Se espera que el mercado de soluciones de procesamiento de pagos de Oriente Medio y el Norte de África crezca con una CAGR del 9,1 % en el período de pronóstico de 2020 a 2027. Los años considerados para el estudio son los que se mencionan a continuación.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/middle-east-and-north-africa-payment-processing-solutions-market

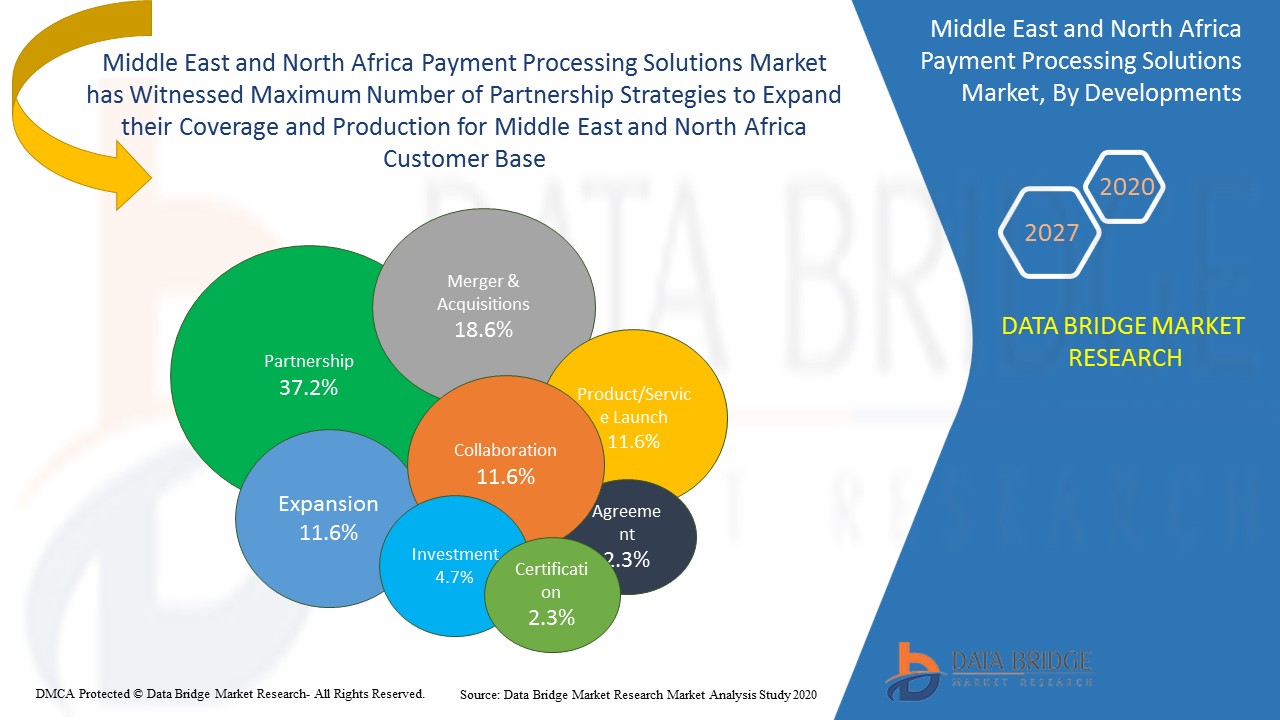

El mercado de soluciones de procesamiento de pagos está en fuerte crecimiento, con un número específico de actores clave, así como actores locales. El mercado ha experimentado un aumento en diversos desarrollos estratégicos gracias a un escenario favorable.

Los principales actores del mercado de soluciones de procesamiento de pagos en Oriente Medio y Norte de África están introduciendo una sólida cartera de productos. Esto ha ayudado a la empresa a maximizar sus ventas con una cartera de productos mejorada.

Por ejemplo,

- En abril de 2018, Telr presentó la nueva solución Telrsecure para proteger las transacciones de pago y ofrecer a comerciantes y compradores una opción más segura en Oriente Medio. El software antifraude mejorará el comportamiento de compra de los usuarios en línea. La compañía está introduciendo nuevos productos para satisfacer las necesidades de seguridad de los clientes, lo que fortalecerá su cartera de productos y ampliará su base de clientes.

Mastercard es el jugador dominante en el mercado de soluciones de procesamiento de pagos de Medio Oriente y el Norte de África y los otros jugadores en el mercado son PayPal, Wirecard, Network International, Infibeam Avenues Limited, GPS, 2Checkout, Palladium Payment Services LLC, PAYFORT INTERNATIONAL FZ LLC, TELR PTE LTD, PayU, First Data Corporation, Alipay y The Mint Corporation, entre otros.

Tarjeta MasterCard

Mastercard, con sede en Nueva York, EE. UU., fue fundada en 2001. La compañía se dedica a proporcionar plataformas de pago en línea a consumidores, organizaciones comerciales y diversos sectores industriales, ofreciendo diferentes tipos de tarjetas. Los productos enfocados en el mercado provienen tanto de empresas como de consumidores. La compañía incluye las tarjetas de débito Mastercard BusinessCard, Mastercard BusinessCard, Mastercard Business Prepaid Card, Mastercard Professional Credit Card, Mastercard Professional Card, World for Business, Multi Card, Fleet, Corporate, Commercial Prepaid, Standard Credit Card, Platinum Credit Card, World Credit Card, Standard Debit Card, Platinum Debit Card, World Debit Card y Mastercard Prepaid Card como sus productos dentro de las subcategorías de tarjetas, tarjetas de débito, tarjetas de crédito y tarjetas prepago.

La empresa tiene una amplia presencia global en Asia-Pacífico, Europa, Latinoamérica, Oriente Medio y África, y Norteamérica. Además, genera ingresos a través de diversas filiales como RiskRecon Inc. (EE. UU.), Cirrus (EE. UU.), Ethoca Limited (Canadá), DataCash (Reino Unido), Applied Predictive Technologies (EE. UU.) y Vyze, Inc. (EE. UU.), entre otras.

Por ejemplo,

- En noviembre de 2019, la colaboración entre Mastercard y PayPal amplió la función de transferencias instantáneas a Singapur y Europa. Esto permitirá a los titulares de Mastercard recibir pagos de PayPal al instante. Esto ayudará a la compañía a ampliar su base de clientes en Europa y Singapur.

PayPal

PayPal, con sede en California, EE. UU., fue fundada en 2015. Ofrece las tarjetas PayPal Cashback Mastercard, PayPal Extras Mastercard, PayPal Credit - Línea de Crédito Digital y la app de PayPal. La empresa ofrece soluciones de pago digitales y móviles para comercios y consumidores. Sus categorías de productos incluyen Personal y Empresa. La categoría Personal se centra en el mercado.

Por ejemplo,

- En diciembre de 2019, PayPal se asoció con Citigroup, Inc. Esta alianza busca fortalecer la red institucional de Citi con la plataforma de pagos en línea de PayPal. Esta alianza ampliará la base de clientes de PayPal a nivel mundial.

La empresa tiene una amplia presencia global en América, Europa, África y Asia-Pacífico. Además, genera ingresos a través de diversas filiales como Braintree (EE. UU.), Venmo (EE. UU.), Xoom Corporation (EE. UU.), iZettle (EE. UU.) y Honey (EE. UU.), entre otras.

Tarjeta de alambre

Wirecard tiene su sede en Aschheim, Alemania, y fue fundada en 1999. La empresa cuenta con una sólida cartera de productos en soluciones para la aceptación y ejecución de pagos. Opera en diversos segmentos de negocio, como procesamiento de pagos y gestión de riesgos (PP&RM), adquisiciones y emisiones (A&I), y servicios de centro de llamadas y comunicación (CC&CS). Su segmento de mercado principal es el procesamiento de pagos y la gestión de riesgos (PP&RM). La empresa está enfocada en diversas colaboraciones para aumentar sus ingresos.

Por ejemplo,

- En enero de 2020, Wirecard colaboró con Sprint para integrar el Internet de las cosas (IoT) con los pagos en línea, creando así el «Internet de los Pagos». Esta colaboración abrirá diversas oportunidades y una amplia base de clientes a nivel mundial.

La empresa tiene una amplia presencia global en África, Asia, Oceanía, Europa, Norteamérica y Sudamérica. Además, genera ingresos a través de diversas filiales, como CLICK2PAY GmbH (Alemania), PT. Wirecard Technologies Indonesia, Wirecard Global Sales GmbH (Alemania) y Wirecard NZ Limited (Nueva Zelanda), entre otras.