The sugar reduction technology market refers to the industry and market segment focused on developing and implementing technologies that reduce the amount of sugar in various food and beverage products. These technologies aim to provide alternative solutions to traditional sugar-based ingredients while maintaining taste, texture, and other sensory attributes. Sugar reduction technologies encompass a wide range of approaches, including but not limited to natural sweeteners. These technologies involve using naturally occurring sweeteners such as stevia, monk fruit extract, and erythritol as substitutes for sugar. Artificial sweeteners include synthetic compounds such as aspartame, sucralose, and saccharin, which provide sweetness without the caloric content of sugar.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-sugar-reduction-technology-market

Long-term use of artificial sweeteners can lead to diabetes, interfering with the body's capacity to control blood sugar and challenging market expansion. Consuming artificial sweeteners over an extended period may result in gastrointestinal problems such as diarrhea and bloating.

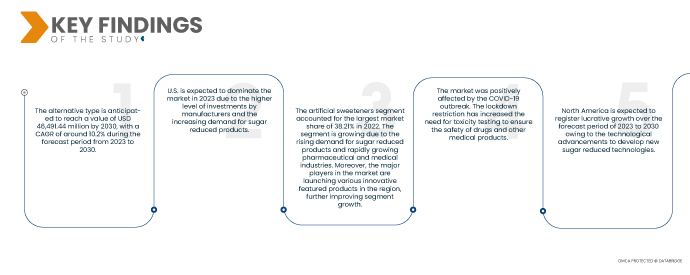

Data Bridge Market Research analyses that the Global Sugar Reduction Technology Market is expected to grow at a CAGR of 10.2% from 2023 to 2030 and reach USD 46,491.44 million by 2030. The rapidly growing pharmaceutical and medical device industries are projected to propel the market's growth.

Key Findings of the Study

- Rapidly growing sugar-reduced industry may drive the market growth

The variables that have dramatically improved consumer products globally have witnessed many revolutionary trends and advances. It was possible to witness the effect of artificial intelligence and big data on the production of sugar-reduced products.

The first significant breakthrough came in the 1870s when saccharin, the first artificial sweetener, was discovered. Saccharin is 300-500 times sweeter than sugar and has no calories. Artificial sweeteners such as cyclamate and aspartame were also developed in the following decades. In the 1950s and 1960s, low-calorie sweeteners such as cyclamate and saccharin gained popularity as sugar substitutes. These sweeteners provided a way to reduce sugar content in various food and beverage products. High-intensity sweeteners are several times sweeter than sugar, allowing for further reduction in sugar content without compromising taste. In the 1970s and 1980s, high-intensity sweeteners such as aspartame, acesulfame potassium (Ace-K), and sucralose were discovered and approved for use.

For instance,

- In May 2020, As per Earth.com published an article named – "Which plant-based natural sweetener is the best pick" cleared that there are many different natural sweeteners available due to the incredible diversity of plants, yet they all have unique characteristics

The prosperity and growth of these industries proportionally increase the demand for sugar-reduced technology for the quality control of the products they develop. Therefore, the rapidly growing demand in various industries act as a driver for the growth of the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Alternative Type (Artificial Sweeteners, Naturally-Derived Sweeteners, Sugar Alcohols, and Sweetness Modulators), Technology (Enzymatic Conversion, Extraction Technology, Flavor Delivery Technology, Cambya Sugar Reduction Technology, and Others), Application (Food & Beverages, Bakery and Confectionery, Processed Foods, Dairy Products, and Others), Sales Channel (Direct Channel, Indirect Channel, and Specialty Stores), Form (Crystallized, Powder, Liquid, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Denmark, Netherlands, Switzerland, Sweden, Poland, Norway, Finland, Rest of Europe, Japan, China, India, South Korea, Australia, New Zealand, Singapore, Thailand, Malaysia, Vietnam, Taiwan, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, Bahrain, U.A.E., Kuwait, Oman, Qatar, Egypt, Israel, and Rest of Middle East and Africa

|

|

Market Players Covered

|

Valio Ltd (Finland)., Kerry Group plc. (U.K.)., Fooditive Group (Netherlands), Arboreal Stevia (India), Sweegen (U.S.), BlueTree Technologies Ltd. (U.S.), Better Juice, (Israel), Inulox Ltd (U.K.), Layn Natural Ingredients (China), Bayn Solutions AB (publ) (Sweden), Sensient Technologies Corporation (U.S.), Givaudan (Switzerland), ADM (U.S.), Cargill Incorporated (U.S.), Tate & Lyle (U.K.), Ingredion Incorporated (U.S.), AJINOMOTO FOODS EUROPE SAS (U.K.), Roquette Freres (France), Celanese Corporation (U.S.), Firmenich SA (India), and DouxMatok (Israel) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The global sugar reduced technology market is segmented into five notable segments such as alternative type, technology, application, sales channel, and form.

- Based on alternative type, the global sugar reduced technology market is segmented into artificial sweeteners, naturally-derived sweeteners, sugar alcohols, sweetness modulators.

In 2023, the artificial sweeteners segment is expected to dominate the global sugar reduced technology market.

In 2023, the artificial sweeteners segment is expected to dominate the market with a market share of 38.57%. It is expected to dominate the market due to its increasing demand among the population.

- Based on technology, the market is segmented into enzymatic conversion, extraction technology, flavor delivery technology, cambya sugar reduction technology, others.

In 2023, the enzymatic conversion segment is expected to dominate the market.

In 2023, the enzymatic conversion segment is expected to dominate the market with a market share of 36.69%. It is expected to dominate the market due to its rising adaptability.

- Based on application, the market is segmented into food & beverages, bakery and confectionery, processed foods, dairy products, others. In 2023, the food & beverages segment is expected to dominate the market with a market share of 42.38%.

- Based on sales channel, the market is segmented into direct channel, indirect channel, specialty stores. In 2023, the direct channel segment is expected to dominate the market with a market share of 47.50%.

- Based on form, the market is segmented into crystallized, powder, liquid, others. In 2023, the crystallized is expected to dominate the market with a market share of 42.82%.

Major Players

Data Bridge Market Research recognizes the following companies as the market players in global sugar reduced technology market Valio Ltd (Finland)., Kerry Group plc. (U.K.)., Fooditive Group (Netherlands), Arboreal Stevia (India), Sweegen (U.S.), BlueTree Technologies Ltd. (U.S.), Better Juice, (Israel), Inulox Ltd (U.K.) , Layn Natural Ingredients (China), Bayn Solutions AB (publ) (Sweden), Sensient Technologies Corporation (U.S.), Givaudan (Switzerland), ADM (U.S.), Cargill Incorporated (U.S.), Tate & Lyle (U.K.), Ingredion Incorporated (U.S.), AJINOMOTO FOODS EUROPE SAS (U.K.), Roquette Freres (France), Celanese Corporation (U.S.), Firmenich SA (India), and DouxMatok (Israel) among others.

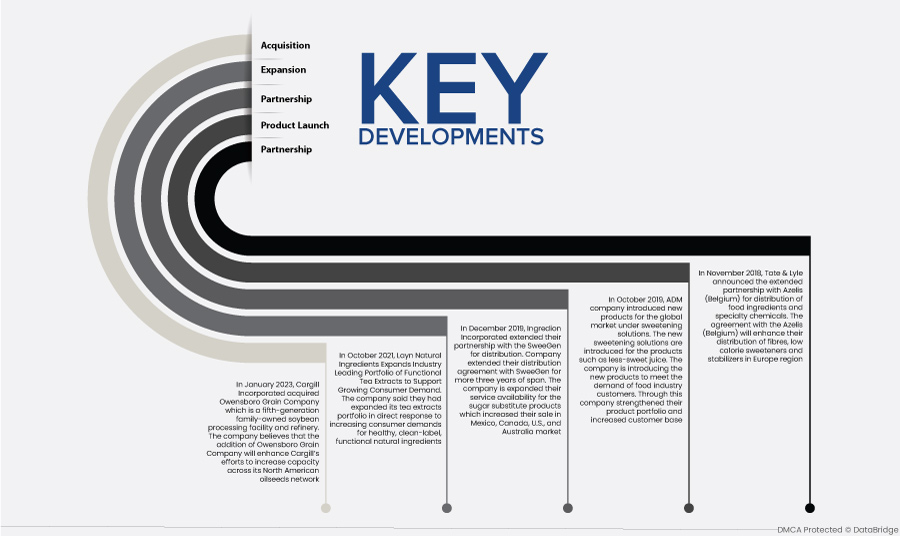

Market Developments

- In January 2023, Cargill Incorporated acquired Owensboro Grain Company, a fifth-generation family-owned soybean processing facility and refinery. The company believes that the addition of Owensboro Grain Company will enhance Cargill's efforts to increase capacity across its North American oilseeds network.

- In October 2021, Layn Natural Ingredients expanded Industry-Leading Portfolio of Functional Tea Extracts to Support Growing Consumer Demand. The company said it had expanded its tea extracts portfolio in direct response to increasing consumer demands for healthy, clean-label, functional natural ingredients.

- In December 2019, Ingredion Incorporated extended its partnership with SweeGen for distribution. Company extended its distribution agreement with SweeGen for more than three years of span. The company is expanded its service availability for sugar substitute products which increased their sale in Mexico, Canada, U.S., and Australia market.

- In October 2019, ADM company introduced new products for the global market under sweetening solutions. New sweetening solutions are introduced for the products, such as less-sweet juice. The company is introducing new products to meet the demand of food industry customers. Through this company strengthened its product portfolio and increased its customer base.

- In November 2018, Tate & Lyle announced the extended partnership with Azelis (Belgium) to distribute food ingredients and specialty chemicals. The agreement with Azelis (Belgium) will enhance their distribution of fibers, low-calorie sweeteners, and stabilizers in the Europe region.

Regional Analysis

Geographically, the countries covered in the global sugar reduced technology market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Denmark, Netherlands, Switzerland, Sweden, Poland, Norway, Finland, Rest of Europe, Japan, China, India, South Korea, Australia, New Zealand, Singapore, Thailand, Malaysia, Vietnam, Taiwan, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, Bahrain, U.A.E., Kuwait, Oman, Qatar, Egypt, Israel, and Rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global sugar reduced technology market during the forecast period 2023 -2030

In 2023, North America is expected to dominate the market owing to the higher level of investments by various manufacturers and increasing demand for sugar reduced technology in the region. North America will continue to dominate the global sugar reduced technology market share and market revenue and flourish its dominance during the forecast period.

Asia-Pacific is estimated to be the fastest-growing region in the global remote patient monitoring and care market for the forecast period 2023-2030

Asia-Pacific is expected to grow during the forecast period due to an increase in the number of healthcare facilities with advanced technology and rising launches and approvals of several new emerging technologies.

For more detailed information about the global sugar-confectionery-market report, click here – https://www.databridgemarketresearch.com/reports/global-sugar-reduction-technology-market