In 2020, Saudi Arabia exported USD 1.63 million worth of diesel buses, making it the world's 66th largest exporter of diesel buses. In the same year, diesel-powered buses were the 957th most exported product in Saudi Arabia. Also in 2020, Saudi Arabia imported USD 523 million in diesel-powered buses, becoming the world's fourth-largest importer of diesel-powered buses. In the same year, diesel-powered buses were the 39th most imported product in Saudi Arabia. The fastest-growing import markets in diesel-powered buses for Saudi Arabia between 2019 and 2020 were Turkey (USD 21.40 million), UAE (USD 5.50 million), and India (USD 1.22 million)

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-diesel-bus-market

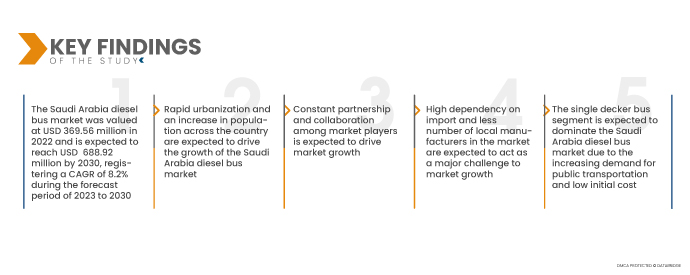

Data Bridge Market Research analyzes that the Saudi Arabia Diesel Bus Market is expected to grow at a CAGR of 8.2% in the forecast period of 2021 to 2030 and is expected to reach USD 688.92 million by 2030. The single-decker bus segment is projected to propel the market growth due to increasing demand for public transportation and low initial cost.

Growing Government Initiatives for Public Transport Infrastructure

Saudi Arabia has accelerated its infrastructure development efforts in recent years, spurred by a growing population and an increasingly diversified economy. This rapid progress has led to an array of new opportunities for both public and private sector enterprises. The government of Saudi Arabia is additionally fueling these opportunities by providing initiatives, and incentives for public and private businesses under various economic segments such as public transport. Other than bullet trains in densely populated areas, the government is focusing over bus rapid transit and regular buses. This is expected to positively affect market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Csustomisable to 2015-2020)

|

|

Quantitative Units

|

Revenue in Million, Volumes in Units, and Pricing in USD

|

|

Segments Covered

|

By Type (Mini Bus, Single Decker Bus, Double Decker Bus, Articulated Bus, School Bus, and Others), Length (Less Than 9 M, 9 M-14 M, and More Than 14 M), Drivetrain (Front Wheel Drive, Rear Wheel Drive, and All Wheel Drive), Pricing (Medium, High, and Premium), Engine Capacity (1000-3000 CC, 3000-5000 CC, and More Than 5000 CC), Seating Capacity (Up To 30 Seater, 31 Seater To 40 Seater, and Above 40 Seater), Body Built (Fully Built and Customizable), Weight Capacity (9 MT, 9 to 14 MT, and Above 14 MT), Axle Type (Multi Axle Bus Chassis and Single Axle Bus Chassis), Sales Channel (Dealer, Company Showroom, and Online), End User (Public Transport, Tourism, Airport, School, University, Hospitals, Hajj & Umrah Transportation, and Others)

|

|

Countries Covered

|

Saudi Arabia

|

|

Market Players Covered

|

TOYOTA MOTOR CORPORATION, Mitsubishi Corporation, Hyundai Motor Company, AB Volvo, Nissan Motor Co., Ltd., Xiamen King Long International Trading Co.,Ltd., Tata Motors, ASHOK LEYLAND, Scania, Foton Motor Inc., Zhongtong Bus Holding Co., Ltd., Eicher Motors Limited, Jiangxi Kama Business Bus Co., Ltd. (BONLUCK), and Golden Dragon among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis

Saudi Arabia diesel bus market is segmented into eleven notable segments based type, length, drivetrain, pricing, engine capacity, seating capacity, body built, weight capacity, axle type, sales channel, and end user.

Based on type, the market is segmented into mini bus, single decker bus, double decker bus, articulated bus, school bus, and others.

A single-decker bus is a bus that has a single deck for passengers. Single-deck buses range in length from about 5 m to 12 m and carry 30 to 50 seated passengers. Increasing demand for public transportation and the low initial cost is expected to act as major driver for segment growth. However, faster modes of public transport such as the metro are hindering segment growth. In 2023, the single decker bus segment is expected to dominate the market with a market share of 51.54% due to the increasing demand for public transportation and low initial cost.

Based on drivetrain, the market is segmented into front wheel drive, rear wheel drive, and all wheel drive. In 2023, the rear wheel drive segment is expected to dominate the market with a market share of 52.55% as rear-engine vehicles tend to prove exceptional braking ability.

Based on pricing, the market is segmented into medium, high, and premium. In 2023, the medium segment is expected to dominate the market with a market share of 63.64% due to factors such as performance-to-price ratio. Moreover, the medium pricing range diesel bus offers high functionality and has less maintenance cost compared to other market segments.

Based on engine capacity, the market is segmented into 1000-3000 CC, 3000-5000 CC, and more than 5000 CC. In 2023, the 3000-5000 CC segment is expected to dominate the market with a 59.45% market share due to economic engine power performance and lower prices compared to high-end engines.

Based on seating capacity, the market is segmented into up to 30 seater, 31 seater to 40 seater, and above 40 seater. In 2023, the up to 30 seater segment is expected to dominate the market with a market share of 51.48% due to the increasing demand and adoption of small-sized buses in urban public transportation.

Based on body built, the market is segmented into fully built and customizable. In 2023, the fully built segment is expected to dominate the market with a market share of 81.78% due to its low initial cost and mass adoption of pre-built buses.

Based on weight capacity, the market is segmented into less than 9 MT, 9 to 14 MT, and above 14 MT. In 2023, the less than 9 MT segment is expected to dominate the market with a market share of 49.49% due to the increasing demand for smaller diesel buses in hospitals, schools, and other public transportation services.

Based on axle type, the market is segmented into multi axle bus chassis and single axle bus chassis. The multi axle bus chassis segment is further sub-segmented into engine chassis length. The engine chassis length is further sub-segmented into less than 14 m and more than 14 m. In 2023, the single axle bus chassis segment is expected to dominate the market with a market share of 75.57% due to its advantages such as higher fuel efficiency, less maintenance, and low cost.

Based on sales channel, the market is segmented into dealer, company showroom, and online. In 2023, the dealer segment is expected to dominate the market with a market share of 49.45% as most people prefer to buy buses from dealers in Saudi Arabia.

Based on end user, the market is segmented into public transport, tourism, airport, school, university, hospitals, Hajj and Umrah transportation, and others. In 2023, the public transport segment is expected to dominate the market with a market share of 36.45% due to the increasing use of public transport.

TOYOTA MOTOR CORPORATION, Mitsubishi Corporation, Hyundai Motor Company, AB Volvo, Nissan Motor Co., Ltd., Xiamen King Long International Trading Co.,Ltd., Tata Motors, ASHOK LEYLAND, Scania, Foton Motor Inc., ZHONGTONG BUS HOLDING CO. LTD., Eicher Motors Limited, JIANGXI KAMA BUSINESS BUS CO., LTD. (BONLUCK), Golden Dragon Bus are engaged in the development of diesel buses for the public transport, school, tourism, hospitals, university, airport, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the major diesel bus market players in the Saudi Arabia diesel bus market, which are TOYOTA MOTOR CORPORATION (Japan), Mitsubishi Corporation (Japan), Hyundai Motor Company (South Korea), AB Volvo (Sweden), Nissan Motor Co., Ltd. (Japan), Xiamen King Long International Trading Co.,Ltd. (China), Tata Motors (India), ASHOK LEYLAND (India), Scania (Sweden), Foton Motor Inc. (China), Zhongtong Bus Holding Co., Ltd. (China), Eicher Motors Limited (India), Jiangxi Kama Business Bus Co., Ltd. (BONLUCK) (China), and Golden Dragon (China) among others.

Market Development

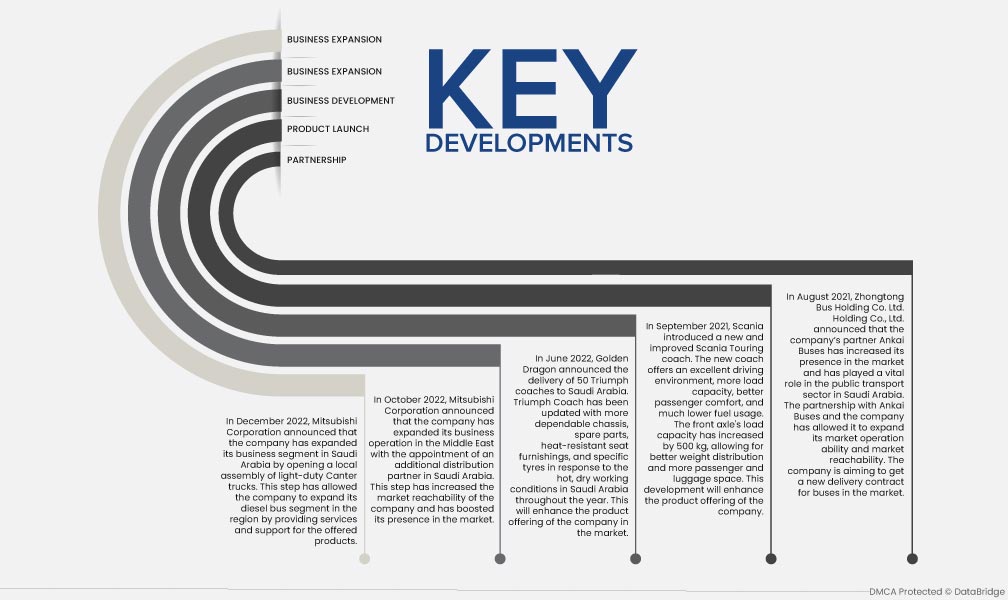

- In December 2022, Mitsubishi Corporation announced that the company has expanded its business segment in Saudi Arabia by opening a local assembly of light-duty Canter trucks. This step has allowed the company to expand its diesel bus segment in the region by providing services and support for the offered products.

- In October 2022, Mitsubishi Corporation announced that the company has expanded its business operation in the Middle East with the appointment of an additional distribution partner in Saudi Arabia. This step has increased the market reachability of the company and has boosted its presence in the market.

- In June 2022, Golden Dragon announced the delivery of 50 Triumph coaches to Saudi Arabia. Triumph Coach has been updated with more dependable chassis, spare parts, heat-resistant seat furnishings, and specific tyres in response to the hot, dry working conditions in Saudi Arabia throughout the year. This will enhance the product offering of the company in the market.

- In September 2021, Scania introduced a new and improved Scania Touring coach. The new coach offers an excellent driving environment, more load capacity, better passenger comfort, and much lower fuel usage. The front axle's load capacity has increased by 500 kg, allowing for better weight distribution and more passenger and luggage space. This development will enhance the product offering of the company

- In August 2021, Zhongtong Bus Holding Co. Ltd. Holding Co., Ltd. announced that the company’s partner Ankai Buses has increased its presence in the market and has played a vital role in the public transport sector in Saudi Arabia. The partnership with Ankai Buses and the company has allowed it to expand its market operation ability and market reachability. The company is aiming to get a new delivery contract for buses in the market

COVID-19 Impact Analysis

The COVID-19 pandemic has had a profound impact on the Saudi Arabia diesel bus market. The decrease in oil prices, coupled with travel restrictions and reduced public transportation usage, has resulted in a decline in demand for diesel buses. The pandemic has also created disruptions in the supply chain, which has added to the cost burden for manufacturers. The decrease in demand for diesel buses has put pressure on the overall market, as manufacturers struggle to maintain profitability.

However, the long-term outlook for the market remains positive, as the Saudi Arabian government has announced plans to invest in its transportation infrastructure. This investment is expected to drive demand for diesel buses in the future, as the country looks to improve its public transportation system and tourism and reduce its reliance on personal vehicles. The growth in the construction sector, which is also a significant contributor to the country's economy, is also expected to drive demand for diesel buses in the future.

In conclusion, the COVID-19 pandemic has had a significant impact on the market, but the country's plans for investment in its transportation infrastructure and the growth in the construction sector suggest that the market will recover over time. Despite the challenges posed by the pandemic, the market remains poised for growth in the long term.

For more detailed information about the market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-diesel-bus-market