Global Better For You Snacks Market

Market Size in USD Billion

CAGR :

%

USD

43.19 Billion

USD

61.42 Billion

2024

2032

USD

43.19 Billion

USD

61.42 Billion

2024

2032

| 2025 –2032 | |

| USD 43.19 Billion | |

| USD 61.42 Billion | |

|

|

|

|

Better For You Snacks Market Size

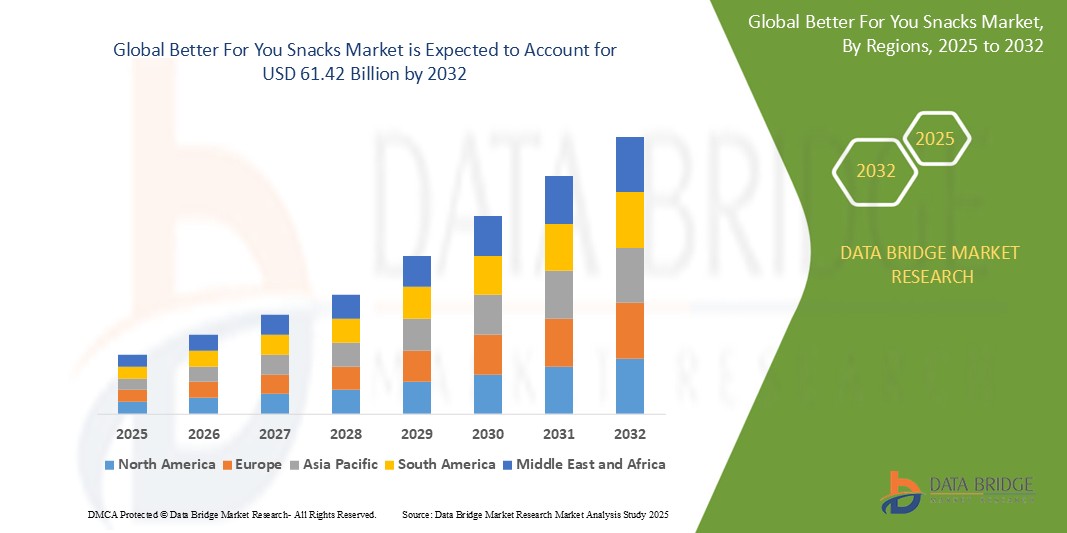

- The global better for you snacks market size was valued at USD 43.19 billion in 2024 and is expected to reach USD 61.42 billion by 2032, at a CAGR of 8.2% during the forecast period

- The market growth is largely fuelled by the rising consumer demand for healthier snacking alternatives, increasing health awareness, and a shift towards clean-label and functional foods that support wellness goals such as weight management, digestive health, and reduced sugar intake

- In addition, the market is driven by innovations in product formulation and packaging, with manufacturers introducing nutrient-rich, gluten-free, and low-calorie options in convenient formats, catering to the on-the-go lifestyles of health-conscious consumers

Better For You Snacks Market Analysis

- The better for you snacks market is witnessing rising popularity across a wide consumer base due to increased focus on mindful eating and growing preference for nutrient-rich alternatives to traditional snacks

- Companies are expanding their product portfolios with innovative offerings such as plant-based, gluten-free, and low-sugar snacks, supported by attractive packaging and accessible pricing to appeal to health-focused consumers

- North America leads the global better-for-you snacks market, accounting for the largest revenue share of 32.4% in 2024. Growth is driven by rising health consciousness and a strong demand for convenient, clean-label snacking options

- Asia-Pacific is expected to be the fastest growing region in the better for you snacks market during the forecast period due to rising health consciousness, growing middle-class population, and increased penetration of clean-label and nutrient-rich products in developing economies

- The savory segment holds the largest market revenue share of 33.5% in 2024, driven by strong consumer preference for flavorful, convenient snacks that offer a balance between taste and health benefits. Increasing product innovation with reduced sodium and natural ingredients further fuels demand within this segment

Report Scope and Better For You Snacks Market Segmentation

|

Attributes |

Better For You Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Better For You Snacks Market Trends

“Growing Demand for Plant-Based and Clean-Label Snack Options”

- Consumers are increasingly shifting towards plant-based and clean-label better for you snacks, seeking products that align with their health goals and ethical values

- This trend is fueled by rising awareness of the health benefits associated with plant-based diets, such as improved digestion and lower cholesterol levels

- Clean-label products, which feature simple, recognizable ingredients and avoid artificial additives, are particularly appealing to health-conscious shoppers

- For instance, brands such as Hippeas offer chickpea-based puffs that are both plant-based and made from organic ingredients, attracting a wide range of consumers

- For instance, the surge in popularity of baked lentil or pea snacks by companies such as Harvest Snaps, which promote both nutrition and transparency in labeling practices

Better For You Snacks Market Dynamics

Driver

“Rising Health Consciousness Among Consumers”

- The rising global health consciousness is driving demand for better for you snacks, as more consumers prioritize nutritious options that support overall well-being without sacrificing taste

- For instance, brands such as KIND and RXBAR have gained popularity by offering snacks with minimal, health-forward ingredients

- The growing prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular conditions is motivating consumers to choose snacks that are low in sugar, fat, and calories but rich in fiber, protein, and essential nutrients

- Increased access to digital health information and social media platforms is empowering consumers to scrutinize product labels and ingredients more carefully, encouraging transparency and accountability in snack offerings

- Brands are responding to these evolving preferences by innovating with clean-label, plant-based, and functional ingredients to appeal to a more health-aware audience

- For instance, companies are incorporating chia seeds, quinoa, and pea protein into snack bars and chips

- Support from public health initiatives and government-led nutrition campaigns is reinforcing consumer interest, helping to transition better for you snacks from a niche segment into a mainstream choice available widely across retail channels

Restraint/Challenge

“High Cost and Limited Accessibility of Premium Ingredients”

- One of the major restraints in the better for you snacks market is the high cost of premium ingredients such as organic, non-GMO, and nutrient-fortified components, which drives up production costs and leads to higher retail prices

- For instance, snacks made with almond flour or chia seeds typically cost more than those using standard ingredients

- These increased costs are a barrier for budget-conscious consumers and can hinder sales growth in price-sensitive regions, where affordability is a critical purchasing factor and premium snack options may be viewed as luxury items

- The specialized production methods required to preserve the nutritional integrity of better for you snacks, such as small-batch processing or the avoidance of artificial preservatives, add complexity and elevate manufacturing expenses

- Distribution challenges further limit market reach, especially in rural or underdeveloped areas where access to health-focused retail options is minimal and logistical networks are not equipped to handle specialized inventory

- Regulatory hurdles surrounding health claims, nutritional labeling, and cross-border compliance add operational strain, making it more difficult for brands to scale efficiently while maintaining consumer trust and legal accuracy across markets

Better For You Snacks Market Scope

The market is segmented based on product type, claim, packaging, and distribution channel.

- By Product Type

On the basis of product type, the better for you snacks market is segmented into frozen & refrigerated, fruit, nuts & seeds, bakery, savory, confectionery, dairy, and others. The savory segment holds the largest market revenue share of 33.5% in 2024, driven by strong consumer preference for flavorful, convenient snacks that offer a balance between taste and health benefits. Increasing product innovation with reduced sodium and natural ingredients further fuels demand within this segment.

The fruit, nuts & seeds segment holds the largest market revenue share in 2024, driven by consumer preference for natural, minimally processed snacks rich in nutrients and fiber. These snacks are widely appreciated for their convenience and perceived health benefits.

- By Claim

On the basis of claim, the market is segmented into gluten-free, low-fat, sugar-free, and others. The low-fat segment dominates the market in 2024 holding a share of 41.2%, supported by growing awareness of fat-related health issues and a shift towards healthier eating habits. Consumers are increasingly opting for snacks that provide indulgence without the guilt, prompting manufacturers to develop a wide range of low-fat snack options.

The sugar-free segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing concerns over sugar consumption and its impact on health, prompting demand for snacks that offer indulgence without added sugars.

- By Packaging

On the basis of packaging, the market is segmented into pouches, boxes, cans, jars, and others. Pouches hold the largest market share of 34% in 2024 due to their convenience, portability, and ability to preserve freshness, making them popular among on-the-go consumers.

The Boxes segment is expected to witness the fastest growth rate during the forecast period, supported by their recyclability and premium appearance, which appeals to environmentally conscious buyers and premium snack brands.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hypermarkets & supermarkets, convenience stores, online, and others. Hypermarkets and supermarkets account for the largest revenue share of 35.8% in 2024, benefiting from wide product availability and consumer trust in established retail outlets.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing e-commerce adoption, growing preference for doorstep delivery, and the ability of online platforms to offer a broader variety of better for you snacks, including niche and specialty products.

Better For You Snacks Market Regional Analysis

- North America leads the global better-for-you snacks market, accounting for the largest revenue share of 32.4% in 2024. Growth is driven by rising health consciousness and a strong demand for convenient, clean-label snacking options

- Consumers in the U.S. and Canada prefer snacks that are low in sugar, gluten-free, and high in protein. The presence of major health-focused brands and advanced retail infrastructure further boost sales

- Increasing awareness of diet-related health issues continues to fuel demand for nutritious alternatives

U.S. Better For You Snacks Market Insight

The U.S. better-for-you snacks market dominates North America, supported by widespread adoption of wellness lifestyles and plant-based diets. Consumers favor snacks that support weight management, heart health, and digestive wellness. E-commerce platforms and health-focused retail chains help make these products accessible nationwide. High disposable income and innovation in snack formulations also play a key role. Demand is especially strong among millennials and Gen Z for functional, on-the-go snacks.

Europe Better For You Snacks Market Insight

Europe is expected to witness the fastest growth rate in the better-for-you snacks market due to strict food safety regulations and rising demand for sustainable, health-conscious products. Consumers are increasingly drawn to snacks with clean labels, no artificial additives, and certified organic ingredients. The push for reduced sugar and salt in diets is encouraging brand innovation. Countries such as Germany, the U.K., and France are driving the regional trend. Increased spending on wellness products further accelerates the market.

U.K. Better For You Snacks Market Insight

The U.K. better-for-you snacks market is expected to witness the fastest growth rate due to increasing consumer awareness of healthy eating and government campaigns promoting low-sugar diets. Popular snack types include high-fiber bars, protein-packed bites, and gluten-free crisps. The market benefits from strong supermarket distribution and a booming online retail environment. Younger consumers and urban dwellers are the primary drivers of this trend. Innovations in plant-based and allergy-friendly snacks are also gaining traction.

Germany Better For You Snacks Market Insight

Germany’s market is expected to witness the fastest growth rate due to consumer demand for functional and organic snack options. Health-conscious Germans prefer snacks with high fiber, reduced sugar, and natural ingredients. A growing number of local brands are focusing on sustainability and eco-friendly packaging. The country’s wellness culture and tech-savvy population support increased adoption. Retailers are offering more shelf space to healthy snack brands across both online and offline channels.

Asia-Pacific Better For You Snacks Market Insight

Asia-Pacific is the fastest-growing region in the better-for-you snacks market, with a projected CAGR of over 9% during the forecast period. Rapid urbanization, rising middle-class income, and increasing health awareness are major growth factors. Countries such as China, India, and Japan are witnessing a shift toward fortified, low-calorie, and traditional-ingredient-based snacks. Government initiatives supporting digital retail and healthy lifestyles aid adoption. Expanding manufacturing capabilities also enhance product availability.

Japan Better For You Snacks Market Insight

Japan’s better-for-you snacks market is expected to witness the fastest growth rate as consumers seek convenient snacks that support immune health, digestion, and energy. Functional ingredients such as probiotics, collagen, and plant proteins are increasingly common. The aging population is driving demand for soft-textured, easy-to-consume snacks with health benefits. Innovation and high-quality standards make Japan a trendsetter in Asia. Integration with wellness and tech products further supports growth.

China Better For You Snacks Market Insight

China is a key region in the Asia-Pacific better-for-you snacks market, supported by a booming middle class and widespread digital adoption. Consumers increasingly favor low-fat, high-protein, and clean-label snacks for both children and adults. Domestic brands and e-commerce giants are launching affordable health-forward options to meet rising demand. Urbanization and busy lifestyles fuel preference for portable, functional snacks. Government efforts to improve national nutrition also play a role.

Better For You Snacks Market Share

The better for you snacks industry is primarily led by well-established companies, including:

- Enjoy Life Foods (U.S.)

- SkinnyPop (Amplify Snack Brands, U.S.)

- Snyder's-Lance (Campbell Soup Company, U.S.)

- Popchips (U.S.)

- Biena Snacks (U.S.)

- Annie's Homegrown (General Mills, U.S.)

- Bare Snacks (U.S.)

- Dang Foods (U.S.)

- Nature’s Bakery (U.S.)

- KIND Snacks (U.S.)

Latest Developments in Global Better For You Snacks Market

- In July 2024, Goodveda launched a new range of healthy baked snacks called 'Milletious,' made from nutritious millet varieties including bajra, jowar, and wheat flour. These lightweight snacks are gluten-free and designed with a low-glycemic index, making them suitable for health-conscious consumers and those managing blood sugar levels. Available in sugar-free and preservative-free options, 'Milletious' comes in four unique flavors: Gazab Garlic, Hotshot Chilli, Mad Masala, and Masoor Methi. This product launch aims to tap into the growing demand for clean-label and nutrient-rich snacks. By introducing millet-based snacks, Goodveda is expanding its footprint in the natural and functional food sector, offering consumers tasty yet wholesome alternatives. This move also caters to diverse taste preferences, broadening its appeal across different consumer groups

- In April 2024, PLANTERS expanded its product portfolio with the launch of Nut Duos, a new snack line that pairs two types of nuts with complementary flavors. The three available flavor combinations—Buffalo Cashews with Ranch Almonds, Cocoa Cashews with Espresso Hazelnuts, and Parmesan Cheese Cashews with Peppercorn Pistachios—offer innovative taste experiences aimed at nut lovers seeking variety and bold flavors. These snacks are available nationwide, reinforcing PLANTERS’ position in the growing market for premium nut-based snacks. The introduction of Nut Duos responds to consumer preferences for convenient, flavorful, and protein-packed options that can fit into an active lifestyle. This product diversification strengthens PLANTERS’ portfolio by blending indulgence with nutrition, appealing to a broader audience seeking better-for-you snacks

- In September 2023, Danone UK&I introduced GetPRO, a new high-protein dairy snack line specifically designed to support fitness enthusiasts and those focused on muscle recovery. The range includes eleven products such as yogurts, mousses, puddings, and beverages, each providing between 15 and 25 grams of protein per serving. The products feature no added sugars and come in low-fat or fat-free options, aligning with consumer demand for healthier indulgences that support active lifestyles. This launch positions Danone as a key player in the functional foods sector, targeting consumers seeking convenient, protein-rich snacks that promote wellness. By addressing the needs of health-conscious customers, GetPRO expands Danone’s offerings beyond traditional dairy products

- In September 2023, Kellanova’s RXBAR collaborated with popular podcaster Maria Menounos to launch a limited edition of RXBAR ManifX bars featuring customizable wrappers for a personalized consumer experience. The bars come in the Chocolate Sea Salt flavor and contain 12 grams of protein, catering to customers looking for both taste and nutritional value. This initiative aims to boost brand engagement through customization, appealing to a younger, digitally-savvy audience. The partnership leverages celebrity influence and personalization trends to create buzz and enhance RXBAR’s market presence. By innovating with packaging and product offerings, RXBAR strengthens its position in the competitive protein bar market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Better For You Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Better For You Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Better For You Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.