Global Cardiac Rhythm Management Devices Market

Market Size in USD Billion

CAGR :

%

USD

21.10 Billion

USD

31.77 Billion

2024

2032

USD

21.10 Billion

USD

31.77 Billion

2024

2032

| 2025 –2032 | |

| USD 21.10 Billion | |

| USD 31.77 Billion | |

|

|

|

|

Cardiac Rhythm Management Devices Market Size

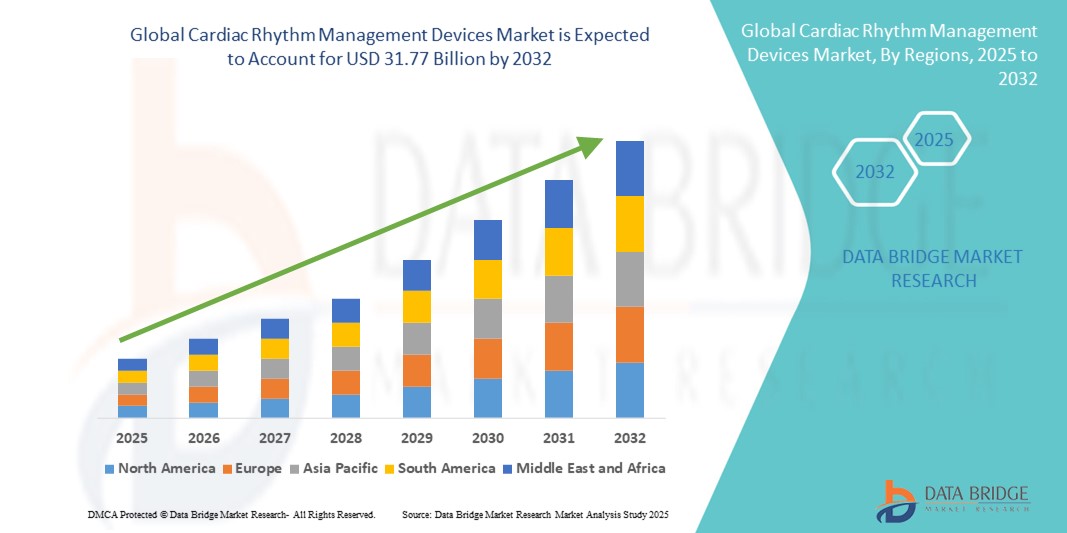

- The global cardiac rhythm management devices market size was valued at USD 21.10 billion in 2024 and is expected to reach USD 31.77 billion by 2032, at a CAGR of 5.25% during the forecast period

- The market growth is primarily driven by the rising prevalence of cardiovascular diseases, aging populations, and increased awareness regarding arrhythmia management, prompting greater adoption of implantable and external cardiac rhythm devices

- In addition, advancements in device technology, including leadless pacemakers, wearable defibrillators, and remote monitoring systems, along with demand for minimally invasive and patient-friendly solutions, are positioning CRM devices as essential tools for effective cardiac care. These combined factors are propelling market expansion and fueling overall industry growth

Cardiac Rhythm Management Devices Market Analysis

- Cardiac rhythm management (CRM) devices, including pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices, are critical for managing arrhythmias and other heart rhythm disorders, providing life-saving therapy and continuous monitoring in both hospital and home settings

- The rising prevalence of cardiovascular diseases, aging populations, and increasing awareness about arrhythmia management are the primary drivers of CRM device adoption, alongside technological advancements in minimally invasive procedures and remote monitoring capabilities

- North America dominated the cardiac rhythm management devices market with the largest revenue share of 39% in 2024, supported by early adoption of advanced cardiac technologies, high healthcare expenditure, and a strong presence of major device manufacturers, with the U.S. witnessing significant growth in device implantation driven by innovations in leadless pacemakers and remote monitoring solutions

- Asia-Pacific is expected to be the fastest growing region in the cardiac rhythm management devices market during the forecast period, attributed to rising cardiovascular disease incidence, expanding healthcare infrastructure, and increasing awareness of early diagnosis and treatment options

- Pacemakers segment dominated the cardiac rhythm management devices market with a market share of 42.2% in 2024, driven by their established efficacy in treating bradyarrhythmias and wide acceptance in both emerging and developed countries

Report Scope and Cardiac Rhythm Management Devices Market Segmentation

|

Attributes |

Cardiac Rhythm Management Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cardiac Rhythm Management Devices Market Trends

Advancements in Remote Monitoring and AI-Enabled Device Management

- A prominent trend in the global CRM devices market is the increasing integration of artificial intelligence (AI) and remote monitoring capabilities into cardiac devices, enhancing patient management, early detection of arrhythmias, and personalized therapy adjustments

- For instance, Medtronic’s MyCareLink Heart remote monitoring system allows physicians to track pacemaker and ICD performance in real time, enabling timely interventions and improved patient outcomes. Similarly, Abbott’s CardioMEMS HF System provides continuous hemodynamic monitoring to optimize heart failure management

- AI-enabled CRM devices can analyze large volumes of patient data to predict abnormal heart rhythms, optimize device settings, and alert clinicians to potential issues. Some advanced pacemakers and ICDs use AI algorithms to detect subtle changes in cardiac activity, reducing hospitalizations and enhancing patient safety

- Integration with mobile and digital health platforms allows patients to engage with their therapy, receive automated alerts, and share real-time data with healthcare providers, creating a more connected and proactive care experience

- This trend toward intelligent, patient-centric, and interconnected devices is reshaping expectations for cardiac care. Companies such as Boston Scientific are developing AI-assisted CRM devices that provide predictive analytics, remote management, and customizable therapy adjustments

- The adoption of AI-enabled, remotely monitored CRM devices is rapidly increasing across hospitals and home care settings as clinicians and patients prioritize convenience, continuous monitoring, and proactive disease management

Cardiac Rhythm Management Devices Market Dynamics

Driver

Rising Prevalence of Cardiovascular Diseases and Awareness of Arrhythmia Management

- The growing incidence of cardiovascular disorders, including arrhythmias, heart failure, and sudden cardiac arrest, is a key driver of CRM device adoption globally

- For instance, in March 2024, Boston Scientific launched an enhanced leadless pacemaker system to improve patient outcomes and expand device accessibility. Initiatives such as these by key companies are expected to fuel CRM device market growth during the forecast period

- Increased awareness of early diagnosis, regular monitoring, and treatment of heart rhythm disorders is encouraging both physicians and patients to adopt advanced CRM technologies

- Continuous improvements in device safety, efficacy, and patient comfort, combined with rising investments in healthcare infrastructure, particularly in emerging regions, are driving widespread adoption

- Patient demand for minimally invasive, easy-to-manage devices with features such as remote monitoring, battery longevity, and automated therapy adjustments is further propelling market growth

Restraint/Challenge

Device Costs and Regulatory Compliance Hurdles

- The high cost of advanced CRM devices, including pacemakers, ICDs, and CRT systems, can limit adoption, particularly in price-sensitive or developing markets. Premium features such as leadless designs, AI-based algorithms, and remote monitoring contribute to higher upfront expenses

- In addition, stringent regulatory approvals and compliance requirements across regions pose challenges for manufacturers, potentially delaying product launches and increasing development costs

- Safety concerns related to device malfunction, battery failure, or inappropriate shocks from ICDs may create hesitancy among patients and healthcare providers.

- For instance, in January 2024, a recall of certain Medtronic ICD models due to battery depletion issues temporarily affected market confidence and highlighted the importance of device reliability. Companies such as Abbott and Medtronic address these issues through rigorous clinical testing, software updates, and patient education programs

- While costs are gradually decreasing and reimbursement policies are improving in several regions, the perceived premium for advanced CRM devices may still limit adoption among certain patient groups

- Overcoming these challenges through cost reduction strategies, enhanced regulatory guidance, and robust patient support programs will be crucial for sustaining market growth

Cardiac Rhythm Management Devices Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the cardiac rhythm management devices market is segmented into pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) devices. The pacemakers segment dominated the market with the largest revenue share of 42.2% in 2024, driven by their established efficacy in treating bradyarrhythmias and wide acceptance across both emerging and developed regions. Pacemakers are often preferred for their minimally invasive implantation, long-term reliability, and proven clinical outcomes. The segment also benefits from technological advancements such as leadless pacemakers, extended battery life, and remote monitoring capabilities, which enhance patient convenience and adherence. Strong awareness among cardiologists and patients about bradycardia management further supports pacemaker adoption. Government initiatives and insurance coverage in key regions facilitate access to these devices, sustaining growth.

The defibrillators segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by rising incidences of sudden cardiac arrest and ventricular arrhythmias. Implantable cardioverter-defibrillators (ICDs) provide immediate therapy for life-threatening arrhythmias, and innovations such as subcutaneous ICDs and wearable defibrillators are increasing adoption. Growing awareness among high-risk populations and expanding reimbursement policies are accelerating the uptake of defibrillators, particularly in emerging markets. Technological integration with remote monitoring platforms also enhances patient safety and physician oversight, contributing to strong market growth.

- By Application

On the basis of application, the cardiac rhythm management devices market is segmented into bradycardia, tachycardia, heart failure, and others. The bradycardia segment dominated the market in 2024, primarily due to the high prevalence of sinus node dysfunction and atrioventricular block among aging populations. Pacemakers remain the standard treatment, providing effective symptom management and improving quality of life. Increasing geriatric population and awareness regarding early diagnosis of slow heart rhythms drive the segment’s revenue. Technological advances, including leadless and MRI-compatible pacemakers, further enhance treatment efficacy. Cardiologists prioritize device therapy for bradycardia management due to proven clinical outcomes and guideline recommendations.

The heart failure segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing adoption of cardiac resynchronization therapy (CRT) devices. CRT improves cardiac function, reduces hospitalizations, and enhances survival in heart failure patients with conduction abnormalities. Rising prevalence of heart failure, combined with advancements such as multipoint pacing and remote monitoring, supports rapid growth. Awareness campaigns and guideline-based recommendations from professional societies further encourage CRT adoption globally.

- By End User

On the basis of end user, the cardiac rhythm management devices market is segmented into hospitals, home care settings, and ambulatory care settings. The hospital segment dominated the market in 2024 due to the requirement for specialized implantation procedures, post-operative monitoring, and access to advanced clinical expertise. Hospitals offer comprehensive cardiac care facilities, including electrophysiology labs and cardiac ICUs, facilitating higher CRM device adoption. Collaborations with device manufacturers and clinical training programs for healthcare professionals enhance hospital capabilities, supporting revenue dominance.

The home care settings segment is expected to witness the fastest growth rate during the forecast period, driven by increasing adoption of remote monitoring technologies and the rising preference for patient-centric care. Wearable defibrillators, remote pacemaker monitoring, and telehealth integration allow patients to manage cardiac conditions safely at home. Growing geriatric populations and chronic disease management initiatives further contribute to segment growth. The convenience of continuous monitoring, reduced hospital visits, and improved patient engagement are accelerating the uptake of CRM devices in home care environments.

Cardiac Rhythm Management Devices Market Regional Analysis

- North America dominated the cardiac rhythm management devices market with the largest revenue share of 39% in 2024, supported by early adoption of advanced cardiac technologies, high healthcare expenditure, and a strong presence of major device manufacturers

- Patients and healthcare providers in the region highly value advanced features such as leadless pacemakers, implantable cardioverter-defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and remote monitoring systems that enable timely interventions and improved patient outcomes

- The market growth is further supported by well-established reimbursement policies, high healthcare spending, and a strong presence of major device manufacturers such as Medtronic, Abbott, and Boston Scientific, which continuously invest in innovation and clinical research

U.S. Cardiac Rhythm Management Devices Market Insight

The U.S. cardiac rhythm management devices market captured the largest revenue share in 2024 within North America, driven by the high prevalence of cardiovascular diseases and the widespread adoption of advanced cardiac technologies. Increasing awareness regarding arrhythmia management and preventive cardiac care is prompting both patients and healthcare providers to adopt pacemakers, ICDs, and CRT devices. The growing integration of remote monitoring systems and AI-enabled devices enhances patient management and allows timely intervention, further supporting market expansion. In addition, robust healthcare infrastructure, well-established reimbursement policies, and the presence of major CRM device manufacturers, such as Medtronic and Abbott, continue to propel U.S. market growth. The convenience of home monitoring solutions and minimally invasive implantation procedures is encouraging wider acceptance among patients, especially the elderly population. Overall, the U.S. remains a key growth driver in the North American CRM devices market.

Europe Cardiac Rhythm Management Devices Market Insight

The Europe cardiac rhythm management devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising cardiovascular disease prevalence and increasing adoption of advanced therapeutic solutions. Strong regulatory frameworks, healthcare initiatives promoting early detection and treatment of arrhythmias, and growing awareness among clinicians and patients are fostering CRM device adoption. The market is witnessing significant growth across hospitals, ambulatory care, and home monitoring applications, with devices being incorporated into both new healthcare facilities and upgrades of existing cardiac care units. Europe’s emphasis on innovation, patient safety, and integration of digital health technologies is also supporting market expansion.

U.K. Cardiac Rhythm Management Devices Market Insight

The U.K. cardiac rhythm management devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing incidences of arrhythmias and heart failure and the rising demand for advanced, patient-centric cardiac therapies. Healthcare providers are focusing on early diagnosis, personalized therapy, and integration of remote monitoring solutions, boosting device adoption. The U.K.’s robust healthcare infrastructure, coupled with favorable reimbursement policies and growing patient awareness, further stimulates market growth. In addition, the rising geriatric population and increasing investment in home-based cardiac care solutions support the adoption of pacemakers, ICDs, and CRT devices.

Germany Cardiac Rhythm Management Devices Market Insight

The Germany cardiac rhythm management devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of cardiovascular health and advanced treatment options. Germany’s well-developed healthcare infrastructure, combined with a focus on technological innovation and patient safety, promotes the adoption of CRM devices in hospitals and specialized cardiac centers. Integration of remote monitoring systems and AI-enabled devices is gaining traction, providing real-time insights and improved patient outcomes. Moreover, the focus on minimally invasive procedures and guideline-based therapy supports sustained market growth.

Asia-Pacific Cardiac Rhythm Management Devices Market Insight

The Asia-Pacific cardiac rhythm management devices market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising cardiovascular disease prevalence, increasing geriatric population, and rapid urbanization in countries such as China, Japan, and India. Growing awareness regarding arrhythmia diagnosis and management, along with expanding healthcare infrastructure, is fueling CRM device adoption. Government initiatives promoting digital health and telemedicine, coupled with increasing affordability and accessibility of advanced devices, are driving market growth. Emerging countries in APAC are witnessing a surge in hospitals and clinics equipped with advanced electrophysiology and cardiac care units.

Japan Cardiac Rhythm Management Devices Market Insight

The Japan cardiac rhythm management devices market is gaining momentum due to the country’s aging population, high incidence of cardiovascular disorders, and focus on advanced healthcare solutions. Adoption of pacemakers, ICDs, and CRT devices is rising, particularly in hospitals and home care settings that integrate remote monitoring and telehealth systems. Japan’s emphasis on technology-driven cardiac care, combined with high patient awareness and government healthcare initiatives, is boosting market growth. In addition, the demand for minimally invasive, easy-to-use, and AI-enabled devices supports adoption in both residential and clinical care environments.

India Cardiac Rhythm Management Devices Market Insight

The India cardiac rhythm management devices market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to increasing cardiovascular disease prevalence, rising healthcare expenditure, and rapid urbanization. Expanding hospital infrastructure and growing awareness of arrhythmia management are driving device adoption across hospitals, ambulatory care, and home monitoring settings. The push towards digital health and telemedicine, combined with affordability improvements and the presence of domestic and multinational device manufacturers, is supporting market growth. Furthermore, India’s increasing geriatric population and rising demand for minimally invasive and remotely monitored cardiac therapies are key factors propelling the CRM devices market.

Cardiac Rhythm Management Devices Market Share

The cardiac rhythm management devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- BIOTRONIK SE & Co. KG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- LivaNova plc (U.K.)

- MicroPort Scientific Corporation (China)

- Terumo Corporation (Japan)

- Schiller AG (Switzerland)

- Stryker Corporation (U.S.)

- Nihon Kohden Corporation (Japan)

- Mindray Medical International Limited (China)

- Progetti Srl (Italy)

- CU Medical Systems Inc. (South Korea)

- Cardiac Science Corporation (U.S.)

- AliveCor, Inc. (U.S.)

- Impulse Dynamics (Belgium)

- Oscor Inc. (U.S.)

- Pacetronix (India)

What are the Recent Developments in Global Cardiac Rhythm Management Devices Market?

- In July 2025, Philips introduced its ECG AI Marketplace, providing cardiac care teams with direct access to a broad portfolio of AI tools at the point of care. This platform aims to reduce the time clinicians spend reviewing ECG results, facilitating faster diagnoses and improving operational efficiency by managing vendor connections for each AI solution

- In March 2025, Abbott announced that it had received CE Mark approval for its Volt™ Pulsed Field Ablation (PFA) System. This system offers a novel therapy option for patients with abnormal heart rhythms, such as atrial fibrillation. PFA utilizes high-energy electrical pulses for ablation procedures, potentially providing benefits in targeting and treating heart tissue more precisely

- In June 2024, Stryker launched the LIFEPAK 35 monitor/defibrillator to support advanced life support in both EMS and hospital settings. The device features an intuitive touchscreen, real-time data connectivity, and an ergonomic design. This launch underscores the ongoing focus on enhancing the usability and efficiency of external defibrillators for frontline healthcare providers

- In January 2024, Medtronic announced that its next-generation Micra AV2 and Micra VR2 leadless pacemakers received CE Mark approval. These devices offer extended battery life and enhanced programmability compared to their predecessors, maintaining the benefits of leadless pacing such as reduced complications and improved patient outcomes. The approval marks a significant step in advancing leadless pacing technology in Europe

- In July 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved the AVEIR dual chamber (DR) leadless pacemaker system. This device is the world's first dual-chamber leadless pacemaker and offers the option to implant an atrial or ventricular device alone, or both for dual-chamber support. This innovation aims to provide a less invasive solution for patients with slow heart rhythms, reducing the complications associated with traditional transvenous leads

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.