Global Android Set Top Box Stb And Television Tv Market

Market Size in USD Billion

CAGR :

%

USD

382.63 Billion

USD

1,106.92 Billion

2024

2032

USD

382.63 Billion

USD

1,106.92 Billion

2024

2032

| 2025 –2032 | |

| USD 382.63 Billion | |

| USD 1,106.92 Billion | |

|

|

|

|

Android Set Top Box (STB) and Television (TV) Market Size

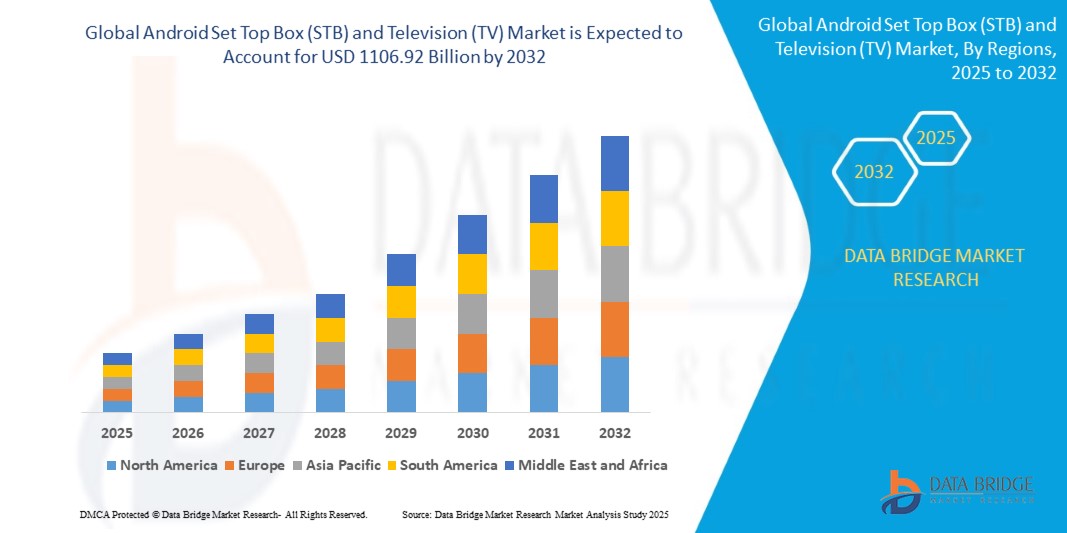

- The global Android Set Top Box (STB) and Television (TV) market size was valued at USD 382.63 billion in 2024 and is expected to reach USD 1106.92 billion by 2032, at a CAGR of 14.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of smart entertainment systems and advancements in Android-based operating platforms, leading to enhanced digital content delivery in both residential and commercial environments

- Furthermore, rising consumer demand for feature-rich, cost-effective, and internet-connected media devices is driving the transition from traditional television to Android-powered Set Top Boxes and Smart TVs. These factors are accelerating Android integration in entertainment ecosystems, thereby significantly propelling the market's expansion

Android Set Top Box (STB) and Television (TV) Market Analysis

- Android STBs and TVs are smart media devices powered by the Android operating system that enable users to access live TV, on-demand streaming content, games, apps, and voice-enabled controls through internet connectivity. These devices support integration with platforms such as Google Assistant, YouTube, Netflix, and the Google Play Store

- The growing demand for Android STBs and TVs is primarily driven by the rising penetration of OTT platforms, increased broadband availability, consumer preference for customizable viewing experiences, and the global trend of cord-cutting, which favors internet-based content over traditional cable services

- North America dominated the Android Set Top Box (STB) and Television (TV) market in 2024, due to the widespread adoption of OTT platforms, high internet penetration, and increasing demand for personalized content

- Asia-Pacific is expected to be the fastest growing region in the Android Set Top Box (STB) and Television (TV) market during the forecast period due to surging urbanization, increasing disposable income, and a growing preference for smart home devices

- Android TV segment dominated the market with a market share of 63.3% in 2024, due to its integrated smart capabilities, growing consumer shift toward connected entertainment systems, and ease of use. Android TVs offer direct internet connectivity, pre-installed streaming apps, voice assistant integration, and regular firmware updates—all of which drive demand across households seeking an all-in-one smart viewing experience. The rise of OTT platforms and increasing preference for personalized content also fuel the widespread adoption of Android TVs

Report Scope and Android Set Top Box (STB) and Television (TV) Market Segmentation

|

Attributes |

Android Set Top Box (STB) and Television (TV) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Android Set Top Box (STB) and Television (TV) Market Trends

“Increasing Demand for Streaming Services”

- The surge in streaming services and over-the-top (OTT) content platforms is transforming the Android STB and TV market, as consumers worldwide shift away from traditional cable toward on-demand, internet-based entertainment

- For instance, market leaders such as Arris, Technicolor, and prominent consumer electronics brands are observing a sharp uptick in demand for Android TV set-top boxes as households and businesses seek affordable, high-performance solutions for accessing apps such as Netflix, Amazon Prime Video, and Disney+. Key features—such as 4K support, voice control, and integrated Google services—are driving adoption, especially among younger and tech-savvy audiences

- Cord-cutting is accelerating with the popularity of cloud video streaming, mobile device integration, and the rising expectation that all home devices, including TVs and STBs, deliver a smart and connected experience

- Innovative hardware improvements, such as AI-powered picture enhancement, enhanced gaming capabilities, better audio, and ultra HD resolution, further boost consumer adoption and differentiate new products

- Subscription and payment model flexibility, improved user interfaces, and content personalization (leveraging AI and machine learning) are increasingly becoming decisive factors for consumers choosing Android-based TV solutions

- Integration with smart home devices and IoT platforms is gaining traction, positioning Android TVs and STBs as central hubs for the connected home ecosystem

Android Set Top Box (STB) and Television (TV) Market Dynamics

Driver

“Growing Demand for Smart TV Solutions”

- The desire for modern, integrated home entertainment and information platforms is pushing both consumers and businesses to upgrade to smart TVs and Android STBs, which combine traditional TV functions with internet access, application ecosystems, and compatibility with smart home technologies

- For instance, government-led digitalization efforts and high-profile rollouts by Arris, Technicolor, SCHNEIDER, and other major players are enabling widespread adoption of Android STBs and TVs across the residential and commercial sectors, particularly in rapidly urbanizing regions

- Enhanced features—such as built-in Wi-Fi and Bluetooth, seamless streaming, app stores, and user-friendly interfaces—are making Android TV solutions a first choice for residential, hospitality, and commercial use, supporting the global digital transformation trend

- The market is experiencing a major push from the rapid deployment of high-speed internet and 5G connectivity, elevating the real-time streaming and interactive capabilities of Android-powered devices

- The increasing popularity of voice-assisted technologies such as Google Assistant and Alexa is influencing consumer expectations, with Android TVs and STBs evolving to offer hands-free navigation, personalized content recommendations, and smart home integration—further strengthening their appeal in the connected device ecosystem

Restraint/Challenge

“Compatibility and Interoperability Issues”

- The proliferation of different Android OS versions, diverse hardware, and rapidly evolving OTT platforms can create persistent compatibility and interoperability challenges for both TV and STB manufacturers and end-users

- For instance, frequent firmware updates, inconsistencies between hardware specifications, and lack of standardization in app support or software updates sometimes result in app crashes, diminished user experience, and customer support bottlenecks—a key challenge reported by Android STB manufacturers and global distributors

- These interoperability barriers can make integration with smart home systems, gaming devices, and future OTT services complex, requiring ongoing investment in firmware support and cross-platform compatibility

- Security and data privacy issues—arising from fragmented OS versions and variable update cycles—further complicate large-scale deployment, especially in commercial and hospitality applications

- End-users may also face difficulties in updating devices or accessing the latest features, which can contribute to faster technological obsolescence and inconsistent performance. As the ecosystem grows, manufacturers must continually address these challenges to maintain customer satisfaction and competitive differentiation

Android Set Top Box (STB) and Television (TV) Market Scope

The market is segmented on the basis of type, distribution channel, application, and resolution.

• By Type

On the basis of type, the Android STB and TV market is segmented into Android Set Top Box (STB) and Android TV. The Android TV segment dominated the largest market revenue share of 63.3% in 2024, attributed to its integrated smart capabilities, growing consumer shift toward connected entertainment systems, and ease of use. Android TVs offer direct internet connectivity, pre-installed streaming apps, voice assistant integration, and regular firmware updates—all of which drive demand across households seeking an all-in-one smart viewing experience. The rise of OTT platforms and increasing preference for personalized content also fuel the widespread adoption of Android TVs.

The Android STB segment is projected to witness the fastest CAGR from 2025 to 2032 due to its cost-effectiveness, retrofit suitability, and flexibility in converting traditional televisions into smart units. This segment is especially favored in emerging economies where consumers seek affordable access to digital content without replacing existing TVs. Telecom and cable operators also promote Android STBs through bundled offerings, enhancing user accessibility and accelerating market penetration.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment accounted for the highest revenue share in 2024, supported by strong consumer preference for in-person demonstrations, installation services, and the ability to assess picture quality and features physically before purchase. Brick-and-mortar electronics stores, hypermarkets, and brand outlets continue to play a vital role, especially in regions with limited internet penetration or where consumers value post-sales service reliability.

The Online segment is expected to grow at the fastest rate from 2025 to 2032, driven by increasing digital literacy, attractive discounts, wide product assortments, and easy doorstep delivery. The surge in e-commerce platforms, brand-specific websites, and online-exclusive Android TV and STB models are influencing consumer buying behavior, especially among urban and tech-savvy populations.

• By Application

On the basis of application, the market is divided into Residential and Commercial/Enterprises. The Residential segment dominated the market in 2024, owing to widespread home adoption of Android TVs for streaming, gaming, and smart home integration. With the proliferation of high-speed internet and expanding middle-class income, households are rapidly transitioning to smart TVs and STBs, especially in developing countries. The increasing preference for voice control, content recommendations, and multi-user profiles enhances the value proposition for Android-based systems in residential settings.

The Commercial/Enterprises segment is poised to register the fastest growth through 2032, driven by growing demand from hotels, hospitals, educational institutions, and office spaces for centralized content management, digital signage, and customized broadcasting. Android TVs and STBs allow commercial users to provide a personalized viewing experience, remotely control multiple units, and integrate with existing IT infrastructures, making them highly attractive for professional environments.

• By Resolution

On the basis of resolution, the Android STB and TV market is categorized into HD, Full HD, and 4K and Above. The Full HD segment held the largest share in 2024, as it strikes a balance between affordability and visual clarity, making it a preferred choice for mid-range consumers. Full HD Android devices remain popular across both urban and rural areas due to lower bandwidth requirements compared to 4K and wider compatibility with content platforms.

The 4K and Above segment is anticipated to grow at the highest rate from 2025 to 2032, fueled by rising consumer expectations for superior picture quality, immersive viewing experiences, and the increasing availability of 4K content from platforms such as Netflix, Prime Video, and YouTube. The falling prices of 4K Android TVs and growing support for HDR, Dolby Vision, and advanced upscaling technologies are accelerating their adoption across both premium residential and commercial installations.

Android Set Top Box (STB) and Television (TV) Market Regional Analysis

- North America dominated the Android Set Top Box (STB) and Television (TV) market with the largest revenue share in 2024, driven by the widespread adoption of OTT platforms, high internet penetration, and increasing demand for personalized content

- Consumers in the region prioritize advanced features such as voice control, 4K resolution, and integrated streaming applications, contributing to strong demand for Android TVs

- The presence of major content providers, tech-forward consumers, and premium broadband infrastructure supports the continued dominance of the region in both residential and commercial deployments

U.S. Market Insight

The U.S. Android STB and TV market captured the largest revenue share in 2024 within North America, owing to the rapid growth of streaming culture and the increasing shift away from traditional cable TV. Consumers are drawn to Android-based platforms for their ease of use, access to Google Play content, and compatibility with Google Assistant and Chromecast. The market is further driven by the rising preference for cord-cutting and subscription-based entertainment.

Europe Android STB and TV Market Insight

The Europe market is projected to grow at a robust CAGR throughout the forecast period, fueled by the demand for connected TVs, multilingual content, and growing smart home adoption. A rise in content consumption through platforms such as Netflix, Prime Video, and YouTube is boosting demand for Android TVs and STBs. The region's focus on energy-efficient and space-saving smart devices is also accelerating market growth across residential and hospitality sectors.

U.K. Market Insight

The U.K. Android STB and TV market is expected to expand significantly, supported by a strong shift towards on-demand streaming, growing fiber broadband coverage, and rising smart TV penetration. Consumers increasingly prefer Android-based systems for their affordability and rich app ecosystem. The growing trend of digital-first content consumption is also encouraging the replacement of traditional TVs with Android-based smart units.

Germany Market Insight

Germany’s Android STB and TV market is poised to grow steadily, driven by the demand for high-definition and UHD content, growing digitization, and the country's commitment to energy-efficient consumer electronics. The market benefits from widespread internet access, strong retail networks, and the presence of local and global smart device brands. Android platforms are gaining popularity for their modularity, especially in IPTV and commercial use cases.

Asia-Pacific Android STB and TV Market Insight

The Asia-Pacific market is expected to grow at the fastest CAGR from 2025 to 2032, driven by surging urbanization, increasing disposable income, and a growing preference for smart home devices. Android STBs and TVs are becoming increasingly accessible due to large-scale local manufacturing, cost-effective offerings, and government-backed digital infrastructure initiatives. Demand is surging across both metro cities and tier-II/III towns in countries such as India, China, and Indonesia.

Japan Market Insight

The Japan market is seeing growing adoption of Android TVs driven by consumer demand for high-quality content, smart home integration, and convenience. Japan’s tech-savvy population and compact living spaces favor multifunctional smart devices. With an aging population, the preference for voice-enabled, easy-to-navigate TV systems is accelerating Android TV penetration, especially in residential settings.

China Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, supported by its booming smart home ecosystem, growing OTT user base, and high smartphone penetration. The presence of domestic brands such as Xiaomi, TCL, and Hisense offering affordable Android-based models is a major growth driver. With increasing smart city development and a vast online entertainment consumer base, China continues to lead regional market growth for both Android TVs and STBs.

Android Set Top Box (STB) and Television (TV) Market Share

The Android Set Top Box (STB) and Television (TV) industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Sony Corporation (Japan)

- NVIDIA Corporation (U.S.)

- SAMSUNG (South Korea)

- Airtel India (India)

- Huawei Technologies Co., Ltd. (China)

- ARRIS International Limited (U.S.)

- Toshiba Corporation (Japan)

- Evolution Digital, LLC (U.S.)

- Xiaomi (China)

- Kaonmedia Co., Ltd. (South Korea)

- HUMAX Electronics Co., Ltd. (South Korea)

- Skyworth Group Limited (China)

- SAGEMCOM (France)

- Technicolor (France)

- Shenzhen SDMC Technology Co., Ltd. (China)

- Hisense (China)

- SHARP CORPORATION (Japan)

- TCL (China)

Latest Developments in Global Android Set Top Box (STB) and Television (TV) Market

- In June 2024, ZTE Corporation partnered with Pakistani telecom operator PTCL to launch the B866V2F Set Top Box, branded as the SHOQ TV Box, powered by Android TV. This strategic move is expected to significantly enhance Android TV adoption in emerging markets by offering over 200 live channels and 15,000 hours of on-demand content, setting a new benchmark for localized, content-rich smart TV experiences in South Asia

- In May 2024, ZTE introduced a new Android TV-powered soundbar STB at BroadcastAsia 2024, equipped with Dolby Atmos® for immersive audio. This innovation is likely to accelerate market growth by combining premium sound with smart TV functionality, targeting consumers seeking all-in-one entertainment solutions and reinforcing Android TV’s position in high-end home entertainment setups

- In April 2024, Vantiva announced that it has shipped nearly 22 million Android TV-enabled set-top boxes globally. This milestone highlights the accelerating pace of Android TV integration in the global STB market, reflecting rising demand for certified, OTT-ready platforms. Vantiva’s wide-scale deployment underscores Android TV’s growing dominance in operator-grade entertainment devices

- In August 2022, Samsung revealed the launch of Samsung OLED in Australia, marking an expansion of its 2022 TV line-up. This TV model boasts over 8 million self-lit pixels combined with Quantum Dot Technology, resulting in enhanced brightness, more precise highlights, and true-to-life colors

- In March 2022, GTPL Hathway Limited (GTPL), a prominent provider of digital cable TV and broadband services in India, launched the GTPL Genie, a Hybrid Android TV Set Top Box. This innovative device offers easy access to Live TV and OTT channels at an attractive bulk price. The GTPL Genie combines the reliability of traditional Cable TV with modern features, providing a customizable environment that offers a diverse range of content from OTT entertainment apps. With the GTPL Genie, customers can now enjoy popular OTT content on their existing TV screens, alongside traditional TV channels, as part of GTPL Genie's "Connection Dil Se" offer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Android Set Top Box Stb And Television Tv Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Android Set Top Box Stb And Television Tv Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Android Set Top Box Stb And Television Tv Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.