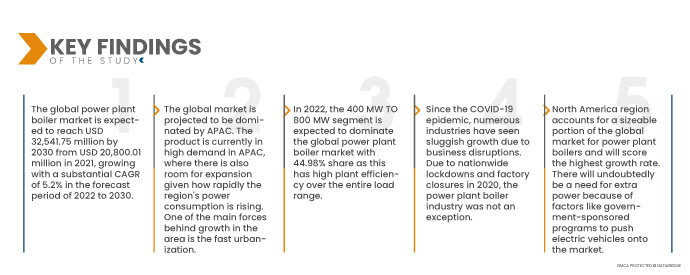

The Global Power Plant Boiler Market is expected to reach USD 32,541.75 million by 2030 from USD 20,800.01 million in 2021, growing with a substantial CAGR of 5.2% in the forecast period of 2022 to 2030. There is a huge demand for energy such as electricity, which boosts the growth of human civilization. Various sources of energy are used in every aspect of life, due to this huge demand for power or energy generation, which can drive the growth of the market as boilers play a vital role in power plants, and energy generation. Growing industrialization in developing and developed nations to meet the emerging need of increased consumer goods, foods, and others is helping the market grow considerably.

Increasing demand for biomass plant boilers across the world will drive the market's growth rate

Increasing emission level in the atmosphere is responsible for global warming. The use of fossil fuels such as oil, gas, and coal causes this rising level of emission. To reduce the emission level and CO2 footprint from the atmosphere, companies are moving towards renewable sources and governments is supporting them. According to the GreenMatch.co.uk Company, businesses in the U.K. are adopting renewable sources to reduce the carbon output by 57% in the next decade. Such a rising initiative is supporting market growth. It creates an opportunity for the market player to introduce solutions that are more advanced with great efficiency for the business applications. Rising support from the government is also creating a lucrative opportunity for the market to grow.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Fuel/Heat Source Type (Coal, Natural Gas, Petroleum, Nuclear Reactor, Others), Pressure Range (High, Medium, Low), Material (Conventional Materials, Designed Materials), Technology (Ultra-Critical, Super Critical, Subcritical, Advanced Ultra Supercritical), Process (Fluidized Bed Combustion, Pulverized Fuel Combustion), Type (Pulverized Coal Tower Boiler, Circulating Fluidized Bed Boiler), Capacity (Less Than 400 MW, 400 MW To 800 MW, More Than 800 MW)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Siemens Energy (Germany), General Electric (U.S.), ALFA LAVAL (Sweden), Babcock & Wilcox Enterprises, Inc. (U.S.), IHI Corporation (Japan), Doosan Heavy Industries & Construction (South Korea), Sumitomo Heavy Industries, Ltd. (Japan), JFE Engineering Corporation (Japan), Sofinter S.p.a (Italy), John Wood Group PLC (U.K.), Bharat Heavy Electricals Limited (India), Thermax Limited (India), ZHENGZHOU BOILER(GROUP) CO.,LTD (China), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), ANDRITZ (Austria), Valmet (Finland), Shanghai Electric (China), PJSC Krasny Kotelshchik (Russia), Hurst Boiler & Welding Co, Inc. (U.S.), ZOZEN boiler Co., Ltd. (China), and Rentech Boilers (U.S.) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

The global power plant boiler market is segmented into seven notable segments, based on the fuel type/heat source, pressure range, material, technology, process, type, and capacity.

- On the basis of fuel type/heat source, the global power plant boiler market is segmented into coal, natural gas, nuclear reactor, petroleum, and others. In 2022, the natural gas segment is expected to dominate the global power plant boiler market with 33.5% share as it is less costly than other fossil fuel sources of energy. Natural gas is much cleaner than other fossil fuels that are because natural gas combustion burns almost completely up to the mark.

- On the basis of pressure range, the global power plant boiler market is segmented into high, medium, and low. In 2022, the high segment is expected to dominate the global power plant boiler market with 43.08% share as high-pressure boilers use forced circulation of water which ensures positive circulation. This also reduces the tendency of scale formation due to the high velocity of the water.

- On the basis of material, the global power plant boiler market is segmented into conventional materials and designed materials. In 2022, the designed materials segment is expected to dominate the global power plant boiler market with 56.11% share as the materials such as stainless steel alloys, nickel alloys are specially designed or manufactured for power plant boiler manufacturing which increases corrosion resistance, strength, and durability.

- On the basis of technology, the global power plant boiler market is segmented into ultra-critical, super critical, subcritical, and advanced ultra-supercritical. In 2022, ultra-critical segment is expected to dominate the global power plant boiler market with 35.73% share as the efficiency of this technology is 46% net efficiency which is significantly higher. It also reduces the CO2 emissions and hence it is dominating.

- On the basis of process, the global power plant boiler market is segmented into fluidized bed combustion and pulverized fuel combustion. In 2022, pulverized fuel combustion segment is expected to dominate the global power plant boiler market with 56.75% share as the thermal efficiency is high. It also results in a faster combustion rate and consequently reduces the requirement of secondary air to complete combustion.

- On the basis of type, the global power plant boiler market is segmented into pulverized coal tower boiler and circulating fluidized bed boiler. In 2022, pulverized coal tower boiler segment is expected to dominate the global power plant boiler market with 56.75% share as it reduces the time of raising the temperature of steam. Furthermore, the combustion of pulverized coal can also be readily be adapted to automatic control.

The pulverized coal tower boiler segment will dominate the type segment of the power plant boiler market

The pulverized coal tower boiler segment will emerge as the dominating segment under type with approximately 31% market share. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the chemicals and industry all around the globe will further bolster the growth of this segment.

- On the basis of capacity, the global power plant boiler market is segmented into less than 400 MW, 400 MW TO 800 MW, more than 800 MW. In 2022, the 400 MW TO 800 MW segment is expected to dominate the global power plant boiler market with 44.98% share as this has high plant efficiency over the entire load range. The general capacity boiler is used in this much capacity as they are made to generate the power in the power plant.

The 400 MW to 800 MW segment will dominate the capacity segment of the power plant boiler market

The 400 MW to 800 MW segment will emerge as the dominating segment under capacity segment. This is because of the growing awareness about the application and usage of 400 MW to 800 MW power plant boilers in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in power plant boiler market: Siemens Energy (Germany), General Electric (U.S.), ALFA LAVAL (Sweden), Babcock & Wilcox Enterprises, Inc. (U.S.), IHI Corporation (Japan), Doosan Heavy Industries & Construction (South Korea), Sumitomo Heavy Industries, Ltd. (Japan), John Wood Group PLC (U.K.), Bharat Heavy Electricals Limited (India), Thermax Limited (India), ZHENGZHOU BOILER(GROUP) CO.,LTD (China), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), PJSC Krasny Kotelshchik (Russia), Hurst Boiler & Welding Co, Inc. (U.S.), ZOZEN boiler Co., Ltd. (China), and Rentech Boilers (U.S.).

Market Development

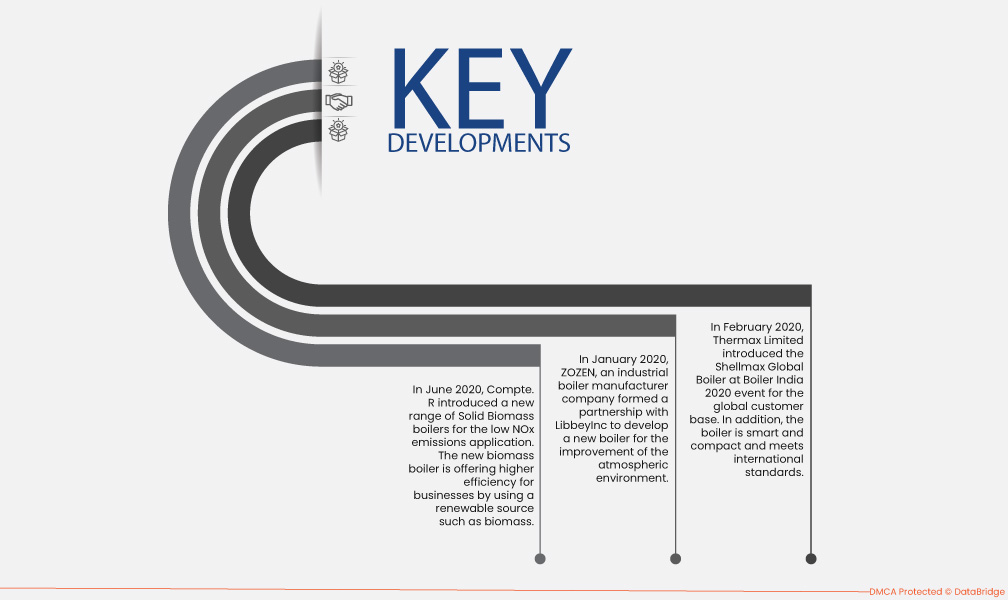

- In June 2020, Compte. R introduced a new range of Solid Biomass boilers for the low NOx emissions application. The new biomass boiler offers higher efficiency for businesses by using a renewable source such as biomass. Industrial businesses are adopting the technology to reduce NOx emissions and it offers automatic cleaning & removal of the ash

- In January 2020, ZOZEN, an industrial boiler manufacturer, formed a partnership with LibbeyInc to develop a new boiler to improve the atmospheric environment. The company is developing low NOx gas-fired boilers for the glassware industry and others. The technology is getting installed at Libbey (China) Co., Ltd plant for which they signed a contract with ZOZEN boiler Co., Ltd. Through this company is lowering the generation of thermal NOx and adhering concept of green manufacturing.

- In February 2020, Thermax Limited introduced the Shellmax Global Boiler at Boiler India 2020 event for the global customer base. The main feature of Shellmax Global Boiler is that it is a biomass-based heating solution used in water treatment solutions, sewage treatment, and other industries. In addition, the boiler is smart and compact and meets international standards.

Regional Analysis

Geographically, the countries covered in the power plant boiler market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in power plant boiler market during the forecast period 2023 - 2030

The global market is projected to be dominated by APAC. The product is currently in high demand in APAC, where there is also room for expansion given how rapidly the region's power consumption is rising. China accounted for the maximum share in the power plant boiler market, due to high power generation capacities in this country and the high number of power plants.

North America is estimated to be the fastest-growing region in power plant boiler market the forecast period 2023 - 2030

North America region accounts for a sizeable portion of the global market for power plant boilers and will score the highest growth rate. There will undoubtedly be a need for extra power because of factors like government-sponsored programs to push electric vehicles onto the market.

COVID-19 Impact

Since the COVID-19 epidemic, numerous industries have seen sluggish growth due to business disruptions. Due to nationwide lockdowns and factory closures in 2020, the power plant boiler industry was not an exception. Several end-use sectors' demand for power decreased because of economic downturns. This further resulted in the utility sector making fewer expenditures to upgrade old power infrastructure and delaying the start of several power projects. According to estimates, countries experienced a decline in electricity demand of almost 20% during lockdown conditions because of less commercial and industrial activity.

For more detailed information about the power plant boiler on market report, click here – https://www.databridgemarketresearch.com/reports/global-power-plant-boiler-market