Global Insect Protein Market

Market Size in USD Billion

CAGR :

%

USD

1.05 Billion

USD

6.16 Billion

2024

2032

USD

1.05 Billion

USD

6.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.05 Billion | |

| USD 6.16 Billion | |

|

|

|

|

Insect Protein Market Size

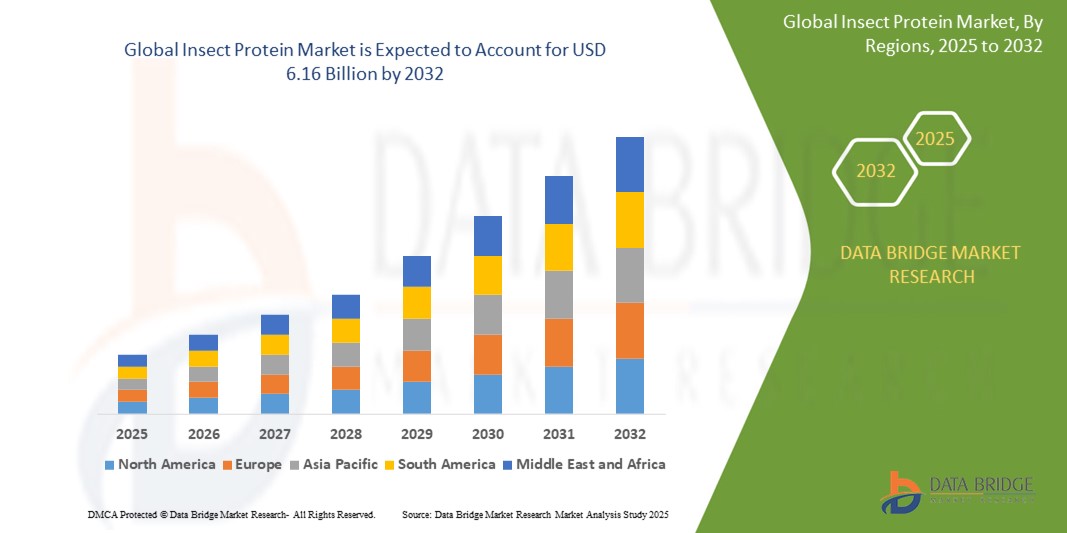

- The global Insect Protein market was valued at USD 1.05 billion in 2024 and is expected to reach USD 6.16 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 24.70%, primarily driven by the rising demand for sustainable and alternative protein sources

- This growth is driven by factors such as the increasing global demand for protein, environmental sustainability concerns, and the growing interest in insect-based protein as a cost-effective and eco-friendly solution

Insect Protein Market Analysis

- The global insect protein market is experiencing significant growth due to increased consumer awareness about sustainable food sources and the rising demand for alternative proteins. This market benefits from the environmental advantages of insect farming, such as lower land and water usage compared to traditional livestock production

- The market is diversified with multiple applications, including food and beverage, animal feed, and pharmaceuticals and cosmetics. These applications cater to different consumer needs, ranging from protein-rich snacks to animal feed and even beauty products containing insect protein

- Technological advancements in insect farming and protein extraction processes are fueling market growth. Innovations in processing have led to products such as protein powders and energy bars, which appeal to health-conscious consumers seeking sustainable protein options

- For Instance, market progress is the partnership between Innova Feed and Archer Daniels Midland Company, which aims to establish a facility in the U.S. to boost insect protein production capacity, addressing the growing demand for sustainable protein sources in agriculture

- As the market matures, major players are expanding their production capacities and focusing on product innovation to cater to the increasing global demand for eco-friendly protein alternatives. This is driving further investments in insect protein production and its application across various industries

Report Scope and Insect Protein Market Segmentation

|

Attributes |

Insect Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Growing Demand For Alternative Protein Sources |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Insect Protein Market Trends

“Technological Innovations in Insect Farming”

- Technological innovations are transforming insect farming, making it more efficient and scalable

- Companies such as Entoverse are developing AI systems that monitor insect behavior and health by analyzing environmental factors and communication patterns, leading to optimized breeding conditions and reduced mortality rates

- Ÿnsect has constructed a fully automated facility in Amiens, France, utilizing robotic systems for tasks such as feeding, sorting, and habitat cleaning of mealworms, aiming to produce 100,000 tons of insect products annually

- Collaborations such as that between Bug Mars and Entoprot are introducing precision bioreactors that enable continuous, optimized insect production, enhancing yield consistency and scalability in farming operations

- The CoRoSect project has implemented specialized robotic systems, such as the D-Robot, to handle crate management in insect farming, achieving success rates above 80% in load positioning, thereby increasing operational efficiency

Insect Protein Market Dynamics

Driver

“Eco-Friendly Insect-Based Proteins”

- Insect protein market is the increasing demand for sustainable and alternative protein sources due to growing environmental concerns. Traditional livestock farming requires significant resources such as land, water, and feed, contributing to environmental degradation. In contrast, insects are highly efficient protein sources that need less land, water, and food, making them a more sustainable option for protein production

- As consumers become more aware of their environmental impact, they are shifting towards more eco-friendly alternatives such as insect-based proteins. This shift is not only occurring in food production but also in animal feed and other industrial uses, where insect proteins are gaining popularity for their minimal ecological footprint

- For instance, in November 2020, Innova Feed partnered with Archer Daniels Midland Company to expand their insect protein production capacity. This collaboration is set to increase production by establishing a new facility in Illinois, U.S., with an annual output of 60,000 tons of insect protein, which highlights the growing market interest in sustainable protein alternatives

- The rising concerns about food security and the need for alternative sources of protein in the face of global population growth are pushing governments, corporations, and consumers to adopt insect-based proteins as viable solutions to meet future protein demand while mitigating environmental harm

- As a result, insect protein is gradually becoming a mainstream ingredient in food and feed industries, and companies are investing in technology and infrastructure to scale up production and meet the rising consumer demand for sustainable protein sources

Opportunity

“Growing Demand for Alternative Protein Sources”

- A major opportunity in the global insect protein market lies in the growing demand for alternative protein sources, especially as concerns about food security and sustainability continue to rise. The increasing popularity of plant-based diets and the need for more eco-friendly protein alternatives are driving the market forward

- Consumers are becoming more conscious of their environmental impact, seeking products that align with sustainable practices. Insects require minimal resources for farming compared to traditional livestock, offering an efficient and environmentally friendly alternative

- For instance, Innova Feed, a leader in insect protein production, partnered with Archer Daniels Midland to establish a facility in Illinois to meet the rising demand for sustainable protein. This partnership aims to produce over 60,000 tons of insect protein annually, positioning the company to capitalize on growing consumer interest

- As consumer behavior shifts towards sustainable protein sources, the insect protein market is increasingly seen as a viable solution for reducing the environmental footprint of food production. Companies are focusing on expanding product offerings, from protein bars to animal feed, to cater to a wider audience

- Furthermore, the increasing adoption of insect protein in animal feed and pet food industries presents significant growth potential. As more regions embrace insect protein as a key ingredient in feed formulations, market players are investing in technology and infrastructure to scale up production and meet demand

Restraint/Challenge

“Regulatory Barriers”

- Regulatory barriers significantly influence the development and adoption of insect protein in global markets

- For Instance, In the European Union, insect-based products are categorized as novel foods, requiring comprehensive safety assessments before market entry. While the EU has approved certain species such as the house cricket and yellow mealworm for human consumption, the approval process is stringent and can be time-consuming, potentially delaying product launches and limiting market growth

- Regulations governing the use of insect protein in animal feed vary by region. For instance, the EU has recently permitted the use of insect proteins in poultry and pig feed, marking a significant development for the industry. However, in the UK, such approvals are pending, hindering the growth potential of the insect protein market compared to other European countries

- Cultural acceptance poses a challenge, especially in Western countries where consumers are largely unfamiliar with entomophagy.

- The absence of a unified international regulatory framework leads to market fragmentation. Inconsistencies across countries regarding the approval and classification of insect-based products complicate international trade and limit the scalability of insect farming operations

- Navigating these regulatory challenges requires ongoing dialogue between industry stakeholders and regulators to harmonize standards, streamline approval processes, and foster consumer acceptance, thereby unlocking the full potential of insect protein in global markets

Insect Protein Market Scope

The market is segmented on the basis product type, insect type, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Insect Type |

|

|

By Application |

|

|

By Distribution Channel |

|

Insect Protein Market Regional Analysis

“Europe is the Dominant Region in the Insect Protein Market”

- Europe currently holds the dominant share in the global insect protein market

- Countries such as the Netherlands, France, and Germany lead the way due to strong government support, high consumer awareness regarding sustainable food sources, and established insect farming infrastructure

- The increasing regulatory support for insect protein in Europe has accelerated adoption, especially within the food and feed industries

- Europe’s dominance is driven by demand for eco-friendly, high-protein alternatives and its well-established supply chains, making it a leader in innovation and market penetration

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific (APAC) is expected to be the fastest growing region in the insect protein market

- This growth is fueled by rising demand in countries such as China, India, and Japan, driven by increasing protein requirements, a large population base, and growing concerns about sustainability

- APAC’s rapid urbanization, expansion of the animal feed market, and a rise in alternative protein consumption are key drivers

- Government initiatives in APAC are also aligning with global trends towards eco-friendly agricultural practices, positioning this region for rapid growth in the insect protein market over the forecast period

Insect Protein Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Aspire Food Group (U.S.)

- EntomoFarms (Canada)

- Protifarm (Netherlands)

- Jimini’s (France)

- Chapul Cricket Protein (U.S.)

- Swarm Nutrition GmbH (Germany)

- AgriProtein Holdings Ltd. (South Africa)

- EnviroFlight LLC (U.S.)

- Innovafeed (France)

- Ÿnsect (France)

- Hexafly (Ireland)

- Protix (Netherlands)

- All Things Bugs, LLC (U.S.)

Latest Developments in Global Insect Protein Market

- In February 2024, Innovafeed launched a new brand to leverage insects' potential in aquaculture and monogastric nutrition. Their new product line includes insect oil tailored for aquaculture and insect protein designed for monogastric animals, expanding their portfolio to address sustainable protein needs across different animal farming sectors

- In October 2023, Tyson Foods, a leading U.S. meat producer, announced an investment in Protix, a Netherlands-based company specializing in insect ingredients. This partnership includes establishing a U.S. factory utilizing animal waste to cultivate black soldier flies. These insects are processed into feed for pets, poultry, and fish. However, Tyson Foods clarified that their efforts primarily focus on using insect protein as an ingredient rather than directly for human consumption

- In April 2022, Global Bugs formed a strategic alliance with Innovative Natural Solutions to jointly promote, support, manufacture, and distribute nutritious food items integrating plant-based components and crickets

- In February 2022, marked Innovafeed's collaboration with ADM, offering black soldier fly protein to develop high-quality, nutritious pet food with a reduced carbon footprint

- In December 2021, Neo Bites launched the first line of functional dog food toppers crafted from insect protein, aiming to enhance dog health and foster environmental sustainability in the pet food industry

- In November 2021, Ÿnsect debuted Bernie’s, an ultra-premium dog feed luxury brand in the U.S. market, in partnership with Pure Simple True LLC

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Insect Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Insect Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Insect Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.