Europe Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.61 Billion

USD

5.17 Billion

2025

2033

USD

3.61 Billion

USD

5.17 Billion

2025

2033

| 2026 –2033 | |

| USD 3.61 Billion | |

| USD 5.17 Billion | |

|

|

|

|

Europe Medical Devices Market Size

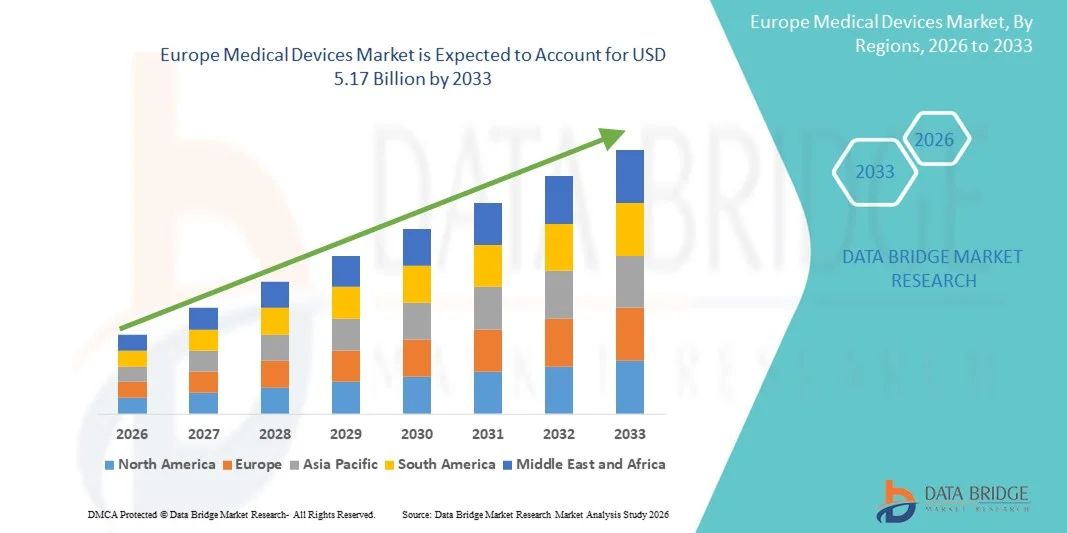

- The Europe medical devices market size was valued at USD 3.61 billion in 2025 and is expected to reach USD 5.17 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases, a rapidly aging population, and continuous technological advancements in medical technologies, which are strengthening demand across hospitals, diagnostic centers, and homecare settings

- In addition, strong healthcare infrastructure, favorable regulatory frameworks supporting innovation, and rising adoption of minimally invasive and digital health solutions are positioning medical devices as a critical component of modern healthcare delivery, thereby significantly accelerating market growth across Europe

Europe Medical Devices Market Analysis

- Medical devices, including ventilators, spirometers, oxygen concentrators, anaesthesia machines, and CPAP/BIPAP systems, are essential to Europe’s healthcare ecosystem, enabling effective diagnostic and therapeutic care across hospitals, specialty clinics, and homecare environments

- The demand for medical devices in Europe is largely driven by the rising prevalence of respiratory and chronic diseases, an aging population, and increasing adoption of advanced therapeutic solutions, particularly portable and homecare-focused medical devices

- Germany dominated the Europe medical devices market with the largest revenue share of 28.6% in 2025, supported by strong healthcare infrastructure, high healthcare spending, and a well-established medical device manufacturing base with widespread adoption of advanced clinical equipment

- Poland is expected to be one of the fastest-growing countries in the Europe medical devices market during the forecast period, driven by increasing public and private healthcare investments, hospital expansion projects, and rising demand for modern and cost-effective medical technologies

- Ventilators segment dominated the Europe medical devices market with a market share of 34.9% in 2025, driven by sustained demand from hospitals and intensive care units, heightened focus on respiratory care, and continued investments in critical care infrastructure across European countries

Report Scope and Europe Medical Devices Market Segmentation

|

Attributes |

Europe Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Medical Devices Market Trends

Rising Adoption of Portable and Homecare Medical Devices

- A significant and accelerating trend in the Europe medical devices market is the growing adoption of portable and homecare-focused medical devices, driven by the need for continuous patient monitoring, reduced hospital stays, and improved patient convenience across both acute and chronic care settings

- For instance, portable oxygen concentrators and CPAP/BIPAP devices are increasingly being adopted across Europe to manage respiratory disorders at home, reducing dependency on hospital-based care while improving patient quality of life

- Technological advancements in medical devices are enabling features such as lightweight design, enhanced battery life, wireless connectivity, and real-time data monitoring, allowing healthcare providers to remotely track patient conditions and optimize treatment outcomes

- The integration of medical devices with digital health platforms and telemedicine solutions is facilitating seamless data exchange between patients and healthcare professionals, supporting timely clinical decisions and personalized care management

- This shift toward portable and homecare medical devices is reshaping patient expectations by emphasizing convenience, mobility, and accessibility, prompting manufacturers to develop user-friendly and compact devices suitable for non-clinical environments

- Consequently, the demand for advanced, portable, and home-based medical devices is growing rapidly across Europe, particularly among elderly populations and patients with long-term respiratory and chronic conditions

Europe Medical Devices Market Dynamics

Driver

Growing Disease Burden and Expansion of Homecare and Hospital Infrastructure

- The increasing prevalence of chronic and respiratory diseases, combined with expanding hospital capacity and rising demand for homecare services, is a major driver for the growth of the Europe medical devices market

- For instance, in recent years, several European countries have increased investments in hospital modernization and intensive care infrastructure, driving sustained demand for ventilators, anaesthesia machines, and oxygen concentrators

- As healthcare systems face rising patient volumes and aging populations, medical devices that enable efficient diagnosis, monitoring, and therapeutic intervention are becoming essential across both inpatient and outpatient settings

- Furthermore, the growing emphasis on home-based care to reduce healthcare costs and hospital overcrowding is accelerating the adoption of portable and easy-to-use medical devices for long-term disease management

- The availability of technologically advanced devices that support early diagnosis and effective therapy is encouraging healthcare providers to upgrade existing equipment and expand their medical device portfolios

- These factors, coupled with favorable healthcare policies and reimbursement frameworks in several European countries, are collectively propelling demand for medical devices across hospitals, specialty clinics, and homecare environments

Restraint/Challenge

High Device Costs and Stringent Regulatory Compliance Requirements

- The high costs associated with advanced medical devices and compliance with stringent European regulatory frameworks present significant challenges to market growth, particularly for small healthcare facilities and emerging manufacturers

- For instance, compliance with the European Union Medical Device Regulation (MDR) has increased documentation, testing, and certification requirements, leading to longer product approval timelines and higher development costs

- These regulatory complexities can delay market entry for new devices and increase operational burdens on manufacturers, especially small and medium-sized enterprises

- In addition, the relatively high procurement and maintenance costs of advanced medical devices can limit adoption among budget-constrained hospitals and homecare provider

- While technological innovation continues to enhance device performance and patient outcomes, the perceived cost-benefit ratio remains a concern for some healthcare providers and end users

- Addressing these challenges through cost-effective device development, regulatory support initiatives, and streamlined compliance processes will be critical for sustaining long-term growth in the Europe medical devices market

Europe Medical Devices Market Scope

The market is segmented on the basis of product, mode, application, facility, end user, and distribution

- By Product

On the basis of product, the Europe medical devices market is segmented into ventilator, spirometers, oxygen concentrators, anaesthesia machines, and CPAP/BIPAP. The ventilator segment dominated the market with the largest market revenue share of 34.9% in 2025, driven by strong demand from hospitals and intensive care units for managing acute and chronic respiratory conditions. Ventilators are critical life-support devices widely used across large healthcare facilities. Rising prevalence of respiratory disorders and post-critical care complications continues to support demand. High government spending on healthcare infrastructure also favors adoption. Technological advancements improving ventilation efficiency further strengthen market dominance. In addition, ventilators remain a priority in national healthcare preparedness strategies across Europe.

The CPAP/BIPAP segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing diagnosis of sleep apnea and chronic respiratory diseases. Growing preference for non-invasive and home-based treatment options is accelerating adoption. These devices reduce hospital dependency while offering effective long-term therapy. Technological improvements enhancing comfort, noise reduction, and portability are increasing patient compliance. Rising awareness of sleep-related breathing disorders further supports growth. Expansion of homecare and telemonitoring services is also contributing to rapid uptake.

- By Mode

On the basis of mode, the Europe medical devices market is segmented into portable, table top, and standalone. The standalone segment dominated the market in 2025 due to its extensive use in hospitals and large healthcare facilities requiring continuous and high-capacity operation. Standalone devices are preferred for critical care and surgical applications. Their advanced functionality supports complex clinical procedures. Strong hospital infrastructure across Europe drives consistent demand. Longer operational life and durability further enhance adoption. Public healthcare investments continue to support this segment.

The portable segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for mobility and home-based healthcare solutions. Portable devices enable patient monitoring outside hospital settings. Rising aging population and chronic disease burden support adoption. Advancements in miniaturization and battery life improve usability. Emergency care and ambulatory services are increasingly relying on portable equipment. Growth in remote patient monitoring further accelerates this segment.

- By Application

On the basis of application, the Europe medical devices market is segmented into diagnostic and therapeutic. The therapeutic segment held the largest market revenue share in 2025, driven by widespread use of ventilators, anaesthesia machines, and CPAP/BIPAP systems for treatment purposes. Rising incidence of chronic respiratory and cardiovascular diseases increases reliance on therapeutic devices. Hospitals prioritize therapeutic equipment to manage high patient volumes. Long-term treatment requirements further support demand. Technological advancements improving treatment outcomes also contribute. Government healthcare spending strongly favors therapeutic care.

The diagnostic segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing focus on early disease detection and preventive healthcare. Spirometers and related diagnostic devices are gaining adoption in outpatient settings. Growth in health screening programs supports expansion. Rising awareness among clinicians and patients boosts diagnostic testing volumes. Portable diagnostic solutions enhance accessibility across care settings. Integration with digital health platforms further drives growth.

- By Facility

On the basis of facility, the Europe medical devices market is segmented into large, small, and medium. The large facility segment dominated the market in 2025 due to high patient intake and extensive use of advanced medical devices. Large hospitals require multiple devices across departments. Higher capital budgets support procurement of advanced technologies. These facilities manage complex and critical cases. Strong public funding drives equipment upgrades. Their central role in healthcare delivery sustains dominance.

The medium facility segment is expected to witness the fastest growth rate from 2026 to 2033, driven by expansion of regional hospitals and specialty clinics. Infrastructure upgrades are increasing in mid-sized facilities. Cost-effective device offerings support adoption. Decentralization of healthcare services is boosting investments. Rising private healthcare participation accelerates growth. Improved reimbursement policies further encourage expansion. In addition, improved reimbursement frameworks are encouraging capacity expansion in medium healthcare facilities.

- By End User

On the basis of end user, the Europe medical devices market is segmented into hospital, ambulatory surgical centres, specialty clinics, long term care centres, rehabilitation centres, and homecare settings. The hospital segment dominated the market in 2025, supported by high patient volumes and broad application of medical devices. Hospitals are primary users of ventilators and anaesthesia machines. Continuous demand for emergency and acute care sustains usage. Strong public healthcare funding supports dominance. Frequent technology upgrades enhance demand. Centralized procurement strengthens market share.

The homecare settings segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by rising preference for home-based treatment. Increasing elderly population supports this trend. Devices such as CPAP/BIPAP and oxygen concentrators are widely adopted at home. Cost savings compared to hospital care encourage usage. User-friendly device designs improve patient compliance. Growth of telehealth and remote monitoring services further accelerates adoption. In addition, increased awareness among patients and caregivers about the benefits of home-based medical treatment is further fueling segment growth.

- By Distribution Channel

On the basis of distribution channel, the Europe medical devices market is segmented into direct sales and third party distributor. The direct sales segment held the largest market revenue share in 2025, as manufacturers prefer direct engagement with hospitals and large healthcare providers. Direct sales enable customization and technical support. High-value device procurement favors direct contracts. Strong manufacturer–provider relationships support dominance. Regulatory compliance requirements favor direct channels. Long-term service agreements strengthen this segment.

The third party distributor segment is expected to witness the fastest CAGR from 2026 to 2033, driven by expanding reach into smaller facilities and homecare markets. Distributors enhance penetration in remote and underserved areas. They offer cost-effective logistics and strong local market expertise. Growing demand from small and medium facilities supports growth. Homecare device distribution increasingly relies on distributors. Expansion of private healthcare networks further fuels adoption.

Europe Medical Devices Market Regional Analysis

- Germany dominated the Europe medical devices market with the largest revenue share of 28.6% in 2025, supported by strong healthcare infrastructure, high healthcare spending, and a well-established medical device manufacturing base with widespread adoption of advanced clinical equipment

- Healthcare providers in the country increasingly adopt advanced medical devices such as ventilators, CPAP/BIPAP systems, and anaesthesia machines to improve patient outcomes and operational efficiency

- This widespread adoption is further supported by government initiatives promoting digital health, rising prevalence of chronic and respiratory diseases, and the growing focus on both hospital and homecare solutions, establishing Germany as a key market for medical devices in Europe

The Germany Medical Devices Market Insight

The Germany medical devices market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust healthcare system, high healthcare spending, and strong domestic manufacturing capabilities. Germany’s well-developed infrastructure supports extensive deployment of ventilators, anaesthesia machines, and diagnostic devices across hospitals and specialty clinics. The emphasis on technological innovation and integration of digital health platforms is promoting the adoption of advanced therapeutic and monitoring devices. Rising prevalence of chronic diseases and respiratory disorders is increasing demand for both hospital and homecare solutions. In addition, government initiatives supporting research and development, reimbursement policies, and healthcare modernization projects are strengthening market growth. Germany continues to serve as a key hub for medical device innovation and high-value adoption in Europe.

U.K. Medical Devices Market Insight

The U.K. medical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of advanced medical technologies and increasing demand for homecare and hospital-based solutions. Growing awareness of respiratory diseases, sleep disorders, and chronic conditions is fueling demand for ventilators, CPAP/BIPAP devices, and oxygen concentrators. The country’s robust healthcare infrastructure and strong presence of private and public healthcare providers support market expansion. Integration of medical devices with digital health and telemedicine platforms is enhancing patient monitoring and care delivery. In addition, government initiatives promoting preventive care and early diagnosis are driving adoption across hospitals and specialty clinics. The U.K.’s focus on innovative, patient-centric healthcare solutions continues to stimulate the medical devices market.

France Medical Devices Market Insight

The France medical devices market is gaining momentum due to increasing healthcare investments and rising prevalence of chronic diseases. Hospitals and specialty clinics are adopting advanced devices such as ventilators and CPAP/BIPAP systems to improve patient outcomes. Emphasis on home-based care and telemonitoring is encouraging the deployment of portable and user-friendly devices. Strong government support through healthcare modernization programs and reimbursement schemes is promoting adoption. The growing awareness among healthcare providers and patients about early diagnosis and effective treatment further supports market growth. In addition, France’s emphasis on technological innovation and digital healthcare integration is driving demand for advanced medical devices across therapeutic and diagnostic applications.

Italy Medical Devices Market Insight

The Italy medical devices market is expected to expand significantly, driven by rising demand for hospital and homecare solutions, particularly for respiratory and chronic disease management. Hospitals are increasingly equipping ICUs and long-term care units with ventilators, oxygen concentrators, and anaesthesia machines. Portable and standalone devices are gaining adoption for homecare and smaller healthcare facilities. The country’s healthcare reforms and supportive reimbursement policies encourage modernization of medical infrastructure. Technological advancements in monitoring, connectivity, and telehealth are further fueling adoption. Increasing awareness about preventive care and patient-centric treatments continues to drive market growth across Italy.

Europe Medical Devices Market Share

The Europe Medical Devices industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- B. Braun SE (Germany)

- Brainlab SE (Germany)

- MED‑EL (Austria)

- Lohmann & Rauscher International GmbH & Co. KG (Germany)

- Siemens Healthineers AG (Germany)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- F. Hoffmann‑La Roche Ltd. (Switzerland)

- MediSensonic (Poland)

- Zimmer Biomet (France)

- Stryker (Netherlands)

- Medtronic (Ireland)

- Abbott (U.K.)

- GE Healthcare (U.K.)

- Boston Scientific Corporation (Ireland)

- BD (France)

- Coloplast A/S (Denmark)

- BIOTRONIK SE & Co. KG (Germany)

- Smith & Nephew (U.K.)

What are the Recent Developments in Europe Medical Devices Market?

- In December 2025, the European Commission officially confirmed the mandatory rollout timeline of EUDAMED’s first four modules, requiring manufacturers to register new medical devices under MDR and IVDR before placing them on the EU market

- In October 2025, the European Commission launched a public “Call for Evidence” to gather stakeholder feedback on modernizing and future‑proofing the EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR). The move is intended to streamline compliance, reduce administrative burdens, and bolster Europe’s global competitiveness in medical technologies

- In July 2025, the European Commission approved up to €403 million in public funding to support innovation in the medical device sector across the EU. The initiative aims to boost development of digital and AI‑enabled medical technologies, unlock additional private investment, and generate around 800 new jobs, particularly benefiting small and medium‑sized medtech companies

- In May 2024, the Council of the European Union formally adopted updated rules to modernize the EU medical devices framework, including the In Vitro Diagnostic Regulation (IVDR). The changes extend transition timelines for certain high-risk devices to avoid shortages, mandate earlier registration in the European medical device database EUDAMED, and require manufacturers to notify authorities and health professionals of potential supply interruptions

- In May 2021, the EU Medical Device Regulation (MDR) entered into full application, replacing previous directives and significantly tightening clinical evidence, safety, transparency, and device traceability requirements across Europe. Industry groups welcomed the move as a major milestone for patient safety and regulatory harmonization in one of the world’s largest medtech markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.