Europe Molecular Diagnostics Services Market

Market Size in USD Million

CAGR :

%

USD

38.02 Million

USD

67.31 Million

2024

2032

USD

38.02 Million

USD

67.31 Million

2024

2032

| 2025 –2032 | |

| USD 38.02 Million | |

| USD 67.31 Million | |

|

|

|

|

Europe Molecular Diagnostics Services Market Size

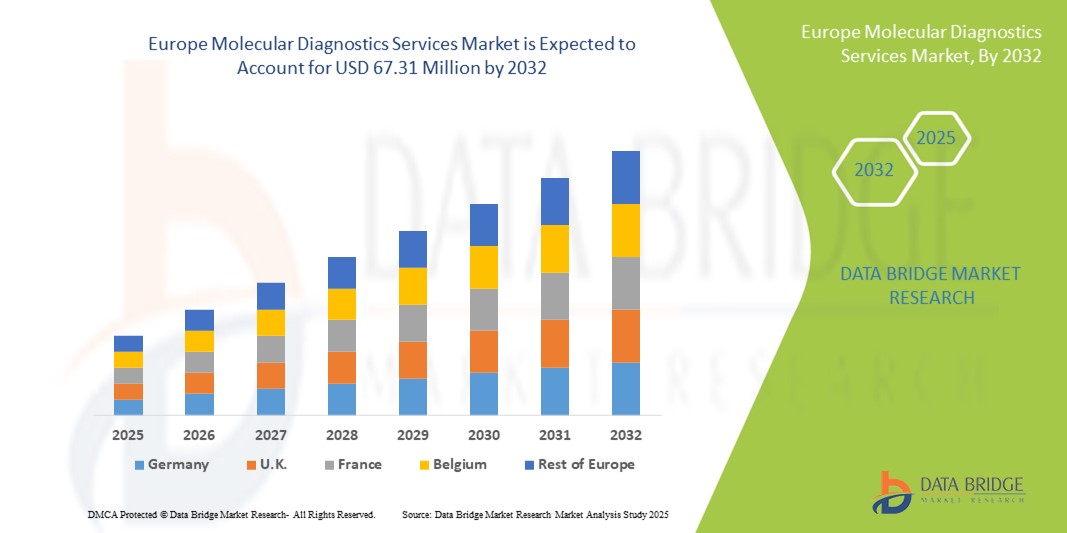

- The Europe molecular diagnostics services market size was valued at USD 38.02 million in 2024 and is expected to reach USD 67.31 million by 2032, at a CAGR of 7.40% during the forecast period

- The market growth is largely driven by increasing prevalence of chronic and infectious diseases, rising adoption of personalized medicine, and technological advancements in molecular diagnostic techniques, such as PCR, NGS, and microarray-based assays

- Furthermore, growing demand for early disease detection, accurate diagnostics, and high-throughput testing solutions in hospitals, diagnostic laboratories, and research centers is positioning molecular diagnostics services as a critical component of modern healthcare. These converging factors are accelerating market adoption, thereby significantly boosting the industry’s growth

Europe Molecular Diagnostics Services Market Analysis

- Molecular diagnostics services, encompassing advanced techniques such as PCR, Real Time PCR, and Next Generation Sequencing, are becoming increasingly essential in Europe’s healthcare ecosystem due to their role in accurate disease detection, research applications, and laboratory workflow optimization across hospitals, diagnostic centers, and academic institutions

- The rising demand for molecular diagnostics services is primarily driven by increasing prevalence of chronic and infectious diseases, growing adoption of precision medicine, and technological advancements enabling faster, more reliable, and cost-effective testing

- Germany dominated the molecular diagnostics services market with the largest revenue share of 39.6% in 2024, supported by advanced healthcare infrastructure, high adoption of molecular technologies, and a strong presence of leading service providers, with significant uptake in hospitals, diagnostic centers, and research institutions

- Poland is expected to be the fastest-growing country in molecular diagnostics services market during the forecast period due to rising healthcare investments, expanding laboratory capabilities, and increasing demand for comprehensive services such as maintenance, calibration, and turnkey solutions

- Maintenance Services segment dominated the molecular diagnostics services market in 2024 with a market share of 29.7%, driven by the growing need for uninterrupted laboratory operations, high reliability of molecular diagnostic instruments, and cost-effective service solutions across clinical and research settings

Report Scope and Europe Molecular Diagnostics Services Market Segmentation

|

Attributes |

Europe Molecular Diagnostics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Molecular Diagnostics Services Market Trends

Advanced Automation and Integrated Laboratory Solutions

- A significant and accelerating trend in the Europe molecular diagnostics services market is the growing adoption of automated and integrated laboratory solutions that enhance workflow efficiency and reduce manual errors

- For instance, scalable automation platforms allow simultaneous handling of multiple samples, improving throughput while maintaining accuracy across PCR, Real Time PCR, and NGS assays

- Integration of software-driven laboratory management systems with diagnostic instruments enables real-time monitoring of instrument performance and sample tracking, reducing operational bottlenecks

- Such automation also allows predictive maintenance and error detection, ensuring uninterrupted service delivery and minimizing laboratory downtime

- Service providers such as Eurofins and SGS are developing end-to-end solutions that combine automation with consultative and training services, improving laboratory efficiency and compliance

- The trend towards intelligent, fully integrated, and automated molecular diagnostic laboratories is reshaping operational standards, driving demand for comprehensive service packages across hospitals and diagnostic centers

Europe Molecular Diagnostics Services Market Dynamics

Driver

Rising Demand Due to Growing Disease Burden and Personalized Medicine

- The increasing prevalence of chronic and infectious diseases, coupled with the rising adoption of personalized medicine, is a significant driver for the heightened demand for molecular diagnostics services

- For instance, hospitals and diagnostic centers are increasingly relying on PCR and NGS-based testing for early detection of genetic disorders and infectious pathogens

- Growing awareness among healthcare professionals and patients about precision diagnostics is fueling demand for faster, more accurate, and reliable testing solutions

- Expansion of healthcare infrastructure, particularly in countries such as Germany, is enabling wider availability of molecular diagnostic services in both clinical and research settings

- Comprehensive service offerings, including maintenance, calibration, and training, enhance laboratory productivity and adoption of advanced diagnostic technologies

- The need for rapid, accurate, and scalable molecular diagnostics solutions is compelling healthcare providers to integrate these services as standard practice in disease management protocols

Restraint/Challenge

High Costs and Regulatory Compliance Challenges

- Concerns regarding high operational and service costs pose a significant challenge to broader market penetration, particularly for small and medium-sized laboratories

- For instance, advanced automation platforms and NGS-based services require significant upfront investment, limiting adoption in budget-constrained facilities

- Strict regulatory and quality compliance requirements in Europe necessitate robust documentation, validation, and certification, increasing operational complexity

- Addressing compliance challenges while ensuring high-quality service delivery is critical for gaining laboratory and institutional trust

- Variability in service pricing and limited availability of skilled personnel for complex molecular diagnostic procedures can restrict market growth in some regions

- Overcoming these challenges through cost optimization, regulatory support, and training programs for laboratory staff will be vital for sustained adoption and market expansion

Europe Molecular Diagnostics Services Market Scope

The market is segmented on the basis of service type, technology, and end user.

- By Service Type

On the basis of service type, the Europe molecular diagnostics services market is segmented into Instrument Repair Services, Training Services, Compliance Services, Calibration Services, maintenance services, scalable automation services, turnkey services, instrument relocation services, hardware customization, performance assurance services, design and development services, supply chain solutions, new product introduction services, manufacturing services, environmental & regulatory services, medical management systems certification & auditing, clinical research services, consultative services, and other services. The Maintenance Services segment dominated the market with the largest market revenue share of 29.7% in 2024, driven by the growing need to ensure uninterrupted laboratory operations. Hospitals, diagnostic centers, and research institutions prioritize maintenance services to avoid costly downtime and ensure high reliability of molecular diagnostic instruments. The demand is further supported by complex workflows in PCR, Real Time PCR, and NGS platforms, where continuous performance monitoring is critical. Service providers also bundle maintenance with calibration and training services, enhancing the overall value proposition. Increasing investments in laboratory infrastructure across Germany and other mature markets strengthen the dominance of maintenance services. Routine and preventive maintenance solutions are increasingly preferred for cost efficiency and regulatory compliance.

The Turnkey Services segment is anticipated to witness the fastest growth rate of 24% from 2025 to 2032, fueled by rising adoption in emerging markets such as Poland. Turnkey services provide end-to-end solutions including installation, workflow design, and training, reducing the burden on laboratories to manage complex implementation processes. These services are particularly attractive for hospitals and diagnostic centers adopting new molecular technologies for the first time. The flexibility, efficiency, and reduced operational risk offered by turnkey services are driving rapid adoption. Increasing preference for comprehensive, ready-to-use solutions accelerates growth in clinical and research laboratories.

- By Technology

On the basis of technology, the Europe molecular diagnostics services market is segmented into PCR, Real Time PCR, next generation sequencing (NGS), and other technologies. The PCR segment dominated the market with the largest revenue share of 35% in 2024, due to its widespread use for routine infectious disease detection, genetic testing, and research applications. PCR is highly reliable, cost-effective, and supported by established service protocols for calibration, maintenance, and repair. Many diagnostic centers and hospitals rely on PCR-based assays for their rapid turnaround times and accuracy, making it the backbone of molecular diagnostics in Europe. Germany and other Western European countries exhibit strong adoption due to advanced healthcare infrastructure and established laboratory networks. Integration with maintenance, calibration, and automation services further reinforces PCR’s dominant position. The extensive clinical familiarity with PCR workflows ensures continued demand across end users.

The Next Generation Sequencing (NGS) segment is expected to witness the fastest CAGR of 23–25% from 2025 to 2032, driven by increasing adoption for personalized medicine, oncology testing, and research applications. NGS enables high-throughput sequencing, providing comprehensive genetic insights for disease diagnosis and therapy selection. The growth is supported by rising investments in training, consultative, and turnkey services to help laboratories implement NGS workflows. Poland and other emerging European markets are increasingly adopting NGS due to growing awareness of precision medicine benefits. Continuous technological improvements and decreasing costs of sequencing are accelerating adoption. NGS is becoming a preferred technology for complex diagnostics requiring comprehensive genomic information.

- By End User

On the basis of end user, the Europe molecular diagnostics services market is segmented into hospitals, diagnostic centers, academic & research institutions, and others. The Hospitals segment dominated the market with the largest revenue share of 40% in 2024, driven by their high-volume diagnostic requirements and demand for reliable molecular testing. Hospitals require comprehensive service offerings including maintenance, calibration, training, and turnkey solutions to ensure accurate and uninterrupted laboratory operations. Germany and other mature European markets have well-established hospital networks that adopt advanced molecular diagnostic technologies such as PCR, Real Time PCR, and NGS. The integration of services with hospital laboratory management systems enhances workflow efficiency and reduces operational downtime. Hospitals’ need for compliance with regulatory standards further reinforces the demand for full-service solutions. Increasing investment in modern molecular diagnostics laboratories keeps hospitals as the dominant end user segment.

The Academic & Research Institutions segment is anticipated to witness the fastest growth rate of 23% from 2025 to 2032, fueled by expanding research activities and funding for genomics, infectious diseases, and translational research. Research institutions increasingly adopt scalable automation, NGS, and turnkey services to accelerate study timelines and improve data reliability. Emerging markets such as Poland are investing in advanced research infrastructure, creating high demand for molecular diagnostics services. Academic institutions benefit from service providers offering training, consultative, and design & development services for specialized applications. The growth is further supported by collaborative research initiatives between universities and hospitals, promoting the adoption of cutting-edge molecular technologies.

Europe Molecular Diagnostics Services Market Regional Analysis

- Germany dominated the molecular diagnostics services market with the largest revenue share of 39.6% in 2024, supported by advanced healthcare infrastructure, high adoption of molecular technologies, and a strong presence of leading service providers, with significant uptake in hospitals, diagnostic centers, and research institutions

- Hospitals, diagnostic centers, and research institutions in Germany prioritize accuracy, reliability, and comprehensive service offerings, including maintenance, calibration, training, and turnkey solutions for PCR, Real Time PCR, and NGS platforms

- This widespread adoption is further supported by high healthcare spending, strong regulatory compliance frameworks, and growing investments in laboratory modernization, establishing molecular diagnostics services as a critical component of clinical and research operations across the country

The Germany Molecular Diagnostics Services Market Insight

The Germany molecular diagnostics services market dominated in the Europe market with the largest revenue share of 39.6% in 2024, fueled by advanced healthcare infrastructure, high adoption of molecular technologies such as PCR, Real Time PCR, and NGS, and growing demand for precision diagnostics. Hospitals, diagnostic centers, and research institutions prioritize reliable, accurate, and high-throughput testing supported by comprehensive services including maintenance, calibration, training, and turnkey solutions. The country’s focus on innovation, regulatory compliance, and laboratory modernization strengthens adoption, while the presence of leading service providers ensures widespread access to cutting-edge molecular diagnostic technologies. Germany’s dominance reflects its technological maturity, well-established laboratory networks, and strong investment in healthcare and research infrastructure, making it a key hub for molecular diagnostics services in Europe.

Poland Molecular Diagnostics Services Market Insight

The Poland molecular diagnostics services market is expected to be the fastest-growing country in Europe during the forecast period, driven by rising healthcare investments, expanding laboratory capabilities, and increasing adoption of advanced molecular diagnostic technologies. Hospitals, diagnostic centers, and research institutions are increasingly relying on services such as maintenance, calibration, turnkey solutions, and training to implement PCR, Real Time PCR, and NGS platforms effectively. Growth is supported by modernizing laboratory infrastructure, increasing awareness of precision medicine, and improving compliance with European regulatory standards. Poland’s emerging healthcare and research centers are accelerating adoption of molecular diagnostics services, making it a rapidly expanding market in Europe.

France Molecular Diagnostics Services Market Insight

The France molecular diagnostics services market is witnessing steady growth, supported by high-quality healthcare infrastructure, growing adoption of molecular technologies, and focus on early disease detection. Hospitals and diagnostic centers in France are increasingly integrating services such as maintenance, calibration, training, and consultative support to improve laboratory efficiency and ensure accurate test results. The country’s emphasis on research, regulatory compliance, and laboratory accreditation is driving demand for professional service providers. France is also adopting innovative solutions such as turnkey and scalable automation services to streamline workflows and reduce operational challenges. Growing awareness of precision medicine and chronic disease management further supports adoption. The market benefits from strong government initiatives promoting healthcare modernization and laboratory standardization.

U.K. Molecular Diagnostics Services Market Insight

The U.K. molecular diagnostics services market is expected to grow at a notable CAGR during the forecast period, fueled by increasing prevalence of infectious and genetic diseases, rising adoption of advanced molecular technologies, and demand for accurate diagnostic solutions. Hospitals, diagnostic centers, and research institutions are investing in comprehensive services, including maintenance, calibration, training, and turnkey solutions, to enhance laboratory productivity. The U.K.’s robust healthcare system, research initiatives, and regulatory frameworks drive market adoption. Integration of molecular diagnostics with precision medicine programs and academic research projects further accelerates growth. Rising demand for automation, workflow optimization, and consultative support strengthens the position of service providers. The market is also supported by growing awareness among clinicians and patients regarding early disease detection and personalized treatment approaches.

Europe Molecular Diagnostics Services Market Share

The Europe Molecular Diagnostics Services industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (U.S.)

- QIAGEN (Germany)

- BIOMÉRIEUX (France)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Danaher Corporation (U.S.)

- Sysmex Corporation (Japan)

- PerkinElmer (U.S.)

- Hologic, Inc. (U.S.)

- Fujirebio Europe NV (Belgium)

- Euroimmun Medizinische Labordiagnostika AG (Germany)

- Centogene AG (Germany)

- GeneProof s.r.o. (Czech Republic)

- altona Diagnostics GmbH (Germany)

- Seegene Inc. (South Korea)

- Aidian Oy (Finland)

- Bioeksen Biotech (Turkey)

- LRE Medical GmbH (Germany)

What are the Recent Developments in Europe Molecular Diagnostics Services Market?

- In November 2024, Menarini Diagnostics and Nucleix entered a long-term commercial agreement for the exclusive distribution of the Bladder EpiCheck test in Europe. This noninvasive, CE-marked urine test detects primary or recurrent bladder and upper tract urinary cancers, aiming to transform bladder cancer patient care in Europe

- In October 2024, Seegene and Werfen finalized a partnership agreement to share technology in molecular diagnostics. This collaboration focuses on integrating Seegene's diagnostic technologies with Werfen's laboratory automation systems, aiming to enhance diagnostic efficiency and expand the reach of molecular testing in Europe

- In October 2024, Alveo Technologies began shipping its first point-of-need molecular test for avian influenza in poultry to the EU. The Alveo Sense Avian Influenza Panel provides rapid, precise results in the field, supporting early detection and control measures in the poultry industry

- In July 2024, Roche announced the acquisition of LumiraDx’s Point-of-Care technology, enhancing its diagnostics portfolio with a multi-assay platform. This acquisition aims to expand access to diagnostic testing in primary care settings and supports Roche's ambition to deliver decentralized solutions, including a rapid point-of-care molecular tuberculosis test in collaboration with the Bill & Melinda Gates Foundation

- In July 2024, AB ANALITICA and SNIBE announced a distribution partnership in Italy for SNIBE's Molecision R8 platform. This collaboration aims to enhance the availability of advanced molecular diagnostic solutions in the Italian market, supporting healthcare providers with innovative testing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.