Market Analysis and Size

Heat treatment has been traditionally used to heal pain and long-lasting aches. The use of heating pads improves the oxygen flow and nutrients to the muscle, thereby helping muscle recovery. A heating pad is used to provide secondary heat to parts of the body (necks, backs, and others) to relieve pain. Smearing heat can reduce pain, relax the strained muscles, and correct muscle contractions. The use of heating pads stimulates the sensual receptors and releases the physiques, thus helping to decline the difficulty and reinstating elasticity. Multiple types of chemical and electric heating pads, including microwavable, are available in the market with moist and dry heat choices.

The rising application of heating pads for reducing stiffness and restoring flexibility and the prevalence of diseases such as arthritis and numerous neurological disorders are some of the drivers expected to boost heating pad demand in the market. With the increasing consumption of heating pads globally, major companies are expanding their production capacities in different countries to strengthen their presence for these products in the market.

The major restraint which may impact the market is the side effects of the heating pad during pregnancy and other related health issues. Also, the availability of counterfeit products can be a restraining factor for the market.

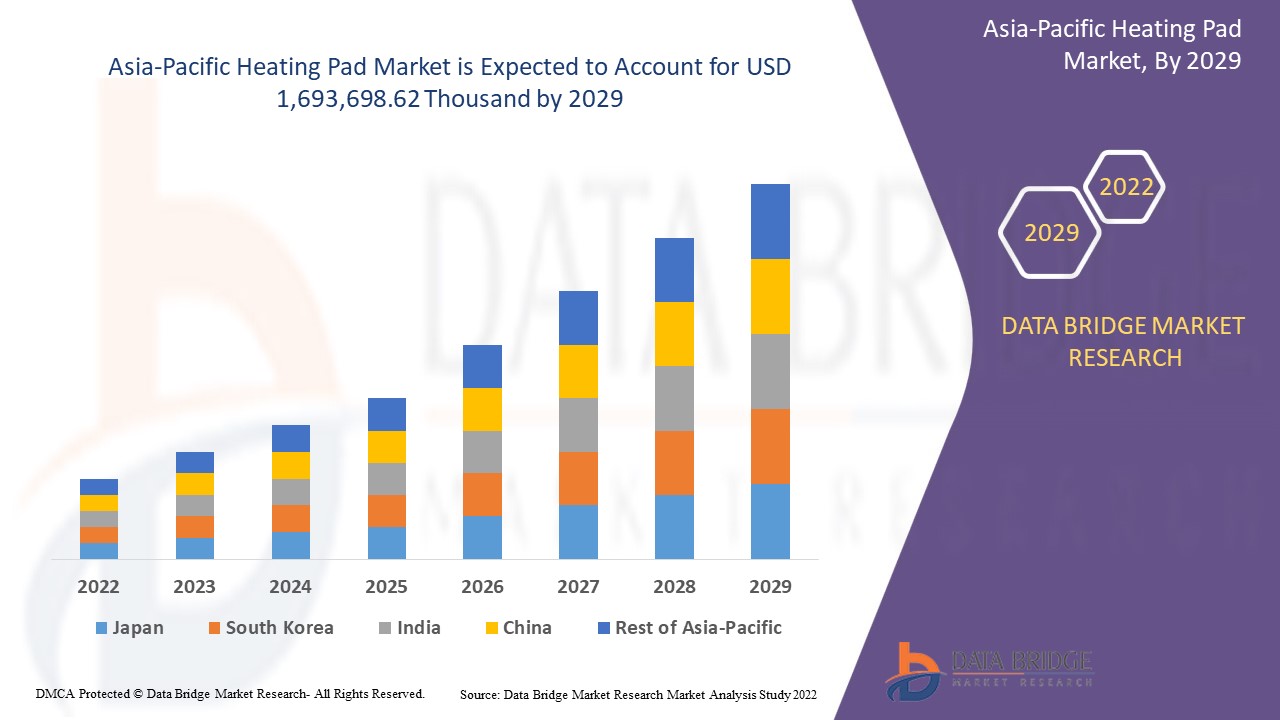

Data Bridge Market Research analyses that the heating pad market is expected to reach the value of USD 1,693,698.62 thousand by the year 2029, at a CAGR of 5.6% during the forecast period. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD, Volume in Units |

|

Segments Covered |

By Product (Microwavable Heating Pad, Water Heating Pad, Electric Heating Pad, Chemical Heating Pad, Infrared Heating Pad, and Others), Application (Home, Medical, Commercial, and Others), Selling Channel (Direct and Indirect) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Hong Kong, Taiwan, Thailand, Indonesia, Philippines, Rest of the Asia-Pacific |

|

Market Players Covered |

Conair LLC, Etsy, Inc., Sinocare, Tynorindia, Drive DeVilbiss Healthcare, Xian Bellavie and Sunbright Group Co., Ltd, Dongguan Yongqi Electric Heat Products Co. Ltd., Beurer, Sunrise Products, Odessey Products, among others |

Market Definition

Heat treatment has been traditionally used to heal pain and long-lasting aches. The use of heating pads improves the oxygen flow and nutrients to the muscle, thereby helping muscle recovery. A heating pad is used to provide secondary heat to parts of the body (necks, backs, and others) to relieve pain. Smearing heat can reduce pain, relax the strained muscles, and correct muscle contractions. The use of heating pads stimulates the sensual receptors and releases the physiques, thus helping to decline the difficulty and reinstating elasticity. Multiple types of chemical and electric heating pads, including microwavable, are available in the market with moist and dry heat choices.

Regulatory Framework

- IEC 80601-2-35:2009(en)- The International Electrotechnical Commission (IEC) is a worldwide organization for standardization comprising all national electrotechnical committees (IEC National Committees)

Medical electrical equipment — Part 2-35: Particular requirements for the basic safety and essential performance of heating devices using blankets, pads, or mattresses intended for heating in medical use

The minimum safety requirements specified in this standard are considered to provide a practical degree of safety in the operation of heating devices using blankets, pads, or mattresses intended for heating in medical use.

This standard amends and supplements IEC 60601-1 (third edition, 2005) Medical electrical equipment — Part 1: General requirements for basic safety and essential performance, referred to as the general standard. The text of this particular standard relating to forced air warmers is based on ASTM F2196-02, the Standard specification for circulating liquid and forced-air patient temperature management devices.

The Market Dynamics of the Asia-Pacific Heating Pad Market Include:

Drivers/Opportunities in the Asia-Pacific Heating Pad Market

- Rise in demand for pain management in-home care settings

The healthcare industry has made significant efforts to offer pain management facilities to their patients and clients in their homes themselves. This is being done to reduce the days of hospital stay of a patient, and at the same time, consumers will decrease expenses of medical care. The heating pad market has better tapped this opportunity by introducing such products, which can be used in homes without any hassle and without a healthcare expert's assistance. These efforts to improve the quality of pain management in home care settings have been made safe, evidence-based, and multimodal.

- Prevalence of diseases such as arthritis and numerous extensive neurological disorders

Using a heating pad for heat therapy and treatment may help heal various chronic conditions like fibromyalgia, arthritis, lower back pain, and various other neurological disorders. Applying a heated compress is one of the oldest, cheapest, and safest forms of heat therapy in curing such disorders. This heat treatment can loosen stiff joints and relieve achy muscles, easing up bodily movement.

- Increasing incidence of sports injuries

Treating sports injuries with the use of a heating pad has been the old way of giving first aid to athletes or sportspeople as providing heat with the help of a heating pad dilates the nerves in the body area instantly and promotes a good supply of blood, easing up the pain and provide instant relief. Moreover, heat application over a larger time has been very effective in dealing with old sports injuries. In addition, applying a heating pad is easy and can be used on the spot where an injury has taken place.

- High prevalence of chronic pain due to sedentary lifestyle and obesity

Various clinical studies and research have reported the effective use of heat therapy to reduce pain, anxiety, nausea, and heart rate in patients suffering from numerous chronic health conditions. Some examples include pain from gallstones (Kober et al 2003a), abdominal pain from renal colic (Kober et al 2003b), pelvic pain from cystitis, urolithiasis, appendicitis, colitis, and rectal trauma, among others (Bertalanffy et al 2006).

Restraints/Challenges faced by the Asia-Pacific Heating Pad Market

- Availability of counterfeit products

The growth of the Asia-Pacific heating pad market has faced problems due to the availability of counterfeit products such as hot water bottles or pain killers. Generally, these counterfeit products offer the same advantages that a genuine and branded heating pad offers but lack the required standards and quality that a heating pad should offer. Hence, these products are available at a lower price than the original ones. However, owing to their low price, the majority of the consumer prefer buying these counterfeit products.

- Side-effects of the heating pad during pregnancy and other related health issues

Using a heating pad for pregnant women and consumers with ailments such as diabetes can cause serious ill effects on one's body. During pregnancy, women have to go through problems such as pain and cramps and they start using heating pads regularly to reduce the pain. However, using the heating pad regularly directly affects their child in the development process, which increases the risk of miscarriage in women.

COVID-19 had a Minimal Impact on Heating Pad Market

COVID-19 impacted various manufacturing and service-providing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Though, the imbalance between demand and supply and its impact on pricing is considered short-term and is expected to recover as this pandemic comes to an end. Due to the outbreak of COVID-19 throughout the globe, the demand for heating pads has increased tremendously. Also, the infected people had severe body pain and muscle pain which helped the heating pad market grow during the pandemic. In addition, heating pad companies introduced new and advanced heating pad products. Thus, even though the other industries suffered a lot during the COVID-19 outbreak, the heating pad industry grew significantly.

Recent Development

- In July 2016, Sinocare completed the acquisition of the U.S.-based PTS diagnostics. The company is the manufacturer of point-of-care biometric testing devices. This acquisition enables both medical professionals and individuals across the globe to identify, monitor, and diagnose chronic diseases at the point of care

Asia-Pacific Heating Pad Market Scope

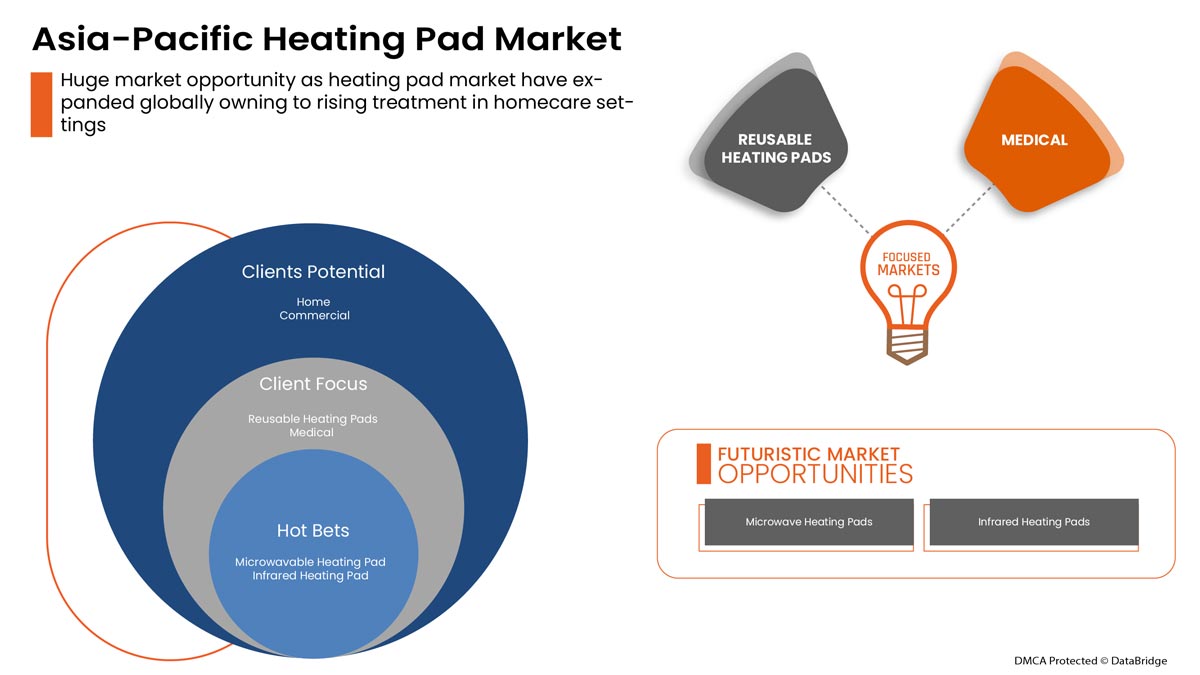

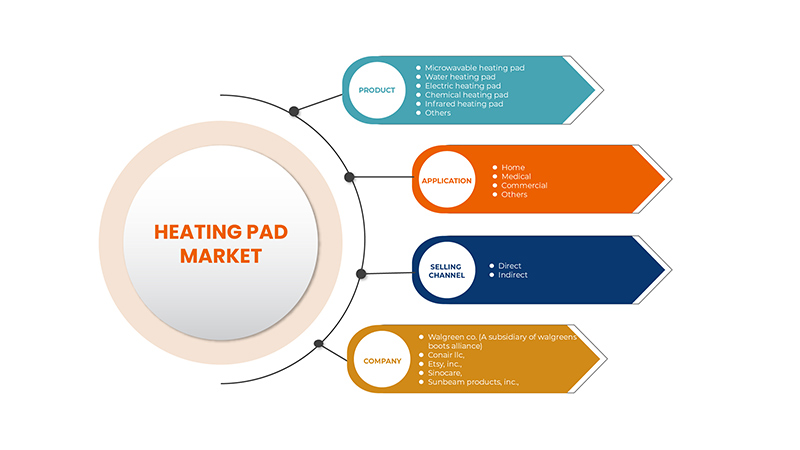

The Asia-Pacific heating pad market is segmented on the basis of product, application, and selling channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Microwavable Heating Pad

- Water Heating Pad

- Electric Heating Pad

- Chemical Heating Pad

- Infrared Heating Pad

- Others

On the basis of product, the Asia-Pacific heating pad market is segmented into microwavable heating pad, water heating pad, electric heating pad, chemical heating pad, infrared heating pad, and others.

Application

- Home

- Medical

- Commercial

- Others

On the basis of application, the Asia-Pacific heating pad market is segmented into home, medical, commercial, and others.

Selling Channel

- Direct

- Indirect

On the basis of selling channel, the Asia-Pacific heating pad market is segmented into direct and indirect.

Asia-Pacific Heating Pad Market Regional Analysis/Insights

The Asia-Pacific heating pad market is analyzed, and market size insights and trends are provided by country, product, application, and selling channel as referenced above.

Some of the countries covered in the Asia-Pacific heating pad market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia & New Zealand, Hong Kong, Taiwan, Thailand, Indonesia, Philippines, Rest of Asia-Pacific.

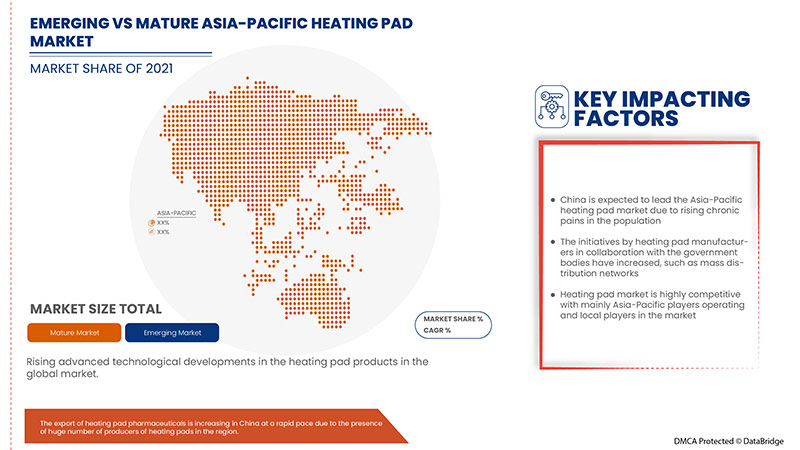

China is expected to dominate the Asia-Pacific heating pad market because of the high disposable income of consumers. China is followed by India and is expected to witness significant growth during the forecast period of 2022 to 2029 due to the growing demand for heating pads for homecare settings in the region. India is followed by Japan and is expected to grow significantly owing to the high prevalence of chronic pain due to sedentary lifestyles and obesity.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Heating Pad Market Share Analysis

The heating pad market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Asia-Pacific heating pad market.

Some of the major market players engaged in the Asia-Pacific heating pad market are Conair LLC, Etsy, Inc., Sinocare, Tynorindia, Drive DeVilbiss Healthcare, Xian Bellavie and Sunbright Group Co., Ltd, Dongguan Yongqi Electric Heat Products Co. Ltd., Beurer, Sunrise Products, Odessey Products, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC HEATING PAD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING APPLICATIONS OF HEATING PADS FOR REDUCING STIFFNESS AND RESTORING FLEXIBILITY

5.1.2 PREVALENCE OF DISEASES SUCH AS ARTHRITIS AND NUMEROUS EXTENSIVE NEUROLOGICAL DISORDERS

5.1.3 INCREASING INCIDENCE OF SPORTS INJURIES

5.1.4 HIGH PREVALENCE OF CHRONIC PAIN DUE TO SEDENTARY LIFESTYLE AND OBESITY

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF COUNTERFEIT PRODUCTS

5.2.2 SIDE-EFFECTS OF HEATING PAD DURING PREGNANCY AND OTHER RELATED HEALTH ISSUES

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR PAIN MANAGEMENT IN-HOME CARE SETTINGS

5.3.2 INCREASING SMART MARKETING ACTIVITIES

5.3.3 SURGE IN DISPOSABLE INCOME AND RAPID URBANIZATION

5.4 CHALLENGE

5.4.1 HIGH COMPETITION AMONG THE EXISTING PLAYERS

6 ASIA PACIFIC HEATING PAD MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ELECTRIC HEATING PAD

6.3 MICROWAVABLE HEATING PAD

6.4 INFRARED HEATING PAD

6.5 WATER HEATING PAD

6.6 CHEMICAL HEATING PAD

6.7 OTHERS

7 ASIA PACIFIC HEATING PAD MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOME

7.2.1 ELECTRIC HEATING PAD

7.2.2 MICROWAVABLE HEATING PAD

7.2.3 INFRARED HEATING PAD

7.2.4 WATER HEATING PAD

7.2.5 CHEMICAL HEATING PAD

7.2.6 OTHERS

7.3 MEDICAL

7.3.1 ELECTRIC HEATING PAD

7.3.2 MICROWAVABLE HEATING PAD

7.3.3 INFRARED HEATING PAD

7.3.4 WATER HEATING PAD

7.3.5 CHEMICAL HEATING PAD

7.3.6 OTHERS

7.4 COMMERCIAL

7.4.1 ELECTRIC HEATING PAD

7.4.2 MICROWAVABLE HEATING PAD

7.4.3 INFRARED HEATING PAD

7.4.4 WATER HEATING PAD

7.4.5 CHEMICAL HEATING PAD

7.4.6 OTHERS

7.5 OTHERS

7.5.1 ELECTRIC HEATING PAD

7.5.2 MICROWAVABLE HEATING PAD

7.5.3 INFRARED HEATING PAD

7.5.4 WATER HEATING PAD

7.5.5 CHEMICAL HEATING PAD

7.5.6 OTHERS

8 ASIA PACIFIC HEATING PAD MARKET, BY SELLING CHANNEL

8.1 OVERVIEW

8.2 DIRECT

8.3 INDIRECT

9 ASIA PACIFIC HEATING PAD MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 MALAYSIA

9.1.5 THAILAND

9.1.6 AUSTRALIA & NEW ZEALAND

9.1.7 SOUTH KOREA

9.1.8 INDONESIA

9.1.9 HONG KONG

9.1.10 SINGAPORE

9.1.11 TAIWAN

9.1.12 PHILIPPINES

9.1.13 REST OF ASIA-PACIFIC

10 ASIA PACIFIC HEATING PAD MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 WALGREEN CO. (A SUBSIDIARY OF WALGREENS BOOTS ALLIANCE)

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 CONAIR LLC

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATE

12.3 ETSY, INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATE

12.4 SINOCARE

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 SUNBEAM PRODUCTS, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATE

12.6 TYNORINDIA

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT UPDATE

12.7 DRIVE DEVILBISS HEALTHCARE

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATE

12.8 BEURER

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATE

12.9 BODYMED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATE

12.1 CAREX HEALTH BRANDS (A SUBSIDIARY OF COMPASS HEALTH BRANDS)

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATE

12.11 CHATTANOOGA MEDICAL SUPPLY, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATE

12.12 DONGGUAN YONGQI ELECTRIC HEAT PRODUCTS CO. LTD.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATE

12.13 NATURE CREATION

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 ODYSSEY PRODUCTS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATES

12.15 PURE ENRICHMENT (A SUBSIDIARY OF BEAR DOWN BRANDS, LLC. COMPANY)

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATE

12.16 SUNNY-BAY

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATE

12.17 SUNRISE PRODUCTS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATE

12.18 THE HEAT COMPANY

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATE

12.19 THERMALON

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATE

12.2 XIAN BELLAVIE AND SUNBRIGHT GROUP CO., LTD

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATE

13 QUESTIONNAIRE

14 RELATED REPORT

List of Table

TABLE 1 IMPORT DATA OF HEATING PAD; HS CODE – 851690 PARTS OF ELECTRIC WATER HEATERS, IMMERSION HEATERS, SPACE-HEATING APPARATUS AND SOIL-HEATING ... (USD THOUSAND)

TABLE 2 EXPORT DATA OF HEATING PAD; HS CODE – 851690 PARTS OF ELECTRIC WATER HEATERS, IMMERSION HEATERS, SPACE-HEATING APPARATUS AND SOIL-HEATING ... (USD THOUSAND)

TABLE 3 ASIA PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC ELECTRIC HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC ELECTRIC HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 ASIA PACIFIC MICROWAVABLE HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC MICROWAVABLE HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC INFRARED HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC INFRARED HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC WATER HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC WATER HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 ASIA PACIFIC CHEMICAL HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC CHEMICAL HEATING PAD IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 ASIA PACIFIC OTHERS IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC OTHERS IN HEATING PAD MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 17 ASIA PACIFIC HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC HOME IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC MEDICAL IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC COMMERCIAL IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC OTHERS IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC DIRECT IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC INDIRECT IN HEATING PAD MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC HEATING PAD MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC HEATING PAD MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 31 ASIA-PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 33 ASIA-PACIFIC HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 39 CHINA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 40 CHINA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 41 CHINA HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 42 CHINA HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 CHINA MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 CHINA COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 CHINA OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 CHINA HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 INDIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 INDIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 49 INDIA HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 INDIA HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 INDIA MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 INDIA COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 INDIA OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 INDIA HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 55 JAPAN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 56 JAPAN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 57 JAPAN HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 58 JAPAN HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 JAPAN MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 60 JAPAN COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 JAPAN OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 62 JAPAN HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 63 MALAYSIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 64 MALAYSIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 65 MALAYSIA HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 MALAYSIA HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 MALAYSIA MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 MALAYSIA COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 MALAYSIA OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 MALAYSIA HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 71 THAILAND HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 THAILAND HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 73 THAILAND HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 74 THAILAND HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 THAILAND MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 76 THAILAND COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 THAILAND OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 78 THAILAND HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 81 AUSTRALIA & NEW ZEALAND HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 AUSTRALIA & NEW ZEALAND HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH KOREA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 SOUTH KOREA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 89 SOUTH KOREA HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 90 SOUTH KOREA HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 SOUTH KOREA MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 SOUTH KOREA COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 SOUTH KOREA OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 94 SOUTH KOREA HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 INDONESIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 INDONESIA HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 97 INDONESIA HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 INDONESIA HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 100 INDONESIA COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 102 INDONESIA HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 103 HONG KONG HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 104 HONG KONG HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 105 HONG KONG HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 HONG KONG HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 107 HONG KONG MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 108 HONG KONG COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 HONG KONG OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 HONG KONG HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 111 SINGAPORE HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 SINGAPORE HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 113 SINGAPORE HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 114 SINGAPORE HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SINGAPORE MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 116 SINGAPORE COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SINGAPORE OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SINGAPORE HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 119 TAIWAN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 120 TAIWAN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 121 TAIWAN HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 TAIWAN HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 123 TAIWAN MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 124 TAIWAN COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 125 TAIWAN OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 126 TAIWAN HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 127 PHILIPPINES HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 128 PHILIPPINES HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 129 PHILIPPINES HEATING PAD MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 PHILIPPINES HOME IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 PHILIPPINES MEDICAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 PHILIPPINES COMMERCIAL IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 PHILIPPINES OTHERS IN HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 PHILIPPINES HEATING PAD MARKET, BY SELLING CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 135 REST OF ASIA-PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 REST OF ASIA-PACIFIC HEATING PAD MARKET, BY PRODUCT, 2020-2029 (UNITS)

List of Figure

FIGURE 1 ASIA PACIFIC HEATING PAD MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC HEATING PAD MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HEATING PAD MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HEATING PAD MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HEATING PAD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HEATING PAD MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC HEATING PAD MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC HEATING PAD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC HEATING PAD MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC HEATING PAD MARKET: APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC HEATING PAD MARKET: CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC HEATING PAD MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC HEATING PAD MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE ASIA PACIFIC HEATING PAD MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 RISING APPLICATION OF HEATING PADS FOR REDUCING STIFFNESS AND RESTORING FLEXIBILITY IS EXPECTED TO DRIVE THE ASIA PACIFIC HEATING PAD MARKET IN THE FORECAST PERIOD

FIGURE 16 ELECTRIC HEATING PAD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HEATING PAD MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC HEATING PAD MARKET

FIGURE 18 URBANIZATION RATE IN CHINA

FIGURE 19 ASIA PACIFIC HEATING PAD MARKET: BY PRODUCT, 2021

FIGURE 20 ASIA PACIFIC HEATING PAD MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC HEATING PAD MARKET: BY SELLING CHANNEL, 2021

FIGURE 22 ASIA-PACIFIC HEATING PAD MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC HEATING PAD MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC HEATING PAD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC HEATING PAD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC HEATING PAD MARKET: BY PRODUCT (2022-2029)

FIGURE 27 ASIA PACIFIC HEATING PAD MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.