Global Ambulatory Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

3.26 Billion

USD

5.48 Billion

2024

2032

USD

3.26 Billion

USD

5.48 Billion

2024

2032

| 2025 –2032 | |

| USD 3.26 Billion | |

| USD 5.48 Billion | |

|

|

|

|

Ambulatory Healthcare Information Technology (IT) Market Size

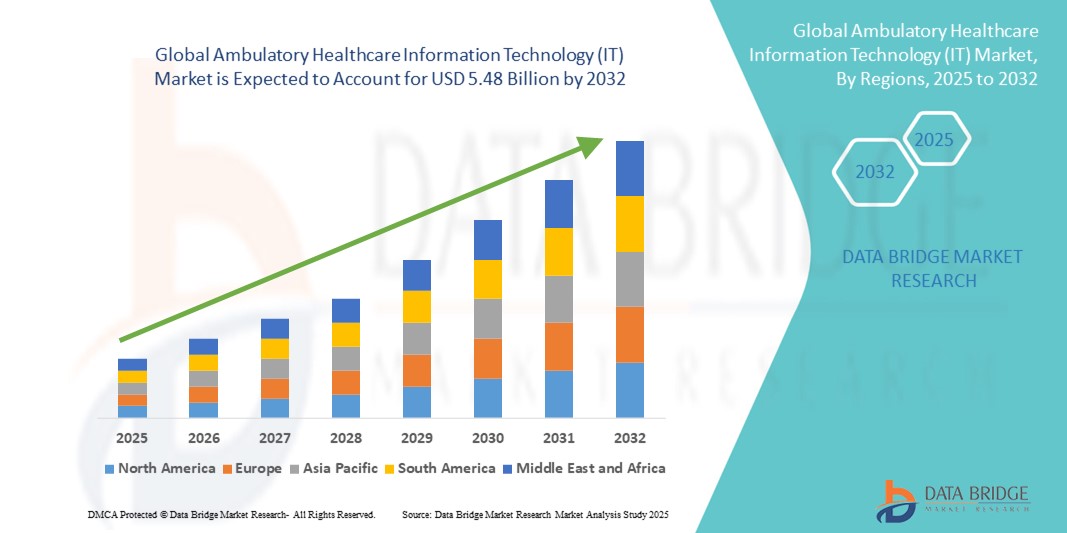

- The global ambulatory healthcare information technology (IT) market size was valued at USD 3.26 billion in 2024 and is expected to reach USD 5.48 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the increasing digital transformation of outpatient care facilities, with healthcare providers adopting advanced IT solutions such as electronic health records (EHR), practice management software, and telehealth platforms to enhance efficiency and patient care quality

- Furthermore, rising demand for cost-effective, interoperable, and patient-centric technologies driven by regulatory mandates, value-based care initiatives, and growing chronic disease prevalence is positioning ambulatory healthcare IT as a core enabler of modern healthcare delivery. These converging factors are accelerating the adoption of digital solutions in ambulatory settings, thereby significantly boosting the industry’s growth

Ambulatory Healthcare Information Technology (IT) Market Analysis

- Ambulatory healthcare IT solutions, encompassing electronic health records (EHR), practice management, e-prescribing, referral management, and telehealth platforms, are increasingly critical for streamlining operations, improving care coordination, and enabling real-time patient data access in outpatient settings due to their interoperability and regulatory compliance features

- The demand for ambulatory healthcare IT is primarily fueled by the global shift toward value-based care, mandatory digital health record initiatives, and the rising need to enhance patient outcomes while reducing operational costs

- North America dominated the ambulatory healthcare information technology (IT) market with the largest revenue share of 40.5% in 2024, supported by advanced healthcare infrastructure, strong government incentives such as the HITECH Act, and high adoption of integrated EHR and telehealth solutions, with the U.S. leading innovations in AI-driven analytics and mobile health technologies for outpatient care

- Asia-Pacific is expected to be the fastest growing region in the ambulatory healthcare information technology (IT) market during the forecast period, driven by rapid healthcare digitalization, increasing investment in health IT infrastructure, and expanding access to ambulatory services in emerging economies

- Hospital-affiliated modality dominated the ambulatory healthcare information technology (IT) market with a market share of 55.3% in 2024, attributed to large health systems’ preference for integrated IT platforms that connect inpatient and outpatient care for improved interoperability and patient experience

Report Scope and Ambulatory Healthcare Information Technology (IT) Market Segmentation

|

Attributes |

Ambulatory Healthcare Information Technology (IT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ambulatory Healthcare Information Technology (IT) Market Trends

Growing Shift Toward Interoperable and AI-Enabled Solutions

- A key and accelerating trend in the global ambulatory healthcare IT market is the integration of artificial intelligence (AI) and advanced interoperability standards into electronic health records (EHR), practice management systems, and telehealth platforms. This convergence is enhancing diagnostic accuracy, streamlining administrative tasks, and improving real-time care coordination between providers

- For instance, Epic Systems has integrated AI-driven clinical decision support tools into its ambulatory EHR to assist physicians in identifying care gaps and predicting patient risks. Similarly, Allscripts (now Veradigm) offers AI-powered analytics for population health management, enabling more targeted interventions in outpatient settings

- AI applications in ambulatory healthcare IT enable predictive analytics for chronic disease management, automated scheduling based on patient flow patterns, and intelligent alerts for abnormal results or missed follow-ups. These tools help reduce administrative burden and improve patient adherence

- Interoperability enhancements, supported by HL7 FHIR standards, facilitate seamless data exchange between hospital-affiliated ambulatory centers, freestanding clinics, laboratories, and pharmacies. This creates a more connected care ecosystem and reduces data silos

- This trend toward AI-driven, interoperable platforms is redefining expectations for efficiency and quality in outpatient care delivery. Companies such as Cerner (Oracle Health) and eClinicalWorks are expanding AI-powered modules with telehealth integration to meet the growing demand for remote and hybrid care models

- The adoption of such intelligent, connected solutions is accelerating across both developed and emerging markets as healthcare providers prioritize value-based care, patient engagement, and operational optimization

Ambulatory Healthcare Information Technology (IT) Market Dynamics

Driver

Rising Demand for Digital Transformation in Outpatient Care

- The growing need for digitization of ambulatory services—driven by regulatory mandates, value-based reimbursement models, and increasing patient expectations for accessible, efficient care is a major driver of market growth

- For instance, in February 2024, the U.S. Office of the National Coordinator for Health IT (ONC) announced new incentives for small and medium-sized outpatient clinics to adopt certified interoperable EHR systems, aiming to boost care quality and data exchange

- Ambulatory healthcare IT enables remote patient monitoring, integrated scheduling, automated billing, and data analytics, offering a clear upgrade over paper-based or siloed digital systems

- The expansion of telehealth, wearable device integration, and patient portals further supports growth by improving access to care and patient engagement, especially in rural and underserved areas

- As outpatient volumes grow worldwide due to cost pressures on inpatient care, healthcare providers are investing heavily in scalable, interoperable IT platforms to manage larger patient loads efficiently

Restraint/Challenge

Cybersecurity Risks and High Implementation Costs

- The increasing digitalization of outpatient services exposes them to cybersecurity threats such as ransomware, data breaches, and unauthorized access, which can erode trust and hinder adoption

- For instance, high-profile healthcare data breaches reported in 2023 led some smaller ambulatory centers to delay IT upgrades due to security concerns

- Addressing these risks requires advanced encryption, multi-factor authentication, regular vulnerability assessments, and compliance with strict regulations such as HIPAA and GDPR. Vendors such as NextGen Healthcare and Greenway Health emphasize their security certifications to reassure clients

- In addition, the high upfront costs of comprehensive IT solutions especially for freestanding clinics can be a barrier, particularly in developing regions. While cloud-based and subscription models are reducing initial expenses, the perceived cost-to-benefit ratio still challenges adoption among smaller practices

- Overcoming these hurdles will require affordable, modular IT solutions, stronger cybersecurity protocols, and government or payer incentives to encourage adoption

Ambulatory Healthcare Information Technology (IT) Market Scope

The market is segmented on the basis of type, modality, surgery type, and application.

- By Type

On the basis of type, the ambulatory healthcare information technology (IT) market is segmented into ambulatory services, primary care offices, outpatient departments, emergency departments, surgical specialty, medical specialty, and others. Primary Care Offices dominated the market with the largest revenue share of 34.6% in 2024, driven by the widespread adoption of electronic health records (EHR) and practice management systems in primary care settings. These offices serve as the first point of contact for most patients, making digital systems critical for efficient scheduling, patient data management, and care coordination. The market growth is also supported by government initiatives and incentives promoting IT integration in primary care to enhance preventive care, chronic disease management, and patient engagement.

Outpatient Departments are anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by the shift of non-emergency procedures and diagnostic services from inpatient hospitals to outpatient settings. Increasing patient preference for convenient, cost-effective care drives investments in cloud-based IT platforms that support appointment scheduling, real-time reporting, and telemedicine integration. Advanced IT also enables electronic prescription management, automated reminders, and analytics for resource optimization. Hospitals are adopting these systems to reduce patient wait times, track performance metrics, and enhance operational efficiency. Growing regulatory focus on data security and patient privacy further motivates adoption of sophisticated IT solutions in outpatient departments.

- By Modality

On the basis of modality, the ambulatory healthcare information technology (IT) market is segmented into hospital-affiliated and freestanding. Hospital-Affiliated facilities dominated the market with the largest revenue share of 55.3% in 2024, as integrated healthcare networks prefer centralized IT systems that connect inpatient and outpatient services. These systems ensure smooth care transitions, reduce duplicated tests, and provide comprehensive patient records accessible across multiple departments. Advanced analytics and decision support tools enable hospitals to optimize resource allocation, monitor patient outcomes, and maintain regulatory compliance. Hospital-affiliated IT solutions also integrate with telehealth, mobile apps, and patient portals, enhancing engagement and follow-up care.

Freestanding ambulatory care centers are projected to grow at the fastest CAGR of 19.4% from 2025 to 2032, driven by the rising number of independent clinics seeking scalable, cost-effective IT solutions. Cloud-based software allows freestanding centers to manage appointments, billing, and medical records without heavy IT infrastructure investment. These systems support telehealth, remote monitoring, and secure data exchange with partner hospitals. Providers benefit from easier upgrades, enhanced cybersecurity, and simplified workflow management. Growing competition among outpatient clinics encourages adoption of technology to enhance patient satisfaction, reduce errors, and attract more patients.

- By Surgery Type

On the basis of surgery type, the ambulatory healthcare information technology (IT) market is segmented into ophthalmology, orthopaedics, gastroenterology, pain management, and others. Orthopaedics dominated the market with a 27.5% revenue share in 2024, driven by the high demand for outpatient joint replacements, fracture repairs, and sports injury treatments. IT solutions are crucial for pre- and post-operative care coordination, electronic documentation, and imaging integration. Digital platforms allow surgeons and staff to track patient progress, schedule follow-ups, and share records with rehabilitation teams. Advanced analytics help predict patient outcomes and resource needs. Cloud-based solutions support remote consultations and tele-rehabilitation.

Gastroenterology is expected to witness the fastest growth rate of 21.2% from 2025 to 2032, driven by increasing outpatient endoscopic procedures and preventive screenings. Integration of imaging, reporting, and scheduling systems is essential for efficient workflow management. EHR and practice management tools allow gastroenterologists to track patient histories, lab results, and follow-ups seamlessly. Telehealth platforms support post-procedure monitoring and patient education. Clinics are adopting AI-powered analytics to optimize procedure scheduling and predict patient needs. Regulatory requirements for secure, accessible, and accurate data further accelerate adoption of IT solutions in GI practices.

- By Application

On the basis of application, the ambulatory healthcare information technology (IT) market is segmented into laceration treatment, bone fracture treatment, emergency care service, and trauma treatment. Emergency Care Service dominated the market with the largest share of 31.4% in 2024, reflecting the critical need for rapid access to patient data, real-time communication, and integrated monitoring tools in urgent outpatient scenarios. IT systems enable clinicians to quickly retrieve medical histories, allergies, and lab results to provide timely care. Digital triage systems optimize patient flow and prioritize critical cases. Mobile access allows staff to update records and communicate across departments instantly. Integration with telehealth enables remote consultation for non-critical emergencies.

Bone Fracture Treatment is expected to grow at the fastest CAGR of 20.5% from 2025 to 2032, driven by rising accidents, sports injuries, and the trend of outpatient orthopedic clinics managing fractures. IT-enabled imaging, record-keeping, and scheduling tools allow precise treatment planning and post-care monitoring. Digital platforms support coordination with physiotherapy and rehabilitation centers. Cloud-based access ensures patient records are available across multiple sites and devices. Automated reminders, teleconsultation, and AI-assisted diagnostics improve patient adherence and outcomes. The increasing number of dedicated fracture clinics and the shift from hospital-based to ambulatory care further propels IT adoption.

Ambulatory Healthcare Information Technology (IT) Market Regional Analysis

- North America dominated the ambulatory healthcare information technology (IT) market with the largest revenue share of 40.5% in 2024, supported by advanced healthcare infrastructure, strong government incentives such as the HITECH Act, and high adoption of integrated EHR and telehealth solutions

- Healthcare providers in the region prioritize interoperability, patient engagement tools, and AI-driven analytics, with widespread implementation of integrated systems that connect hospital-affiliated and outpatient facilities

- This strong adoption is further supported by favorable government initiatives such as the HITECH Act, high digital literacy among healthcare professionals, and a growing focus on value-based care, positioning ambulatory healthcare IT as a core enabler of efficient, coordinated, and patient-centric outpatient services

U.S. Ambulatory Healthcare Information Technology (IT) Market Insight

The U.S. ambulatory healthcare information technology (IT) market captured the largest revenue share of 82% in 2024 within North America, driven by the country’s advanced healthcare infrastructure, strong regulatory mandates for EHR adoption, and robust investment in digital health innovations. Providers are increasingly prioritizing integrated platforms for scheduling, billing, telehealth, and population health management. The growth of value-based care models, combined with patient demand for digital engagement tools and remote monitoring, is further accelerating adoption. Moreover, the integration of AI-driven analytics and interoperability solutions is significantly enhancing clinical decision-making and operational efficiency.

Europe Ambulatory Healthcare Information Technology (IT) Market Insight

The Europe ambulatory healthcare information technology (IT) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the enforcement of stringent data protection regulations such as GDPR and the push for interoperable health data exchange. Rising demand for patient-centric care and the need for efficient outpatient service delivery are fostering adoption across the region. European healthcare systems are increasingly leveraging telemedicine, e-prescription services, and AI-enabled diagnostics. Both public and private sector initiatives are encouraging deployment in hospitals, primary care offices, and specialty clinics.

U.K. Ambulatory Healthcare Information Technology (IT) Market Insight

The U.K. ambulatory healthcare information technology (IT) market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the National Health Service’s (NHS) ongoing digital transformation programs and the increasing demand for efficient outpatient management. The shift toward remote consultations and digital patient records, accelerated by post-pandemic healthcare reforms, is a key driver. In addition, the adoption of cloud-based practice management systems and integrated health platforms is improving operational workflows and patient engagement across primary and specialty care.

Germany Ambulatory Healthcare Information Technology (IT) Market Insight

The Germany ambulatory healthcare information technology (IT) market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s commitment to healthcare innovation under the Digital Healthcare Act. High investment in telehealth infrastructure, patient portals, and AI-based diagnostic support tools is driving adoption. Germany’s focus on secure, interoperable solutions aligns with its stringent data privacy laws, fostering trust in digital platforms. The integration of ambulatory IT systems into both public and private care networks is enhancing efficiency and care coordination.

Asia-Pacific Ambulatory Healthcare Information Technology (IT) Market Insight

The Asia-Pacific ambulatory healthcare information technology (IT) market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, fueled by rapid urbanization, growing healthcare investments, and government-led digitalization initiatives in countries such as China, Japan, and India. The rising prevalence of chronic diseases and the increasing need for accessible outpatient care are spurring adoption. In addition, APAC’s emergence as a hub for health IT software development and medical outsourcing is expanding the availability of cost-effective, scalable IT solutions for ambulatory care providers.

Japan Ambulatory Healthcare Information Technology (IT) Market Insight

The Japan ambulatory healthcare information technology (IT) market is gaining momentum due to the country’s tech-forward healthcare environment, aging population, and emphasis on preventive care. High adoption of telehealth services, AI-enabled diagnostic tools, and electronic health records is transforming outpatient service delivery. Integration of ambulatory IT solutions with national health insurance systems is improving efficiency, while patient-facing apps and connected medical devices are enhancing patient engagement and remote care capabilities.

India Ambulatory Healthcare Information Technology (IT) Market Insight

The India ambulatory healthcare information technology (IT) market accounted for the largest market revenue share in Asia Pacific in 2024, driven by a booming private healthcare sector, rapid digital adoption, and large-scale government programs such as Ayushman Bharat Digital Mission. The market is witnessing increasing deployment of cloud-based EHRs, practice management software, and telemedicine platforms in both urban and rural areas. Rising awareness of preventive care, combined with the affordability of locally developed IT solutions, is making ambulatory healthcare technology more accessible across the country.

Ambulatory Healthcare Information Technology (IT) Market Share

The Ambulatory Healthcare Information Technology (IT) industry is primarily led by well-established companies, including:

- Epic Systems Corporation (U.S.)

- Cerner Corporation (U.S.)

- Allscripts Healthcare Solutions, Inc. (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- eClinicalWorks LLC (U.S.)

- athenahealth, Inc. (U.S.)

- McKesson Corporation (U.S.)

- Greenway Health, LLC (U.S.)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Medical Information Technology, Inc. (U.S.)

- Practice Fusion, Inc. (U.S.)

- Kareo, Inc. (U.S.)

- AdvancedMD, Inc. (U.S.)

- CompuGroup Medical SE & Co. KGaA (Germany)

- Netsmart Technologies, Inc. (U.S.)

- IntraHealth Systems Limited (Canada)

- HealthFusion, Inc. (U.S.)

- Computer Programs and Systems, Inc. (U.S.)

What are the Recent Developments in Global Ambulatory Healthcare Information Technology (IT) Market?

- In July 2025, Philips announced a collaboration with Epic to integrate its suite of ambulatory cardiac monitoring and diagnostic technologies directly into Epic’s Aura platform. This partnership delivers the most comprehensive cardiac care portfolio accessible through Epic, enhancing interoperability by allowing clinicians to order and review ECG results seamlessly within the HER eliminating manual data entry and streamlining diagnostic workflows

- In October 2024, Oracle upgraded the solution to the Clinical AI Agent, incorporating next-gen generative AI to further reduce clinician burnout. It now supports automatic draft note generation, follow-up action suggestions, multilingual support, and EHR integration, all via a user-friendly voice interface

- In September 2024, Oracle Health delivered a suite of EHR innovations aimed at streamlining clinician tasks and reducing burnout. These enhancements such as streamlined chart reviews, mobile charting, improved medication workflows, and interoperability via Seamless Exchange were built into their ambulatory EHR offerings to enhance efficiency and patient care

- In June 2024, Oracle unveiled its Clinical Digital Assistant a mobile, AI-powered assistant for U.S. ambulatory clinics. Integrated with Oracle Health EHR, it uses generative AI combined with voice and screen-driven tools to automate note-taking and surface relevant patient data in real time, cutting documentation time by 20%–40%

- In April 2024, the Voice EHR concept emerged from academic research through a preprint publication. This innovation enables mobile/web apps to collect healthcare data using audio recordings, capturing biomarkers, speech patterns, and semantic context—pioneering scalable, low-cost audio-based health record systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.