Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services costs for surgeries and hospital stays have created a new financial epidemic in Mexico and around the world. The cost of medical services is comprised of the cost of surgery, doctor fees, hospital stay cost, cost of the emergency room, and diagnostic testing costs, among others.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mexico-private-health-insurance-market

Data Bridge Market Research analyses that the Mexico Private Health Insurance Market is expected to grow at a CAGR of 4.3% in the forecast period of 2023 to 2030 and is expected to reach USD 60,268.11 million by 2030. Therefore, the increasing cost of medical services and health expenditure is expected to act as a driver for the Mexico private health insurance market growth.

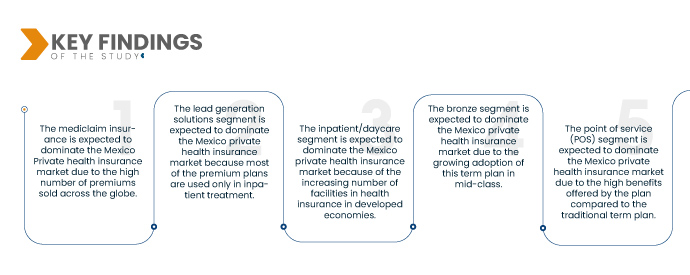

Key Findings of the Study

Increasing Cost of Medical Services and Health Expenditure is Expected to Drive the Market's Growth Rate

Health insurance plans give coverage for many different types of surgeries and ailments, along with other aspects of medical treatment. In the Mexico, due to increasing demand for medical services during the COVID-19 pandemic pushed many people to reevaluate their health and health insurance as medical costs are increasing rapidly. In many medical cases, health insurance covers ambulance costs, the cost of medicines, consultations fee, hospitalization costs, tests as well as the expenditure of post-hospitalization. Due to this, people secure their life by taking a health insurance policy.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2020-20216)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, and Pricing in USD

|

|

Segments Covered

|

By Product Type (Into Mediclaim Insurance, Hospitalization Coverage Insurance, Critical Illness Insurance, Individual Coverage Insurance, Family Floater Coverage Insurance, Senior Citizen Coverage Insurance, Unit Linked Health Plans, Permanent Health Insurance, and Others), Business Solution (Lead Generation Solutions, Revenue Management and Billing Solutions, Robotic Process Automation, Insurance Cloud Solutions, Claims Administration Cloud Solutions, Value-Based Payments Solutions, Artificial Intelligence & Blockchain Solutions, Intelligent Case Management Solutions, and Others), Assistance/Service Type (Inpatient/Daycare, Hospital Accommodation, Medical Evacuation, Oncology, Rehabilitation Treatment, Palliative Care, Organ Transplant, Psychiatry and Psychotherapy, Laser Eye Treatment, Accidental Death Benefit, Maternity, Dental, Out-Patient, Repatriation Plan, and Others), Level Of Coverage (Bronze, Silver, Gold, and Platinum), Type Of Insurance Plans (Point Of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Others), Demographics (Adults, Minors, and Senior), Coverage Type (Lifetime Coverage and Term Coverage), End User (Family, Corporate, Individual, and Others), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics, and Others)

|

|

Country Covered

|

Mexico

|

|

Market Players Covered

|

AXA (Paris, France), GNP Seguros (A subsidiary of SAB National Provincial Group) (Baja California, Mexico), Pan- American Life Insurance Group (Los Angeles, U.S.), Banco Bibao Vizcaya Argentaria S.A. (Nuevo Leon, Mexico), Seguros Monterrey New York Life (Nuevo León, Mexico), MetLife, Inc. (Ciudad de México, Mexico), Chub (Alcaldía Cuauhtémoc, Mexico), Guardian Insurance MX.( Jalisco, Mexico), Allianz (Munich, Germany), Now Health International (Hong Kong, China), Best Doctors Insurance (Florida, U.S.), Zurich Santander Seguros México, SA (Mexico City, Mexico), and Bupa (London, U.K.) among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The Mexico private health insurance market is segmented into nine notable segments, which are based on the basis of product type, business solution, assistance/service type, level of coverage, type of insurance plans, demographics, coverage type, end user, and distribution channel.

- On the basis of product type, the market is segmented into mediclaim insurance, hospitalization coverage insurance, critical illness insurance, individual coverage insurance, family floater coverage insurance, senior citizen coverage insurance, unit linked health plans, permanent health insurance and others. In 2023, into mediclaim insurance is expected to dominate the Mexico private health insurance market due to the high number of premiums sold across the globe.

In 2023, the lead generation solutions segment is expected to dominate the Mexico private health insurance market because most of the premium plans are used only in inpatient treatment

In 2023, the lead generation solutions segment is expected to dominate the Mexico private health insurance market because most of the premium plans are used only in inpatient treatment, with CAGR of 6.1% in the forecast period of 2023 to 2030.

- On the basis of assistance/service type, the market is segmented into inpatient/daycare, hospital accommodation, medical evacuation, oncology, rehabilitation treatment, palliative care, organ transplant, psychiatry and psychotherapy, laser eye treatment, accidental death benefit, maternity, dental, out-patient, repatriation plan, and others. In 2023, the inpatient/daycare segment is expected to dominate the Mexico private health insurance market with 28.96% market share because of the increasing number of facilities in health insurance in developed economies.

- On the basis of the level of coverage, the market is segmented into bronze, silver, gold, and platinum. In 2023, the bronze segment is expected to dominate the Mexico private health insurance market with 43.06% market share due to the growing adoption of this term plan in mid-class.

- On the basis of type of insurance plans, the market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity private health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others. In 2023, the point of service (POS) segment is expected to dominate the Mexico private health insurance market with 36.16% market share due to the high benefits offered by the plan compared to the traditional term plan.

- On the basis of demographics, the market is segmented into adults, minors, and senior. In 2023, the adults segment is expected to dominate the Mexico private health insurance market with 49.00% market share because of the large adult pool of customers.

- On the basis of coverage type, the market is segmented into lifetime coverage and term coverage. In 2022, the lifetime coverage segment is expected to dominate the Mexico private health insurance market with 63.77% market share on account of increasing facilities in healthcare sector and insurance coverage facilities

- On the basis of end user, the market is segmented into family, corporate, individual, and others. In 2023, the corporates segment is expected to dominate the Mexico private health insurance market with 45.45% market share due to strict regulation and high spending on health insurance.

- On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others. In 2023, the direct sales segment is expected to dominate the Mexico private health insurance market with a 52.93% market share due to various third-party vendors' availability and wide acceptance in the domestic market.

Major Players

Data Bridge Market Research recognizes the following companies as the major players operating in the market are AXA, GNP Seguros (A subsidiary of SAB National Provincial Group), Pan- American Life Insurance Group, Banco Bibao Vizcaya Argentaria S.A., Seguros Monterrey New York Life, MetLife, Inc., Chub, Guardian Insurance MX., Allianz, Now Health International, Best Doctors Insurance, Zurich Santander Seguros México, SA, and Bupa, among others.

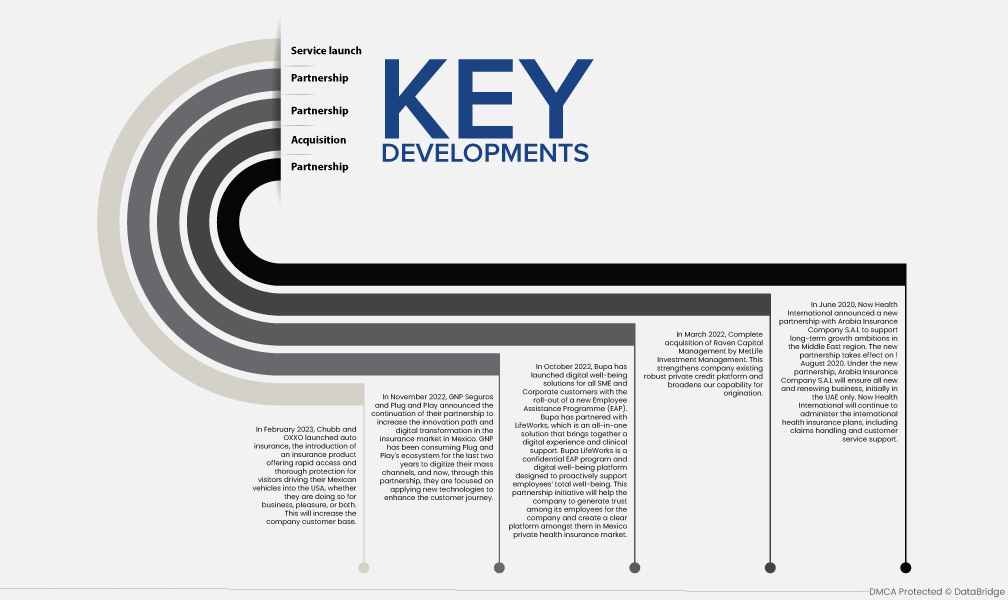

Market Development

- In February 2023, Chubb and OXXO launched auto insurance, the introduction of an insurance product offering rapid access and thorough protection for visitors driving their Mexican vehicles into the USA, whether they are doing so for business, pleasure, or both. This will increase the company customer base.

- In November 2022, GNP Seguros and Plug and Play announced the continuation of their partnership to increase the innovation path and digital transformation in the insurance market in Mexico. GNP has been consuming Plug and Play's ecosystem for the last two years to digitize their mass channels, and now, through this partnership, they are focused on applying new technologies to enhance the customer journey.

- In October 2022, Bupa has launched digital well-being solutions for all SME and Corporate customers with the roll-out of a new Employee Assistance Programme (EAP). Bupa has partnered with LifeWorks, which is an all-in-one solution that brings together a digital experience and clinical support. Bupa LifeWorks is a confidential EAP program and digital well-being platform designed to proactively support employees’ total well-being. This partnership initiative will help the company to generate trust among its employees for the company and create a clear platform amongst them in the Mexico private health insurance market.

- In March 2022, Complete acquisition of Raven Capital Management by MetLife Investment Management. This strengthens the company existing robust private credit platform and broadens our capability for origination.

- In June 2020, Now Health International announced a new partnership with Arabia Insurance Company S.A.L to support long-term growth ambitions in the Middle East region. The new partnership takes effect on 1 August 2020. Under the new partnership, Arabia Insurance Company S.A.L will ensure all new and renewing business, initially in the UAE only. Now Health International will continue to administer the international health insurance plans, including claims handling and customer service support.

COVID-19 Impact Analysis

The outbreak of COVID-19 largely impacted the healthcare industry. The Mexico private health insurance market was, however, adversely affected by it. The imposition of the lockdown and social distancing restrictions by the government to curb the COVID-19 pandemic outbreak led to the emergence of various challenges such as the denied healthcare care services, halt of various operations, cancelled or postponed elective surgeries, stifling business growth, suspensions of new developments and even increasing skin injuries in COVID-19 medical care providers, further limiting the industry's expansion. As the admission of COVID-19 patients in hospitals increased, numerous elective procedures were canceled or postponed to reserve hospital beds and patient care staff to COVID-19 patient care. Developing and implementing contingency plans is highly crucial for business operations and key imported raw materials.

On the brighter side, there has been a decline in COVID-19 patients worldwide, which will result in increased healthcare services. Moreover, the restrictions and measures are likely to relax, which will help market to witness a slight increment. Thus, the advanced Mexico private health insurance market will grow at an accelerated pace post COVID-19.

For more detailed information about the Mexico private health insurance market report, click here – https://www.databridgemarketresearch.com/reports/mexico-private-health-insurance-market