Asia Pacific Respiratory Care Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

10.43 Billion

2024

2032

USD

4.80 Billion

USD

10.43 Billion

2024

2032

| 2025 –2032 | |

| USD 4.80 Billion | |

| USD 10.43 Billion | |

|

|

|

|

Asia-Pacific Respiratory Care Devices Market Size

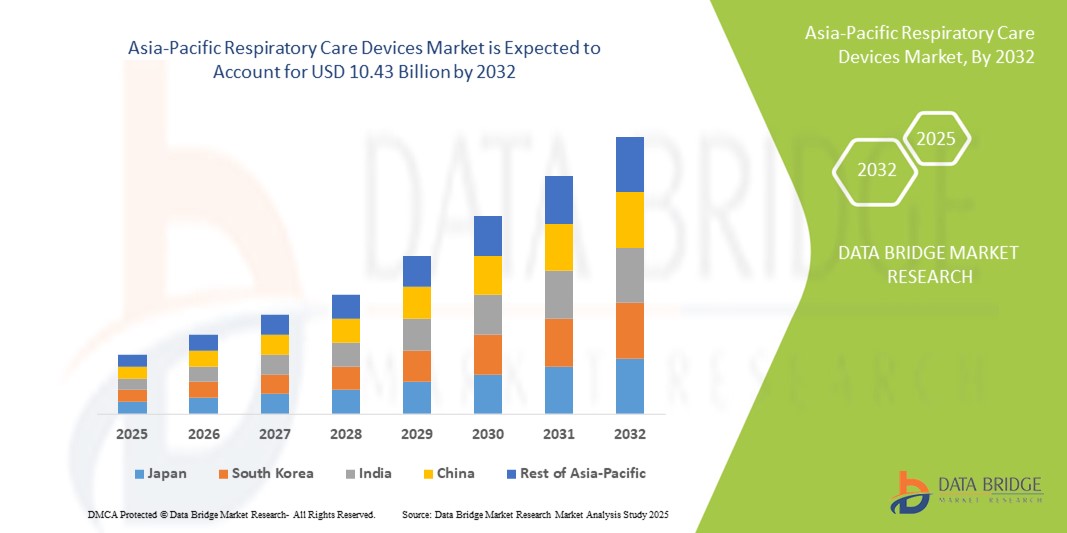

- The Asia-Pacific respiratory care devices market size was valued at USD 4.80 billion in 2024 and is expected to reach USD 10.43 billion by 2032, at a CAGR of 10.20% during the forecast period

- The market growth is largely fueled by the rising prevalence of respiratory diseases, an aging population, and increasing healthcare spending, which are driving demand for advanced respiratory care solutions across hospitals, clinics, and home care settings

- Furthermore, ongoing technological advancements in respiratory care devices, combined with increasing consumer preference for effective, user-friendly, and integrated healthcare solutions, are positioning these devices as essential tools for patient care. These converging factors are accelerating the adoption of respiratory care devices, thereby significantly boosting the industry's growth

Asia-Pacific Respiratory Care Devices Market Analysis

- Respiratory care devices, including therapeutic devices, monitoring devices, diagnostic devices, and consumables and accessories, are increasingly vital components of modern healthcare in both hospitals and home care settings due to their role in managing respiratory diseases, improving patient outcomes, and supporting chronic care

- The escalating demand for respiratory care devices is primarily fueled by the rising prevalence of respiratory disorders such as COPD, asthma, and sleep apnea, an aging population, and increasing healthcare spending across major Asia-Pacific countries

- Japan dominated the Asia-Pacific respiratory care devices market with the largest revenue share of 28.9% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative medical devices, and strong government initiatives to manage chronic respiratory diseases, with hospitals being the key end users for advanced therapeutic and monitoring devices

- China is expected to be the fastest growing country in the Asia-Pacific respiratory care devices market during the forecast period, due to improving healthcare access, rising disposable incomes, and growing awareness of respiratory health management, particularly for home care and ambulatory care settings

- Therapeutic devices segment dominated the Asia-Pacific respiratory care devices market with a market share of 42.5% in 2024, driven by increasing demand for ventilators, oxygen therapy devices, and CPAP machines to manage COPD, sleep apnea, and other chronic respiratory conditions

Report Scope and Asia-Pacific Respiratory Care Devices Market Segmentation

|

Attributes |

Asia-Pacific Respiratory Care Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Respiratory Care Devices Market Trends

Integration of Connected and AI-Enabled Respiratory Devices

- A significant and accelerating trend in the Asia-Pacific respiratory care devices market is the integration of connected and AI-enabled devices, including ventilators, oxygen concentrators, and monitoring systems, enhancing patient care and remote disease management

- For instance, the ResMed AirSense 11 connects to mobile apps and cloud platforms, allowing patients and caregivers to monitor sleep apnea therapy remotely, track adherence, and adjust settings as required

- AI-enabled respiratory devices can analyze patient breathing patterns to suggest personalized treatment adjustments and provide predictive alerts for exacerbations, such as some Philips ventilators that optimize ventilation settings automatically

- The seamless integration of respiratory care devices with telehealth platforms allows healthcare providers to monitor multiple patients remotely, offering centralized data management and enabling early interventions for chronic respiratory conditions

- This trend toward intelligent, connected respiratory solutions is transforming patient expectations for disease management and home-based care. Consequently, companies such as Fisher & Paykel are developing devices with AI-assisted monitoring, cloud connectivity, and mobile app integration for enhanced patient engagement

- The demand for connected and AI-enabled respiratory care devices is rising rapidly across both hospital and home care settings, as patients and providers increasingly prioritize convenience, continuous monitoring, and improved clinical outcomes

Asia-Pacific Respiratory Care Devices Market Dynamics

Driver

Rising Prevalence of Respiratory Disorders and Aging Population

- The increasing prevalence of respiratory diseases such as COPD, asthma, and sleep apnea, combined with an aging population in major Asia-Pacific countries, is a significant driver of respiratory care device demand

- For instance, in 2024, Philips launched advanced home-use CPAP machines in China to support growing numbers of sleep apnea patients, driving device adoption across home care and hospital settings

- As healthcare providers and patients seek effective management of chronic respiratory conditions, devices offering oxygen therapy, ventilatory support, and continuous monitoring are increasingly preferred over traditional care methods

- Furthermore, increasing healthcare expenditure and government initiatives in countries such as Japan and Australia are facilitating improved access to advanced respiratory care solutions, boosting market growth

- The growing adoption of telehealth and remote monitoring platforms is enhancing device utilization, enabling continuous patient management and increasing demand in both hospital and home care segments

Restraint/Challenge

High Device Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced respiratory care devices and accessories poses a challenge to broader market adoption, particularly in developing Asia-Pacific countries where affordability is a key concern

- For instance, portable ventilators and AI-enabled monitoring systems can be cost-prohibitive for home care patients, limiting adoption despite clear clinical benefits

- Stringent regulatory compliance requirements for medical devices in countries such as Japan, Australia, and China can delay product launches, increasing development costs and creating market entry barriers for new companies

- Addressing affordability through cost-effective device options and ensuring compliance with regional medical regulations is crucial for sustaining market growth and encouraging adoption in emerging economies

- Enhancing awareness about device efficacy, providing training for healthcare providers, and offering flexible financing solutions can help mitigate adoption barriers and improve market penetration

Asia-Pacific Respiratory Care Devices Market Scope

The market is segmented on the basis of product, indication, and end user.

- By Product

On the basis of product, the Asia-Pacific respiratory care devices market is segmented into therapeutic devices, monitoring devices, diagnostic devices, and consumables and accessories. The therapeutic devices segment dominated the market with the largest revenue share of 42.5% in 2024, driven by the widespread need for devices such as ventilators, oxygen concentrators, and CPAP machines. Hospitals and home care providers often prioritize therapeutic devices for their critical role in managing chronic respiratory conditions and providing life-saving support in acute care settings. The segment benefits from ongoing technological advancements, including AI-enabled ventilators and portable oxygen therapy systems, which improve patient outcomes and ease of use. Rising prevalence of COPD, asthma, and sleep apnea across Asia-Pacific countries further fuels demand. Therapeutic devices are also preferred due to their compatibility with monitoring systems, enabling integrated respiratory care. In addition, government initiatives to improve respiratory healthcare infrastructure enhance adoption in hospitals and specialized clinics.

The monitoring devices segment is anticipated to witness the fastest growth rate of 10.5% from 2025 to 2032, fueled by increasing adoption of remote patient monitoring and connected devices. Monitoring devices, including pulse oximeters, spirometers, and wearable respiratory sensors, allow continuous assessment of patient respiratory status, making them critical for home care and ambulatory care centres. These devices also support early detection of complications and treatment adherence, which is becoming increasingly important in managing chronic diseases. The integration of monitoring devices with telehealth platforms and mobile apps enhances patient engagement and enables physicians to track therapy outcomes remotely. Rising awareness of respiratory health and growing investments in smart healthcare infrastructure contribute to the rapid growth of this segment.

- By Indication

On the basis of indication, the market is segmented into COPD, sleep apnea, asthma, infectious diseases, and other indications. The COPD segment dominated the market with the largest revenue share of 35% in 2024, driven by the high prevalence of chronic obstructive pulmonary disease in countries such as China, Japan, and India. COPD patients require continuous respiratory support, including therapeutic and monitoring devices, which boosts demand in both hospital and home care settings. The segment benefits from the development of portable ventilators, oxygen therapy devices, and AI-assisted treatment devices, which enhance patient quality of life. Increasing awareness about disease management and government programs targeting chronic respiratory conditions further support adoption. Hospitals and home care providers often prefer COPD-focused solutions due to their demonstrated clinical efficacy. Technological innovations that enable remote monitoring and integration with patient management systems also drive segment growth.

The sleep apnea segment is expected to witness the fastest growth rate of 11.2% from 2025 to 2032, fueled by rising diagnosis rates and growing awareness of the health risks associated with untreated sleep apnea. CPAP devices and other sleep therapy systems are increasingly adopted in home care settings, supported by reimbursement programs and telehealth integration. Continuous monitoring and connected devices allow clinicians to adjust therapy remotely, improving adherence and treatment outcomes. Rising urbanization, sedentary lifestyles, and increasing obesity rates in the Asia-Pacific region contribute to higher prevalence, driving demand. Patient preference for comfortable, portable, and user-friendly sleep therapy devices further accelerates adoption in residential and ambulatory care settings.

- By End User

On the basis of end user, the market is segmented into hospitals, home care settings, and ambulatory care centres. The hospitals segment dominated the market with the largest revenue share of 50% in 2024, driven by high demand for intensive care units, chronic respiratory care wards, and emergency respiratory interventions. Hospitals require advanced therapeutic and monitoring devices to manage acute and chronic respiratory conditions effectively. The adoption of AI-enabled ventilators, connected monitoring systems, and integrated respiratory care platforms supports improved clinical outcomes. Hospitals also benefit from government funding and healthcare infrastructure investments, which enhance the availability of advanced devices. The need for patient safety, regulatory compliance, and centralized monitoring further reinforces hospital preference for comprehensive respiratory solutions. Hospitals remain the primary channel for high-value device adoption across Asia-Pacific.

The home care settings segment is expected to witness the fastest growth rate of 12.1% from 2025 to 2032, fueled by rising demand for home-based respiratory care, portable therapeutic devices, and remote monitoring solutions. Increasing awareness about chronic disease management, particularly for COPD and sleep apnea, drives patient preference for home care solutions. Telehealth-enabled devices allow patients to receive continuous support without frequent hospital visits, improving treatment adherence and convenience. Rising disposable incomes, urbanization, and government initiatives supporting home healthcare also accelerate growth. Home care adoption is further enhanced by user-friendly devices, portability, and integration with mobile apps and cloud platforms for real-time monitoring.

Asia-Pacific Respiratory Care Devices Market Regional Analysis

- Japan dominated the Asia-Pacific respiratory care devices market with the largest revenue share of 28.9% in 2024, characterized by advanced healthcare infrastructure, high adoption of innovative medical devices, and strong government initiatives to manage chronic respiratory diseases, with hospitals being the key end users for advanced therapeutic and monitoring devices

- Patients and healthcare providers in the region highly value the effectiveness, reliability, and integration of respiratory care devices with hospital monitoring systems and telehealth platforms, enhancing patient management and clinical outcomes

- This widespread adoption is further supported by rising healthcare expenditure, an aging population, and increasing awareness of respiratory health, establishing respiratory care devices as essential solutions across hospitals, home care settings, and ambulatory care centres

Japan Respiratory Care Devices Market Insight

Japan dominated the Asia-Pacific respiratory care devices market with the largest revenue share in 2024, fueled by advanced healthcare infrastructure, high technology adoption, and rising prevalence of chronic respiratory conditions. Hospitals and home care providers are increasingly integrating AI-enabled ventilators, monitoring systems, and connected devices to improve patient outcomes. Japan’s aging population further drives demand for user-friendly, portable, and home-based respiratory care solutions. Government initiatives promoting chronic disease management and telehealth integration are also fueling growth across hospital and home care segments.

China Respiratory Care Devices Market Insight

The China respiratory care devices market is expected to be the fastest growing in the Asia-Pacific region during the forecast period, attributed to rapid urbanization, rising disposable incomes, and growing awareness of respiratory health. Hospitals and home care facilities are adopting advanced therapeutic and monitoring devices to manage COPD, sleep apnea, and asthma. Technological innovations such as portable ventilators, connected monitoring devices, and AI-assisted diagnostics are boosting adoption. Strong government support for healthcare infrastructure and increasing focus on respiratory disease management programs are further accelerating market growth.

India Respiratory Care Devices Market Insight

The India respiratory care devices market accounted for a significant revenue share in 2024, driven by a high prevalence of respiratory disorders, rapid urbanization, and expanding healthcare infrastructure. Hospitals, home care settings, and ambulatory care centres are increasingly adopting oxygen therapy devices, CPAP machines, and monitoring solutions. Rising awareness of chronic respiratory disease management, coupled with affordable device options and domestic manufacturing capabilities, is fueling market growth. Government initiatives promoting healthcare accessibility and telehealth integration are also supporting adoption.

South Korea Respiratory Care Devices Market Insight

The South Korea respiratory care devices market is expanding as a result of rising healthcare expenditure, technological innovation, and a focus on home-based respiratory care solutions. Hospitals are increasingly adopting AI-enabled ventilators, connected monitoring devices, and diagnostic tools, while home care adoption is driven by patient preference for portable and user-friendly devices. Government programs supporting chronic disease management and telehealth adoption are further fueling market growth, positioning South Korea as a key contributor to the Asia-Pacific respiratory care devices market.

Asia-Pacific Respiratory Care Devices Market Share

The Asia-Pacific Respiratory Care Devices industry is primarily led by well-established companies, including:

- Fisher & Paykel Healthcare Limited (New Zealand)

- ResMed (U.S.)

- Medtronic (Ireland)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Drägerwerk AG & Co. KGaA (Germany)

- Masimo (U.S.)

- BD (U.S.)

- Teleflex Incorporated (U.S.)

- Hamilton Medical (Switzerland)

- Vyaire Medical Inc. (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- ICU Medical, Inc. (U.S.)

- Air Liquide S.A. (France)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- TEIJIN LIMITED (Japan)

- Owens & Minor, Inc. (U.S.)

- Unison Healthcare Group (Taiwan)

- Wellell Inc. (Taiwan)

What are the Recent Developments in Asia-Pacific Respiratory Care Devices Market?

- In May 2025, Fisher & Paykel Healthcare introduced the ICON+ Auto CPAP device in South Korea, combining advanced pressure relief and integrated humidification. The ICON+ Auto features SensAwake responsive pressure relief and ThermoSmart humidifier systems, aiming to enhance patient comfort. It also incorporates cloud-based technologies for compliance data recording and reporting

- In August 2023, ResMed launched the AirSense 11 CPAP machine in Australia, featuring wireless connectivity and enhanced comfort settings. The AirSense 11 offers auto-adjusting pressure, integrated humidification, and a user-friendly interface. Its wireless capabilities allow for remote monitoring and adjustments, improving patient adherence to therapy. The device is available for pre-order in Australia

- In November 2021, Indian pharmaceutical and medical device company Cipla Limited announced the launch of Spirofy, India’s first pneumotach-based portable, wireless spirometer. The device is a significant development in the diagnosis and monitoring of Chronic Obstructive Pulmonary Disease (COPD) and asthma. This launch represents a move toward more accessible and decentralized respiratory care in a key Asia-Pacific market

- In August 2021, Siemens Healthineers inaugurated a new manufacturing facility for molecular diagnostic kits in Vadodara, Gujarat, India. With a production capacity of 25 million tests per annum, this development was a direct response to the need for diagnostics, particularly for infectious diseases that affect the respiratory system. It represents a major investment in the manufacturing infrastructure of the Asia-Pacific region by a leading global medical device company

- In June 2021, Siemens Healthineers announced a collaboration with Nanogen, a Vietnamese biotechnology company, for clinical trials of Nanogen's COVID-19 vaccine candidate, "Nanocovax."

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.