Global Black Soldier Fly Market

Market Size in USD Billion

CAGR :

%

USD

11.09 Billion

USD

68.09 Billion

2024

2032

USD

11.09 Billion

USD

68.09 Billion

2024

2032

| 2025 –2032 | |

| USD 11.09 Billion | |

| USD 68.09 Billion | |

|

|

|

|

What is the Global Black Soldier Fly Market Size and Growth Rate?

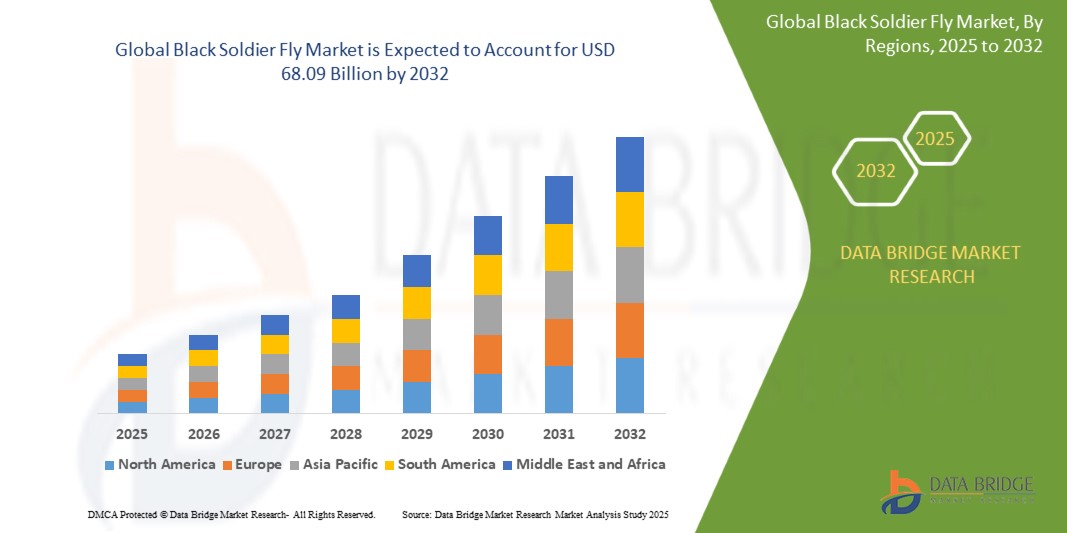

- The global black soldier fly market size was valued at USD 11.09 billion in 2024 and is expected to reach USD 68.09 billion by 2032, at a CAGR of 34.70% during the forecast period

- Increasing global meat demand, growing aquaculture industry, increasing demand from the animal feed industry for alternative proteins is the major factor accelerating the growth of the BSF Market

- Furthermore, rising prices of soybean meal, growing government support for the use of insect meal in livestock feed, and growing investment by key players in the black soldier fly industry are also expected to drive the growth of the black soldier fly market. The use of Maggot BSF and BSF Maggots as sustainable protein sources has gained traction as a cost-effective and eco-friendly alternative for animal nutrition. These Black Soldier Fly Larvae are increasingly recognized as a valuable source of protein, supporting the trend of edible insects in the food and feed sector.

- However, decline in fish consumption, poultry, pork, and beef restrains the black soldier fly market, whereas, non-standardized regulatory framework across Europe will challenge market growth.

What are the Major Takeaways of Black Soldier Fly Market?

- Black Soldier Flies (BSFs) are gaining prominence in waste management and animal feed industries due to their exceptional ability to convert organic waste into high-protein biomass and nutrient-rich compost

- The increasing adoption of BSFs is primarily driven by growing environmental concerns, rising demand for sustainable protein sources in aquaculture and livestock feed, and regulatory support for insect-based protein production

- Commercial interest in black soldier fly farming is expanding rapidly, supported by technological advancements in rearing systems, cost-effective waste conversion models, and rising investments in circular economy solutions

- Europe dominated the black soldier fly market with the largest revenue share of 38.6% in 2024, driven by strong regulatory support for sustainable protein production, growing interest in circular agriculture, and increasing investment in insect farming infrastructure

- Asia-Pacific black soldier fly market is projected to grow at the fastest CAGR of 14.1% from 2025 to 2032, fueled by rising demand for alternative proteins, rapid urbanization, and increasing government focus on food security and waste management

- The Protein Meals segment dominated the black soldier fly market with the largest market revenue share of 52.8% in 2024, owing to its high protein content and suitability as a sustainable alternative to fishmeal and soy-based feeds

Report Scope and Black Soldier Fly Market Segmentation

|

Attributes |

Black Soldier Fly Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Black Soldier Fly Market?

“Rising Demand for Sustainable Protein and Waste Management Solutions”

- A prominent trend driving the black soldier fly market is the increasing use of black soldier fly larvae as a sustainable alternative protein source for animal feed and aquaculture, addressing the global protein shortage and reducing dependence on fishmeal and soy-based feeds

- BSF larvae are also gaining attention for their role in organic waste bioconversion, where they convert food and agricultural waste into high-value products such as biofertilizers and insect biomass. This positions black soldier fly’s at the heart of circular economy initiatives and sustainable agriculture practices

- For instance, Protix (Netherlands) and EnviroFlight (U.S.) are leveraging BSF technology to produce eco-friendly insect-based proteins while addressing food waste and carbon emissions. These companies have built industrial-scale black soldier fly rearing facilities, demonstrating commercial viability

- The integration of automation and AI in black soldier fly farming operations is also becoming a key trend, enabling real-time monitoring of larvae growth, feeding optimization, and predictive analytics to increase production efficiency and reduce labor costs

- This trend is expected to reshape waste management and feed production industries by offering a low-footprint, high-efficiency alternative that aligns with global sustainability and ESG goals

What are the Key Drivers of Black Soldier Fly Market?

- The growing demand for sustainable and alternative protein sources in the livestock, poultry, and aquaculture industries is one of the primary drivers of BSF market growth. Black soldier fly larvae offer high protein content, essential amino acids, and low environmental impact

- Increasing government regulations and bans on landfilling and incineration of organic waste are encouraging industries and municipalities to adopt BSF-based waste management systems, creating new revenue streams through waste valorization

- For instance, in March 2024, French biotech company Ÿnsect received USD 160 million in funding to expand its BSF production facilities focused on sustainable feed and fertilizer production. Such investments reflect rising confidence in insect farming solutions

- Furthermore, the low water and land use requirements of black soldier fly farming, combined with fast reproduction cycles, make them suitable for both urban and rural deployment addressing food security and sustainability challenges across geographies

- Adoption is also being accelerated by growing consumer awareness, technological advancements in automated insect farming, and rising interest in circular bioeconomy practices

Which Factor is challenging the Growth of the Black Soldier Fly Market?

- Despite its advantages, the lack of standardized regulations and approvals for insect-based products in certain regions, particularly in pet food and human consumption markets, poses a significant barrier to the global scale-up of the BSF industry

- For instance, in regions such as the U.S. and parts of Asia, regulatory frameworks for insect proteins remain fragmented or restrictive, slowing commercial adoption and limiting market access for black soldier fly -derived products

- Another challenge lies in scaling production economically, as many BSF startups struggle with high capital expenditure, supply chain constraints, and inconsistent larval yields, which can affect product pricing and quality

- Moreover, consumer acceptance of insect-derived ingredients in food and feed remains a cultural and perceptual hurdle in some markets, requiring education campaigns and transparent labeling practices

- Addressing these challenges through policy support, research collaboration, and infrastructure investment is essential to unlocking the full potential of the black soldier fly market on a global scale

How is the Black Soldier Fly Market Segmented?

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the black soldier fly market is segmented into Protein Meals, Biofertilizers (Frass), Chitin/Chitosan, and Others. The Protein Meals segment dominated the Black Soldier Fly market with the largest market revenue share of 52.8% in 2024, owing to its high protein content and suitability as a sustainable alternative to fishmeal and soy-based feeds. BSF protein meals are widely adopted in aquaculture, poultry, and livestock sectors due to their rich nutritional profile, low environmental impact, and growing regulatory support for insect-based feed.

The Biofertilizers (Frass) segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, driven by increasing awareness about organic farming and sustainable soil health solutions. Frass, a nutrient-rich residue from BSF farming, enhances crop yield and soil microbiota, making it popular among eco-conscious farmers and horticulturists. The expanding use of biofertilizers in integrated farming systems is expected to boost this segment further.

• By Application

On the basis of application, the black soldier fly market is segmented into Animal Feed, Agriculture, Pet Food, Pharmaceutical, Cosmetic, and Biofuel. The Animal Feed segment held the largest market revenue share of 47.6% in 2024, primarily driven by rising demand for sustainable protein sources in aquaculture and livestock feed. The digestibility, amino acid profile, and minimal land/water requirements of BSF larvae make them ideal for replacing traditional feed ingredients.

The Pet Food segment is projected to register the fastest CAGR from 2025 to 2032, due to the rising trend of insect-based, hypoallergenic, and environmentally friendly pet diets. Increasing pet ownership, particularly in urban areas, combined with consumer awareness of sustainable pet nutrition, is fueling demand for black soldier fly -based pet food products. In addition, growing product launches and retail availability in this category are expected to support segment expansion.

Which Region Holds the Largest Share of the Black Soldier Fly Market?

- Europe dominated the black soldier fly market with the largest revenue share of 38.6% in 2024, driven by strong regulatory support for sustainable protein production, growing interest in circular agriculture, and increasing investment in insect farming infrastructure

- Countries across the region are prioritizing the use of black soldier fly larvae for organic waste bioconversion and animal feed, in alignment with the European Green Deal and Farm to Fork Strategy. These initiatives encourage sustainable practices and open new funding avenues for BSF companies

- Europe’s robust research ecosystem, combined with widespread acceptance of insect-based products in feed and fertilizer markets, has established the region as a global leader in black soldier fly innovation and commercialization

Germany Black Soldier Fly Market Insight

Germany black soldier fly market captured the largest revenue share in Europe in 2024, supported by the country’s commitment to waste reduction and circular economy models. Germany's advanced waste management infrastructure, combined with government incentives for sustainable agriculture, is driving adoption of black soldier fly -based solutions in animal feed and biofertilizer production. The presence of prominent biotech firms and a focus on environmental compliance continue to fuel market expansion.

France Black Soldier Fly Market Insight

The France black soldier fly market is anticipated to grow at a significant CAGR during the forecast period, backed by strong public and private investments in insect protein production. Government-backed projects and collaborations with research institutions are accelerating black soldier fly innovation in sectors such as aquaculture feed and soil health. France’s proactive stance on reducing food waste and reliance on imported feed ingredients further supports demand.

Netherlands Black Soldier Fly Market Insight

The Netherlands black soldier fly market is witnessing strong growth due to its reputation as a hub for agricultural technology and sustainable farming. Dutch companies such as Protix are leading global BSF innovation, focusing on scaling production and expanding product applications. The country’s dense agricultural sector and strong export capabilities make it a key player in the European black soldier fly ecosystem.

Which Region is the Fastest Growing in the Black Soldier Fly Market?

Asia-Pacific black soldier fly market is projected to grow at the fastest CAGR of 14.1% from 2025 to 2032, fueled by rising demand for alternative proteins, rapid urbanization, and increasing government focus on food security and waste management. Countries such as China, India, and Southeast Asian nations are investing heavily in BSF startups and research, supported by policies promoting organic waste recycling and sustainable agriculture. The expanding middle-class population, combined with rising meat consumption and growing awareness of environmental issues, is boosting demand for BSF-derived animal feed and biofertilizers. Manufacturing advancements and favorable climate conditions also enable cost-effective BSF farming across the region.

China Black Soldier Fly Market Insight

The China black soldier fly market held the largest share within Asia-Pacific in 2024, driven by the country’s vast food production needs, expanding aquaculture sector, and strong government support for smart agriculture. Local manufacturers are scaling up BSF farming to meet both domestic and export demands, leveraging China’s manufacturing capabilities and urban food waste streams.

India Black Soldier Fly Market Insight

The India black soldier fly market is expected to expand rapidly during the forecast period, propelled by increasing concerns over agricultural sustainability and waste management. The government’s focus on organic farming and rural entrepreneurship is encouraging small-scale black soldier fly operations, particularly in animal husbandry and compost production. Educational initiatives and startup funding are also promoting early adoption.

Japan Black Soldier Fly Market Insight

The Japan black soldier fly market is growing steadily, supported by the country's push for sustainable food sources and smart agriculture. High-tech automation in BSF farming is being integrated into Japan’s advanced waste management systems. With limited arable land and growing protein demand, Japan is turning to BSF as a viable and eco-friendly solution.

Which are the Top Companies in Black Soldier Fly Market?

The black soldier fly industry is primarily led by well-established companies, including:

- Applied Bio-nomics Ltd. (Canada)

- Biobest (Belgium)

- Bioline AgroSciences Ltd. (U.K.)

- Fargro Ltd (U.K.)

- Andermatt Biocontrol AG (Switzerland)

- ARBICO Organics (U.S.)

- BioBee Sde Eliyahu (Israel)

- Biological Services (Australia)

- Dudutech (Kenya)

- NATURAL INSECT CONTROL (Canada)

- Tip Top Bio-Control (U.S.)

- Beneficial Insectary, Inc. (U.S.)

- Bionema Limited (U.K.)

- Koppert Biological Systems (Netherlands)

- Bionema (U.K.)

- Vegalab SA (Switzerland)

- STK bio-ag technologies (Israel)

- Corteva (U.S.)

- Bayer AG (Germany)

What are the Recent Developments in Global Black Soldier Fly Market?

- In March 2025, Scottish insect genetics company Beta Bugs secured investment led by Tricapital Agents along with Scottish Enterprise, following a previous funding round two years prior. The capital will be used to expand production and strengthen Beta Bugs’ leadership in Black Soldier Fly genetics. This funding highlights growing investor confidence in the scalability and genetic innovation of BSF technology

- In October 2024, the Central Marine Fisheries Research Institute (CMFRI) developed an eco-friendly fish feed made from Black Soldier Fly larvae meal and transferred the technology to Amala Ecoclean, a sustainability-focused start-up. This alternative protein feed aims to reduce reliance on conventional fishmeal, promoting sustainable aquaculture. This initiative marks a significant advancement in reducing ecological pressure from traditional feed sources

- In August 2024, Innovafeed partnered with U.S.-based pet food companies Jiminy’s and Arch to launch co-branded insect-based dog food under the “Powered by Hilucia” label, promoting the nutritional and environmental benefits of BSF-derived ingredients. This collaboration underscores the growing acceptance of insect protein in mainstream pet nutrition markets

- In November 2023, Insectum introduced a cost-efficient and modular Black Soldier Fly facility designed to reduce capital expenditure by 75% for its users, offering portability and scalability. This development supports wider adoption of BSF farming through accessible and budget-friendly infrastructure solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.