Emerging markets across Asia-Pacific—characterized by dense populations, accelerating urbanization, and rising disposable incomes—are sustaining and even increasing the demand for tobacco products, despite global health efforts to curb usage. Cultural normalization of tobacco, aggressive industry marketing, and weak enforcement of regulations further exacerbate the issue. Consequently, the Asia-Pacific region remains not only the largest contributor to global tobacco consumption but also one of the most stubborn obstacles in achieving global reductions in tobacco use, placing substantial strain on international public health initiatives.

For instances, In January 2025, an article by financial time report that cigarette sales in China increased despite anti-smoking campaigns, driven by loosely enforced regulations and heavy reliance on tobacco as a revenue source—China produced 2.4 trillion cigarettes in 2023, up over 35% since 2003, and cigarette sales captured nearly 47% of global volume. The China National Tobacco Corporation (CNTC) generated RMB1.5 trillion (~USD 206 billion), accounting for approximately 7% of central government revenue. In May 2025, a report by TobaccoReporter, the global cigarette market was valued at approximately USD 1.1 trillion, with projections reaching USD 1.38 trillion by 2033—underscoring the continued economic dominance of combustibles, particularly supported by regional demand in Asia-Pacific.

Rising demand in Asia-Pacific is a powerful driver of the Global Tobacco Products Market, with China and India at the forefront. China alone produces 2.4 trillion cigarettes annually, generating nearly half of global sales and over RMB 1.5 trillion in government revenue, while sustaining a smoker population of more than 300 million. In India, despite a decline in prevalence to 7.1%, the absolute number of smokers remains enormous at 72.7 million, and tobacco use among youth continues to grow, with 20 million children already addicted. The region’s scale and entrenched cultural acceptance ensure that the global cigarette market—valued at USD 1.1 trillion in 2024 and projected to rise to USD 1.38 trillion by 2033—remains robust. With rural smoking prevalence exceeding urban rates, weak enforcement of age-related restrictions, and governments’ fiscal reliance on tobacco revenues, Asia-Pacific not only sustains but actively propels the economic dominance of combustibles worldwide.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-tobacco-products-market

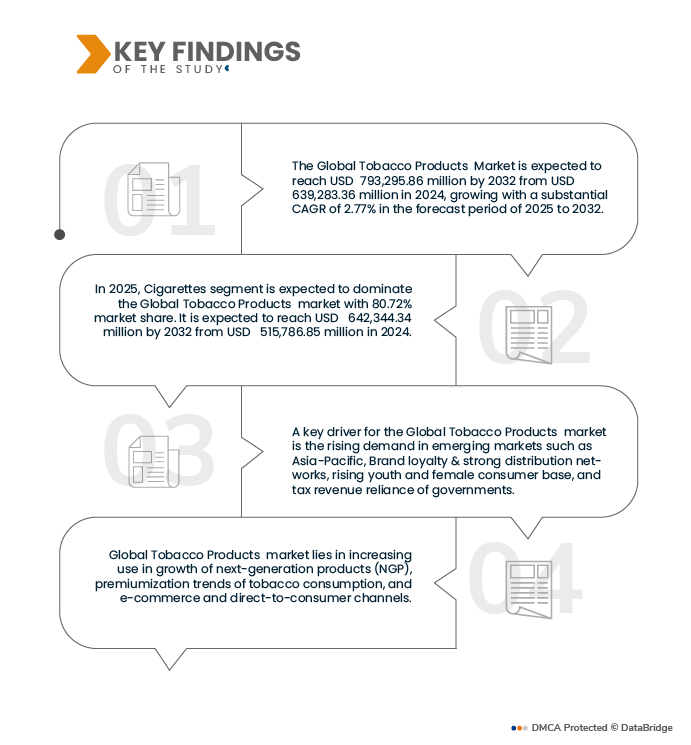

Data Bridge market research analyzes that the Global Tobacco Products Market is expected to reach USD 793,295,860.04 thousand by 2032 from USD 639,283,360.00 thousand in 2024, growing with a substantial CAGR of 2.77% in the forecast period of 2025 to 2032.

Key Findings of the Study

Premiumization Trends of Tobacco Consumption

Amidst intensifying public health scrutiny and tightening regulations, the global tobacco industry is pivoting toward premiumization as a strategic growth lever. Consumers—especially in emerging and mature markets—are increasingly gravitating toward high-end tobacco products, drawn by superior quality, lifestyle appeal, and perceived reduced health impact. This rising preference for premium formats, including flavored, design-led, and innovative delivery systems, enables manufacturers to enhance margins, differentiate portfolios, and capture the aspirational consumer segment—turning premiumization into a compelling opportunity for sustained market expansion.

For Instances, In September 2022 Article Published in PubMed highlighted about Studies that have shown the ‘Premiumization’ strategy to promote the concept that the premium brands of cigarettes are higher quality and less harmful used by the China National Tobacco Corporation (CNTC) does in fact work [37,38]. According to the accounts above, it appears that CNTC’s promotion strategy has an influence on people’s cigarette brand consumption choice. People have been wrongly led to believe that premium cigarettes are of better quality and less harmful.

The growing trend of premiumization within the global tobacco industry is redefining consumer perceptions and market dynamics, particularly in both mature and emerging markets. By aligning tobacco products with themes of luxury, quality, and lifestyle aspiration—as seen through the marketing of brands such as ESSE in India or the content in cigar lifestyle magazines—manufacturers are effectively repositioning smoking as a high-status choice. This strategy not only allows companies to offset volume declines by increasing per-unit margins but also capitalizes on affluent demographics' willingness to pay for exclusivity and perceived sophistication. However, this trend also raises concerns over misperceptions about reduced harm associated with premium products, as observed in China’s CNTC marketing and other global campaigns. Ultimately, premiumization presents a potent growth opportunity, but one that may invite further regulatory attention due to its influence on consumer behavior and health risk perception.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Product type (Cigarettes, Cigar & Cigarillos, E-Cigarettes, Smokeless Tobacco, Next Generation Products, Roll-Your-Own (Ryo) Tobacco, Hookah/Shisha Tobacco, Bidis, Pipes, and Others), By Tobacco Type (Virginia, Burley, Oriental, Mixed, and Others) By Flavor (Flavored, Regular and Others), By Price Range (Mass, Premium, and Luxury), By Age Group (Millennials (25–40 years), Generation X (41–56 years), and Baby Boomers (57–75 years)), By End-User (Men, Women, and Unisex), By Distribution Channel (Non-Store Retailers and Store-Based Retailers)

|

|

Countries Covered

|

India, Indonesia, Philippines, Malaysia, Vietnam, Taiwan, Hong Kong, Rest of South and Pacific Asia, Germany, Italy, France, Spain, Switzerland, Russia, Poland, Netherlands, Belgium, Luxembourg, Rest of Europe, Mexico, Colombia, Venezuela, Paraguay, Uruguay, Rest of Central & South America, Saudi Arabia, Bahrain, Oman, Rest of Middle East, South Africa, Nigeria, Morocco, Kenya, Tanzania, Mozambique, Côte d’Ivoire, Angola, Cameroon, Senegal, Libya, Congo, Rest of Africa, Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan and Tajikistan

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The global tobacco products market is segmented into seven segments based on product type, tobacco type, flavor, price range, age group, end-user, and distribution channel.

- On the basis of product type, the global tobacco products market is segmented into cigarettes, cigar & cigarillos, e-cigarettes, smokeless tobacco, next generation products, Roll-Your-Own (RYO) tobacco, hookah/shisha tobacco, bidis, pipes, and others.

In 2025, the Cigarettes segment is expected to dominate the market

In 2025, the Cigarettes segment is expected to dominate the market with a market share of 80.72% due to long consumer preference and habit formation, high accessibility and availability, strong distribution network, power price as compared to premium, and extensive marketing and brand loyalty.

- On the basis of tobacco type the Virginia, burley, oriental, mixed, and others.

In 2025, the Virginia segment is expected to dominate the market

In 2025, the Virginia segment is expected to dominate the market with a market share of 56.82% due to mild flavor profile and low nicotine content, high suitability for blending, large scale cultivation, consumer preference for lighter teasting tobacco, and strong demand from leading cigarette manufactures.

- On the basis of flavor, the market is segmented into flavored, regular, others.

In 2025, the flavored segment is expected to dominate the market

In 2025, the flavored segment is expected to dominate the market with a market share of 47.47% due to the high consumer appeal, wide product variety, strong penetration in emerging markets, and marketing strategies focused on lifestyle and experience.

- On the basis of price range, the market is segmented into mass, premium, and luxury.

In 2025, the mass segment is expected to dominate the market

In 2025, the mass segment is expected to dominate the market with a market share of 60.95% due to its affordability and accessibility, high consumption in developing and price sensitive markets, large scale production and distribution, wider retail presence, and strong brand loyalty.

- On the basis of age group, the market is segmented into blood sample-based millennials (25–40 years), Generation X (41–56 years), and baby boomers (57–75 years).

In 2025, the millennials segment is expected to dominate the market

In 2025, the millennials segment is expected to dominate the market with a market share of 42.63% due to its largest smoking population, lifestyle driven consumption, strong adoption of flavored and next-generation products, high brand engagement, and rising affordable income in emerging markets.

- On the basis of end user, the market is segmented into men, women, and unisex.

In 2025, the men segment is expected to dominate the market

In 2025, the men segment is expected to dominate the market with a market share of 68.25% due to the high prevalence of tobacco among men, greater acceptance of smoking in male dominated societies, and targeted marketing and branding.

- On the basis of distribution channel, the market is segmented into non-store retailers and store-based retailers.

In 2025, the store retailers segment is expected to dominate the market

In 2025, the store retailers segment is expected to dominate the market with a market share of 84.41% due to high consumer preference for physical purchase, wide availability across store retailers, higher trust and authenticity perception, and established distribution networks.

Major Players

Philip Morris Products S.A. (U.S.), Imperial Brands Plc (U.K.), British American Tobacco p.l.c (U.K.), JTI SA (Switzerland), PT Djarum (Indonesia) among others.

Market Developments

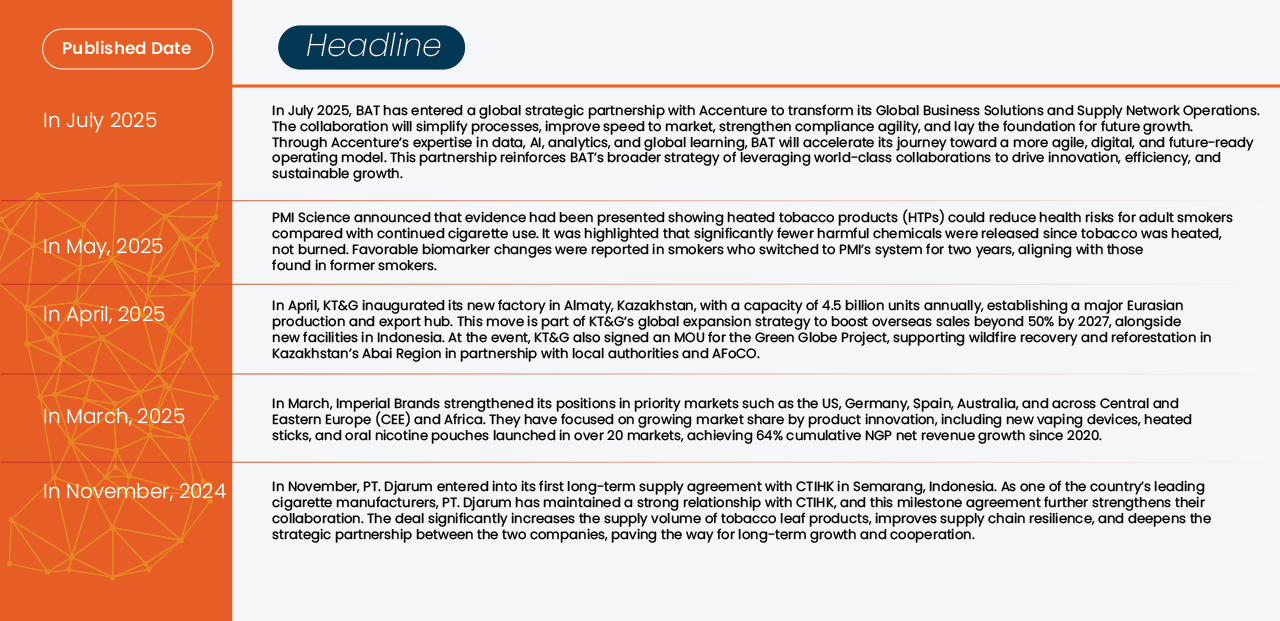

- In July 2025, BAT has entered a global strategic partnership with Accenture to transform its Global Business Solutions and Supply Network Operations. The collaboration will simplify processes, improve speed to market, strengthen compliance agility, and lay the foundation for future growth. Through Accenture’s expertise in data, AI, analytics, and global learning, BAT will accelerate its journey toward a more agile, digital, and future-ready operating model. This partnership reinforces BAT’s broader strategy of leveraging world-class collaborations to drive innovation, efficiency, and sustainable growth.

- In May 2025, PMI Science announced that evidence had been presented showing heated tobacco products (HTPs) could reduce health risks for adult smokers compared with continued cigarette use. It was highlighted that significantly fewer harmful chemicals were released since tobacco was heated, not burned. Favorable biomarker changes were reported in smokers who switched to PMI’s system for two years, aligning with those found in former smokers.

- In April 2025, KT&G inaugurated its new factory in Almaty, Kazakhstan, with a capacity of 4.5 billion units annually, establishing a major Eurasian production and export hub. This move is part of KT&G’s global expansion strategy to boost overseas sales beyond 50% by 2027, alongside new facilities in Indonesia. At the event, KT&G also signed an MOU for the Green Globe Project, supporting wildfire recovery and reforestation in Kazakhstan’s Abai Region in partnership with local authorities and AFoCO.

- In March 2025, Imperial Brands strengthened its positions in priority markets such as the US, Germany, Spain, Australia, and across Central and Eastern Europe (CEE) and Africa. They have focused on growing market share by product innovation, including new vaping devices, heated sticks, and oral nicotine pouches launched in over 20 markets, achieving 64% cumulative NGP net revenue growth since 2020.

- In November 2024, PT. Djarum entered into its first long-term supply agreement with CTIHK in Semarang, Indonesia. As one of the country’s leading cigarette manufacturers, PT. Djarum has maintained a strong relationship with CTIHK, and this milestone agreement further strengthens their collaboration. The deal significantly increases the supply volume of tobacco leaf products, improves supply chain resilience, and deepens the strategic partnership between the two companies, paving the way for long-term growth and cooperation.

As per Data Bridge Market Research analysis:

For more detailed information about the Global Tobacco Products Market report, click here – https://www.databridgemarketresearch.com/reports/global-tobacco-products-market