As palmilhas para sapatos, também conhecidas como palmilhas ou palmilhas interiores, são inserções colocadas no interior do calçado para proporcionar conforto, suporte e proteção adicionais aos pés. Melhoram o alinhamento dos pés, absorvem choques e reduzem a pressão, melhorando a saúde geral dos pés. Os utilizadores finais incluem atletas que necessitam de apoio e prevenção de lesões durante atividades de alto impacto, pessoas com problemas nos pés, como fascite plantar e joanetes, que necessitam de alívio da dor e apoio, diabéticos que necessitam de cuidados adequados com os pés para evitar úlceras, idosos que procuram mais conforto e mobilidade, trabalhadores em empregos fisicamente exigentes, como construção civil e saúde, para apoio prolongado para estar de pé ou caminhar, e consumidores em geral que procuram mais conforto no seu calçado do dia-a-dia.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/global-shoe-insoles-market

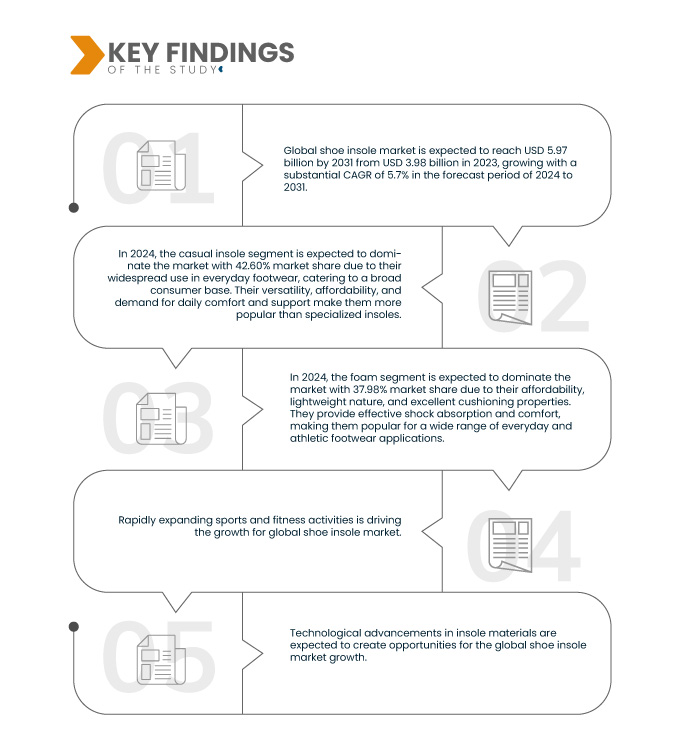

A Data Bridge Market Research analisa que o mercado global de palmilhas para calçado deverá atingir os 5,97 mil milhões de dólares até 2031, face aos 3,98 mil milhões de dólares em 2023, crescendo a um CAGR de 5,7% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento da incidência de distúrbios nos pés e doenças crónicas

À medida que a população global envelhece e a prevalência de condições como a diabetes, a artrite e a obesidade aumenta, há uma procura crescente por soluções de calçado de suporte e terapêutico. As perturbações nos pés, incluindo fascite plantar, pés chatos e joanetes, estão a tornar-se mais comuns, levando as pessoas a procurar palmilhas que ofereçam maior suporte, amortecimento e alívio da dor.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2021-2016)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Tipo (palmilha casual, palmilha desportiva/atlética, palmilha ortopédica, palmilha de segurança e outras), material (espuma, gel, plástico/polímero, silicone , poliuretano , fibra de carbono e outras), gama de preços (baixa, média e alta), personalização (padrão e personalizada), prescrição (sem receita médica e sem receita médica), comprimento (comprimento total, comprimento de 3/4 e calcanhar), espessura da palmilha (fina, média e grossa), utilizador final (idoso (acima de 50 anos), adulto (25 a 50 anos), adolescente (15 a 24 anos) e criança (menor de 14 anos)), canal de distribuição (online e offline)

|

Países abrangidos

|

EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Holanda, Espanha, Rússia, Suíça, Turquia, Bélgica, Luxemburgo, resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Nova Zelândia, resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, África do Sul, Egito e resto do Médio Oriente e África

|

Participantes do mercado abrangidos

|

Decathlon (França), Texon International Group (uma subsidiária da Coats Group plc) (Reino Unido), Bauerfeind USA Inc. (EUA), SUPERFEET WORLDWIDE, LLC (EUA), SPENCO (uma marca da Implus Footcare LLC) (EUA), Scholl’s Wellness Company Limited (EUA), SOLO Laboratories, Inc. (EUA), PROFOOT INC. (EUA), Foot Science International (Nova Zelândia), PowerStep (EUA), Li Ning (China) Sports Goods Co., Ltd. (China), YONEX Co., Ltd. (Japão), SIDAS (França), ENERTOR (Inglaterra), MYFRIDO (Índia), FOOTBALANCE SYSTEM LTD. (Finlândia), Helios India (Índia) e Rehband Limited (Chipre), entre outras

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análise detalhada e atualizada das tendências de preços e análise do défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos:

O mercado global de palmilhas para calçado está segmentado em nove segmentos notáveis com base no tipo, material, gama de preços, personalização, prescrição, comprimento, espessura da palmilha, utilizador final e canal de distribuição.

- Com base no tipo, o mercado global de palmilhas para calçado está segmentado em palmilhas casuais, palmilhas desportivas/atléticas, palmilhas ortopédicas, palmilhas de segurança e outras.

Em 2024, prevê-se que o segmento das palmilhas casuais domine o mercado global de palmilhas para calçado

Em 2024, prevê-se que o segmento das palmilhas casuais domine o mercado com 42,60% de quota devido à sua ampla utilização em calçado do dia a dia , servindo uma ampla base de consumidores. A sua versatilidade, preço acessível e procura por conforto e suporte diários tornam-nos mais populares do que as palmilhas especializadas.

- Com base no material, o mercado global de palmilhas para calçado está segmentado em espuma, gel, plástico/polímero, silicone, poliuretano, fibra de carbono e outros

Em 2024, prevê-se que o segmento da espuma domine o mercado global de palmilhas para calçado

Em 2024, prevê-se que o segmento da espuma domine o mercado com 37,98% de quota de mercado devido à sua acessibilidade, natureza leve e excelentes propriedades de amortecimento. Proporcionam uma absorção de choque eficaz e conforto, tornando-os populares para uma vasta gama de aplicações de calçado desportivo e do dia a dia.

- Com base na gama de preços, o mercado global de palmilhas para calçado está segmentado em baixo, médio e alto. Em 2024, prevê-se que o segmento baixo domine o mercado com uma quota de mercado de 56,86%

- Com base na personalização, o mercado global de palmilhas para calçado está segmentado em standard e personalizadas. Em 2024, prevê-se que o segmento standard domine o mercado com uma quota de mercado de 65,02%

- Com base na prescrição, o mercado global de palmilhas para calçado está segmentado em OTC e prescrito. Em 2024, prevê-se que o segmento OTC domine o mercado com uma quota de mercado de 63,71%

- Com base no comprimento, o mercado global de palmilhas para calçado está segmentado em comprimento total, comprimento de 3/4 e calcanhar. Em 2024, prevê-se que o segmento de comprimento total domine o mercado com uma quota de mercado de 60,15%

- Com base na espessura da palmilha, o mercado global de palmilhas para calçado está segmentado em finas, médias e grossas. Em 2024, prevê-se que o segmento fino domine o mercado com uma quota de mercado de 54,14%

- Com base no utilizador final, o mercado global de palmilhas para calçado está segmentado em idosos (acima dos 50 anos), adultos (25 a 50 anos), adolescentes (15 a 24 anos) e crianças (abaixo dos 14 anos). Em 2024, prevê-se que o segmento sénior (acima dos 50 anos) domine o mercado com uma quota de mercado de 56,62%.

- Com base no canal de distribuição, o mercado global de palmilhas para calçado está segmentado em online e offline. Em 2024, prevê-se que o segmento offline domine o mercado com uma quota de mercado de 54,83%

Principais jogadores

A Data Bridge Market Research reconhece as seguintes empresas como os principais participantes do mercado global de palmilhas para calçado, incluindo a Decathlon (França), Texon International Group (uma subsidiária da Coats Group plc) (Reino Unido), Bauerfeind USA Inc. (EUA), SUPERFEET WORLDWIDE, LLC (EUA), SPENCO (uma marca da Implus Footcare LLC) (EUA).

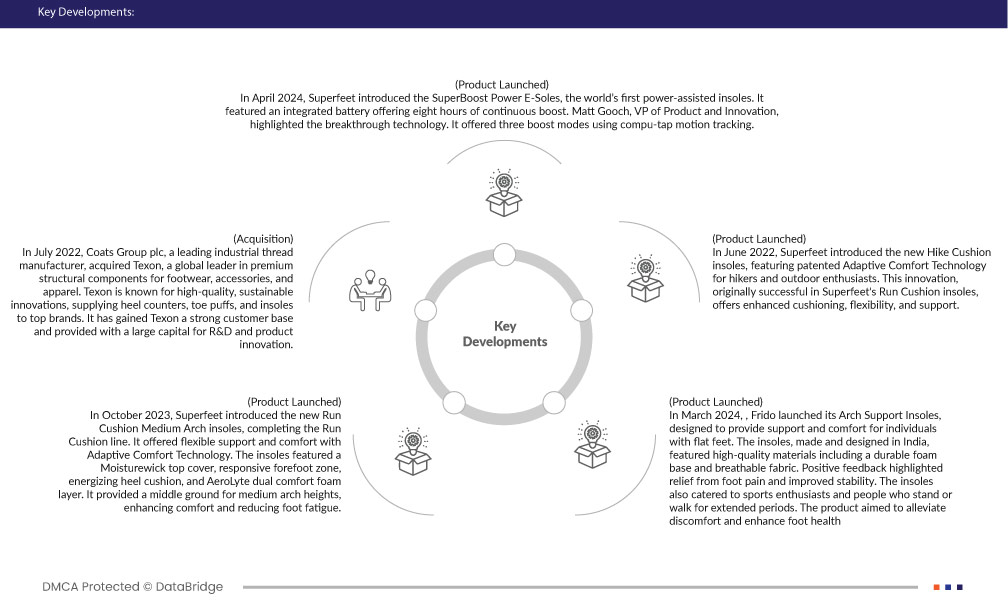

Desenvolvimentos de mercado

- Em abril de 2024, a Superfeet lançou as SuperBoost Power E-Soles, as primeiras palmilhas assistidas por energia do mundo. Contava com uma bateria integrada que oferecia oito horas de potência contínua. Matt Gooch, vice-presidente de produto e inovação, destacou a tecnologia inovadora. Ofereceu três modos de reforço usando o rastreamento de movimento computacional

- Em fevereiro de 2024, a Superfeet lançou as palmilhas Work Cushion e Work Slim-Fit Cushion, concebidas para um suporte durável e antifadiga. O alvo eram trabalhadores da construção civil, indústria, saúde e hotelaria. O Work Cushion é adequado para calçado mais espaçoso, enquanto o Work Slim-Fit Cushion é adequado para calçado mais justo e de inspiração atlética. A tecnologia Adaptive Comfort da Superfeet e a capa Moisturewicktop foram características essenciais. Num estudo recente, 80% referiram uma redução do desconforto e da dor após 30 dias

- Em outubro de 2023, a Superfeet lançou as novas palmilhas Run Cushion Medium Arch, completando a linha Run Cushion. Ofereceu um suporte flexível e conforto com a Tecnologia de Conforto Adaptável. As palmilhas apresentam uma cobertura superior Moisturewick, zona do antepé responsiva, almofada de calcanhar energizante e camada dupla de espuma de conforto AeroLyte. Forneceu um meio-termo para alturas de arco médio, aumentando o conforto e reduzindo a fadiga do pé

- Em junho de 2023, a Superfeet lançou novos nomes e embalagens para as suas palmilhas, de forma a refletir melhor o seu propósito e sensação. Os nomes atualizados incluem descritores para atividades como Caminhada, Corrida e Hóquei, bem como benefícios como Suporte e Amortecimento. A embalagem destaca agora características importantes como a altura do arco, a espessura e a sensação de amortecimento

- Em junho de 2022, a Superfeet lançou as novas palmilhas Hike Cushion, com tecnologia patenteada Adaptive Comfort para praticantes de caminhadas e entusiastas de atividades ao ar livre. Esta inovação, originalmente bem-sucedida nas palmilhas Run Cushion da Superfeet, oferece amortecimento, flexibilidade e suporte melhorados. As palmilhas incluíam Aerolytefoam, uma zona frontal responsiva, uma almofada energizante no calcanhar e Moisturewick para respirabilidade e controlo de odores

Análise Regional

Com base na geografia, o mercado está segmentado em EUA, Canadá, México, Alemanha, Reino Unido, França, Itália, Holanda, Espanha, Rússia, Suíça, Turquia, Bélgica, Luxemburgo, resto da Europa, China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Tailândia, Indonésia, Malásia, Filipinas, Nova Zelândia, resto da Ásia-Pacífico, Brasil, Argentina, resto da América do Sul, Arábia Saudita, Emirados Árabes Unidos, Israel, África do Sul, Egito e resto do Médio Oriente e África.

De acordo com a análise de estudos de mercado da Data Bridge :

A Ásia-Pacífico é a região de crescimento mais rápido e deverá ser a região dominante no mercado global de palmilhas para calçado

Espera-se que a Ásia-Pacífico domine o mercado devido ao seu rápido crescimento industrial, à elevada procura de tecnologias de impressão e à ampla capacidade de fabrico, impulsionando a inovação e a produção na região.

Para obter informações mais detalhadas sobre o relatório do mercado global de palmilhas para calçado, clique aqui – https://www.databridgemarketresearch.com/reports/global-shoe-insoles-market