Obesity can cause heart attacks, organ failure, and other health problems. Obesity affects 25% of males and 26% of women in England, according to NHS Digital data from 2021. Consumers prefer organic and natural food due to increased awareness about healthy living and nutritional food: health-conscious consumers prefer fat-free and sugar-free products. Wheat gluten is a good source of vitamins and minerals essential to a healthy diet. Wheat gluten is used to replace soy-based foods and meat. Wheat gluten is a common ingredient in baking and confectionery items.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-wheat-gluten-market

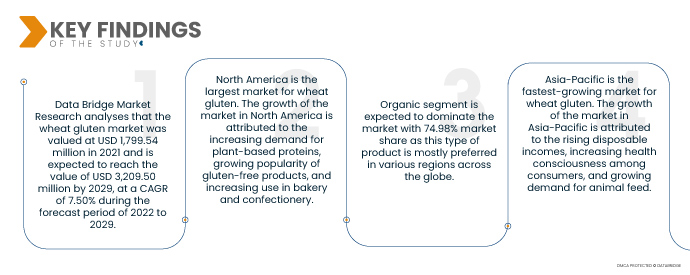

Data Bridge Market Research analyses that the Wheat Gluten Market was valued at USD 1,799.54 million in 2021 and is expected to reach the value of USD 3,209.50 million by 2029, at a CAGR of 7.50% during the forecast period of 2022 to 2029. The growth of the market is driven by the increasing demand for plant-based proteins, growing popularity of gluten-free products, increasing use in bakery and confectionery, and rising demand for animal feed. Wheat gluten is a good source of protein for animals, and it is also a relatively inexpensive ingredient. The demand for animal feed is expected to grow in the coming years, which will drive the demand for wheat gluten.

Growing demand for plant-based proteins is expected to drive the market's growth rate

The global population is becoming increasingly health-conscious, and there is a growing demand for plant-based proteins. Wheat gluten is a good source of protein, and it is also gluten-free, making it a popular choice for people following a gluten-free diet. A growing number of people who are sensitive to gluten are looking for gluten-free alternatives to their favorite foods. Wheat gluten is a common ingredient in many foods but can be easily replaced with gluten-free alternatives.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014- 2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Category (Organic and Inorganic), Function (Emulsifier, Solidifier, Binder and Others), Form (Liquid and Dry), Application (Food & Beverages, Animal Feed and Others), Packaging (Bottle/Jar, Pouch & Bags, Boxes and Others), Distribution Channel (Store Based Retailers and Non-Store Based Retailers), End User (Household/Retail and Commercial)

|

|

Countries Covered

|

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

|

|

Market Players Covered

|

Cargill, Incorporated (U.S.), ADM (U.S.), Crespel & Deiters Group (Germany), Glico Nutrition Co., Ltd. (Japan), Sedamyl (U.K.), Manildra Group (Australia), Roquette Frères (France), Henan Tianguan Group Co. Ltd (China), Permolex, Meelunie B.V. (Canada), Mühlenchemie GmbH & Co. KG (Netherlands), Royal Ingredients Group (Germany), and Kröner Stärke (Netherlands)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

The global wheat gluten market is categorized into seven notable segments such as category, function, form, packaging, application, end user, and distribution channel.

- Based on category, the market is segmented into organic and inorganic. Organic segment is expected to dominate the market with 74.98% market share as this type of product is mostly preferred in various regions across the globe.

- Based on function, the market is segmented into, emulsifier, solidifier, binder, and others. Binder segment is expected to dominate the market with 54.37% market share as this type of function has more impact on the market.

- Based on form, the market is segmented into liquid and dry. Dry segment is expected to dominate the market with 94.04% market share as this type of product is easy to handle and has more impact on the market.

- Based on application, the market is segmented into food & beverages, animal feed, and others. Food & beverages segment is expected to dominate the market with 57.73% market share as this category is majorly sold in the market.

- Based on packaging, the market is segmented into bottle/jar, pouch & bags, boxes, and others. In 2022, pouch & bags segment is expected to dominate the market with 51.36% market share as this type of packaging has more demand in the market.

The pouch & bags segment will dominate the packaging segment of the wheat gluten market

The pouch & bags segment will emerge as the dominating segment packaging segment. This is because of the growing number of food & beverages processing industries in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

- Based on end user, the market is segmented into household/retail and commercial. Commercial segment is expected to dominate the market with 66.16% market share as this type of end user has a strong share in the market.

- Based on distribution channel, the market is segmented into store based retailers and non-store based retailers. Store based retailers segment is expected to dominate the market with 69.58% market share as this type of distributional channel has a wider range of segments in the market.

The store based retailers segment will dominate the distribution channel segment of the wheat gluten market

The store based retailers segment will emerge as the dominating segment under distribution channel. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the food and beverages industry all around the globe will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the major market players: Cargill, Incorporated (U.S.), ADM (U.S.), Crespel & Deiters Group (Germany), Glico Nutrition Co., Ltd. (Japan), Sedamyl (U.K.), Manildra Group (Australia), Roquette Frères (France), Henan Tianguan Group Co. Ltd (China), Permolex, Meelunie B.V. (Canada), Mühlenchemie GmbH & Co. KG (Netherlands), Royal Ingredients Group (Germany), and Kröner Stärke (Netherlands).

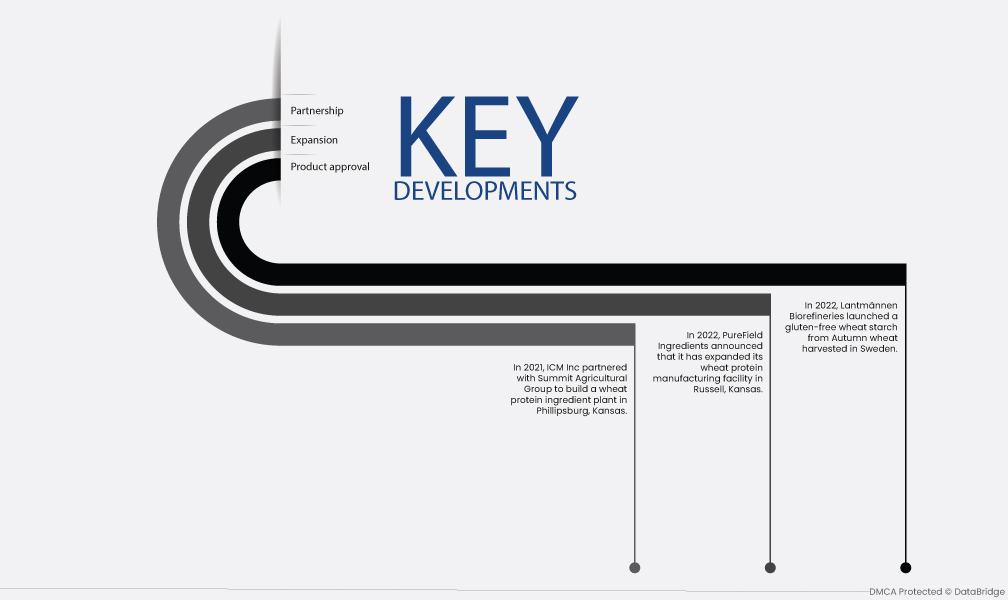

Market Development

- In 2022, Lantmännen Biorefineries launched a gluten-free wheat starch from Autumn wheat harvested in Sweden. The product is a fine white powder with a neutral taste that contains about 0.35% gluten protein. The product is launched for its use in bakery products. Lantmännen Biorefineries is a Swedish company that produces a variety of food ingredients, including wheat starch. The company has a long history of innovation in the food industry and is committed to providing high-quality products that meet the needs of consumers.

- In 2022, PureField Ingredients announced that it has expanded its wheat protein manufacturing facility in Russell, Kansas. The company expanded its production capacity to 50% to meet the growing demand for sustainable wheat protein. Wheat protein is a high-quality protein that is a good source of amino acids. It can be used in a variety of food products, including baked goods, snacks, and meat substitutes.

- In 2021, ICM Inc partnered with Summit Agricultural Group to build a wheat protein ingredient plant in Phillipsburg, Kansas. The Summit Agricultural Group produces wheat gluten ingredients for use in food and specialty feed products. Wheat gluten is a high-protein ingredient that is used to give baked goods their structure and texture. It is also used in a variety of other food products, such as pasta, noodles, and bread crumbs.

Regional Analysis

Geographically, the countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

As per Data Bridge Market Research analysis:

North America is the dominant region in the wheat gluten market during the forecast period 2022-2029

North America is the largest market for wheat gluten. The growth of the market in North America is attributed to the increasing demand for plant-based proteins, growing popularity of gluten-free products, and increasing use in bakery and confectionery.

Asia-Pacific is estimated to be the fastest-growing region in the wheat gluten market in the forecast period 2022-2029

Asia-Pacific is the fastest-growing market for wheat gluten. The growth of the market in Asia-Pacific is attributed to rising disposable incomes, increasing health consciousness among consumers, and growing demand for animal feed.

For more detailed information about the wheat gluten market report, click here – https://www.databridgemarketresearch.com/reports/global-wheat-gluten-market