La demanda de servicios regulares de Mantenimiento, Reparación y Operaciones (MRO) se intensifica. Las aeronaves requieren inspecciones y actualizaciones más frecuentes para garantizar que cumplan con los estándares de seguridad y rendimiento. Esto incrementa la necesidad de soluciones integrales de MRO, que incluyen mantenimiento periódico, reparaciones estructurales y revisiones mayores. Los servicios regulares de MRO ayudan a prolongar la vida útil de las aeronaves, prevenir posibles problemas y mantener la eficiencia operativa. A medida que las flotas de aeronaves envejecen, la importancia de contar con proveedores confiables de MRO se vuelve crucial para mantener operaciones de aviación seguras y eficientes.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/south-east-asia-air-maintenance-repair-and-operations-market

Data Bridge Market Research analiza que se espera que el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático alcance los USD 8.03 mil millones para 2031 desde USD 5.87 mil millones en 2023, creciendo con una CAGR del 4,1% en el período de pronóstico de 2024 a 2031.

Principales hallazgos del estudio

Los requisitos regulatorios aumentan la demanda de servicios MRO

Los requisitos regulatorios exigen revisiones periódicas de mantenimiento para garantizar la seguridad y fiabilidad de las aeronaves. Estas estrictas regulaciones exigen inspecciones, revisiones y reparaciones periódicas, lo que impulsa la demanda de servicios de Mantenimiento, Reparación y Mantenimiento Integral (MRO). El cumplimiento de estas normas es crucial para mantener la seguridad operativa y prevenir fallos en los equipos, lo que refuerza la necesidad de soluciones integrales de MRO.

Como resultado, el sector MRO se está expandiendo para satisfacer estas exigencias regulatorias. La mayor frecuencia de las tareas de mantenimiento requeridas y la complejidad de las aeronaves modernas han propiciado un aumento de los servicios e instalaciones de MRO especializados. Este crecimiento respalda el compromiso de la industria aeronáutica con la seguridad y la eficiencia, a la vez que impulsa avances en las tecnologías y prácticas de mantenimiento.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable de 2016 a 2021)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Tipo (equipo MRO, servicios MRO, software MRO), tipo de ala (ala fija, ala rotatoria), tipo de aeronave (cuerpo estrecho, fuselaje ancho, helicóptero, avión regional y aeronave muy grande), generación (aeronaves de generación antigua, generación media y nueva), aplicación (inspección, reemplazo de piezas, análisis predictivo, monitoreo de rendimiento, movilidad y funcionalidad), usuario final [MRO de aerolínea/operador, MRO independiente, MRO de carga, MRO de fabricante de equipo original (OEM)], tipo de aviación (aviación civil, aviación militar y aviación de entrenamiento)

|

Países cubiertos

|

Indonesia, Tailandia, Malasia, Vietnam, Singapur, Filipinas, Myanmar, Camboya, Laos, Resto del Sudeste Asiático

|

Actores del mercado cubiertos

|

ST Engineering (Singapur), AAR (EE.UU.), StandardAero (EE.UU.), MTU Aero Engines AG (Alemania), General Dynamics Corporation (Malasia), PT GMF AEROASIA TBK. (Indonesia), Rolls-Royce plc (Reino Unido), SAFRAN (Francia), Textron Aviation Inc. (EE. UU.), ExecuJet MRO Services., Lufthansa Technik (Alemania), Sepang Aircraft Engineering Sdn Bhd (Malasia), AIROD SDN BHD (Malasia), Asia Aerotechnics Sdn Bhd. (Malasia), FL Technics (Lituania), Lion Air.(Indonesia), Malaysia Airlines Berhad (Malasia), PT. Aeroespacial Indonesia (Indonesia) y PT. KALIMASADA PUSAKA (Indonesia) entre otros

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor del mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos

El mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático está segmentado en siete segmentos notables que se basan en el tipo, tipo de ala, tipo de aeronave, generación, aplicación, usuario final y tipo de aviación.

- Según el tipo, el mercado se segmenta en equipos MRO, servicios MRO y software MRO.

En 2024, se espera que el segmento de equipos MRO domine el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático.

Se espera que en 2024, el segmento de equipos MRO domine el mercado con una participación de mercado del 48,35% debido a la rápida expansión de la flota de la región y al aumento del tráfico aéreo, lo que requiere una inversión sustancial en herramientas y maquinaria avanzadas.

- Según el tipo de ala, el mercado se segmenta en ala fija y ala rotatoria.

Se espera que en 2024, el segmento de ala fija domine el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático.

Se espera que en 2024, el segmento de ala fija domine el mercado con una participación de mercado del 87,75%.

- Según el tipo de aeronave, el mercado se segmenta en aviones de fuselaje estrecho, de fuselaje ancho, helicópteros, aviones regionales y aeronaves de gran tamaño. En 2024, se prevé que el segmento de fuselaje estrecho domine el mercado de mantenimiento, reparación y operaciones aéreas del Sudeste Asiático, con una cuota de mercado del 21%.

- En función de la generación, el mercado se segmenta en generación antigua, generación media y nueva generación. Se prevé que en 2024, el segmento de generación antigua domine el mercado de mantenimiento, reparación y operaciones aéreas del Sudeste Asiático, con una cuota de mercado del 40,39%.

- Según la aplicación, el mercado se segmenta en inspección, reemplazo de piezas, análisis predictivo, monitoreo de rendimiento, movilidad y funcionalidad, entre otros. En 2024, se espera que el segmento de inspección domine el mercado con una participación del 39,48%.

- En función del usuario final, el mercado se segmenta en MRO de aerolíneas/operadores, MRO independiente, MRO de carga y MRO de fabricantes de equipos originales (OEM). En 2024, se espera que el segmento de MRO de aerolíneas/operadores domine el mercado con una cuota de mercado del 0,5 %.

- Según el tipo de aviación, el mercado se segmenta en aviación civil, aviación militar y aviación de entrenamiento. Se prevé que en 2024, el segmento de aviación civil domine el mercado con una cuota de mercado del 40%.

Actores principales

Investigación de mercado de Data Bridge ST Engineering (Singapur), Lufthansa Group (Alemania), StandardAero (EE. UU.), Rolls-Royce plc (Reino Unido) y SAFRAN (Francia) son las principales empresas que operan en el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático.

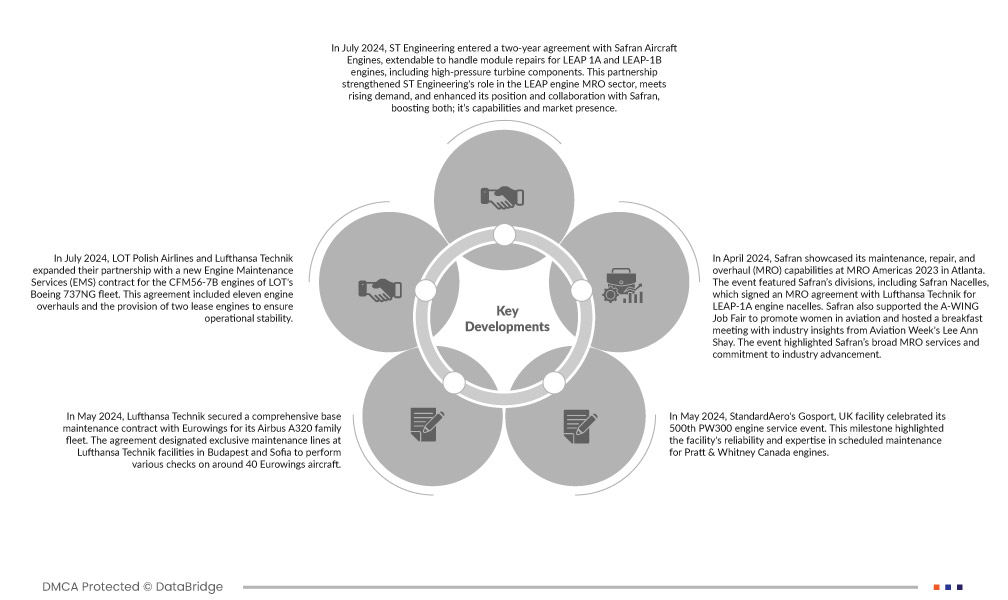

Desarrollo del mercado

- En julio de 2024, ST Engineering firmó un acuerdo de dos años con Safran Aircraft Engines, prorrogable para la reparación de módulos de los motores LEAP 1A y LEAP-1B, incluyendo componentes de turbinas de alta presión. Esta colaboración fortaleció el papel de ST Engineering en el sector de MRO de motores LEAP, satisfizo la creciente demanda y fortaleció su posición y colaboración con Safran, impulsando tanto sus capacidades como su presencia en el mercado.

- En julio de 2024, LOT Polish Airlines y Lufthansa Technik ampliaron su colaboración con un nuevo contrato de Servicios de Mantenimiento de Motores (EMS) para los motores CFM56-7B de la flota Boeing 737NG de LOT. Este acuerdo incluyó once revisiones de motores y el arrendamiento de dos motores para garantizar la estabilidad operativa. Este contrato reforzó la posición de Lufthansa Technik como proveedor líder de servicios MRO de motores, ampliando su alcance operativo y profundizando su relación con LOT Polish Airlines. La exitosa ejecución de estos servicios reforzó la reputación de Lufthansa Technik en cuanto a fiabilidad y experiencia técnica en mantenimiento de motores.

- En mayo de 2024, Lufthansa Technik firmó un contrato integral de mantenimiento de base con Eurowings para su familia Airbus A320. El acuerdo designó líneas de mantenimiento exclusivas en las instalaciones de Lufthansa Technik en Budapest y Sofía para realizar diversas revisiones en alrededor de 40 aeronaves de Eurowings. Este contrato consolidó la posición de Lufthansa Technik como proveedor preferente de servicios de mantenimiento de base, demostrando su capacidad para satisfacer las necesidades específicas de los clientes y mantener altos estándares de calidad. Reforzó las capacidades operativas de Lufthansa Technik y reforzó su reputación de ofrecer soluciones de mantenimiento fiables y flexibles.

- En mayo de 2024, las instalaciones de StandardAero en Gosport, Reino Unido, celebraron su 500.º evento de servicio de motores PW300. Este hito destacó la fiabilidad y la experiencia de las instalaciones en el mantenimiento programado de motores Pratt & Whitney Canadá. El logro resaltó la sólida reputación de StandardAero y su compromiso con un servicio de alta calidad. La planta de Gosport, con más de 80 años de experiencia, continuó ampliando sus capacidades y dando soporte a una amplia gama de motores, mejorando la seguridad y el servicio para los clientes de toda la región EMEA y más allá.

- En abril de 2024, Safran presentó sus capacidades de mantenimiento, reparación y revisión (MRO) en MRO Americas 2023 en Atlanta. El evento contó con la participación de las divisiones de Safran, incluyendo Safran Nacelles, que firmó un acuerdo de MRO con Lufthansa Technik para las góndolas de los motores LEAP-1A. Safran también apoyó la Feria de Empleo A-WING para promover a las mujeres en la aviación y organizó un desayuno con perspectivas del sector a cargo de Lee Ann Shay, de Aviation Week. El evento destacó la amplia gama de servicios de MRO de Safran y su compromiso con el avance de la industria.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado global de administradores de infraestructura virtual son Indonesia, Tailandia, Malasia, Vietnam, Singapur, Filipinas, Myanmar, Camboya, Laos y el resto del sudeste asiático.

Según el análisis de investigación de mercado de Data Bridge:

Se espera que Indonesia domine y sea el país de más rápido crecimiento en el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático.

En 2024 , se espera que Indonesia domine el mercado de mantenimiento, reparación y operaciones aéreas del Sudeste Asiático gracias a su ubicación estratégica como centro clave para el tráfico aéreo regional e internacional, lo que impulsa una alta demanda de servicios MRO. El país ha invertido significativamente en la expansión y modernización de su infraestructura MRO, mejorando su capacidad para gestionar una flota creciente de aviones comerciales.

Para obtener información más detallada sobre el mercado de mantenimiento, reparación y operaciones aéreas del sudeste asiático , haga clic aquí: https://www.databridgemarketresearch.com/reports/south-east-asia-air-maintenance-repair-and-operations-market