멕시코 디지털 애니메이션 시장은 디지털 미디어 및 엔터테인먼트 산업에 대한 투자 증가로 수혜를 입고 있습니다. 국내외 기업들이 멕시코가 고품질 애니메이션 제작 허브로서 지닌 잠재력을 인지하고 있기 때문입니다. 주요 스튜디오, 스트리밍 플랫폼, 게임 회사들은 스트리밍 서비스, 브랜드 디지털 캠페인, 몰입형 게임 경험의 인기 증가에 힘입어 애니메이션 콘텐츠에 대한 투자를 늘리고 있습니다. 정부 인센티브와 민간 부문의 자금 지원은 인프라 구축 및 인재 양성을 더욱 활성화하여 멕시코 스튜디오들이 제작 규모를 확대하고 멕시코 내에서 경쟁할 수 있도록 지원하고 있습니다. 이러한 자본 유입은 혁신을 가속화하고 제작 역량을 확대하며, 멕시코가 디지털 애니메이션 산업의 핵심 국가로서 입지를 공고히 하는 데 기여하고 있습니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/mexico-digital-animation-market 에서 확인하세요.

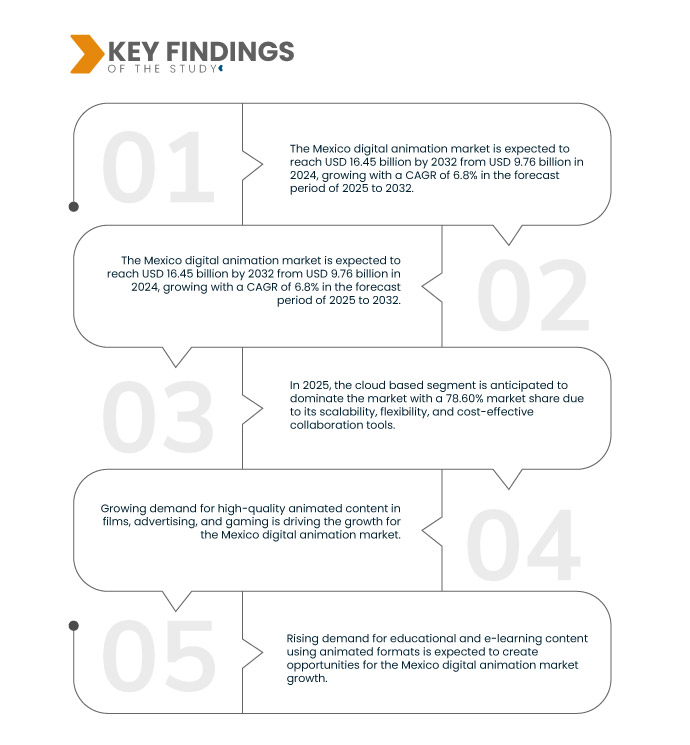

Data Bridge Market Research에 따르면 멕시코 디지털 애니메이션 시장은 2024년 97억 6천만 달러에서 2032년 164억 5천만 달러로 성장할 것으로 예상되며, 2025년부터 2032년까지의 예측 기간 동안 연평균 성장률 6.8%를 기록할 것으로 전망됩니다.

연구의 주요 결과

영화, 광고, 게임에서 고품질 애니메이션 콘텐츠에 대한 수요 증가

멕시코 디지털 애니메이션 시장은 영화, 광고, 게임 분야에서 고품질 애니메이션 콘텐츠에 대한 멕시코 내 수요 증가에 힘입어 탄탄한 성장을 이룰 것으로 예상됩니다. 숙련된 인력, 경쟁력 있는 제작비, 그리고 국제 협력 확대를 바탕으로 멕시코는 디지털 애니메이션 산업의 주요 국가로 부상하고 있습니다. 스트리밍 플랫폼의 확장과 기술 발전은 이러한 성장을 더욱 가속화하여 지역 스튜디오와 애니메이터들에게 새로운 기회를 창출할 것입니다. 시장이 지속적으로 발전함에 따라 멕시코 애니메이션 산업은 엔터테인먼트 산업의 창의적, 상업적 요구를 충족하는 데 있어 점점 더 중요한 역할을 할 것으로 예상됩니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2025년부터 2032년까지

|

기준 연도

|

2024

|

역사적인 해

|

2023 (2018년부터 2023년까지 사용자 정의 가능)

|

양적 단위

|

매출 (USD 10억)

|

다루는 세그먼트

|

유형( 3D 애니메이션 , 2D 애니메이션, 모션 캡처/모션 그래픽, 라이브 액션 애니메이션, 타이포그래피 애니메이션, 화이트보드 애니메이션, 로토스코핑, 전통/수제/셀 애니메이션, 스톱 모션/프레임별, 컷아웃 애니메이션, 클레이 애니메이션 및 기타), 배포 모드(클라우드 기반 및 온프레미스), 마케팅 채널(OTT, 광고, 티켓 판매, 방송/위성 방송권, 만화/만화 및 기타), 애플리케이션(엔터테인먼트, 마케팅 및 광고, 게임, 건축 및 엔지니어링 설계, 시뮬레이션, 데이터 시각화, 현대 미술 및 기타), 수직(영화/영화 산업, 게임 산업, 교육 및 학계, 의료 및 제약 산업, 대량 소비, 자동차 산업, 소매 및 전자 상거래 산업, 부동산 부문, 정부 및 국방 및 기타), 최종 소비자(스트리밍 플랫폼, 텔레비전 채널, 광고 대행사 및 기타), 애니메이션 및 미디어 제작 서비스 유형(2D 및 3D 애니메이션 서비스, 후반 작업 및 시각 효과(VFX), 사전 제작 및 컨셉 개발, 비디오 제작 및 디지털 미디어, 오디오 제작 및 사운드 디자인 등)

|

포함 국가

|

멕시코시티, 멕시코주, 누에보레온, 할리스코, 베라크루즈, 과나후아토, 바하칼리포르니아, 소노라, 치와와 및 멕시코 나머지 지역

|

시장 참여자 포함

|

Epic Games, Inc.(미국), Universal Studios(미국), SEGA(일본), Anima Estudios SAPI de CV(멕시코), Visualma(멕시코), VIDENS(멕시코), Casa Anafre | Animation Studio(멕시코), Intermedia Digital Studio(멕시코), Estudio Haini(멕시코), wearehobby(멕시코), Chaman Animation Studio(멕시코), Morita Creative Studios(멕시코), Cinema Fantasma(멕시코), EXODO ANIMATION STUDIOS(멕시코), Cluster Studio(멕시코), Boxel Studio(멕시코), Clik Clak Studio(멕시코), Sony Pictures Animation Inc.(미국), Huevocartoon(멕시코), Disney Enterprises, Inc.(미국) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, PESTLE 분석이 포함되어 있습니다.

|

세그먼트 분석

멕시코 디지털 애니메이션 시장은 유형, 배포 모드, 마케팅 채널, 응용 프로그램, 수직, 최종 소비자, 애니메이션 및 미디어 제작 서비스 유형을 기준으로 7개의 주요 세그먼트로 구분됩니다.

- 멕시코 디지털 애니메이션 시장은 유형별로 3D 애니메이션, 2D 애니메이션, 모션 캡처/모션 그래픽, 실사 애니메이션, 타이포그래피 애니메이션, 화이트보드 애니메이션, 로토스코핑, 전통/수작업/셀 애니메이션, 정지 모션/프레임별 애니메이션, 컷아웃 애니메이션, 클레이 애니메이션 등으로 구분됩니다.

2025년에는 3D 애니메이션 부문이 멕시코 디지털 애니메이션 시장을 장악할 것으로 예상됩니다.

2025년에는 기업들이 글로벌 인재와 비용 효율적인 제작 솔루션에 관심을 갖게 되면서 3D 애니메이션 부문이 25.43%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 배포 모드를 기준으로 멕시코 디지털 애니메이션 시장은 클라우드 기반과 온프레미스로 구분됩니다.

2025년에는 클라우드 기반 세그먼트가 멕시코 디지털 애니메이션 시장을 지배할 것으로 예상됩니다.

2025년에는 클라우드 기반 부문이 확장성, 유연성, 비용 효율적인 협업 도구 덕분에 78.60%의 시장 점유율을 차지하며 시장을 지배할 것으로 예상됩니다.

- 멕시코 디지털 애니메이션 시장은 마케팅 채널을 기준으로 OTT, 광고, 티켓 판매, 방송/위성 중계권, 만화/만화 등으로 세분화됩니다. 2025년에는 OTT 부문이 38.83%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 멕시코 디지털 애니메이션 시장은 응용 분야별로 엔터테인먼트, 마케팅 및 광고, 게임, 건축 및 엔지니어링 설계, 시뮬레이션, 데이터 시각화, 현대 미술 등으로 세분화됩니다. 2025년에는 엔터테인먼트 부문이 27.25%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 멕시코 디지털 애니메이션 시장은 산업별로 영화/영화 산업, 게임 산업, 교육 및 학술, 의료 및 제약 산업, 대량 소비, 자동차 산업, 소매 및 전자상거래 산업, 부동산 부문, 정부 및 국방 등으로 세분화됩니다. 2025년에는 영화/영화 산업 부문이 25.07%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 멕시코 디지털 애니메이션 시장은 최종 소비자를 기준으로 스트리밍 플랫폼, TV 채널, 광고 대행사 등으로 세분화됩니다. 2025년에는 스트리밍 플랫폼 부문이 47.11%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

- 애니메이션 및 미디어 제작 서비스 유형을 기준으로 멕시코 디지털 애니메이션 시장은 2D 및 3D 애니메이션 서비스, 후반 작업 및 시각 효과(VFX), 사전 제작 및 콘셉트 개발, 영상 제작 및 디지털 미디어, 오디오 제작 및 사운드 디자인 등으로 세분화됩니다. 2025년에는 2D 및 3D 애니메이션 서비스 부문이 36.91%의 시장 점유율로 시장을 장악할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research는 멕시코 디지털 애니메이션 시장에서 운영되는 주요 회사로 Epic Games, Inc.(미국), Universal Studios(미국), SEGA(일본), Anima Estudios SAPI de CV(멕시코), Visualma(멕시코)를 분석했습니다.

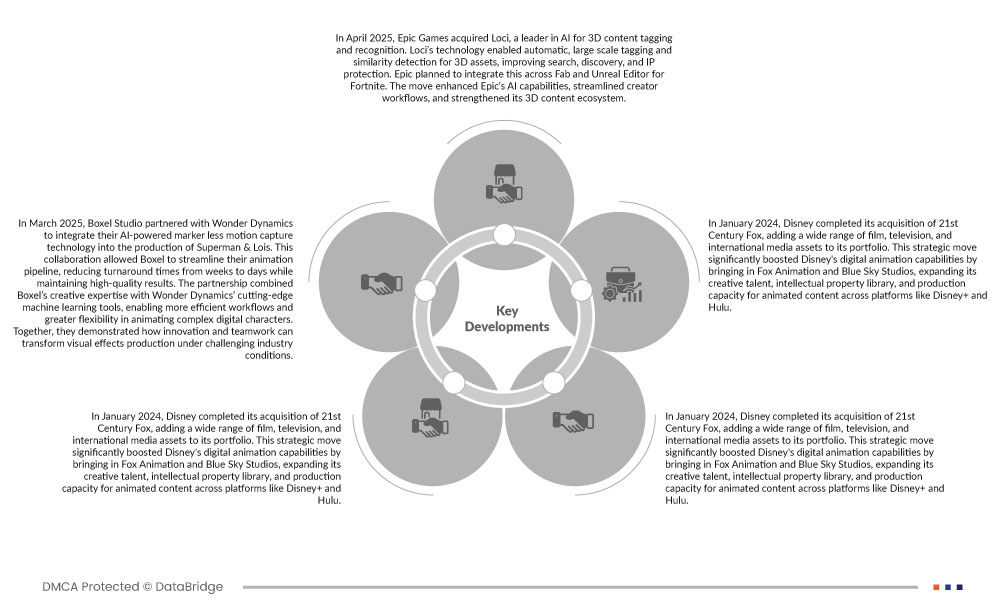

시장 개발

- 2023년 7월, Cluster Studio는 효율성을 높이고 엔터테인먼트 시장 진출을 지원하기 위해 Base light TWO 시스템을 업그레이드했습니다. 멕시코에 본사를 둔 이 후반 작업 스튜디오는 DI, 컬러 그레이딩, VFX, 편집을 포함한 엔드 투 엔드 솔루션으로 서비스를 강화했습니다. 업그레이드를 통해 저장 용량이 세 배로 늘어나고 4K/HDR 워크플로우가 간소화되었습니다. 이러한 투자를 통해 Cluster는 라틴 아메리카 시장에서 입지를 강화하고 넷플릭스, 아마존 등 주요 플랫폼과의 협업을 가능하게 했습니다.

- 2025년 4월, 에픽게임즈는 3D 콘텐츠 태그 지정 및 인식 분야의 AI 선도 기업인 로시(Loci)를 인수했습니다. 로시의 기술은 3D 애셋에 대한 자동 대규모 태그 지정 및 유사성 감지를 가능하게 하여 검색, 발견 및 지적 재산권 보호를 향상시켰습니다. 에픽게임즈는 포트나이트용 Fab 및 언리얼 에디터 전반에 이 기술을 통합할 계획이었습니다. 이를 통해 에픽게임즈의 AI 역량이 강화되고, 크리에이터 워크플로가 간소화되며, 3D 콘텐츠 생태계가 강화되었습니다.

- 2025년 3월, Boxel Studio는 Wonder Dynamics와 파트너십을 맺고 AI 기반 마커리스 모션 캡처 기술을 Superman & Lois 제작에 통합했습니다. 이 협업을 통해 Boxel은 애니메이션 파이프라인을 간소화하여 제작 기간을 몇 주에서 며칠로 단축하는 동시에 고품질 결과물을 유지할 수 있었습니다. Boxel의 창의적 전문성과 Wonder Dynamics의 최첨단 머신러닝 도구를 결합한 이 파트너십은 복잡한 디지털 캐릭터 애니메이션 제작에 있어 더욱 효율적인 워크플로와 뛰어난 유연성을 제공합니다. 두 회사는 혁신과 팀워크가 어려운 업계 환경 속에서 시각 효과 제작을 어떻게 변화시킬 수 있는지 보여주었습니다.

- 2024년 1월, 디즈니는 21세기 폭스 인수를 완료하여 광범위한 영화, TV 프로그램, 그리고 국제 미디어 자산을 포트폴리오에 추가했습니다. 이러한 전략적 행보는 폭스 애니메이션과 블루스카이 스튜디오를 인수함으로써 디즈니의 디지털 애니메이션 역량을 크게 강화했으며, 디즈니+와 훌루 등 다양한 플랫폼에서 창의적인 인재, 지적 재산권, 그리고 애니메이션 콘텐츠 제작 역량을 확대했습니다.

- 2024년 10월, 에픽게임즈는 퀄컴 테크놀로지스와 파트너십을 맺고 언리얼 엔진을 스냅드래곤 콕핏 플랫폼에 최초로 통합했습니다. 이 사전 통합 솔루션을 통해 자동차 제조업체는 고급 실내 시각화 도구를 독점적으로 사용할 수 있게 되었습니다. 이러한 협력을 통해 고품질의 맞춤형 사용자 인터페이스와 더욱 빠른 개발이 가능해졌습니다. 에픽게임즈는 언리얼 엔진의 자동차 기술 분야 진출을 확대하여 다양한 산업 분야에서 실시간 3D 애플리케이션을 강화했습니다.

지역 분석

지리적으로 멕시코 디지털 애니메이션 시장이 포괄하는 지역은 멕시코시티, 멕시코주, 누에보레온, 할리스코, 베라크루스, 과나후아토, 바하칼리포르니아, 소노라, 치와와, 그리고 멕시코의 나머지 지역입니다.

Data Bridge Market Research 분석에 따르면:

멕시코시티는 멕시코 디지털 애니메이션 시장에서 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

멕시코시티는 주요 애니메이션 스튜디오가 밀집되어 있고, 숙련된 인재 풀이 있으며, 첨단 디지털 인프라에 대한 접근성이 뛰어나 멕시코 디지털 애니메이션 시장에서 우위를 점하고 가장 빠르게 성장하는 지역이 될 것으로 예상됩니다.

Data Bridge Market Research 분석에 따르면:

멕시코 디지털 애니메이션 시장에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/mexico-digital-animation-market