Private health insurance offers individuals and families access to a wide range of healthcare services and benefits. Its applications encompass medical consultations, hospital stays, surgery, and preventive care. Key benefits of private health insurance include faster access to specialists, shorter wait times, and coverage for elective procedures. It provides financial security by covering medical expenses, including prescriptions and therapies. Notable features of private health insurance often include customizable coverage options, choice of healthcare providers, and international coverage, ensuring individuals receive tailored care and peace of mind in managing healthcare costs.

Access Full Report @ https://www.databridgemarketresearch.com/reports/malaysia-private-health-insurance-market

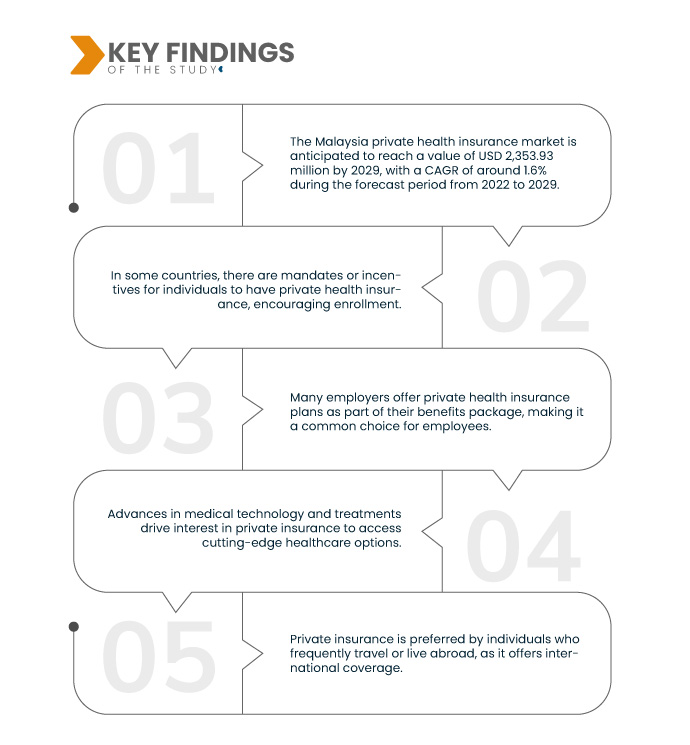

Data Bridge Market Research analyses that the Malaysia Private Health Insurance Market is valued at USD 2,073.21 million in 2021 and is expected to reach USD 2,353.93 million by 2029, registering a CAGR of 1.6% during the forecast period of 2022 to 2029. With escalating healthcare costs, private health insurance becomes a vital financial safeguard. Individuals and employers turn to it to mitigate expenses and secure access to top-notch medical services. It offers peace of mind by covering a significant portion of healthcare bills, ensuring quality care remains accessible and affordable.

Key Findings of the Study

Aging population is expected to drive the market's growth rate

The aging population places greater demands on healthcare services due to increased medical needs associated with aging. Consequently, more individuals turn to private health insurance to ensure comprehensive coverage. Private plans often offer broader healthcare options, shorter wait times, and access to specialized care, addressing the specific needs of the elderly population. This demographic shift propels the demand for private insurance, which caters to the unique healthcare requirements that come with aging, providing peace of mind and better access to healthcare services.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS) and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years) and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators and Others)

|

|

Market Players Covered

|

AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), HSBC Group (Hong Kong), Great Eastern Holdings Limited (Malaysia), Zurich (Switzerland), ASSICURAZIONI GENERALI S.P.A. (Italy), AXA (France), Etiqa (Malaysia), Prudential Assurance Malaysia Berhad (Malaysia), Hong Leong Assurance Berhad (Malaysia), Manulife Holdings Berhad (Malaysia)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The Malaysia private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group, and distribution channel.

- On the basis of type, the market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance, and others.

- On the basis of health plan category/metal levels, the market is segmented into bronze, silver, gold platinum, and others.

- On the basis of provider type, the market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (EPOS), point-of-service (POS) plans, high-deductible health plans (HDHPS), and others.

- On the basis of age group, the market is segmented into young adulthood (19-44 years), middle adulthood (45-64 years) and older adulthood (65 years and above).

- On the basis of distribution channel, the market is segmented into direct insurance companies, insurance aggregators, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the major Malaysia private health insurance market players in Malaysia private health insurance market are AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), HSBC Group (Hong Kong), Great Eastern Holdings Limited (Malaysia), Zurich (Switzerland), ASSICURAZIONI GENERALI S.P.A. (Italy), AXA (France), Etiqa (Malaysia), Prudential Assurance Malaysia Berhad (Malaysia), Hong Leong Assurance Berhad (Malaysia), Manulife Holdings Berhad (Malaysia)

Market Developments

- In February 2022, Assicuranzioni Generali S.P.A. entered into an agreement to acquire La Médicale, an insurance company specializing in healthcare professionals' coverage. As part of this agreement, Predica's death coverage portfolio, which is currently marketed and managed by La Médicale, is also set to be divested.

- In February 2022, Manulife Holdings Berhad has introduced two new insurance products, emphasizing flexibility and affordability. Manulife Universal Saver is a versatile life endowment plan that combines wealth accumulation and protection. Meanwhile, Manulife Easy 5 offers financial security against five prevalent Critical Illnesses. These additions to their product lineup enable the company to diversify and enhance its offerings.

For more detailed information about the Malaysia private health insurance market report, click here – https://www.databridgemarketresearch.com/reports/malaysia-private-health-insurance-market