Europe Yeast Market

Market Size in USD Billion

CAGR :

%

USD

1.67 Billion

USD

2.41 Billion

2024

2032

USD

1.67 Billion

USD

2.41 Billion

2024

2032

| 2025 –2032 | |

| USD 1.67 Billion | |

| USD 2.41 Billion | |

|

|

|

|

Yeast Market Size

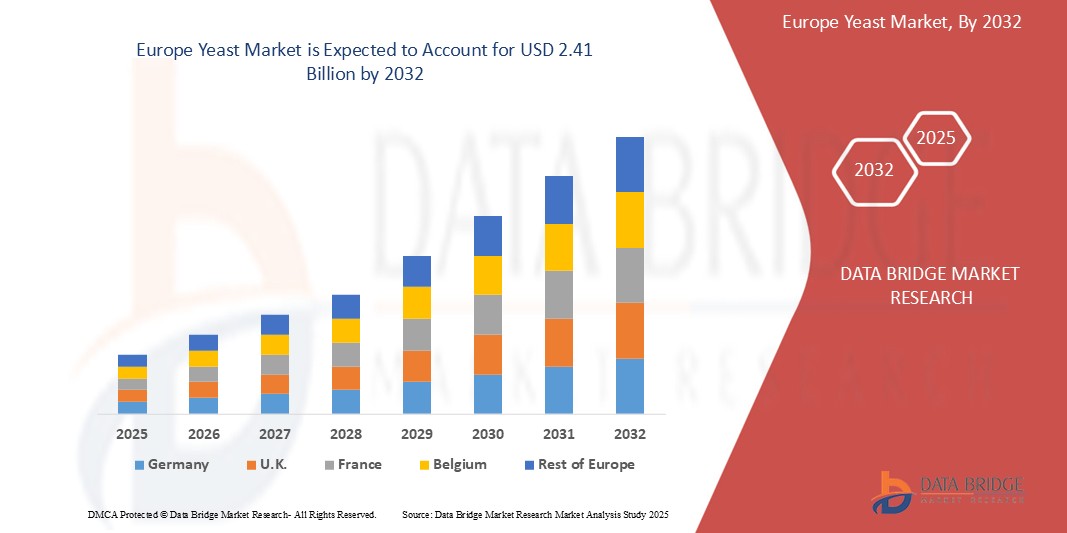

- The Europe Yeast market size was valued at USD 1.67 billion in 2024 and is expected to reach USD 2.41 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing consumption of bakery and processed food products, where yeast plays a crucial role in leavening and flavour development

Yeast Market Analysis

- Yeast is a microorganism used in baking and brewing to help dough rise and ferment beverages such as beer and wine

- It converts sugars into carbon dioxide and alcohol, playing a key role in fermentation and flavor development

- Germany dominates the Yeast market with the largest revenue share of 60% in 2025, characterized by robust baking industry and high consumption of bread and bakery products Yeast is a fundamental ingredient in a wide variety of German breads, which are a staple in the national diet

- U.K. is expected to be the fastest growing region in the Yeast market during the forecast period due to increasing consumption of processed foods and bakery products in the region, coupled with a rising disposable income that allows for greater expenditure on such items

- Baker’s yeast segment is expected to dominate the Yeast Market with a market share in 2025, driven by its widespread and essential use in the baking industry, which has a significant presence across European countries Bread, pastries, and other baked goods are staples in the European diet, leading to high demand for baker's yeast

Report Scope and Yeast Market Segmentation

|

Attributes |

Yeast Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Yeast Market Trends

“Growing Demand for Natural and Organic Yeast”

- A prominent trend in the European yeast market, is the increasing consumer demand for natural and organic food ingredients

- This preference extends to yeast, with a growing number of consumers seeking out yeast products that are non-GMO and produced through organic processes

- For instance, bakeries are increasingly using organic yeast to cater to this demand, and food manufacturers are incorporating natural yeast extracts as flavor enhancers to achieve cleaner labels

- This trend is driven by a greater awareness of health and environmental concerns among European consumers, pushing manufacturers to offer more natural and sustainable options in their product lines

- Consequently, the market is witnessing a rise in the availability and consumption of organic and natural yeast varieties across various applications

Yeast Market Dynamics

Driver

“Increasing Consumption of Processed and Convenience Foods”

- A key driver for the Europe yeast market is the consistently high consumption of processed and convenience food products

- The fast-paced lifestyles in many European countries contribute to the demand for ready-to-eat meals, snacks, and baked goods, where yeast is a crucial ingredient for leavening, texture, and flavor development

- For Instance, the wide variety of bread types consumed daily across Europe, from baguettes in France to sourdough in Germany, relies heavily on yeast

- Furthermore, the increasing popularity of frozen dough products and ready-made pizza bases also fuels the demand for yeast to ensure proper rising and texture

- This continuous consumption of processed and convenience foods provides a strong and stable driver for the European yeast market

Restraint/Challenge

“Stringent Regulations and Quality Standards”

- A notable restraint and challenge for the Europe yeast market is the presence of stringent regulations and high-quality standards imposed by the European Union on food ingredients and production processes

- These regulations cover aspects such as food safety, labeling, and the use of genetically modified organisms, which can impact yeast producers

- For instance, compliance with these regulations often requires significant investment in quality control and traceability systems

- Furthermore, any changes in these regulations can necessitate adjustments in production processes and product formulations, potentially increasing costs and complexities for yeast manufacturers

- Navigating this rigorous regulatory landscape while maintaining competitive pricing remains a key challenge for the growth and operation of businesses in the European yeast market

Yeast Market Scope

The market is segmented on the basis of type, form, strains, and derivatives.

- By Type

On the basis of type, the yeast market is segmented into baker’s yeast, brewer’s yeast, wine yeast, bioethanol yeast, feed yeast, and others. The baker’s yeast segment dominates the largest market revenue share in 2025, driven by its widespread and essential use in the baking industry, which has a significant presence across European countries bread, pastries, and other baked goods are staples in the European diet, leading to high demand for baker's yeast.

The bioethanol yeast segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing focus on renewable energy sources and the European union's initiatives to promote the use of biofuels. The demand for bioethanol as a sustainable alternative to fossil fuels is rising, directly boosting the need for bioethanol yeast used in its production.

- By Form

On the basis of form, the yeast market is segmented into fresh yeast, active dry yeast, instant yeast, and others. The fresh yeast held the largest market revenue share in 2025 of, driven by many professional and artisanal bakers for its superior leavening properties and the distinct flavor it imparts to baked goods the perception of fresh yeast as a more "natural" option also resonates with some European consumers.

The instant yeast segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its convenience, longer shelf life, and ease of use, which appeal to both home bakers and industrial users The increasing demand for convenience in food preparation is driving its rapid adoption.

- By Strains

On the basis of strains, the yeast market is segmented into saccharomyces cerevisiae, saccharomyces carlsbergiensis, kluyveromyces lactis, and others. The saccharomyces cerevisiae held the largest market revenue share in 2025, driven by the widely used in both baking (as baker's yeast) and brewing (as ale yeast), which are significant industries in Europe its versatility and well-understood fermentation characteristics contribute to its widespread use.

The kluyveromyces lactis segment held a significant market share in 2025, favored for its increasing use in the dairy industry for lactose fermentation and the production of certain enzymes and flavor compounds. The rising demand for dairy alternatives and specialty dairy products is likely fueling this growth.

- By Derivatives

On the basis of derivatives, the yeast market is segmented into cell walls/MOS, high purified betaglucans, and yeast culture. The cell walls/MOS (mannan oligosaccharides) segment accounted for the largest market revenue share in 2024, driven by their extensive use in animal feed as prebiotics, promoting gut health and improving animal performance the large agricultural sector in Europe and the focus on animal health drive the demand for MOS.

The high purified betaglucans segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing awareness of their health benefits as immune-modulating agents and their growing use in dietary supplements and functional foods the rising consumer interest in health and wellness is boosting the demand for betaglucans.

Yeast Market Regional Analysis

- Germany dominates the yeast market with the largest revenue share of 60% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Germany's well-established brewing industry also plays a crucial role The production of various types of German beer relies heavily on yeast fermentation, further bolstering the market size The country's strong food processing sector, which utilizes yeast in various applications beyond baking and brewing, also contributes to its leading position in the European yeast market

- The presence of key yeast manufacturers and suppliers within Germany ensures a stable supply chain and caters effectively to the substantial demand from the baking, brewing, and food processing industries, solidifying its dominance

U.K. Yeast Market Insight

The U.K. yeast market captured the largest revenue share within Europe in 2025, fueled by the swift developing brewing industry in several Eastern European countries is also contributing to the increased demand for yeast Furthermore, the growing adoption of Western dietary habits, which often include more baked goods and processed foods, is fueling market expansion.

France Yeast Market Insight

The France yeast market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing consumption of processed foods and bakery products in the region, coupled with a rising disposable income that allows for greater expenditure on such items.

Poland Yeast Market Insight

The Poland yeast market is expected to expand at a considerable CAGR during the forecast period, fueled by consumed in industrial and artisan applications. The large hub of bakery products and their high demand have resulted in the increased utilization of yeast ingredients in the country's bakery and breweries industries.

Yeast Market Share

The Yeast industry is primarily led by well-established companies, including:

- Lesaffre (France)

- Asmussen Gmbh (Germany)

- ACH Food Companies, Inc (U.S.)

- Fleischmann's (Germany)

- LALLEMAND Inc (Canada)

- AB Mauri Food (U.S.)

- AngelYeast Co., Ltd. (China)

- Associated British Food PLC (U.K.)

- Oriental Yeast Co., Ltd. (Japan)

- Cargill, Incorporated (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Alltech (U.S.)

- Lallemand Inc (Canada)

- DSM (Netherlands)

- Nutreco (Netherlands)

- Kerry Group (Ireland)

Latest Developments in Europe Yeast Market

- In October 2024, Lesaffre, a global player in fermentation and microorganisms, acquired Biorigin, a business unit of Zilor that produces yeast derivative products. The acquisition aims to enhance the supply of yeast derivatives for animal nutrition and human food industries. This integration will improve production processes, logistics, and services for customers worldwide

- In January 2024, Phileo by Lesaffre introduced Actisaf Sc 47 HR+ yeast probiotic at the International Production & Processing Expo (IPPE). Following its European launch, this yeast probiotic, already established in the ruminant and swine sectors, is now available for poultry industry applications

- In September 2022, Leiber, a brewers' yeast specialist, is making significant investments in sustainability by constructing a new biomass power plant in Engter, Lower Saxony. The plant aims to use waste wood to generate a large portion of the heat energy and about one-third of the electricity required for its production operations

- In March 2021, Alltech (US), a global leader in animal health, has launched Acutia, a subsidiary focusing on human health. Acutia offers high-quality supplements aimed at enhancing everyday nutrition and long-term wellness. The selenium found in Acutia Selenium and Acutia Brain Health is made from a specialized, high-quality strain of brewer's yeast to optimize the quality, absorption, safety, and efficacy of the products

- In March 2021, AB Mauri, a global leader in promoting bakery consumption, has relocated its Global Technology Centre from Made to Etten-Leur in The Netherlands, approximately 40 km from Rotterdam. This move signifies an investment to bolster the company's position in supporting customers with innovative bakery solutions and technology. The new center will serve as an international hub for research and development (R&D), applications in bakery solutions, technology, and sensory analysis. It includes research laboratories, a large bakery, pilot plant, sensory panel, and seminar facility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Yeast Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Yeast Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Yeast Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.