The U.S. ambulatory surgical centers market represents a dynamic and rapidly evolving sector within the healthcare industry. ASCs are specialized facilities that provide same-day surgical procedures without needing overnight hospital stays, offering a wide range of procedures in a more convenient setting than traditional hospital settings. These centers have gained popularity for their ability to enhance patient experience and improve overall efficiency.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-ambulatory-surgical-centers-market

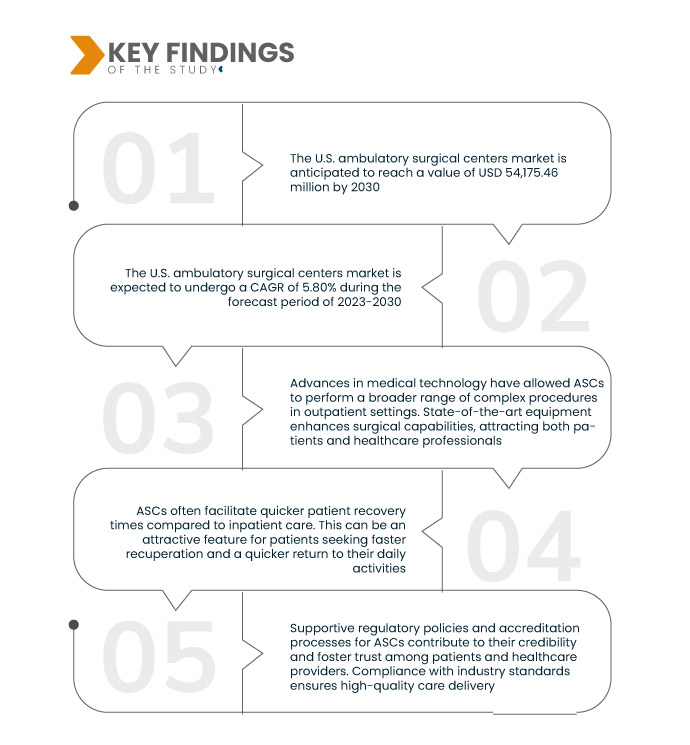

Data Bridge Market Research analyses that the U.S. Ambulatory Surgical Centers Market, which was USD 34,507.8 million in 2022, is expected to reach USD 54,175.46 million by 2030 and is expected to undergo a CAGR of 5.80% during the forecast period of 2023-2030. ASCs are cost-efficient, offering surgical services at lower expenses than traditional hospitals. This appeals to patients, insurers, and healthcare providers, aligning with the broader healthcare goal of controlling and reducing medical expenses while maintaining quality care standards.

Key Findings of the Study

Increasing reimbursement policies is expected to drive the market's growth rate

The U.S. ambulatory surgical centers (ASC) market experiences heightened demand due to increasing reimbursement policies. Notably, the Center for Medicare & Medicaid Services (CMS) supports this trend by reimbursing services in ASCs. In adherence to CMS policies, Medicare covers expenses incurred in ambulatory surgery centers. CMS plays a pivotal role in designating payment groups, determining payment rates, and establishing a structured framework for reimbursable treatments at ASCs, thereby contributing significantly to these outpatient facilities' economic viability and sustainability.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Hospital-Associated And Free Standing), IT Components (Hardware, Software, And Services), IT Product And Services (Clinical IT Solutions, Non-Clinical Healthcare IT Solutions, And HCIT Outsourcing Services), Ownership (Physician Only, Corporate-Physician, Hospital-Physician, Corporate-Hospital And Other), Surgery Type (Endoscopy, Ophthalmology, Orthopedic, Pain, Plastic Surgery, Podiatry, Gynecology, Dental, Otolaryngology, And Others), Specialty (Single Specialty And Multispecialty), Services (Diagnosis And Treatment), Population Type (Children And Adults)

|

|

Market Players Covered

|

Oracle (U.S.), MCKESSON CORPORATION (U.S.), Veradigm LLC (U.S.)., Epic Systems Corporation (U.S.), athenahealth, Inc. (U.S.), Optum Inc. (U.S.), General Electric (U.S.)., Prospect Medical Holdings, Inc.(U.S.), Nuance Communications, Inc (U.S.)., CareCloud, Inc (U.S.)., Advanced Data Systems (U.S.), NXGN Management, LLC (U.S.)., Medical Facilities Corporation (Canada), Koninklijke Philips N.V.(Netherlands), Ambulatory Surgery Center Association and ASCA Foundation (U.S.), AMSURG (Kohlberg Kravis Roberts & Co.L.P) (U.S.), T.H. Medical (U.S.), Surgery Partners (U.S.), SurgCenter (U.S.), HCA Healthcare (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The U.S. ambulatory surgical centers market is segmented on the basis of type, IT components, IT product and services, ownership, surgery type, specialty, services, and population type.

- On the basis of type, the U.S. ambulatory surgical centers market is segmented into hospital-associated and free standing

- On the basis of IT components, the U.S. ambulatory surgical centers market is segmented into hardware, software, and services

- On the basis of IT product and services, the U.S. ambulatory surgical centers market is segmented into clinical IT solutions, non-clinical healthcare IT solutions, and HCIT outsourcing services

- On the basis of ownership, the U.S. ambulatory surgical centers market is segmented into physician only, corporate-physician, hospital-physician, corporate-hospital, and other

- On the basis of surgery type, the U.S. ambulatory surgical centers market is segmented into endoscopy, ophthalmology, orthopedic, pain, plastic surgery, podiatry, gynecology, dental, otolaryngology, and others

- On the basis of specialty, the U.S. ambulatory surgical centers market is segmented into single specialty and multispecialty

- On the basis of services, the U.S. ambulatory surgical centers market is segmented into diagnosis and treatment

- On the basis of population type, the U.S. ambulatory surgical centers market is segmented into children and adults

Major Players

Data Bridge Market Research recognizes the following companies as the major U.S. ambulatory surgical centers market players in U.S. ambulatory surgical centers market are Koninklijke Philips N.V. (Netherlands), Ambulatory Surgery Center Association and ASCA Foundation (U.S.), AMSURG (Kohlberg Kravis Roberts & Co.L.P) (U.S.), T.H. Medical (U.S.), Surgery Partners (U.S.), SurgCenter (U.S.), HCA Healthcare (U.S.)

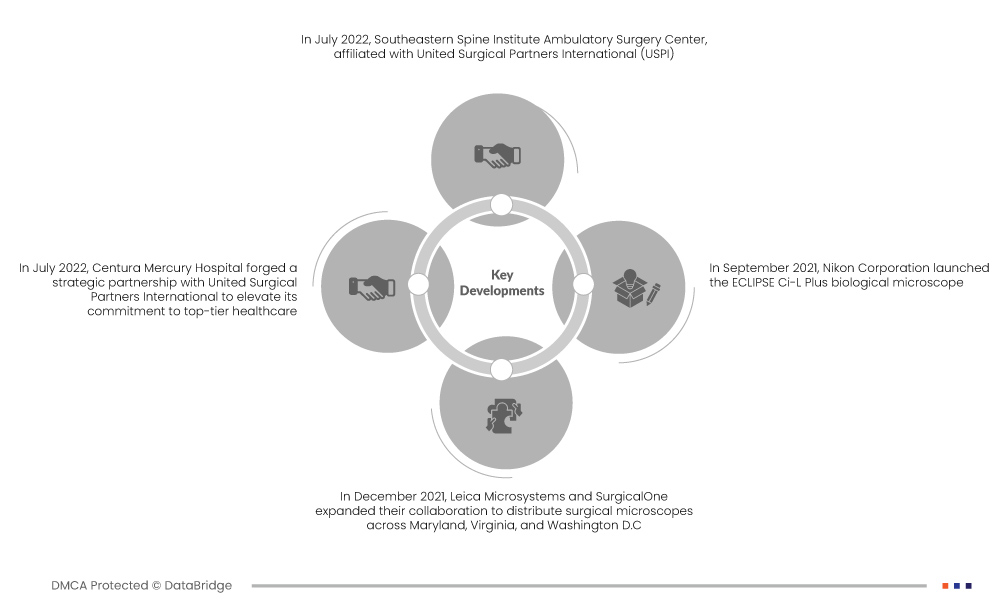

Market Developments

- In July 2022, Southeastern Spine Institute Ambulatory Surgery Center, affiliated with United Surgical Partners International (USPI), launched a cutting-edge robotic-assisted surgery program. This program focuses on utilizing advanced robotic systems for total knee replacements, showcasing a commitment to innovative healthcare solutions and improved patient outcomes in the field of ambulatory surgery

- In July 2022, Centura Mercury Hospital forged a strategic partnership with United Surgical Partners International to elevate its commitment to top-tier healthcare. This partnership aims to enhance patient care by constructing an advanced Ambulatory Surgery Center (ASC) in Colorado. The ASC will serve as a key facility, extending Centura Mercury Hospital's reach and capabilities in delivering efficient and high-quality outpatient surgical services to the local community

- In December 2021, Leica Microsystems and SurgicalOne expanded their collaboration to distribute surgical microscopes across Maryland, Virginia, and Washington D.C. This strategic collaboration aims to enhance the availability of advanced surgical microscopy technology in the region, ensuring healthcare providers in these areas have access to cutting-edge equipment for improved precision and efficacy in surgical procedures

- In September 2021, Nikon Corporation launched the ECLIPSE Ci-L Plus biological microscope. This innovative microscope streamlines the imaging process by eliminating the necessity for light intensity adjustments following magnification changes. Notably, it addresses user comfort during prolonged observations by minimizing physical strain. The ECLIPSE Ci-L Plus represents a technological advancement that enhances operational efficiency and ergonomic design in the realm of biological microscopy

For more detailed information about the U.S. ambulatory surgical centers market report, click here – https://www.databridgemarketresearch.com/reports/us-ambulatory-surgical-centers-market