Global 5g Mm Wave Technology Market

Market Size in USD Billion

CAGR :

%

USD

3.41 Billion

USD

10.23 Billion

2024

2032

USD

3.41 Billion

USD

10.23 Billion

2024

2032

| 2025 –2032 | |

| USD 3.41 Billion | |

| USD 10.23 Billion | |

|

|

|

|

What is the Global 5G mm Wave Technology Market Size and Growth Rate?

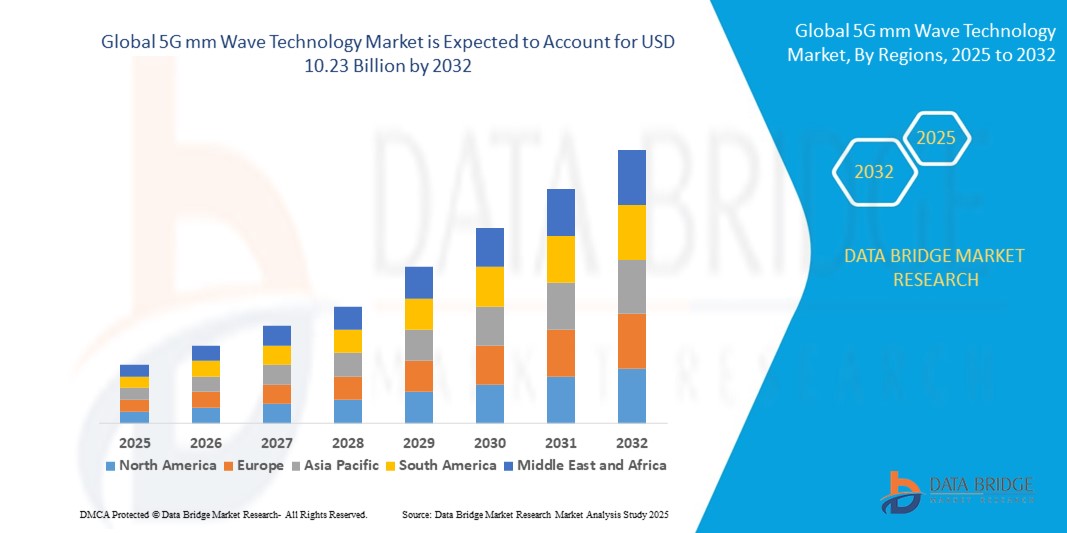

- The global 5G mm Wave Technology market size was valued at USD 3.41 billion in 2024 and is expected to reach USD 10.23 billion by 2032, at a CAGR of 14.70% during the forecast period

- Rising utilization of mmwave technology products in high spectrum 5G deployment is driving market revenue growth. Millimeter wave (Mmwave) technology supports core requirements of latency-free and high-speed 5G spectrums ranging 24 GHz to 300 GHz, which enables data-intensive applications such as faster transfer of large volumes of data, 4K/8K Ultra High Definition (UHD) video streaming, Virtual Reality (VR), and Augmented Reality (AR). Internet users across the region are shifting toward buying 5G bands enabled smart devices which is driving the market revenue growth

What are the Major Takeaways of 5G mm Wave Technology Market?

- 5G mmWave technology, known for its high-frequency millimeter waves, is a vital driver in the 5G market due to its capability to offer exceptionally high data transmission speeds. Unsuch as 4G networks, 5G mmWave can potentially reach several gigabits per second, significantly enhancing data transfer rates

- This remarkable speed is attributed to the higher frequency bands utilized by mmWave technology, which allow for a larger bandwidth and thus, faster data throughput. The adoption of 5G mmWave is therefore seen as a transformative step in the evolution of wireless communication technologies

- North America led the 5G mm Wave Technology market with the largest revenue share of 37.56% in 2024, driven by widespread 5G deployment, rising demand for high-speed connectivity, and supportive regulatory frameworks

- Asia-Pacific region is anticipated to register the fastest CAGR of 10.25% from 2025 to 2032, owing to surging demand for high-speed connectivity across densely populated urban centers and industrial zones in China, India, Japan, and South Korea

- The Antennas and transceiver components segment dominated the market with the largest revenue share of 28.6% in 2024, owing to their critical role in enhancing signal transmission and enabling ultra-high-speed data connectivity across millimeter wave frequencies

Report Scope and 5G mm Wave Technology Market Segmentation

|

Attributes |

5G mm Wave Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the 5G mm Wave Technology Market?

Edge Computing Integration and Network Densification

- A key trend shaping the global 5G mm wave technology market is the integration of edge computing and the rapid deployment of dense small-cell networks to reduce latency and support high-speed, high-bandwidth applications across industries

- Telecom providers and tech firms are increasingly focusing on mmWave-enabled edge nodes to deliver ultra-low latency services for autonomous vehicles, smart cities, and industrial IoT

- For instance, in May 2024, Verizon partnered with Amazon Web Services (AWS) to deploy 5G Edge zones in key metro areas, enhancing real-time data processing capabilities

- Advanced antenna technologies such as beamforming and MIMO (multiple-input multiple-output) are being coupled with mmWave bands to overcome signal attenuation and expand coverage in urban environments

- This trend also aligns with the shift toward private 5G networks, especially in sectors such as manufacturing and logistics, where real-time data flow and minimal delay are critical

- As a result, major players such as Qualcomm, Ericsson, and Nokia are investing in mmWave R&D and infrastructure to deliver scalable, low-latency solutions for future-ready enterprises

What are the Key Drivers of 5G mm Wave Technology Market?

- Surging demand for ultra-fast mobile broadband, particularly for applications such as AR/VR, 4K/8K video streaming, and cloud gaming, is a major growth driver for 5G mm Wave Technology

- For instance, in January 2024, Samsung Electronics launched mmWave-compatible 5G devices aimed at delivering gigabit speeds in dense environments, enhancing consumer experience

- The increasing need for enterprise digital transformation and smart factory initiatives is pushing industries to adopt mmWave-powered 5G networks for real-time machine communication and predictive analytics

- Government initiatives, such as spectrum auctions and regulatory support in countries such as the U.S., Japan, and South Korea, are accelerating infrastructure rollout and vendor participation

- The demand for low-latency and high-throughput connectivity in mission-critical operations, such as remote surgery, drone monitoring, and autonomous driving, is also fueling adoption

- In addition, the rising number of IoT devices and growing pressure on existing sub-6 GHz 5G bands are pushing network operators to shift toward mmWave for improved speed and capacity

Which Factor is challenging the Growth of the 5G mm Wave Technology Market?

- A significant challenge to market growth is the limited range and high signal attenuation of mmWave frequencies, which require dense small-cell deployments to maintain stable connections

- For instance, indoor penetration remains a critical issue, especially in high-rise buildings or underground areas, leading to inconsistent user experiences in some geographies

- The high capital expenditure required for infrastructure upgrades and cell densification discourages adoption in cost-sensitive regions such as Africa and parts of Southeast Asia

- Moreover, complex spectrum allocation processes and regulatory uncertainty in several developing economies slow down technology rollouts and hinder operator investments

- Another challenge is the limited availability of mmWave-compatible devices, which restricts large-scale commercial use and affects consumer access to full 5G potential

- To mitigate these hurdles, companies are investing in hybrid 5G networks, combining mmWave with sub-6 GHz and mid-band spectrum, while also exploring software-defined networking (SDN) and AI-based beam optimization to boost signal reach and reliability

How is the 5G mm Wave Technology Market Segmented?

The market is segmented on the basis of components, product, frequency band, and application.

- By Components

On the basis of components, the 5G mm wave technology market is segmented into Antennas and transceiver components, Frequency sources and related, Communication and networking components, Imaging components, Sensors and controls, Interface components, and Others. The Antennas and transceiver components segment dominated the market with the largest revenue share of 28.6% in 2024, owing to their critical role in enhancing signal transmission and enabling ultra-high-speed data connectivity across millimeter wave frequencies. The increasing deployment of 5G infrastructure globally has further driven the demand for compact, high-performance antenna arrays and transceivers.

The Frequency sources and related segment is projected to grow steadily, supported by rising demand for stable signal generation in radar and wireless backhaul applications.

- By Product

On the basis of product, the market is segmented into Scanning systems, Radar and satellite communication systems, Telecommunication equipment, and Others. The Telecommunication equipment segment held the dominant market share of 36.2% in 2024, driven by the rapid rollout of 5G networks and the need for advanced base station hardware capable of operating at mmWave frequencies. These systems ensure faster data rates and low-latency connections, fueling their integration into global telecom infrastructure.

The Radar and satellite communication systems segment is also gaining momentum due to its applications in aerospace, defense, and weather forecasting.

- By Frequency Band

On the basis of frequency band the market is segmented into 24–57 GHz, 57–95 GHz, and 95–300 GHz. In 2024, the 24–57 GHz band led the market with the highest revenue contribution of 41.9%, attributed to its allocation for licensed 5G use and strong industry adoption. This band strikes a balance between performance and propagation range, making it ideal for dense urban deployments and fixed wireless access.

The 57–95 GHz band is expected to register the fastest growth through 2032, supported by innovations in high-capacity point-to-point communication and satellite applications.

- By Application

On the basis of application, the 5G mm wave technology market is segmented into Mobile and telecom, Consumer and commercial, Healthcare, Industrial, Automotive and transportation, and Imaging. The Mobile and telecom segment dominated with a market share of 44.7% in 2024, underpinned by escalating 5G network deployments and rising mobile data consumption worldwide. Telecom providers are increasingly investing in mmWave technology to support ultra-fast internet, high-capacity user handling, and smart city initiatives.

The Automotive and transportation segment is poised for robust growth due to the rising integration of mmWave radar in autonomous vehicles and ADAS (Advanced Driver-Assistance Systems).

Which Region Holds the Largest Share of the 5G mm Wave Technology Market?

- North America led the 5G mm Wave Technology market with the largest revenue share of 37.56% in 2024, driven by widespread 5G deployment, rising demand for high-speed connectivity, and supportive regulatory frameworks

- The region is a hub for key market players, government-backed 5G infrastructure initiatives, and advanced R&D activities, particularly in the U.S., enhancing early adoption and innovation in mmWave technology

- Increasing use of 5G mmWave in autonomous vehicles, smart cities, and military applications further reinforces North America's dominant position in the global landscape

U.S. 5G mm Wave Technology Market Insight

The U.S. accounted for the largest share in North America in 2024 due to early commercial 5G rollouts, high consumer demand for ultra-fast internet, and robust investments by telecom giants such as Verizon, AT&T, and T-Mobile. Integration of mmWave in enterprise-grade applications, cloud computing, and smart manufacturing is further accelerating market traction across sectors.

Europe 5G mm Wave Technology Market Insight

The European market is projected to grow steadily, supported by EU-led digital transformation programs, strong automotive and industrial sectors, and rising adoption of 5G-based connectivity in public infrastructure. Key markets including Germany, France, and Italy are enhancing deployment of mmWave-enabled private networks and satellite systems to meet increasing bandwidth needs.

U.K. 5G mm Wave Technology Market Insight

The U.K. market is expected to witness significant growth fueled by 5G testbeds, smart transportation projects, and rising demand for secure, low-latency communication in healthcare and logistics. As 5G mmWave networks expand in urban centers and industrial zones, technology providers are tapping into multi-sector collaborations and government funding schemes.

Germany 5G mm Wave Technology Market Insight

Germany’s 5G mmWave adoption is rising, driven by the country’s leadership in Industry 4.0, engineering excellence, and focus on intelligent automation. Investments in automotive-to-everything (V2X) communication, factory automation, and connected mobility are enhancing the role of mmWave in next-generation digital infrastructure.

Which Region is the Fastest Growing in the 5G mm Wave Technology Market?

Asia-Pacific region is anticipated to register the fastest CAGR of 10.25% from 2025 to 2032, owing to surging demand for high-speed connectivity across densely populated urban centers and industrial zones in China, India, Japan, and South Korea. Government 5G incentives, expanding telecom infrastructure, and rising consumer tech adoption are major growth accelerators. This drives the demand for warehouses, which can benefit from the use of 5G mm wave technology

Japan 5G mm Wave Technology Market Insight

Japan is witnessing growing demand for compact mmWave devices and base stations due to its dense urban environment and emphasis on low-latency communication for robotics, healthcare, and factory automation. Telecom leaders such as NTT Docomo and SoftBank are accelerating 5G mmWave rollouts in smart city developments and mobility systems.

China 5G mm Wave Technology Market Insight

China captured the largest revenue share in Asia-Pacific in 2024, driven by massive state-led investments in 5G infrastructure, industrial IoT, and autonomous driving networks. With a strong presence of domestic manufacturers and rising international exports, China is rapidly scaling mmWave adoption across public safety, transportation, and enterprise networks.

Which are the Top Companies in 5G mm Wave Technology Market?

The 5G mm Wave Technology industry is primarily led by well-established companies, including:

- L3Harris Technologies, Inc. (U.S.)

- NEC Corporation (Japan)

- DENSO CORPORATION (Japan)

- Fujitsu Limited (Japan)

- Mitsubishi Electric Corporation (Japan)

- E‑Band Communications, LLC (U.S.)

- Hubei YJT Technology Co., Ltd. (China)

- Sage Millimeter, Inc. (U.S.)

- Millimeter Wave Products Inc. (U.S.)

- Farran (Ireland)

What are the Recent Developments in Global 5G mm Wave Technology Market?

- In December 2023, T-Mobile announced a significant breakthrough in 5G technology within the U.S., where it conducted a test using 5G standalone millimeter wave (mmWave) on its live network. Partnering with Qualcomm Technologies, Inc. and Telefonaktiebolaget LM Ericsson, the company aggregated eight mmWave spectrum channels, reaching download speeds exceeding 4.3 Gbps—without the use of mid- or low-band spectrum. This milestone underlines the growing capability of mmWave to deliver standalone, ultra-high-speed mobile connectivity

- In August 2023, Fujitsu Limited unveiled the development of a 5G millimeter wave chip that can multiplex up to four beams via a single chip used in the radio units (RU) of 5G base stations. This innovation was part of Japan’s national Research & Development Project for the Enhanced Infrastructure for Post 5G. The advancement highlights Japan’s commitment to building high-performance 5G hardware for future infrastructure scalability

- In February 2023, Qualcomm Technologies, Inc. and Telefonaktiebolaget LM Ericsson launched the world’s first commercial 5G mmWave mobile network during MWC 2023 in Barcelona, Spain. The event showcased a range of 5G mmWave-compatible devices powered by Snapdragon platforms, giving device partners real-time access to the Ericsson-backed network. This achievement demonstrated the commercial viability and global readiness of 5G mmWave networks

- In June 2022, Nokia, in collaboration with Elisa and Qualcomm, successfully achieved 5G uplink speeds exceeding 2 Gbps on mmWave technology. This milestone significantly boosts the feasibility of ultra-low-latency and high-performance applications over wireless networks. The test set a new benchmark for upstream data capabilities in mmWave-driven 5G deployments

- In May 2021, UScellular, Qualcomm, Ericsson, and Inseego set a record for the longest 5G mmWave Fixed Wireless Access (FWA) link in the U.S. at 7 km, delivering download speeds around 1 Gbps and peaking over 2 Gbps. Utilizing Ericsson’s infrastructure and Inseego’s gateway powered by Qualcomm, this achievement tackled the “last mile” issue in underserved communities. This breakthrough reinforced mmWave’s potential for bridging digital divides through extended-range, high-speed access

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 5g Mm Wave Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 5g Mm Wave Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 5g Mm Wave Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.