Usage-Based Insurance (UBI) applications utilize telematics technology to track and analyze driving behavior, capturing data on factors such as speed, distance, braking, and acceleration. This data helps insurers make personalized risk assessments, offering tailored coverage and premiums based on an individual's driving habits. UBI apps promote safer driving practices by providing feedback to users on their driving performance and encouraging responsible behavior on the roads. With UBI applications, customers can potentially save on insurance costs while enjoying more transparent and fairer coverage options.

Access Full Report : https://databridgemarketresearch.com/reports/global-usage-based-insurance-market

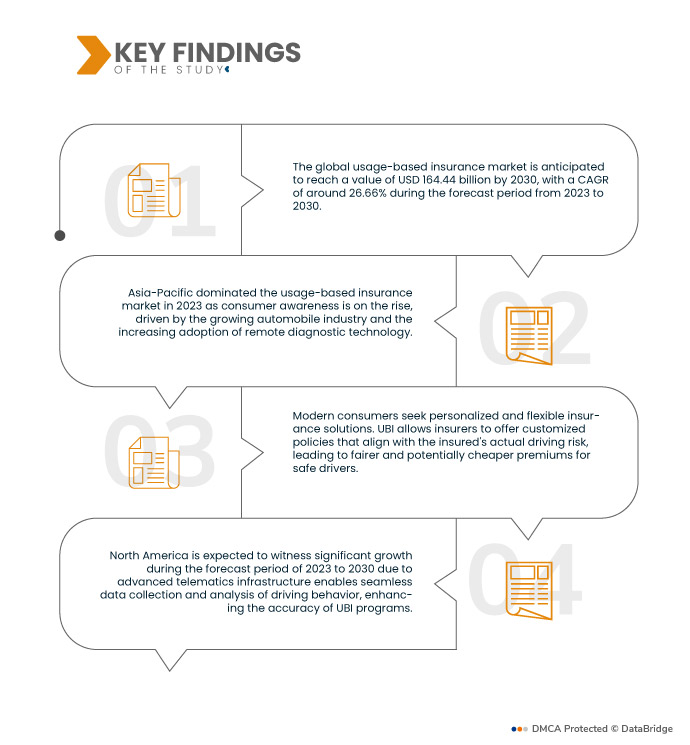

Data Bridge Market Research analyses that the Global Usage-Based Insurance Market is valued at USD 24.83 billion in 2022 and is expected to reach USD 164.44 billion by 2030, registering a CAGR of 26.66% during the forecast period of 2023 to 2030. The continuous advancements in data analytics enable insurers to process and interpret the vast amounts of data collected through telematics effectively. This helps in making informed decisions on risk assessment and pricing.

Key Findings of the Study

Improved data analytics is expected to drive the market's growth rate

Big data analytics and artificial intelligence have revolutionized the insurance industry, enabling insurers to efficiently process and analyze vast amounts of driving data. With this capability, insurers can make more accurate risk assessments based on individual driving behavior, leading to the creation of highly precise pricing models for Usage-Based Insurance. This data-driven approach promotes personalized and fairer insurance premiums, rewarding safe drivers while encouraging safer practices on the roads.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

Segments Covered

|

Vehicle Type (Passenger Car, Commercial Vehicle), Package Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)), Device Offering (Company Provided, Bring Your Own Device (BYOD), Technology (OBD-II, Smartphone, Embedded System, Black Box, Others, Hybrid, Metal Forming Market for Automotive), Vehicle Age (New Vehicles, On-Road Vehicles), Electric and Hybrid Vehicle Type (Hybrid Electric Vehicle (HEV), Plug-In Hybrid Vehicle (PHEV), Battery Electric Vehicle (BEV))

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

Market Players Covered

|

Cambridge Mobile Telematics (U.S.), insurethebox (U.K.), Progressive Casualty Insurance Company (U.S.), The Modus Group, LLC (U.S.), Inseego Corp. (U.S.), Lemonade Inc. Metromile (U.S.), The Floow Limited (U.K.), Allstate Insurance Company (U.S.), Octo Group S.p.A (Italy), TomTom International BV. (Netherlands), UNIPOLSAI ASSICURAZIONI S.P.A. (Italy), Assicurazioni Generali S.p.A (Italy), Liberty Mutual Insurance (U.S.), Equitable Holdings, Inc.(Italy), MAPFRE(Spain), Sierra Wireless (Canada), Verizon (U.S.), Allianz Partners (Germany)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The usage-based insurance market is segmented on the basis of vehicle type, package type, device offering, technology, vehicle age, and electric and hybrid vehicle type.

- On the basis of vehicle type, the market is segmented into passenger car, commercial vehicle.

- On the basis of package type, the market is segmented into pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive (MHYD).

- On the basis of device offering, the market is segmented into company provided, bring your own device (BYOD).

- On the basis of technology, the market is segmented into OBD-II, smartphone, Embedded System, black box, others, hybrid, Metal Forming Market for automotive.

- On the basis of vehicle age, the market is segmented into new vehicles, on-road vehicles.

- On the basis of electric andHybrid Vehicle type, the market is segmented into hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV).

Major Players

Data Bridge Market Research recognizes the following companies as the major Usage-based insurance market players in Usage-based insurance market are Cambridge Mobile Telematics (U.S.), insurethebox (U.K.), Progressive Casualty Insurance Company (U.S.), The Modus Group, LLC (U.S.), Inseego Corp. (U.S.), Lemonade Inc. Metromile (U.S.), The Floow Limited (U.K.), Allstate Insurance Company (U.S.)

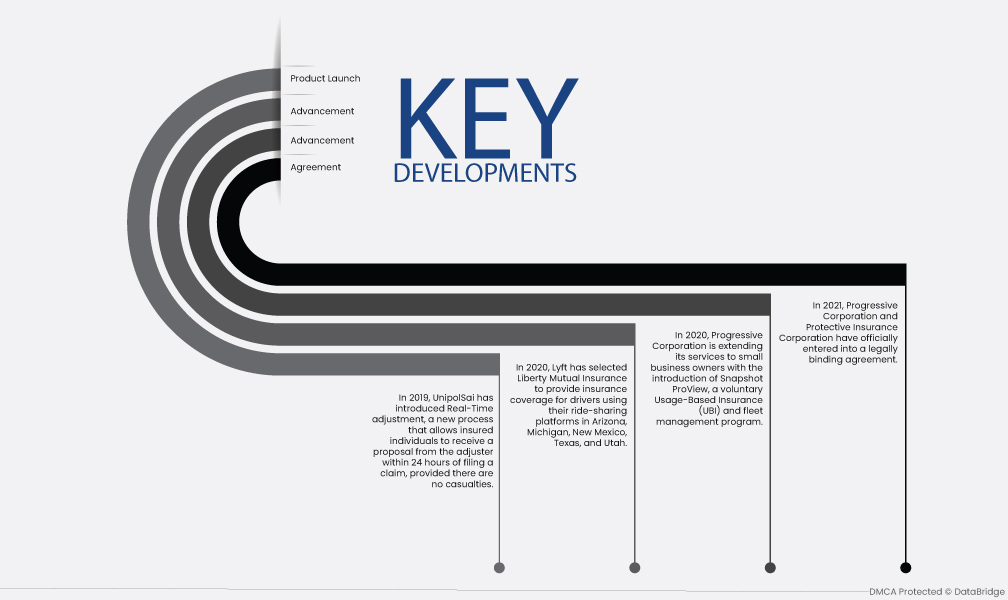

Market Developments

- In 2021, Progressive Corporation and Protective Insurance Corporation have officially entered into a legally binding agreement. According to the deal, Progressive will acquire all of Protective Insurance Corporation's outstanding Class A and Class B common shares.

- In 2020, Progressive Corporation is extending its services to small business owners with the introduction of Snapshot ProView, a voluntary Usage-Based Insurance (UBI) and fleet management program. This program is now integrated into Smart Haul, which is Progressive's UBI initiative for truckers, utilizing Electronic Logging Device (ELD) data to provide discounts for practicing defensive driving.

- In 2020, Lyft has selected Liberty Mutual Insurance to provide insurance coverage for drivers using their ride-sharing platforms in Arizona, Michigan, New Mexico, Texas, and Utah. Under this program, Liberty Mutual offers specific insurance coverages in these five states from the moment a driver activates their Lyft app until they deactivate it.

- In 2019, UnipolSai has introduced Real-Time adjustment, a new process that allows insured individuals to receive a proposal from the adjuster within 24 hours of filing a claim, provided there are no casualties. This innovative procedure streamlines the use of the black box, making it more user-friendly for customers.

Regional Analysis

Geographically, the countries covered in the usage-based insurance market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in usage-based insurance market during the forecast period 2023 - 2030

In 2023, Asia-Pacific dominated the usage-based insurance market due to the surge in the number of connected cars has led to the introduction of new usage-based insurance (UBI) offerings. These advancements enable personalized insurance plans that factor in individual driving behavior, providing cost-effective and tailored coverage for drivers. This trend reflects the industry's response to the demands of a tech-savvy and safety-conscious consumer base, fostering a positive shift towards more efficient and customer-centric insurance solutions.

North America is expected to witness significant growth during the forecast period of 2023 to 2030

In 2023, North America is expected to witness significant growth due to high smartphone penetration facilitating easy integration of UBI apps and encouraging greater consumer participation. The presence of major insurance providers focusing on UBI offerings fosters competition and innovation in the market. Together, these factors have created a conducive environment for the rapid adoption of UBI, providing drivers with more personalized and cost-effective insurance options based on their driving habits.

For more detailed information about the usage-based insurance market report, click here – https://www.databridgemarketresearch.com/reports/global-usage-based-insurance-market