The push for Electric Vehicle (EV) adoption and stricter global emissions standards has fundamentally changed the automotive manufacturing landscape. Manufacturers are under immense pressure to reduce vehicle weight to extend battery range and improve overall efficiency. This has led to a significant shift from traditional metal components to advanced, lightweight polymers. Glass fiber-reinforced Polyphenylene Ether (PPE) compounds are emerging as a key material in this transition. These compounds offer a superior balance of high strength, rigidity, and low density, making them ideal for structural and under-the-hood applications where they can replace heavier metal parts. Their excellent heat resistance and dimensional stability ensure they can withstand the demanding thermal and mechanical stress of an EV's engine bay and chassis. This trend is particularly pronounced in the Middle East, ASEAN, China, and India, as these regions are experiencing rapid growth in EV production and adoption.

Access Full Report @ https://www.databridgemarketresearch.com/reports/middle-east-asean-china-and-india-polypropylene-compounds-market

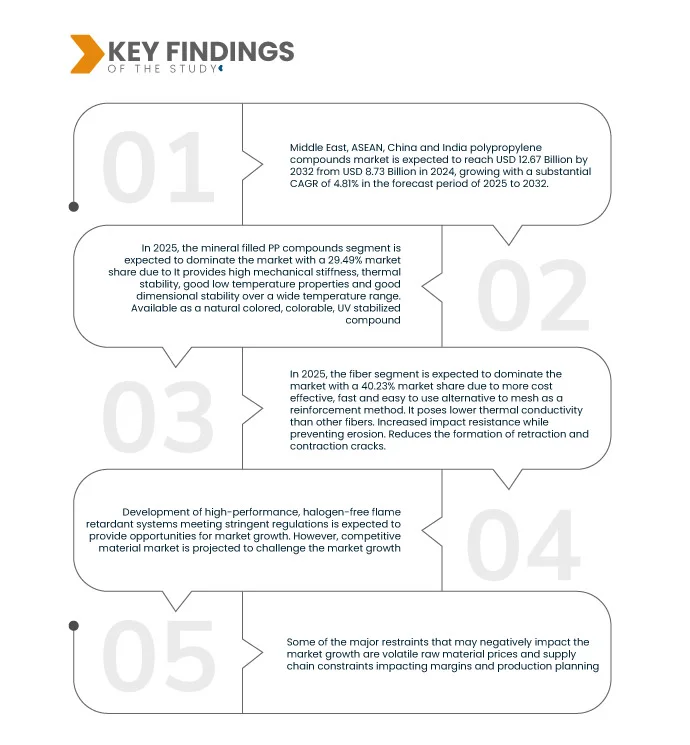

Data Bridge market research analyzes that The Middle East, ASEAN, China and India Polypropylene Compounds Market is expected to reach USD 12.67 Billion by 2032 from USD 8.73 Billion in 2024, growing with a substantial CAGR of 4.81% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rising Demand for Flame-Retardant PPE Grades in EV Battery Modules, Connectors, and High-Voltage Housings

The high-energy density of EV battery systems presents a significant fire risk, making flame retardancy a critical safety requirement. This has led to a surge in demand for specialized flame-retardant polymers, with PPE compounds being a top choice. The excellent electrical insulation, thermal stability, and inherent flame resistance of PPE make it an ideal material for protecting sensitive battery components, high-voltage connectors, and other electrical housings. The development of advanced, halogen-free flame-retardant PPE grades is especially important as the industry moves away from traditional, halogenated flame retardants due to environmental and health concerns. This trend is accelerating in all four regions as they ramp up EV production and implement more stringent safety standards

Report Scope and Middle East, ASEAN, China and India Polypropylene Compounds Market

Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD

|

|

Segments Covered

|

By Type (Mineral Filled Pp Compounds, Glass Reinforced PP Compounds, Impact Copolymers, Thermoplastic Polyolefins (TPO), Flame Retardant Compounds, UV Stabilized Compounds and Others), Polypropylene Type (Homopolymers and Copolymers), Manufacturing Technique (Injection Molding, Extrusion, Blow Molding, Thermoforming and Others), Application (Fiber, Films & Sheets, Raffia, Foam, Tape and Others), End Use (Automotive, Packaging, Building and Construction, Electrical and Electronics, Consumer Goods, Medical, Textile, and Others)

|

|

Countries Covered

|

India, China, Indonesia, Thailand, Malaysia, Philippines, Singapore, Vietnam, Myanmar, Cambodia, Brunei, Laos, Saudi Arabia, U.A.E, Egypt, Israel, Kuwait, Oman, Qatar, Bahrain, Iran, Iraq, Jordan, Syria, Lebanon, Yemen, Rest of Middle East

|

|

Market Players Covered

|

Distributors

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Middle East, ASEAN, China and India polypropylene compounds market is segmented into five notable segments based on type, polypropylene type, manufacturing technique, application and end-user.

- On the basis of type, the market is segmented into mineral filled PP compounds, glass reinforced pp compounds, impact copolymers, thermoplastic polyolefins (TPO), flame retardant compounds, uv stabilized compounds and others

In 2025, the mineral filled PP compounds segment is expected to dominate the market

In 2025, the mineral filled PP compounds segment is expected to dominate the market with a 29.49% market share due to It provides high mechanical stiffness, thermal stability, good low temperature properties and good dimensional stability over a wide temperature range. Available as a natural colored, colorable, UV stabilized compound

- On the basis of polypropylene type, the market is segmented into homopolymers and copolymers

In 2025, the homopolymers segment is expected to dominate the market

In 2025, the homopolymers segment is expected to dominate the market with a 72.50% share due to It provides high strength to weight ratio, excellent chemical resistance, high performance in thermoforming and corrosive enviroments, no moisture absorption, resist most acids, alkalis, degreasing agents, and organic solvents, good weldability, lightweight, and non-toxic and non-staining

- On the basis of manufacturing technique, the market is segmented into injection molding, extrusion, blow molding, thermoforming and others

In 2025, injection molding segment is expected to dominate the market

In 2025, injection molding segment is expected to dominate the market with a 41.70% market share due to cost efficiency, scalability, design flexibility, automation, and rising demand for durable protective equipment

- . On the basis of application, the market is segmented into fiber, film & sheet, raffia, and others

In 2025, the fiber segment is expected to dominate the market

In 2025, the fiber segment is expected to dominate the market with a 40.23% market share due to more cost effective, fast and easy to use alternative to mesh as a reinforcement method. It poses lower thermal conductivity than other fibers. Increased impact resistance while preventing erosion. Reduces the formation of retraction and contraction cracks.

- On the basis of end-user, the market is segmented into automotive, packaging, building and construction, electrical and electronics, consumer goods, medical, textile, and others

In 2025, the automotive segment is expected to dominate the market

In 2025, the automotive segment is expected to dominate the market with a 35.28% market share due to it is low in cost but has out- standing mechanical properties and moldability, it accounts for more than half of all the plastic materials used in automobiles. PP compounds are used for a variety of parts, including bumper facias, instrumental panels and door trims

Major Players

China Petrochemical Corporation (China), Exxon Mobil Corporation (U.S.), SABIC (Saudi Arabia), BASF SE (Germany), Borealis AG (Austria)

Market Developments

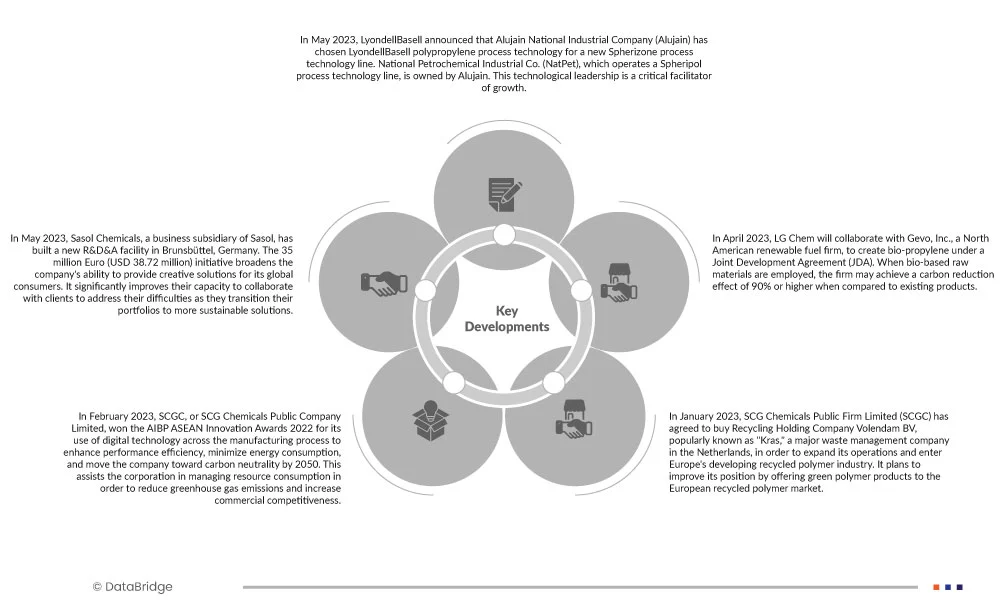

- In May 2023, LyondellBasell announced that Alujain National Industrial Company (Alujain) has chosen LyondellBasell polypropylene process technology for a new Spherizone process technology line. National Petrochemical Industrial Co. (NatPet), which operates a Spheripol process technology line, is owned by Alujain. This technological leadership is a critical facilitator of growth

- In May 2023, Sasol Chemicals, a business subsidiary of Sasol, has built a new R&D&A facility in Brunsbüttel, Germany. The 35 million Euro (USD 38.72 million) initiative broadens the company's ability to provide creative solutions for its global consumers. It significantly improves their capacity to collaborate with clients to address their difficulties as they transition their portfolios to more sustainable solutions

- In February 2023, SCGC, or SCG Chemicals Public Company Limited, won the AIBP ASEAN Innovation Awards 2022 for its use of digital technology across the manufacturing process to enhance performance efficiency, minimize energy consumption, and move the company toward carbon neutrality by 2050. This assists the corporation in managing resource consumption in order to reduce greenhouse gas emissions and increase commercial competitiveness

- In January 2023, SCG Chemicals Public Firm Limited (SCGC) has agreed to buy Recycling Holding Company Volendam BV, popularly known as "Kras," a major waste management company in the Netherlands, in order to expand its operations and enter Europe's developing recycled polymer industry. It plans to improve its position by offering green polymer products to the European recycled polymer market

- In April 2023, LG Chem will collaborate with Gevo, Inc., a North American renewable fuel firm, to create bio-propylene under a Joint Development Agreement (JDA). When bio-based raw materials are employed, the firm may achieve a carbon reduction effect of 90% or higher when compared to existing products

As per Data Bridge Market Research analysis:

For more detailed information about the Middle East, ASEAN, China and India polypropylene compounds Market report, click here – https://www.databridgemarketresearch.com/reports/middle-east-asean-china-and-india-polypropylene-compounds-market