The demand for automated external defibrillators has surged due to their effectiveness in administering prompt defibrillation, a key factor in increasing survival rates for SCA victims. Modern automated external defibrillator devices portability and user-friendly nature have made them accessible to a broader range of individuals, including those without extensive medical training. This has resulted in a push for broader deployment in various public spaces, workplaces, and even homes, contributing to the growth of the automated external defibrillator market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/uk-and-republic-of-ireland-automated-external-defibrillator-aed-market

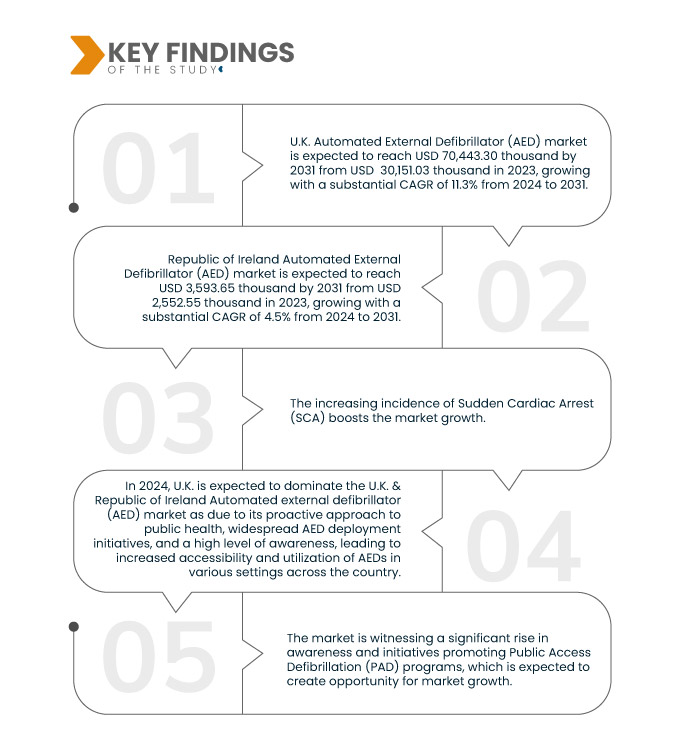

Data Bridge Market Research analyzes that the U.K. Automated External Defibrillator (AED) Market is expected to reach USD 70,443.30 thousand by 2031 from USD 30,151.03 thousand in 2023, growing with a substantial CAGR of 11.3% in the forecast period of 2024 to 2031 and the Republic of Ireland Automated External Defibrillator (AED) market is expected to reach USD 3,593.65 thousand by 2031 from USD 2,552.55 thousand in 2023, growing with a substantial CAGR of 4.5% in the forecast period of 2024 to 2031.

Key Findings of the Study

- Increasing Incidence of Sudden Cardiac Arrest (SCA)

The Sudden Cardiac Arrest (SCA) is a life-threatening condition that can strike without warning, leading to a rapid and unexpected loss of heart function. The risk of SCA has also increased as the prevalence of cardiovascular diseases rises and the aging population grows. This has created a pressing need for effective and rapid intervention, with automated external defibrillators crucial in providing immediate treatment.

The demand for automated external defibrillators has surged due to their effectiveness in administering prompt defibrillation, a key factor in increasing survival rates for SCA victims. Modern automated external defibrillator devices' portability and user-friendly nature have made them accessible to a broader range of individuals, including those without extensive medical training. This has resulted in a push for broader deployment in various public spaces, workplaces, and even homes, contributing to the growth of the automated external defibrillator market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable into 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Units, and Pricing in USD

|

|

Segments Covered

|

Product Type (Automated External Defibrillators (AED) Devices, Automated External Defibrillators (AED) Accessories), Application (Ventricular Fibrillation, Pulseless Ventricular Tachycardia, and Others), End User (Pre-Hospital Care and Emergency Medical Service (EMS) Providers, Hospitals, Ambulatory Surgical Centers (ASC), Cardiac Centers, Public Access, Military and Defense, Home Care Settings, Ambulatory Care Centers, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Online Sales, Retail Sales, and Others)

|

|

Country Covered

|

U.K. and Republic of Ireland

|

|

Market Players Covered

|

Koninklijke Philips N.V (Netherlands), NIHON KOHDEN CORPORATION (Japan), Stryker (U.S.), Asahi Kasei Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd.(China), corpuls (Germany), CU Medical Germany GmbH (Germany), Amiitalia (Italy), Cardia International A/S (Denmark), SCHILLER AG (Switzerland), Metrax GmbH (Germany), WEINMANN Emergency Medical Technology GmbH + Co. KG (Germany), MEDIANA Co., Ltd.(South Korea), Progetti srl (Italy), and HEARTHERO (U.S.) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

The U.K. & Republic of Ireland Automated External Defibrillator (AED) market is segmented into four notable segments based on product type, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

- On the basis of product type, the market is segmented into Automated External Defibrillators (AED) devices and Automated External Defibrillators (AED) accessories

In 2024, the Automated External Defibrillators (AED) devices segment is expected to dominate the U.K. & Republic of Ireland Automated External Defibrillator (AED) market

In 2024, the Automated External Defibrillators (AED) devices segment is expected to dominate the U.K. Automated External Defibrillator (AED) market due to their user-friendly design, portability, and automated functionalities with 72.35% market share.

In 2024, the Automated External Defibrillators (AED) devices segment is expected to dominate the Republic of Ireland Automated External Defibrillator (AED) market due to their user-friendly design, portability, and automated functionalities with 72.84% market share.

- On the basis of application, the market is segmented into ventricular fibrillation, pulseless ventricular tachycardia, and others

In 2024, the ventricular fibrillation segment is expected to dominate the U.K. & Republic of Ireland Automated External Defibrillator (AED) market

In 2024, the ventricular fibrillation segment is expected to dominate the U.K. Automated External Defibrillator (AED) market due to its association with sudden cardiac arrests, and AEDs are specifically designed to address this life-threatening condition with 56.73% market share.

In 2024, the ventricular fibrillation segment is expected to dominate the Republic of Ireland Automated External Defibrillator (AED) market due to its association with sudden cardiac arrests, and AEDs are specifically designed to address this life-threatening condition with 57.73% market share.

- On the basis of end user, the market is segmented into pre-hospital care and emergency medical service (EMS) providers, hospitals, Ambulatory Surgical Centers (ASC), cardiac centers, public access, military and defense, home care settings, ambulatory care centers, specialty clinics, and others. In 2024, the pre-hospital care and Emergency Medical Service (EMS) providers segment is expected to dominate the U.K. Automated External Defibrillator (AED) market with 24.55% market share. In 2024, the pre-hospital care and Emergency Medical Service (EMS) providers segment is expected to dominate the Republic of Ireland Automated External Defibrillator (AED) market with 26.94% market share

- On the basis of distribution channel, the U.K. Automated External Defibrillator (AED) market is segmented into direct tender, online sales, retail sales, and others. In 2024, the direct tender segment is expected to dominate the U.K. Automated External Defibrillator (AED) market with 51.36% market share . In 2024, the direct tender segment is expected to dominate the Republic of Ireland Automated External Defibrillator (AED) market with 52.87% market share

Major Players

Data Bridge Market Research analyzes Koninklijke Philips N.V (Netherlands), NIHON KOHDEN CORPORATION (Japan), Stryker (U.S.), Asahi Kasei Corporation (Japan), and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China) as the major companies in the U.K & Republic of Ireland Automated External Defibrillator (AED) market.

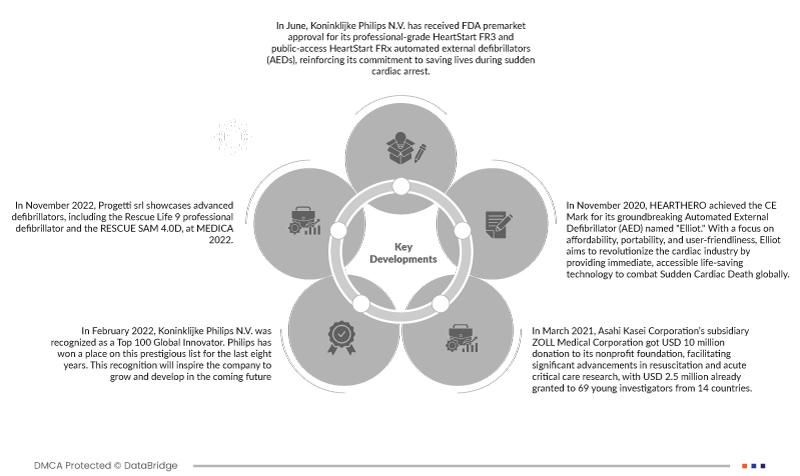

Market Developments

- In November 2022, Progetti srl showcases advanced defibrillators, including the Rescue Life 9 professional defibrillator and the RESCUE SAM 4.0D, at MEDICA 2022. The Rescue Life 9 offers a robust TFT LCD display, extended battery life, and versatile configurations, while the RESCUE SAM 4.0D features a rapid analysis system for efficient defibrillation. Such exhibitions help the company to cater to customers attention globally

- In June, Koninklijke Philips N.V. has received FDA premarket approval for its professional-grade HeartStart FR3 and public-access HeartStart FRx automated external defibrillators (AEDs), reinforcing its commitment to saving lives during sudden cardiac arrest. The approval expands Philips' industry-leading AED portfolio, emphasizing its crucial role in emergency response for medical professionals and the public

- In February 2022, Koninklijke Philips N.V. was recognized as a Top 100 Global Innovator. Philips has won a place on this prestigious list for the last eight years. This recognition will inspire the company to grow and develop in the coming future

- In March 2021, Asahi Kasei Corporation’s subsidiary ZOLL Medical Corporation got USD 10 million donation to its nonprofit foundation, facilitating significant advancements in resuscitation and acute critical care research, with USD 2.5 million already granted to 69 young investigators from 14 countries. The foundation's impactful support is nurturing a new generation of researchers, fostering scientific progress in these vital fields, and ensuring continuity through mentorship for future researchers

- In November 2020, HEARTHERO achieved the CE Mark for its groundbreaking Automated External Defibrillator (AED) named "Elliot." With a focus on affordability, portability, and user-friendliness, Elliot aims to revolutionize the cardiac industry by providing immediate, accessible, life-saving technology to combat Sudden Cardiac Death globally

As per Data Bridge Market Research Analysis

The countries covered in this market report are U.K. and Republic of Ireland.

In 2024, U.K. is expected to dominate and be the fastest growing country in the U.K. & Republic of Ireland Automated External Defibrillator (AED) market

In 2024, U.K. is expected to dominate and be the fastest growing country in the U.K. & Republic of Ireland Automated External Defibrillator (AED) market due to its proactive approach to public health, widespread AED deployment initiatives, and a high level of awareness, leading to increased accessibility and utilization of AEDs in various settings across the country.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

For more detailed information about the U.K. & Republic of Ireland Automated External Defibrillator (AED) market report, click here – https://www.databridgemarketresearch.com/reports/uk-and-republic-of-ireland-automated-external-defibrillator-aed-market