Europe Thin And Ultra Thin Films Market

Market Size in USD million

CAGR :

%

USD

12,000.00 million

USD

13,350.00 million

2022

2030

USD

12,000.00 million

USD

13,350.00 million

2022

2030

| 2023 –2030 | |

| USD 12,000.00 million | |

| USD 13,350.00 million | |

|

|

|

|

Europe Thin and Ultra-Thin Films Market Analysis and Size

The Europe thin and ultra-thin films market refers to the industry involved in the production, distribution, and utilization of thin and ultra-thin films for various applications. Thin films are typically characterized by their thinness, which is generally in the range of a few nanometres to a few micrometres. Ultra-thin films, on the other hand, are even thinner, often measuring less than a nanometre in thickness.

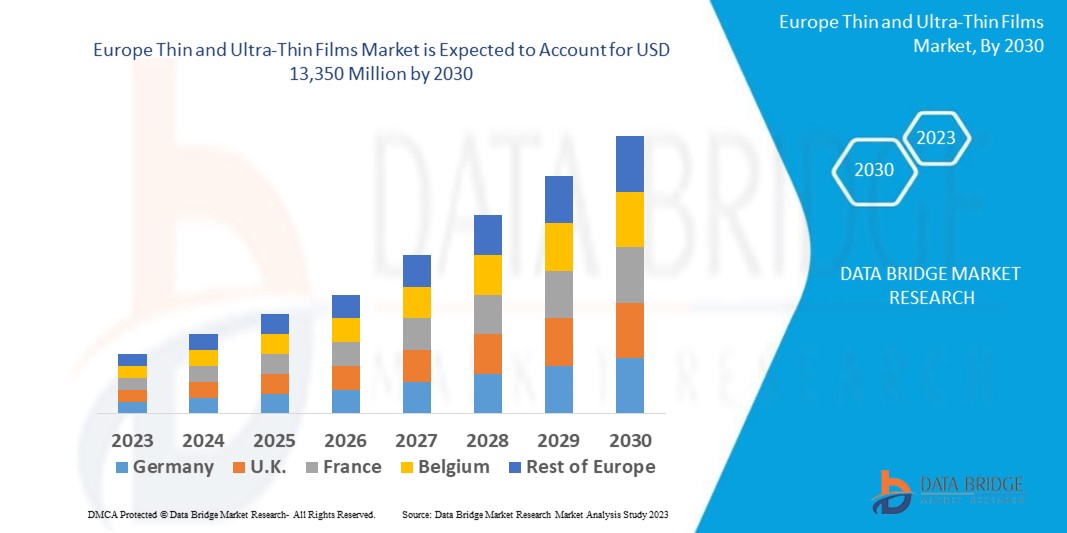

Data Bridge Market Research analyses that the Europe thin and ultra-thin films market which was USD 12,000 million in 2022, is expected to reach to USD 13,350 million by 2030, and is expected to undergo a CAGR of 7.12% during the forecast period of 2023 to 2030. “The coating method” is dominant in Europe thin and ultra-thin films market due to its widespread applicability, cost-effectiveness, and ability to achieve precise thickness control. Thin and ultra-thin films encompasses diverse industries such as electronics, optoelectronics, solar cells, energy storage, sensors, medical devices, coatings, and more. These films are used for their unique properties, which can include electrical conductivity, optical transparency, barrier properties, mechanical strength, and chemical resistance. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Thin and Ultra-Thin Films Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Coating Methods (Gaseous State, Solutions State, Molten or Semi-Molten State), Type (Thin, Ultra-Thin), Deposition Techniques (Physical Deposition, Chemical Deposition), and Application (Electronics and Semiconductor, Renewable Energy, Healthcare and Biomedical Applications, Automotive, Aerospace and Defence, and Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

Umicore Group (Belgium), Ascent Solar Technologies Ltd (U.S.), American Elememts (U.S.), Kaneka Corporation (Japan), Moser Baer India Pvt. Ltd. (India), Hanergy Thin Film Power Group Limited (China), Corning Incorporated (U.S.), E. I. du Pont de Nemours and Company (U.S.), China National Building Material Company Ltd (China) |

|

Market Opportunities |

|

Market Definition

The Europe thin and ultra-thin films market refers to the segment of the global materials industry that focuses on the production, distribution, and utilization of thin films and ultra-thin films. These films are characterized by their extremely thin and often nanoscale thickness, typically ranging from a few nanometres to a few micrometres. Thin and ultra-thin films are fabricated through various deposition techniques, such as physical vapour deposition (PVD), chemical vapour deposition (CVD), atomic layer deposition (ALD), and other thin-film coating processes. These films can be composed of diverse materials, including metals, oxides, semiconductors, polymers, and organic compounds.

Europe Thin and Ultra-Thin Films Market Dynamics

Drivers

- Increasing Demand from Electronics Industry

Thin and ultra-thin films are extensively used in the electronics industry for applications such as semiconductors, displays, and microelectronics. The growing demand for electronic devices such as smartphones, tablets, and wearable devices is driving the need for advanced thin and ultra-thin film technologies.

- Advancements in Nanotechnology

Nanotechnology has led to significant advancements in thin film deposition techniques, allowing the production of ultra-thin films with improved properties. These films find applications in various industries, including electronics, energy, optics, and healthcare. The continuous progress in nanotechnology is driving the growth of the Europe thin and ultra-thin films market.

- Growing Energy Efficiency Requirements

Thin and ultra-thin films are crucial for improving the energy efficiency of devices and systems. For instance, thin film solar cells are being developed to enhance the efficiency of solar energy conversion. Additionally, thin and ultra-thin films are used in energy storage devices, such as batteries and capacitors, to improve their performance. The growing focus on energy conservation and sustainability is propelling the demand for thin and ultra-thin films.

Opportunity

- The Increasing demand for Advanced Electronic Devices

The Europe thin and ultra-thin films market presents significant opportunities for growth and innovation. The increasing demand for advanced electronic devices, coupled with the need for energy-efficient solutions, drives the adoption of thin and ultra-thin films across various industries. The continuous advancements in nanotechnology and deposition techniques offer opportunities to develop thinner and more precise films with enhanced properties. The miniaturization trend in electronics further expands the market potential, as thinner films enable the production of compact and lightweight devices.

Restraint/Challenge

- Complex Manufacturing Processes and Specialized Equipment

Thin and ultra-thin film technologies often involve complex manufacturing processes and specialized equipment, which can be costly. The initial investment and production costs may hinder the widespread adoption of these films, especially in price sensitive markets. Manufacturers need to find a balance between achieving cost efficiency and maintaining the desired quality and performance of the films are projected to challenge the market in the forecast period of 2023-2030.

This Europe thin and ultra-thin films market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Europe thin and ultra-thin films market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In August 2017, Hanergy Thin Film Power Group Limited and Audi have signed a memorandum of understanding (MoU) to establish strategic cooperation in thin-film solar cell technology. The partnership aims to explore the integration of thin-film solar technology into Audi's vehicles, promoting sustainable and innovative solutions in the automotive industry.

- In October 2016, Praxair S.T. Technology, Inc. joined hands with GE Aviation, a company engaged in providing jet engines, components and systems for military, commercial and general aviation aircraft. The joint venture increased the capabilities of coating technology which was being used by GE aviation engines. The joint venture led to the formation of PG Technologies, LLC acting as growth for the company.

Europe Thin and Ultra-Thin Films Market Scope

The Europe thin and ultra-thin films market is segmented on the basis of coating methods, type, deposition techniques and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Coating Methods

- Gaseous State

- Solutions State

- Molten or Semi-Molten State

Type

- Thin

- Ultra-Thin

Deposition Techniques

- Physical Deposition

- Chemical Deposition

Application

- Electronics and Semiconductor

- Renewable Energy

- Healthcare and Biomedical Applications

- Automotive

- Aerospace and Defense

- Others

Europe Thin and Ultra-Thin Films Market Regional Analysis/Insights

The Europe thin and ultra-thin films market is analysed and market size insights and trends are provided by coating methods, type, deposition technique and application as referenced above.

The countries covered in the Europe thin and ultra-thin films market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey and Rest of Europe in Europe

Germany dominates the Europe thin and ultra-thin films market because of its strong engineering and technological capabilities. The country has a well-developed research and development infrastructure, which allows for innovation and advancements in thin and ultra-thin film technologies. German companies and institutions are at the forefront of developing cutting-edge manufacturing processes and materials for thin films.

Europe is expected to witness significant growth in the Europe thin and ultra-thin films market during the forecast period of 2023 to 2030 due to of rapid urbanization, increasing infrastructure development, and the adoption of advanced technologies in countries such as Germany, France and U.K. In addition, strong industrial base, including sectors such as chemicals, pharmaceuticals, automotive, and manufacturing. Thin and ultra-thin films play a crucial role in these industries, where precise monitoring and control are essential for quality control, process optimization, and compliance with regulatory standards. Furthermore, favourable government initiatives and investments in smart city projects further drive the market growth in the European region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Thin and Ultra-Thin Films Market Share Analysis

The Europe thin and ultra-thin films market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Europe thin and ultra-thin films market.

Some of the major players operating in the Europe thin and ultra-thin films market are:

- Umicore Group (Belgium)

- Ascent Solar Technologies Ltd (U.S.)

- American Elememts (U.S.)

- Kaneka Corporation (Japan)

- Moser Baer India Pvt. Ltd. (India)

- Hanergy Thin Film Power Group Limited (China)

- Corning Incorporated (U.S.)

- E. I. du Pont de Nemours and Company (U.S.)

- China National Building Material Company Ltd (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE THIN AND ULTRA-THIN FILMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE THIN AND ULTRA-THIN FILMS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 EUROPE THIN AND ULTRA-THIN FILMS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 PREMIUM INSIGHTS

6.1 PENETRATION AND GROWTH POSPECT MAPPING

6.2 COMPETITOR KEY PRICING STRATEGIES

6.3 TECHNOLOGY ANALYSIS

6.3.1 KEY TECHNOLOGIES

6.3.2 COMPLEMENTARY TECHNOLOGIES

6.3.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

6.4 COMPANY COMPETITIVE ANALYSIS

6.4.1 STRATEGIC DEVELOPMENT

6.4.2 TECHNOLOGY IMPLEMENTATION PROCESS

6.4.2.1. CHALLENGES

6.4.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

6.4.3 TECHNOLOGY SPEND OF COMPANY

6.4.4 CUSTOMER BASE

6.4.5 SERVICE POSITIONING

6.4.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

6.4.7 APPLICATION REACH

6.4.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

6.5 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

6.6 USED CASES & ITS ANALYSIS

7 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHOD

7.1 OVERVIEW

7.2 GASEOUS STATE

7.3 SOLUTION STATE

7.4 MOLTEN OR SEMI-MOLTEN STATE

8 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 THIN

8.3 ULTRA-THIN

9 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUE

9.1 OVERVIEW

9.2 PHYSICAL DEPOSITION

9.2.1 BY TYPE

9.2.1.1. EVAPORATION TECHNIQUE

9.2.1.2. SPUTTERING DEPOSITION

9.2.1.3. PULSED LASER DEPOSITION (PLD)

9.2.1.4. OTHERS

9.2.2 BY MATERIAL

9.2.2.1. SPUTTERING TARGET

9.2.2.2. PELLET

9.2.2.3. OTHERS

9.3 CHEMICAL DEPOSITION

9.3.1 BY TYPE

9.3.1.1. CHEMICAL VAPOR DEPOSITION (CVP)

9.3.1.2. SOL-GEL DEPOSITION

9.3.1.3. PLATING

9.3.1.4. OTHERS

9.3.2 BY MATERIAL

9.3.2.1. METAL HALIDES

9.3.2.2. METAL HYDRIDES

9.3.2.3. REACTIVE GASES

9.3.2.4. ORGANOMETALLIC COMPOUNDS

9.3.2.5. METAL SALTS

9.3.2.6. OTHERS

9.4 SILICON

10 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS

10.3 BATTERIES

10.4 PHOTOVOLTAICS

11 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY END USE

11.1 OVERVIEW

11.2 ELECTRONICS AND SEMICONDUCTOR

11.2.1 FULLY TRANSPARENT ELECTRICAL CONDUCTORS

11.2.2 INTEGRATED CIRCUIT FABRICATION

11.2.3 THIN FILM BATTERIES

11.2.4 OTHERS

11.3 RENEWABLE ENERGY

11.3.1 SOLAR

11.3.2 WIND

11.4 HEALTHCARE AND BIOMEDICAL

11.5 AUTOMOTIVE

11.6 AEROSPACE AND DEFENSE

11.7 OTHER

12 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY REGION

12.1 EUROPE THIN AND ULTRA-THIN FILMS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1.1 EUROPE

12.1.1.1. GERMANY

12.1.1.2. FRANCE

12.1.1.3. U.K.

12.1.1.4. ITALY

12.1.1.5. SPAIN

12.1.1.6. RUSSIA

12.1.1.7. TURKEY

12.1.1.8. BELGIUM

12.1.1.9. NETHERLANDS

12.1.1.10. SWITZERLAND

12.1.1.11. REST OF EUROPE

12.1.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 EUROPE THIN AND ULTRA-THIN FILMS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 MERGERS & ACQUISITIONS

13.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.4 EXPANSIONS

13.5 REGULATORY CHANGES

13.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 EUROPE THIN AND ULTRA-THIN FILMS MARKET, SWOT AND DBMR ANALYSIS

15 EUROPE THIN AND ULTRA-THIN FILMS MARKET, COMPANY PROFILE

15.1 EUROPE COMPANIES

15.2 UMICORE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 AIXTRON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 LEW TECHNIQUES

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 PI-KEM

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 THE RUBBER COMPANY –

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 SILEX LTD

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 FHR ANLAGENBAU GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 BOLLORÉ GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 DELTA OPTICAL THIN FILM A/S

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

16 GLOBAL

16.1 HANERGY THIN FILM POWER GROUP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 KANA CORPORATIONEK

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 MATERION CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 INTEVAC, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 AIXTRON

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 AMERICAN ELEMENTS.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 ANGSTROM ENGINEERING INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ARROW THIN FILMS, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 DENTON VACUUM

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GEOMATEC CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 ORANGE THIN FILMS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Thin And Ultra Thin Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Thin And Ultra Thin Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Thin And Ultra Thin Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.