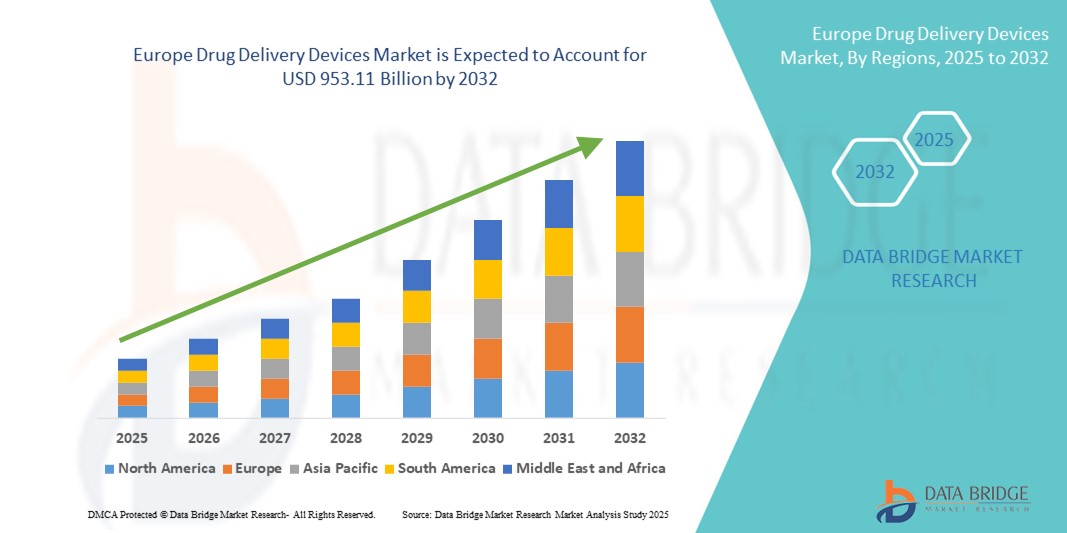

Europe Drug Delivery Devices Market

Market Size in USD Billion

CAGR :

%

USD

534.41 Billion

USD

953.11 Billion

2024

2032

USD

534.41 Billion

USD

953.11 Billion

2024

2032

| 2025 –2032 | |

| USD 534.41 Billion | |

| USD 953.11 Billion | |

|

|

|

|

Europe Drug Delivery Devices Market Size

- The Europe drug delivery devices market size was valued at USD 534.41 Billion in 2024 and is expected to reach USD 953.11 Billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the rising incidence of neurological and psychological disorders across Europe, leading to increased demand for advanced therapeutic solutions such as drug delivery devices (Vagus Nerve Stimulation - VNS). The growing burden of epilepsy, treatment-resistant depression, and other chronic neurological conditions is driving the adoption of VNS devices in both hospital and outpatient settings

- Furthermore, favorable reimbursement policies, ongoing clinical research, and increased awareness among healthcare professionals and patients are establishing drug delivery Devices as a preferred neuromodulation therapy. These converging factors are accelerating the uptake of Europe Drug Delivery Devices solutions, thereby significantly boosting the industry's growth

Europe Drug Delivery Devices Market Analysis

- The Europe drug delivery devices market is witnessing robust growth driven by rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders that require efficient and patient-friendly drug administration systems

- Increasing adoption of advanced drug delivery technologies like wearable injectors, inhalers, smart infusion pumps, and needle-free devices is fueling market expansion by improving therapeutic outcomes and patient compliance

- Germany dominated the Europe Drug Delivery Devices market with the largest revenue share of 29.4% in 2024, attributed to high healthcare expenditure, a well-established pharmaceutical industry, and strong adoption of innovative drug delivery solutions

- France is expected to witness the highest CAGR of 8.1% during the forecast period, driven by supportive government policies promoting healthcare innovation, growing awareness of personalized medicine, and increasing investment in research and development

- The hospitals segment held the largest market share of 48.9% in 2024, driven by the availability of advanced infrastructure and skilled professionals to administer complex therapies like intravenous injections and implantable devices

Report Scope and Europe Drug Delivery Devices Market Segmentation

|

Attributes |

Europe Drug Delivery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Drug Delivery Devices Market Trends

Surging Demand for Advanced Drug Delivery Solutions Across Europe

- The Europe drug delivery devices market is experiencing robust growth, primarily driven by the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions, which require efficient and sustained medication administration

- The demand for user-friendly, accurate, and minimally invasive delivery systems — including prefilled syringes, autoinjectors, inhalers, and transdermal patches — is growing across both hospital and homecare settings, particularly in countries like Germany, France, and the U.K.

- Technological innovation remains central to this market’s growth, with companies introducing smart drug delivery devices that enable real-time monitoring, dose tracking, and digital health integration to improve patient adherence and treatment outcomes

- For instance, connected insulin pens and digital inhalers that sync with patient smartphones are seeing rapid adoption in European diabetes and respiratory care sectors, supported by regulatory bodies emphasizing digital health interoperability

- Europe's strong pharmaceutical manufacturing base, especially in Germany and Switzerland, combined with rising healthcare expenditure and a shift toward value-based care models, is further propelling the adoption of sophisticated drug delivery devices

- In addition, an aging population across Europe is contributing to increased demand for home-based treatment solutions. Devices that simplify complex medication regimens for elderly patients — such as needle-free injectors and wearable pumps — are gaining traction

- Environmental sustainability is also emerging as a trend in the European market, with manufacturers exploring recyclable, single-use drug delivery formats in compliance with EU Green Deal directives

- With favorable regulatory pathways from the EMA and growing investment in biologics, biosimilars, and personalized therapies, the drug delivery devices market in Europe is set for continued expansion, especially in the areas of oncology, immunology, and endocrine disorders

Europe Drug Delivery Devices Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Chronic Diseases and Demand for Advanced Drug Administration Solutions

- The increasing prevalence of chronic diseases such as diabetes, cancer, cardiovascular conditions, and respiratory disorders across Europe is significantly boosting the demand for innovative and efficient drug delivery devices

- For instance, in April 2024, BD (Becton, Dickinson and Company) announced the expansion of its pre-fillable syringe production in Spain to meet growing demands for chronic disease treatments, reflecting ongoing investment in advanced delivery formats

- The shift toward biologics and personalized medicine is further driving the need for precise, targeted, and patient-friendly delivery systems such as auto-injectors, implantables, and inhalers

- Furthermore, the emphasis on improving medication adherence—especially among aging populations—has fueled the adoption of home-use devices that are easy to operate and reduce hospital dependency

- Healthcare providers and patients are increasingly seeking devices that support self-administration, portability, and minimal side effects, thus accelerating the uptake of smart, connected drug delivery systems across hospitals, specialty clinics, and homecare settings

Restraint/Challenge

High Cost and Regulatory Complexity

- The high development and production costs associated with advanced drug delivery devices, particularly those involving biologics or implantables, pose a substantial challenge in terms of affordability and widespread access

- In addition, navigating Europe’s diverse and evolving regulatory landscape—including MDR (Medical Device Regulation)—can delay approvals and market entry for novel delivery systems.

- For instance, the increased scrutiny under MDR has extended timelines for CE marking of Class II and III drug-device combination products, impacting innovation cycles and launch strategies.

- Moreover, disparities in reimbursement policies across European countries create unequal access—patients in Western Europe may have more comprehensive coverage compared to those in Central or Eastern Europe

- Addressing these challenges requires coordinated efforts, including harmonizing reimbursement structures, streamlining regulatory pathways, and promoting public-private partnerships to support clinical validation and adoption of cost-effective solutions

Europe Drug Delivery Devices Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe drug delivery devices market is segmented into oral drug delivery, injectable drug delivery, topical drug delivery, ophthalmic drug delivery, nasal drug delivery, pulmonary drug delivery, transmucosal drug delivery, and implantable drug delivery. The oral drug delivery segment accounted for the largest market revenue share of 34.6% in 2024, owing to its ease of administration, high patient compliance, and widespread use for chronic diseases such as cardiovascular conditions and diabetes.

The injectable drug delivery segment is projected to witness the fastest CAGR of 19.2% from 2025 to 2032, driven by the rising demand for biologics, vaccines, and biosimilars, along with advancements in auto-injectors and prefilled syringes that enhance safety and ease of use.

- By End User

On the basis of end user, the market is segmented into hospitals, home healthcare, clinics, community healthcare, and others. The hospitals segment held the largest market share of 48.9% in 2024, driven by the availability of advanced infrastructure and skilled professionals to administer complex therapies like intravenous injections and implantable devices.

The home healthcare segment is expected to grow at the fastest CAGR of 20.4% during the forecast period, owing to the increasing preference for self-administered treatments, especially among elderly and chronic disease patients. Rising availability of wearable, portable, and user-friendly drug delivery systems is supporting this shift.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders, hospital pharmacies, pharmacy stores, and online pharmacy. The hospital pharmacies segment dominated the market with a revenue share of 36.7% in 2024, attributed to the procurement of specialty medications and complex drug delivery devices directly associated with inpatient care.

The online pharmacy segment is anticipated to grow at the fastest CAGR of 22.1% from 2025 to 2032, driven by increasing digitalization in healthcare, convenience of doorstep delivery, and growing consumer comfort with purchasing medical devices and prescriptions online.

Europe Drug Delivery Devices Market Regional Analysis

- The Europe drug delivery devices market accounted for 28.5% of the global revenue share in 2024

- The region’s leadership is attributed to its strong healthcare infrastructure, increasing prevalence of chronic diseases requiring efficient drug administration, and rising investments in innovative drug delivery technologies such as wearable injectors, smart pumps, and needle-free devices

- Supportive reimbursement policies and continuous technological advancements in drug delivery systems further reinforce Europe’s prominence in the global market

Germany Drug Delivery Devices Market Insight

The Germany drug delivery devices market captured the largest revenue share of 29.4% in 2024 within Europe, driven by the country’s advanced healthcare infrastructure and significant adoption of innovative drug delivery solutions. Germany's leadership in pharmaceutical manufacturing, strong R&D capabilities, and early uptake of self-administration devices support sustained growth. Government initiatives promoting personalized medicine and chronic disease management further boost market expansion.

France Drug Delivery Devices Market Insight

The France drug delivery devices market accounted for a substantial growth with a CAGR of 8.1% revenue share in 2024, supported by increasing cases of diabetes and respiratory disorders. National health programs focusing on improving patient compliance and accessibility to modern drug delivery systems contribute to market growth. The country’s solid healthcare framework and active involvement in clinical trials for novel delivery technologies further stimulate adoption.

U.K. Drug Delivery Devices Market Insight

The U.K. drug delivery devices market is projected to grow at a notable CAGR during the forecast period. Rising prevalence of chronic diseases and growing preference for home-based care solutions are driving demand for user-friendly drug delivery devices. The U.K.’s advanced digital health ecosystem and government support for telehealth and remote patient monitoring play critical roles in market development.

Netherlands Drug Delivery Devices Market Insight

The Netherlands drug delivery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, reflecting its focus on integrating cutting-edge healthcare technologies. The country benefits from a strong network of academic medical centers and public-private collaborations fostering innovation. Adoption of advanced drug delivery devices is increasing, especially in diabetes management and respiratory care, supported by government pilot projects and healthcare provider partnerships.

Europe Drug Delivery Devices Market Share

The Europe drug delivery devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Sanofi (France)

- Johnson & Johnson and its affiliates (U.S.)

- 3M (U.S.)

- Gerresheimer AG (Germany)

- Medmix (Switzerland)

- OraSure Technologies Inc. (U.S.)

- Insulet Corporation (U.S.)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

- GSK plc. (U.K.)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Elcam Medical (Israel)

- SMC Ltd. (Israel)

- ViVO Smart Medical Devices Ltd. (Israel)

- West and Pharmaceutical Services, Inc. (U.S.)

Latest Developments in Europe Drug Delivery Devices Market

- In August 2023, Janssen Pharmaceutical Companies of Johnson & Johnson Services, Inc. submitted the supplemental Biologics License Application (sBLA) to the U.S. Food and Drug Administration (FDA) seeking sanction of DARZALEX in combination with Kyprolis and dexamethasone for relapsed/refractory multiple myeloma. If approved this will increase the product portfolio and also revenue generation of the company

- In February 2025, Synergia Medical announced that its NAO.VNSdevice, implanted in five patients in Belgium as part of its AURORA first-in-human clinical trial, met its primary safety endpoint at three months with no serious adverse events. The next-generation optoelectronic device—MRI-compatible and featuring a fast‑charge battery with a 15-year lifespan—is advancing toward pivotal FDA and CE trials to treat drug-resistant epilepsy (DRE)

- In January 2025, Synergia Medical confirmed the implantation of its NAO.VNS in five patients at Cliniques Universitaires Saint‑Luc and UZ Gent, Belgium. Concurrently, Charles Nolet was appointed CEO, leading the transition from R&D toward scalable manufacturing and clinical commercialization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.