Global Algae Based Food Additive Market

Market Size in USD million

CAGR :

%

USD

189.40 million

USD

275.59 million

2024

2032

USD

189.40 million

USD

275.59 million

2024

2032

| 2025 –2032 | |

| USD 189.40 million | |

| USD 275.59 million | |

|

|

|

|

Algae-based Food Additive Market Size

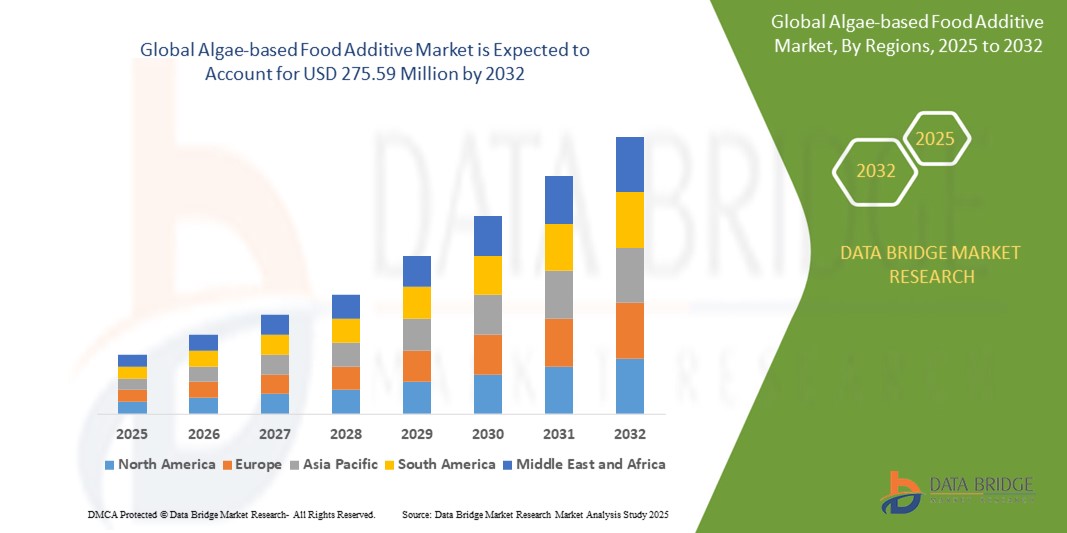

- The global algae-based food additive market was valued at USD 189.40 million in 2024 and is expected to reach USD 275.59 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.80%, primarily driven by rising consumer demand for natural, sustainable, and plant-based ingredients

- This growth is driven by growing awareness of the nutritional benefits of algae, such as high protein, essential fatty acids, and antioxidants

Algae-based Food Additive Market Analysis

- The algae-based food additive market is growing rapidly, driven by increasing demand for plant-based, sustainable, and natural food ingredients. Consumers are becoming more aware of the environmental impact of their choices, prompting manufacturers to focus on eco-friendly and nutrient-rich algae-based solutions, supported by collaborations with biotechnology firms and food innovation centers

- The surge in functional foods, rising veganism, and heightened interest in gut health and immunity are expanding the adoption of algae-based food additives across multiple sectors, including beverages, bakery, and dietary supplements. Clean-label trends, coupled with advancements in algae cultivation techniques such as photobioreactors and open-pond farming, are further supporting market growth

- For instance, in January 2025, Corbion partnered with Wageningen University to study algae-derived omega-3’s role in heart health and subsequently launched a new algae oil product line targeted at the functional food sector

- Emerging technologies such as fermentation-based algae production, CRISPR gene editing for optimized strains, and AI-driven nutritional profiling are revolutionizing the development of algae-based ingredients. Strong regulatory encouragement for natural food additives and increasing R&D investments in sustainable nutrition solutions are solidifying the algae-based food additive market’s role in the future of global food innovation

Report Scope and Algae-based Food Additive Market Segmentation

|

Attributes |

Algae-based Food Additive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Algae-based Food Additive Market Trends

Surge in Sustainable and Clean-label Innovations

- Consumers are increasingly preferring sustainable, traceable, and eco-friendly food ingredients, leading to rising demand for clean-label algae-based food additive

- Food companies are reformulating their products to replace synthetic additives with algae-derived natural alternatives, enhancing brand transparency and consumer trust

- Green certifications such as USDA Organic, Non-GMO Project Verified, and EU Organic labels are becoming critical for algae-based food additive market acceptance globally

For instance,

- In March 2025, Algaia secured EU Organic certification for its entire line of Algae-based Food Additive ingredients, reinforcing its commitment to sustainability

- Earthrise Nutritionals launched a Non-GMO spirulina-based additive certified by the Clean Label Project in late 2024

- Cargill introduced a traceable red algae extract for food fortification in February 2025, with full blockchain-based transparency features

- As eco-conscious consumerism grows, sustainable and clean-label innovations will drive the next wave of growth in the algae-based food additive sector

Algae-based Food Additive Market Dynamics

Driver

Growing Demand for Plant-Based and Vegan Products

- The global shift towards plant-based diets is creating new opportunities for algae-based food additive as a nutrient-rich, animal-free alternative

- Food and beverage brands are incorporating algae-based food additive into vegan formulations to enhance nutritional value without compromising clean-label commitments

- Strategic partnerships between algae producers and plant-based brands are facilitating innovative launches across dairy alternatives, meat substitutes, and beverages

For instance

- In 2025, NotCo partnered with an algae biotechnology firm to fortify its plant-based milk with Algae-based Food Additive for enhanced nutritional content.

- In late 2024, Oatly introduced a limited-edition algae-fortified oat milk in select U.S. and European markets

- Beyond Meat announced R&D collaboration with AlgaVia (Corbion) to integrate Algae-based Food Additive into its next-generation plant-based meats in early 2025

- The plant-based revolution will ensure robust, long-term demand for algae-based food additive across global food systems

Opportunity

Integration into Sports Nutrition and Active Lifestyle Products

- Algae-based Food Additive’s natural antioxidant, anti-inflammatory, and recovery-supporting properties make it ideal for sports nutrition and fitness-focused products

- Brands are introducing algae-based food additive-enriched protein powders, recovery drinks, and endurance supplements to cater to the growing active lifestyle segment

- Performance-focused clean-label products targeting athletes and fitness enthusiasts are positioning algae-based food additive as a key functional ingredient

For instance

- In early 2025, Herbalife launched a new sports recovery supplement featuring Algae-based Food Additive for antioxidant and joint support

- Optimum Nutrition introduced an algae-infused post-workout beverage in late 2024 to promote muscle recovery

- GNC expanded its sports nutrition line with Algae-based Food Additive-fortified endurance capsules in March 2025

- As fitness and wellness trends surge worldwide, sports nutrition will offer a dynamic growth avenue for algae-based food additive applications

Restraint/Challenge

High Production Costs and Limited Economies of Scale

- Despite rising demand, large-scale production of high-quality algae-based food additive remains costly due to specialized cultivation, harvesting, and processing requirements

- Smaller algae producers often struggle to scale operations economically, making premium pricing a barrier for mainstream adoption

- Investment in cost-effective cultivation technologies such as heterotrophic fermentation and closed-loop systems is crucial to overcoming production challenges

For instance

- In 2024, Algatech invested USD 20 million in expanding its photobioreactor facilities to achieve better economies of scale

- Heliae Development introduced a cost-reduction initiative for microalgae production in early 2025 to support wider food industry adoption

- Algenol faced setbacks in commercializing its low-cost algae cultivation platform in late 2024 due to high infrastructure costs

- Reducing production costs will be essential for algae-based food additive manufacturers to compete effectively with synthetic and traditional additives

Algae-based Food Additive Market Scope

The market is segmented on the basis of product type, source, functionality, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Source |

|

|

By Functionality |

|

|

By Application

|

|

Algae-based Food Additive Market Regional Analysis

North America is the Dominant Region in the Algae-based Food Additive Market

- North America holds the leading share in the algae-based food additive market due to high consumer awareness and strong demand for natural ingredients

- The region benefits from robust research and development activities aimed at innovating algae-derived products for food and beverage applications

- Key players across the U.S. and Canada are actively investing in expanding production capacities and forming strategic partnerships to strengthen their market presence

- North America's dominance in the algae-based food additive market is expected to continue, driven by a growing preference for plant-based and sustainable food source

Asia-Pacific is projected to register the Highest Growth Rate

- Asia-Pacific is expected to witness the highest growth rate in the algae-based food additive market due to rising health consciousness and demand for functional foods

- The expansion of the food and beverage industry in countries such as China, India, and Japan is boosting the adoption of algae-based ingredients

- Government initiatives supporting sustainable food production and investments in algae farming are further driving market growth in the region

- Asia-Pacific's rapid economic development and shifting dietary preferences are set to position it as the fastest-growing region in the algae-based food additive market

Algae-based Food Additive Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Corbion N.V. (Netherlands)

- Aliga (Denmark)

- Triton Algae Innovation (U.S.)

- Cargill, Incorporated (U.S.)

- Gino Biotech (China)

- Tate & Lyle (U.K.)

- AEP Colloids (U.S.)

- Hispanagar S A (Spain)

- Algama Foods (France)

- Arizona Algae Products, LLC (U.S.)

- FENCHEM (China)

- Algatech LTD (Israel)

- BASF (Germany)

- Roquette Frères (France)

- Koninklijke DSM N.V. (Netherlands)

- Kerry Group plc (Ireland)

- DuPont (U.S.)

- BlueBioTech International GmbH (Germany)

- Cyanotech Corporation (U.S.)

- Enovix Corporation (U.S.)

- JRS PHARMA LP, USA (U.S.)

Latest Developments in Global Algae-based Food Additive Market

- In November 2023, Enovix Corporation partnered with a leading food manufacturer to supply astaxanthin for functional food applications, expanding its footprint in the rapidly growing functional foods industry

- In September 2023, Algatechnologies secured European Union approval for its new astaxanthin ingredient for use in food supplements, reinforcing its leadership position in the European health ingredients market

- In July 2023, the SUBMARINER Network initiated the AlgaeProBANOS (APB) project to develop high-value algae-based products across industries such as human and animal feed, textiles, and cosmetics, driving innovation in the sustainable algae economy

- In May 2023, Corbion introduced its Algal Omega-3 and Omega-9 products for dietary supplements, launching the AlgaVia product line and entering the human nutrition market, strengthening its presence in the global health supplements sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Algae Based Food Additive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Algae Based Food Additive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Algae Based Food Additive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.