Asia Pacific Excipients Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

2.51 Billion

2024

2032

USD

1.33 Billion

USD

2.51 Billion

2024

2032

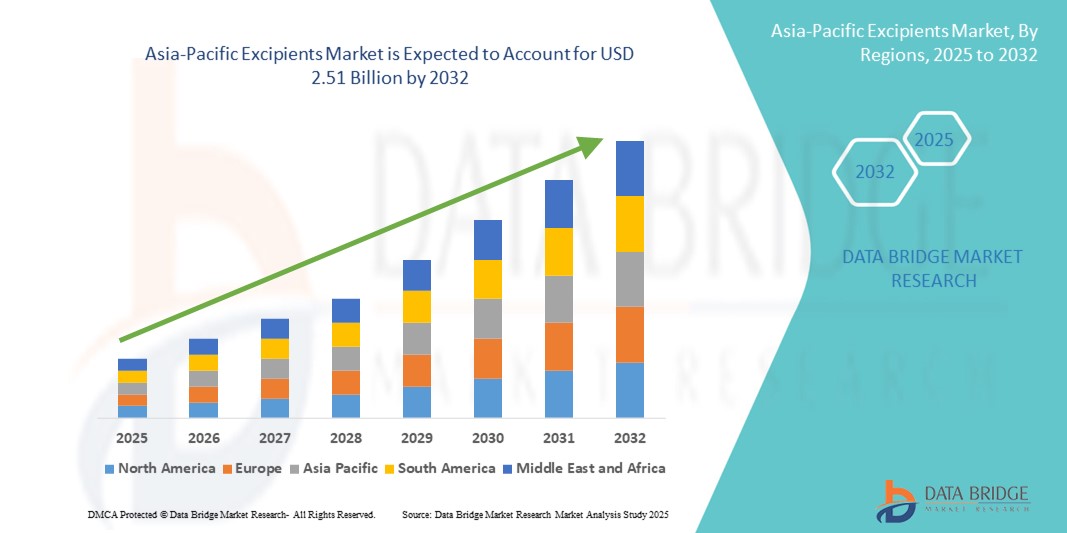

| 2025 –2032 | |

| USD 1.33 Billion | |

| USD 2.51 Billion | |

|

|

|

|

Asia-Pacific Excipients Market Size

- The Asia-Pacific excipients market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 2.51 billion by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is primarily driven by the expanding pharmaceutical and nutraceutical industries in the region, supported by increasing drug production and formulation activities

- In addition, rising demand for advanced excipients that improve drug stability, efficacy, and patient compliance is pushing manufacturers to innovate and adopt newer excipient technologies. These factors collectively are fueling the rapid adoption of excipients in pharmaceutical formulations, thereby accelerating the region’s market expansion

Asia-Pacific Excipients Market Analysis

- Excipients, which act as inactive carriers or additives in pharmaceutical formulations, are becoming increasingly essential across the Asia-Pacific pharmaceutical and biopharmaceutical industries, supporting drug stability, efficacy, and patient compliance

- The growth in excipient demand is primarily driven by the rapid expansion of pharmaceutical manufacturing, increased generic drug production, and rising investments in advanced excipient technologies

- China dominated the Asia-Pacific excipients market with the largest revenue share of 38.5% in 2024, supported by its strong pharmaceutical sector, government incentives, and expanding research capabilities

- India is expected to be the fastest growing country in the Asia-Pacific excipients market in the region during the forecast period, owing to growing pharmaceutical exports, increasing R&D, and government initiatives encouraging domestic production of excipients

- The primary excipients segment dominated the Asia-Pacific excipients market with a share of 65.5% in 2024, fueled by their fundamental role in drug formulation and widespread usage across solid, semi-solid, and liquid dosage forms

Report Scope and Asia-Pacific Excipients Market Segmentation

|

Attributes |

Asia-Pacific Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Excipients Market Trends

Rising Preference for Natural and Functional Excipients

- A key and accelerating trend in the Asia-Pacific excipients market is the growing demand for natural, plant-based excipients and multifunctional excipients that improve drug performance and patient compliance. This shift is driven by increasing consumer awareness of clean-label ingredients and regulatory encouragement toward safer additives

- For instance, manufacturers are increasingly adopting natural polymers such as cellulose derivatives and starches extracted from renewable sources, which are favored in both generic and specialty drug formulations. Functional excipients that offer combined binding, disintegration, and controlled-release properties are gaining prominence

- Advances in excipient technology are enabling tailored solutions, such as pregelatinized starches improving bioavailability or novel coatings enhancing drug stability. This functional innovation supports more effective and patient-friendly formulations

- Regulatory bodies in the region are also encouraging the use of excipients with well-established safety profiles, which further drives the shift toward natural and functional excipients. Companies such as Roquette and Kerry Group are investing heavily in this segment to cater to evolving market needs

- The growing demand for excipients that support innovative drug delivery systems and meet sustainability criteria is shaping product development strategies, presenting a major growth avenue for excipient suppliers

Asia-Pacific Excipients Market Dynamics

Driver

Increasing Pharmaceutical Production and Generic Drug Expansion

- The rapid growth of pharmaceutical manufacturing and generic drug production in Asia-Pacific is a primary driver of excipient demand. With countries such as China and India becoming major global drug suppliers, the need for high-quality excipients has surged

- For instance, India’s increasing focus on pharmaceutical exports and biosimilars has amplified excipient consumption, fueling market growth

- The region’s expanding healthcare infrastructure and rising prevalence of chronic diseases have also escalated drug demand, indirectly boosting excipient usage

- Moreover, government incentives to promote domestic excipient production are enhancing supply chain robustness, reducing reliance on imports, and supporting competitive pricing

- The combined effect of these factors sustains robust growth in the excipients market, positioning the region as a global manufacturing hub

- Growing investments in R&D and capacity expansion by local excipient manufacturers are enabling them to meet both domestic and export demand effectively

- Increasing adoption of digital technologies and Industry 4.0 in pharmaceutical manufacturing is improving excipient quality and production efficiency, further driving market expansion

Restraint/Challenge

Regulatory Variability and Quality Standardization Issues

- Asia-Pacific excipients market faces challenges related to inconsistent regulatory frameworks and quality standards across different countries, complicating compliance and market entry for excipient manufacturers

- For instance, smaller manufacturers sometimes struggle to meet international pharmacopeia standards, limiting their access to export markets

- Variations in excipient approval processes, documentation requirements, and testing protocols slow down product registration and increase operational costs

- In addition, quality standardization is critical since excipients directly impact drug safety and efficacy, yet uneven quality control practices among regional suppliers pose risks

- Addressing these challenges through harmonization of regulations, stringent quality management systems, and industry collaborations will be essential to foster trust and ensure sustainable market expansion

- Supply chain disruptions, exacerbated by regional geopolitical tensions and global trade issues, add complexity to timely excipient availability and consistent quality maintenance

- Limited awareness and training about excipient regulatory compliance among smaller local players hinder the market’s overall growth potential and reputation

Asia-Pacific Excipients Market Scope

The market is segmented on the basis of origin, category, products, chemistry type, chemistry synthesis, functionality, dosage form, route of administration, end user, and distribution channel.

- By Origin

On the basis of origin, the Asia-Pacific excipients market is segmented into organic and inorganic excipients. The inorganic segment dominated the market with the largest revenue share of 60.5% in 2024. This dominance is attributed to the extensive use of inorganic excipients such as minerals and salts, which are favored for their chemical stability, cost-effectiveness, and versatility across a wide range of pharmaceutical formulations including tablets and injectables. Their availability in large quantities and well-established manufacturing processes further support their widespread adoption.

The organic segment is anticipated to witness the fastest growth rate from 2025 to 2032. This rapid growth is driven by increasing consumer demand for natural and plant-based excipients, which align with global trends toward sustainability, clean-label ingredients, and safety. Pharmaceutical companies are progressively adopting organic excipients derived from renewable resources to meet regulatory expectations and cater to the rising preference for ‘green’ pharmaceuticals.

- By Category

On the basis of category, the Asia-Pacific excipients market is segmented into primary excipients and secondary excipients. The primary excipients segment dominated the market with 65.5% share in 2024. Primary excipients such as fillers, binders, and diluents are fundamental components of nearly all pharmaceutical formulations. Their role in providing bulk, structure, and consistency makes them indispensable in tablet, capsule, and other dosage form manufacturing. Moreover, these excipients are often used in large quantities, contributing to their dominant market revenue.

The secondary excipients segment is expected to register the fastest growth during the forecast period. This is largely due to increasing formulation complexity and innovation. Secondary excipients, which include additives such as preservatives, antioxidants, colorants, and solubilizers, improve drug stability, efficacy, taste, and appearance. As pharmaceutical companies focus on enhancing patient compliance and drug performance, demand for such specialized excipients is rapidly increasing, propelling growth in this segment.

- By Products

On the basis of products, the Asia-Pacific excipients market is segmented into polymers, sugars, alcohols, minerals, gelatin, and others. Polymers dominated the market with 35% share in 2024, primarily because of their multifunctional properties. Polymers are widely used in controlled-release formulations, coating applications, and as binders, offering versatility that is crucial for modern drug delivery systems. Their ability to enhance bioavailability and modify release profiles makes them highly sought after.

Sugars are projected to witness the fastest growth during forecast period. This growth is fueled by their extensive use as sweetening agents and bulking substances in oral and chewable dosage forms, especially pediatric medicines. The natural sweetness and biocompatibility of sugars such as sucrose and lactose make them preferred excipients, while increasing patient-centric formulation development supports rising sugar excipient demand.

- By Chemistry Type

On the basis of chemistry type, the Asia-Pacific excipients market is segmented into plant, animal, synthetic, and minerals. Synthetic excipients held the dominant position with 55% market share in 2024, favored due to their high purity, batch-to-batch consistency, and scalable manufacturing processes. Synthetic excipients such as synthetic polymers and chemically synthesized stabilizers meet stringent pharmaceutical standards and allow for precise formulation control.

The plant-based segment is expected to grow at the fastest pace during the forecast period. This growth is driven by the growing consumer and regulatory preference for natural, sustainable ingredients that are derived from renewable plant sources such as cellulose and starch. The rise of natural product formulations in both conventional and nutraceutical markets further stimulates the adoption of plant-derived excipients.

- By Chemistry Synthesis

On the basis of chemistry synthesis, the Asia-Pacific excipients market is segmented into lactose monohydrate, sucralose, polysorbate, benzyl alcohol, cetostearyl alcohol, soy lecithin, pregelatinized starch, and others. Lactose monohydrate dominated the market with 40% share in 2024. This dominance is because lactose monohydrate serves as a versatile filler and binder, widely used in oral solid dosage forms for its excellent compressibility and compatibility with active pharmaceutical ingredients (APIs).

Pregelatinized starch is expected to record the fastest growth rate during forecast period, due to its multifunctionality, acting as both a binder and disintegrant. Its ability to improve tablet strength while ensuring rapid disintegration makes it invaluable in modern tablet manufacturing. Other excipients such as sucralose and polysorbate are also gaining prominence for their roles as sweetening agents and emulsifiers, respectively, meeting formulation needs for palatability and stability.

- By Functionality

On the basis of functionality, the ma Asia-Pacific excipients market rket is segmented into binders and adhesives, disintegrants, coating materials, coloring agents, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidants, chelating agents, antifoaming agents, and others. The binders and adhesives segment dominated the market with 30% share in 2024. Binders and adhesives are crucial for ensuring tablet integrity, enhancing mechanical strength, and maintaining consistent drug release profiles. Their widespread use across multiple dosage forms secures their leading position.

The coating materials segment is anticipated to witness the fastest growth rate during forecast period, driven by increased demand for controlled-release formulations, taste masking, and enhanced shelf life. Coatings not only improve patient compliance by masking unpleasant tastes but also protect drugs from environmental factors, supporting their rising adoption.

- By Dosage Form

On the basis of dosage form, the Asia-Pacific excipients market is segmented into solid, semi-solid, and liquid. The solid dosage form segment dominated the market with nearly 70% share in 2024. This dominance is attributed to the prevalence of tablets and capsules, which are the most widely manufactured and prescribed pharmaceutical forms worldwide. Solid forms offer advantages such as convenience, stability, and cost-effectiveness.

The semi-solid segment is expected to register the fastest growth during forecast period, due to increasing demand in topical applications such as creams, ointments, and gels, especially in dermatology and cosmetic industries. Growing awareness of skin health and expanding applications for localized drug delivery are fueling this segment’s expansion.

- By Route of Administration

On the basis of route of administration, the Asia-Pacific excipients market is segmented into oral excipients, topical excipients, parenteral excipients, and others. Oral excipients dominated the market with 75% share in 2024, as oral administration remains the most preferred and convenient drug delivery method globally. This segment includes excipients used in tablets, capsules, and liquids for oral intake.

Topical excipients are expected to experience the fastest growth during forecast period, driven by rising demand for dermatological, cosmetic, and transdermal drug delivery systems. Increasing skin-related conditions and consumer preference for topical therapeutics support this growth. Parenteral excipients maintain steady demand, particularly due to the growing biologics sector and injectable drug market.

- By End User

On the basis of end user, the Asia-Pacific excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organizations and academics, and others. Pharmaceutical and biopharmaceutical companies dominated the market with approximately 60% share in 2024, fueled by their large-scale drug manufacturing operations and extensive excipient requirements.

Contract formulators are anticipated to be the fastest growing segment during forecast period, due to rising outsourcing trends, as pharmaceutical companies seek to optimize costs and focus on core competencies. Research organizations and academic institutions contribute to innovation and development of new excipient technologies, supporting the overall market advancement.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific excipients market is segmented into direct tender, retail sales, and others. Direct tender dominated the market with 50% share in 2024, as bulk purchases by pharmaceutical manufacturers, hospitals, and government institutions constitute a significant portion of excipient sales.

The ‘others’ segment, which includes e-commerce and specialized distribution platforms, is expected to register the fastest growth during forecast period, due to increasing digitalization, easier access to global suppliers, and growing preference for online procurement channels.

Asia-Pacific Excipients Market Regional Analysis

- China dominated the Asia-Pacific excipients market with the largest revenue share of 38.5% in 2024, supported by its strong pharmaceutical sector, government incentives, and expanding research capabilities

- The country’s strong infrastructure, government support for local excipient production, and increasing investments in pharmaceutical R&D contribute to high demand for diverse excipient types, including advanced functional excipients

- In addition, China’s expanding biopharmaceutical sector and rising chronic disease burden further accelerate excipient consumption, solidifying its role as the key driver of growth in the Asia-Pacific region

The China Asia-Pacific Excipients Market Insight

The China excipients market dominated the Asia-Pacific market with the largest revenue share in 2024, driven by its position as the region’s leading pharmaceutical manufacturing hub. Rapid growth in generic drug production, increasing investments in pharmaceutical R&D, and a strong government focus on local excipient production contribute to this dominance. The country’s expanding biopharmaceutical sector and rising prevalence of chronic diseases further fuel demand for high-quality excipients, including advanced functional and specialty grades.

Japan Asia-Pacific Excipients Market Insight

The Japan excipients market holds a significant share in the Asia-Pacific market, supported by its advanced pharmaceutical industry and stringent regulatory standards. The country’s focus on innovative drug delivery technologies and high demand for safe, effective excipients drives market growth. Increasing research activities and strong collaborations between pharmaceutical companies and excipient manufacturers promote continuous development of novel excipients.

India Asia-Pacific Excipients Market Insight

The India excipients market is one of the fastest-growing excipients markets in the Asia-Pacific region, attributed to its expanding pharmaceutical manufacturing base and growing contract manufacturing organizations (CMOs). The country’s large pool of skilled workforce, cost-effective production capabilities, and rising domestic demand for generic medicines propel market expansion. Government initiatives to boost pharmaceutical exports and investments in healthcare infrastructure are expected to sustain rapid growth.

South Korea Asia-Pacific Excipients Market Insight

The South Korea excipients market is witnessing substantial growth in its excipients market due to increasing biopharmaceutical production and innovation in drug formulation technologies. The country’s emphasis on high-quality excipients and strict compliance with global pharmaceutical standards enhances demand. Growing R&D investments and partnerships between local excipient producers and multinational pharmaceutical companies further strengthen market prospects.

Asia-Pacific Excipients Market Share

The Asia-Pacific Excipients industry is primarily led by well-established companies, including:

- Dow Inc. (U.S.)

- BASF SE (Germany)

- Ashland Global Holdings Inc. (U.S.)

- JRS Pharma GmbH & Co. KG (Germany)

- FMC Corporation (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Roquette Frères (France)

- Eastman Chemical Company (U.S.)

- Colorcon, Inc. (U.S.)

- Evonik Industries AG (Germany)

- Ingredion Incorporated (U.S.)

- CP Kelco (U.S.)

- Siltech Corporation (Canada)

- Thermo Fisher Scientific Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Croda International Plc (U.K.)

- Jubilant Life Sciences Ltd. (India)

- Lamberti S.p.A. (Italy)

- Brenntag AG (Germany)

- Sasol Ltd. (South Africa)

What are the Recent Developments in Asia-Pacific Excipients Market?

- In November 2024, Clariant introduced a new range of high-performing excipients at the CPHI India 2024 trade show. These excipients are designed to meet the evolving needs of the pharmaceutical industry, focusing on performance and regulatory compliance

- In October 2023, Roquette, a global leader in plant-based ingredients, unveiled three new excipient grades: LYCATAB CT-LM, MICROCEL 103 SD, and MICROCEL 113 SD. These excipients are specifically designed for moisture-sensitive drug formulations. The new grades offer extremely low water activity and are a part of Roquette's wider moisture-protection portfolio, which aims to help pharmaceutical and nutraceutical manufacturers tackle the long-standing problem of active ingredient hydrolysis and moisture-related degradation

- In September 2023, IFF announced the launch of Methanova, a new cellulose-based biopolymer designed to address key formulation challenges in the pharmaceutical industry. The excipient is specifically developed to improve the bioavailability of poorly soluble drugs, enhance drug stability, and enable advanced controlled-release formulations

- In May 2022, Lubrizol Life Science (LLS) Health launched Apisolex, a new excipient designed to improve solubility and simplify the manufacturing of parenteral drug products. This innovative technology is a significant development because it addresses the challenge of poorly water-soluble active pharmaceutical ingredients (APIs), which accounts for a large percentage of new drugs in development

- In September 2021, the U.S. Food and Drug Administration (FDA) announced the Novel Excipient Review Pilot Program. This initiative was created to establish a pathway for the review of new excipients before they're used in drug formulations. The program was developed to encourage the use of novel excipients that could provide significant public health benefits, such as improving drug bioavailability, enabling new routes of drug delivery, or creating abuse-deterrent opioid formulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.