Europe Self Injections Market

Market Size in USD Billion

CAGR :

%

USD

12.08 Billion

USD

24.96 Billion

2024

2032

USD

12.08 Billion

USD

24.96 Billion

2024

2032

| 2025 –2032 | |

| USD 12.08 Billion | |

| USD 24.96 Billion | |

|

|

|

|

Europe Self-Injections Market Size

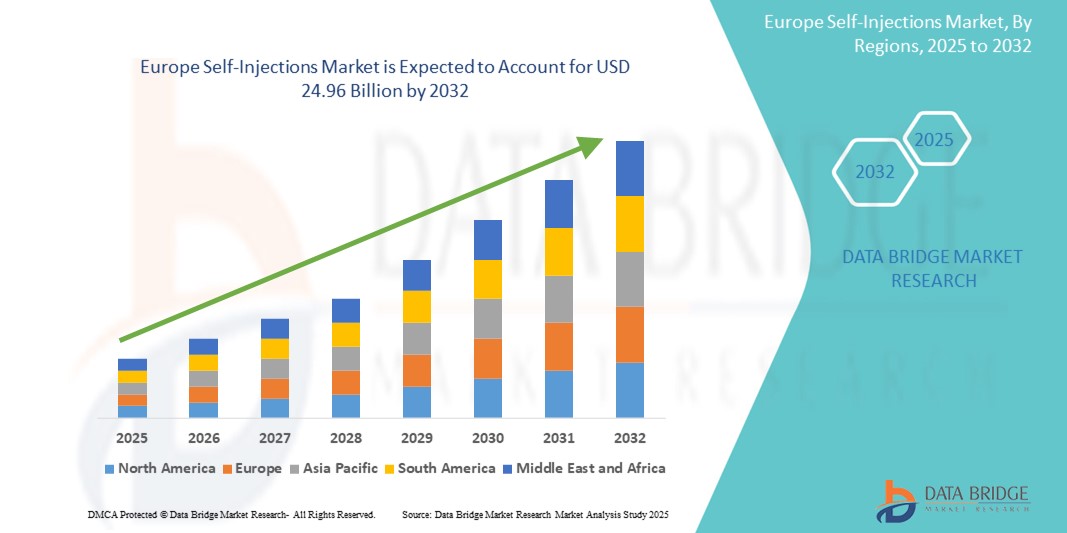

- The Europe Self-Injections market size was valued at USD 12.08 billion in 2024 and is expected to reach USD 24.96 billion by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and multiple sclerosis, which require long-term treatment and drive demand for convenient drug delivery methods

- Furthermore, rising patient preference for home-based care, coupled with technological advancements in auto-injectors and pen injectors, is positioning self-injection devices as an essential tool in modern healthcare. These converging factors are accelerating the uptake of self-injection solutions, thereby significantly boosting the industry's growth

Europe Self-Injections Market Analysis

- Self-injections, enabling patients to administer medications via devices or formulations, are increasingly critical to chronic disease management and personalized treatment across both homecare and clinical environments due to their convenience, cost-efficiency, and improved adherence

- The escalating demand for self-injections is primarily fueled by the rising prevalence of chronic and autoimmune diseases, a growing shift toward patient-centric care, and continuous advancements in self-injection devices such as auto-injectors and pen injectors

- Germany dominated the self-injections market with the largest revenue share of 30.5% in 2024, supported by advanced healthcare infrastructure, high disease burden, and early adoption of biologics and biosimilars requiring self-administration, particularly for autoimmune and hormonal therapies

- Poland is expected to be the fastest growing country in the Europe self-injections market during the forecast period due to improvements in healthcare accessibility, growing public health awareness, and increasing demand for home-based therapeutic solutions

- Self-Injection Devices segment dominated the self-injections market with a share of 65.9% in 2024, driven by their ease of use, patient safety features, and rising preference among both physicians and patients for device-based drug delivery options

Report Scope and Europe Self-Injections Market Segmentation

|

Attributes |

Europe Self-Injections Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Self-Injections Market Trends

“Technological Advancements Driving Device Innovation and Home-Based Care”

- A significant and accelerating trend in the Europe self-injections market is the rapid innovation in device technology aimed at improving usability, safety, and adherence—especially for chronic disease patients requiring frequent injections at home

- For instance, pharmaceutical companies in collaboration with medical device firms are introducing advanced auto-injectors with features such as hidden needles, audible/visual cues, and connectivity capabilities. SHL Medical’s Molly® modular auto-injector platform, for instance, allows easy customization for different therapies and patient needs

- Smart self-injection devices with Bluetooth or NFC connectivity are being piloted in Germany and France, enabling data transfer to apps for tracking injection times, doses, and adherence, thus facilitating remote monitoring by healthcare professionals

- The integration of ergonomic designs, temperature stabilization, and controlled injection speed in pen injectors is also improving the self-injection experience, particularly for elderly or pediatric patients. Companies such as Ypsomed and Owen Mumford are leading in designing intuitive self-injection systems tailored to specific patient demographics

- This trend toward patient-centric, intelligent, and home-compatible self-injection devices is reshaping expectations for chronic care, with a strong push from health systems to reduce clinic visits and promote home-based treatment

- As healthcare in Europe increasingly emphasizes cost-effectiveness and long-term disease management, these device innovations are helping patients take control of their treatment with greater safety, comfort, and confidence

Europe Self-Injections Market Dynamics

Driver

“Rising Chronic Disease Burden and Shift Toward Self-Managed Care”

- The rising prevalence of chronic conditions such as diabetes, multiple sclerosis, and autoimmune disorders across Europe, coupled with a growing shift toward self-managed and home-based care, is a major driver fueling the self-injections market

- For instance, the European Centre for Disease Prevention and Control (ECDC) highlights increasing rates of non-communicable diseases, prompting healthcare systems to encourage outpatient and self-administered therapies to reduce hospital load

- Countries such as Germany, the UK, and France are witnessing increased prescription of biologics and biosimilars that rely on self-injection delivery routes, making devices such as auto-injectors and prefilled syringes essential in routine care

- Patient empowerment, alongside supportive reimbursement policies and eHealth initiatives, is further accelerating the adoption of self-injections, with mobile apps and training aids improving patient confidence and adherence

- The convenience of administering medications without clinical supervision, reduced dependency on healthcare infrastructure, and enhanced quality of life are key factors driving adoption, especially among working-age adults and elderly patients seeking independence

Restraint/Challenge

“Injection Site Reactions and Regulatory Compliance Complexity”

- A key challenge in the Europe self-injections market is the incidence of injection site reactions such as pain, swelling, or erythema, which can negatively affect patient adherence, particularly with frequent dosing schedules

- In addition, navigating complex regulatory landscapes across multiple EU countries presents hurdles for market entry and product standardization. Variability in medical device regulations, labeling requirements, and reimbursement protocols can delay product approvals and commercialization

- For instance, differences in market authorization processes between EU member states may require customized clinical data, packaging, or instructions, raising development costs and time-to-market for manufacturers

- Furthermore, ensuring that devices meet EU Medical Device Regulation (MDR) standards while maintaining affordability can be difficult, especially for smaller manufacturers. Some companies have also reported delays in certification due to stricter post-market surveillance requirements

- Addressing these challenges through patient education, enhanced formulation techniques to reduce adverse reactions, and closer collaboration with regulatory authorities is critical to sustaining market momentum and expanding access to self-injection therapies across Europe

Europe Self-Injections Market Scope

The market is segmented on the basis of product type, dosage form, route of administration, application, age group, gender, and distribution channel.

- By Product Type

On the basis of product type, the Europe self-injections market is segmented into self-injection devices and self-injection formulation. The self-injection devices segment dominated the market with the largest market revenue share of 65.9% in 2024, driven by the widespread adoption of auto-injectors and pen injectors. These devices offer ease of use, enhanced safety, and are widely used in the treatment of chronic diseases such as diabetes and autoimmune disorders. Their ergonomic designs and hidden needle systems improve patient compliance and reduce injection anxiety.

The self-injection formulation segment is expected to witness steady growth during forecast period, supported by innovations in biologics and biosimilars that require subcutaneous or intramuscular delivery, and the development of stable formulations for use in non-clinical settings.

- By Dosage Form

On the basis of dosage form, the market is segmented into single dose and multi-dose. The single dose segment dominated the market with the largest market revenue share of 59.8% in 2024, attributed to reduced contamination risk, increased accuracy in dosing, and growing use in emergency medications and chronic care therapies. These are often used in disposable auto-injectors, which offer safety and convenience for patients managing treatment at home.

The multi-dose segment is expected to grow steadily during forecast period, due to its cost-effectiveness and utility in ongoing therapies such as insulin and hormone treatments. Patient education and device advancements are supporting its adoption across multiple treatment categories.

- By Route of Administration

On the basis of route of administration, the market is segmented into subcutaneous, intramuscular, and others. The subcutaneous segment dominated the market with the largest market revenue share of 71.2% in 2024, due to its minimal invasiveness and suitability for chronic therapies including autoimmune and hormonal disorders. It is preferred for home administration as it requires less training and causes less discomfort compared to intramuscular injections.

The intramuscular segment is anticipated to witness moderate growth during forecast period, particularly in the emergency care segment and for long-acting injectables used in mental health and oncology.

- By Application

On the basis of application, the Europe self-injections market is segmented into autoimmune diseases, pain management, emergency drugs, oncology, hormonal disorders, and others. The autoimmune diseases segment dominated the market with the largest market revenue share of 34.6% in 2024, driven by the increasing incidence of conditions such as rheumatoid arthritis and multiple sclerosis that require long-term biologic therapy administered via self-injection.

The oncology segment is projected to register the fastest growth during forecast period, as self-injection becomes increasingly viable for supportive care treatments, targeted biologics, and therapies for managing cancer symptoms outside of hospital settings.

- By Age Group

On the basis of age group, the market is segmented into adult, geriatric, and pediatric. The adult segment dominated the market with the largest market revenue share of 63.7% in 2024, reflecting the high prevalence of lifestyle-related and chronic conditions such as diabetes and autoimmune diseases in this age group. Adults are also more such asly to manage their conditions independently, making them ideal candidates for self-injection therapy.

The geriatric segment is also witnessing significant growth during forecast period, due to the rising aging population in Europe and the increasing incidence of age-related diseases that require long-term injectable treatment.

- By Gender

On the basis of gender, the market is segmented into male and female. The female segment dominated the market with the largest market revenue share of 51.2% in 2024, due to the higher prevalence of autoimmune conditions in women and the increasing demand for hormone-related therapies such as fertility treatments and menopause management that are delivered via self-injection.

The male segment is also growing steadily during forecast period, with increasing diagnoses of diabetes and hormonal imbalances requiring injectable therapies.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, hospital pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market with the largest market revenue share of 42.9% in 2024, driven by hospital-based treatment plans, trusted access to biologics and injectables, and the support provided to patients for proper self-administration training.

The online pharmacy segment is anticipated to witness the fastest growth during forecast period, propelled by increasing digitalization of healthcare, convenience of home delivery, and growing patient preference for discreet, accessible purchasing options, particularly for chronic and hormonal therapies.

Europe Self-Injections Market Regional Analysis

- Germany dominated the self-injections market with the largest revenue share of 30.5% in 2024, supported by advanced healthcare infrastructure, high disease burden, and early adoption of biologics and biosimilars requiring self-administration, particularly for autoimmune and hormonal therapies

- Patients in the country increasingly prefer self-injection therapies for conditions such as diabetes, rheumatoid arthritis, and multiple sclerosis, valuing the convenience, reduced clinic visits, and improved adherence offered by modern self-injection devices

- This widespread adoption is further supported by favorable reimbursement policies, increased awareness of self-managed care, and a technologically advanced medical device landscape, positioning self-injections as a trusted solution for long-term treatment management across diverse age groups

The Germany Self-Injections Market Insight

The Germany self-injections market accounted for the largest revenue share in Europe in 2024, supported by a robust healthcare infrastructure, high prevalence of autoimmune and metabolic disorders, and a strong inclination toward self-administered biologic therapies. The country benefits from advanced drug delivery technologies and a mature pharmaceutical sector that emphasizes innovation and patient compliance. Ongoing efforts to reduce hospital burden and improve treatment adherence are fueling the demand for self-injection systems in both hospital-to-home transition programs and chronic disease management.

France Self-Injections Market Insight

The France self-injections market is projected to grow at a notable CAGR during the forecast period, driven by increasing acceptance of self-care models and investments in connected healthcare solutions. French patients are showing rising interest in smart self-injection devices with digital tracking and reminders. Government initiatives supporting digital health transformation and early access programs for biologics are also boosting the use of self-injection therapies, especially in rheumatology, oncology, and endocrinology applications.

U.K. Self-Injections Market Insight

The U.K. self-injections market is anticipated to witness steady growth, fueled by rising awareness of self-management strategies and strong support for telehealth and remote care delivery. The NHS promotes home-based treatment for eligible chronic conditions, increasing the need for reliable, easy-to-use injection devices. Furthermore, partnerships between biotech firms and healthcare providers are encouraging the adoption of patient-focused injectable therapies, including biosimilars and digital-enabled self-injection tools.

Poland Self-Injections Market Insight

The Poland self-injections market is projected to grow at the fastest CAGR in Europe during the forecast period, supported by ongoing improvements in healthcare access, rising chronic disease prevalence, and government efforts to modernize outpatient care. The country is witnessing growing adoption of biosimilars and injectable biologics, particularly in rheumatology and endocrinology. Increasing awareness campaigns, favorable pricing strategies, and a shift toward home-based treatment are driving demand for self-injection devices and formulations among both urban and rural populations.

Europe Self-Injections Market Share

The Europe Self-Injections industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- UCB Pharma (Belgium)

- Ipsen Biopharmaceuticals, Inc. (France)

- Teva Pharmaceuticals Industries Ltd (Israel)

- Recipharm AB (Sweden)

- SCHOTT Pharma (Germany)

- Lilly (U.S.)

- AstraZeneca (U.K.)

- Takeda Pharmaceuticals Company Limited (Japan)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- AbbVie (U.S.)

- Biogen (U.S.)

- YPSOMED (Switzerland)

- Bausch Health Companies Inc. (Canada)

- Merck & Co. (U.S.)

- Amgen Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- PharmaJet (U.S.)

- Societe Industrielle de Sonceboz SA (Switzerland)

- Terumo Corporation (Japan)

- Haselmeier (Germany)

- Owen Mumford (U.K.)

- Midas Pharma GmbH (Germany)

What are the Recent Developments in Europe Self-Injections Market?

- In June 2024, Ypsomed AG announced the expansion of its self-injection device manufacturing facility in Schwerin, Germany, to meet growing European demand for auto-injectors and wearable devices. This expansion reinforces Ypsomed’s commitment to serving the rising need for self-managed chronic care, particularly in autoimmune and diabetic patient populations, while strengthening its supply capabilities across key EU markets

- In May 2024, Nemera launched its reusable electronic add-on for pre-filled syringes, e-Advancia®, across several European countries. This innovation aims to improve patient adherence by offering dose tracking, injection reminders, and real-time feedback, aligning with the growing trend of digital health integration in self-administered therapies. The launch demonstrates Nemera's focus on combining drug delivery with connected care for enhanced treatment outcomes

- In March 2024, Owen Mumford Ltd. received CE certification for its UniSafe 1mL springless auto-injector, enabling widespread commercial deployment throughout Europe. The device is designed for safety, usability, and reduced user anxiety, particularly for patients with rheumatoid arthritis and other long-term conditions requiring regular biologic injections. This milestone enhances the company’s footprint in the EU’s self-injection device landscape

- In February 2024, Biocorp Production SA entered into a strategic agreement with a leading European pharmaceutical firm to supply its connected self-injection device, Mallya®, for insulin pen monitoring. The partnership aims to scale remote patient monitoring and personalized care for diabetic patients across France, Germany, and the Nordics, contributing to greater treatment adherence and reduced healthcare system strain

- In January 2024, SHL Medical announced a collaboration with a major biotech company to produce customized autoinjectors for European markets. The initiative focuses on patient-centric designs that simplify self-administration and meet EU regulatory standards. By leveraging its advanced manufacturing hub in Switzerland, SHL aims to meet the growing demand for ergonomic, safe, and intuitive self-injection solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.