Global Chinese Hamster Ovary Cho Hormones Market

Market Size in USD Million

CAGR :

%

USD

24.70 Million

USD

43.80 Million

2024

2032

USD

24.70 Million

USD

43.80 Million

2024

2032

| 2025 –2032 | |

| USD 24.70 Million | |

| USD 43.80 Million | |

|

|

|

|

Chinese Hamster Ovary (CHO) Hormones Market Size

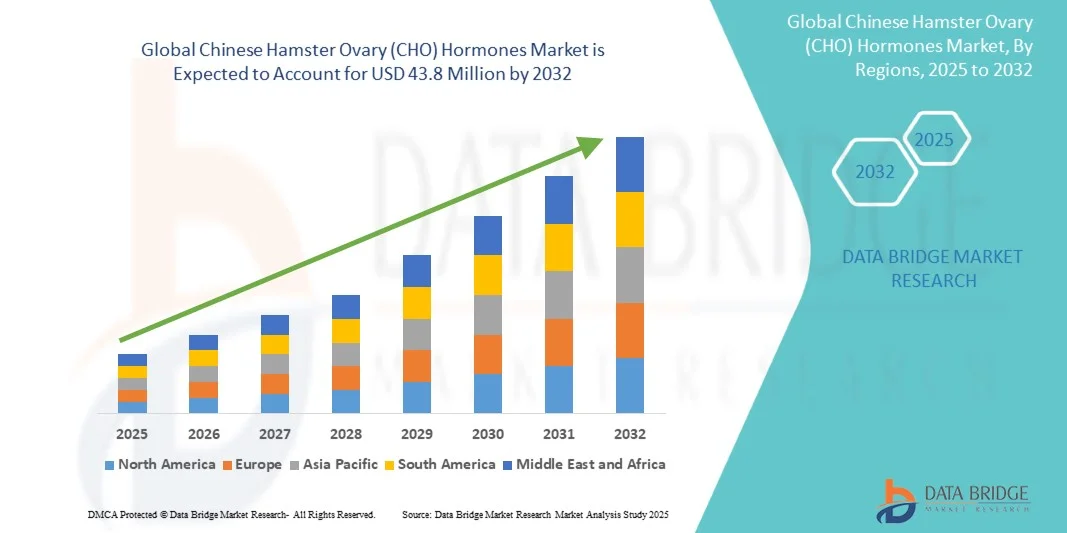

- The global Chinese Hamster Ovary (CHO) hormones market size was valued at USD 24.7 million in 2024 and is expected to reach USD 43.8 million by 2032, at a CAGR of 7.42% during the forecast period

- The market expansion is primarily driven by the increasing use of CHO cell lines for the production of complex therapeutic hormones, owing to their high productivity, human-such as glycosylation, and scalability advantages in biopharmaceutical manufacturing

- Moreover, rising demand for recombinant hormones in treating anemia, infertility, and growth disorders, coupled with ongoing advancements in bioprocessing technologies and biosimilar development, is strengthening the adoption of CHO-based expression systems, thereby fueling the overall market growth

Chinese Hamster Ovary (CHO) Hormones Market Analysis

- CHO hormones, produced using Chinese Hamster Ovary cell lines, play a crucial role in the large-scale manufacturing of recombinant therapeutic hormones such as erythropoietin (EPO), follicle-stimulating hormone (FSH), and human chorionic gonadotropin (hCG), widely used in treating anemia, infertility, and growth disorders due to their high yield, stability, and human-such as protein glycosylation

- The growing demand for CHO-derived hormones is primarily fueled by the increasing prevalence of chronic and endocrine disorders, rising biopharmaceutical R&D expenditure, and the expanding use of mammalian expression systems in biologics production

- North America dominated the CHO hormones market with the largest revenue share of 42.1% in 2024, driven by the strong presence of leading biopharmaceutical manufacturers, advanced bioprocessing infrastructure, and supportive regulatory frameworks promoting biologics and biosimilar development

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to expanding biotechnology investments, favorable government initiatives, and the rapid emergence of contract manufacturing organizations (CMOs) in countries such as China, India, and South Korea

- The erythropoietin (EPO) segment dominated the CHO hormones market with a market share of 45.2% in 2024, supported by high therapeutic demand for anemia management in patients with chronic kidney disease and cancer, along with continuous innovation in recombinant hormone formulations and biosimilar production

Report Scope and Chinese Hamster Ovary (CHO) Hormones Market Segmentation

|

Attributes |

Chinese Hamster Ovary (CHO) Hormones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Chinese Hamster Ovary (CHO) Hormones Market Trends

“Advancements in Biosimilar Development and Cell Line Engineering”

- A significant and accelerating trend in the CHO hormones market is the development of biosimilar recombinant hormones and engineering of CHO cell lines to improve yield, stability, and human-such as glycosylation patterns

- For instance, biosimilar erythropoietin and FSH products are being developed using next-generation CHO cell lines with optimized expression vectors to meet regulatory standards and cost-effective production

- Innovations in cell line engineering enable faster production timelines, higher protein quality, and reduced post-translational variability, enhancing the therapeutic efficacy of CHO-derived hormones

- The integration of high-throughput screening and gene-editing technologies allows manufacturers to identify high-producing CHO clones, improving overall process efficiency and scalability for commercial hormone production

- This trend towards more precise, efficient, and regulatory-compliant CHO cell-based production is reshaping industry standards for biologics manufacturing

- The demand for advanced CHO-derived hormone products is growing rapidly across both therapeutic and biosimilar markets, as healthcare providers increasingly prioritize efficacy, safety, and affordability

Chinese Hamster Ovary (CHO) Hormones Market Dynamics

Driver

“Increasing Prevalence of Chronic and Endocrine Disorders”

- The rising incidence of anemia, infertility, and growth disorders, along with growing patient awareness, is a key driver for heightened demand for CHO-derived therapeutic hormones

- For instance, the increasing number of chronic kidney disease patients globally has accelerated demand for recombinant erythropoietin, promoting market expansion

- CHO-derived hormones offer high therapeutic efficacy and safety, making them the preferred choice over alternative expression systems for treating critical endocrine and hematologic conditions

- In addition, the expanding adoption of biologics and biosimilars in emerging markets is increasing accessibility to CHO-produced hormones, further supporting market growth

- Advanced bioprocessing technologies and supportive regulatory frameworks are enabling faster approvals and scaling of CHO-based hormone production, boosting overall market adoption

- Growing focus on personalized medicine and tailored hormone therapies is driving demand for flexible CHO-based production systems capable of producing patient-specific formulations

- Increasing government initiatives and funding for biotechnology research in key regions are enhancing CHO hormone development capabilities and market expansion

Restraint/Challenge

“High Production Costs and Regulatory Compliance Complexities”

- The complex biomanufacturing process of CHO hormones, including stringent quality control and post-translational modifications, results in high production costs, which can limit broader market access

- For instance, maintaining optimized CHO cell culture conditions, glycosylation consistency, and compliance with GMP standards requires significant investment in infrastructure and skilled personnel

- Navigating complex regulatory pathways for biosimilars and originator hormones across different regions can delay product launches and impact market penetration

- The comparatively higher cost of CHO-derived hormones versus microbial-expressed alternatives can pose adoption challenges, particularly in price-sensitive markets

- Overcoming these challenges through process optimization, cost-efficient scale-up, and regulatory harmonization will be crucial for sustained growth of the CHO hormones market

- Supply chain complexities, including sourcing of raw materials and ensuring batch-to-batch consistency, can hinder production efficiency and timely market supply

- Potential immunogenicity and safety concerns related to glycosylation variations in CHO-expressed hormones may require additional clinical validation, increasing development timelines and costs

Chinese Hamster Ovary (CHO) Hormones Market Scope

The market is segmented on the basis of product type, cell line, product form, and therapeutic application.

- By Product Type

On the basis of product type, the CHO hormones market is segmented into Erythropoietin (EPO), Follicle-Stimulating Hormone (FSH), Luteinizing Hormone (LH), Human Chorionic Gonadotropin (hCG), Growth Hormone (GH), Thyroid-Stimulating Hormone (TSH), and Other CHO-derived hormones. The Erythropoietin (EPO) segment dominated the market with the largest market revenue share of 45.2% in 2024, driven by its high demand in treating anemia in chronic kidney disease and cancer patients. CHO-derived EPO is preferred for its human-such as glycosylation, ensuring better efficacy and reduced immunogenicity. The widespread adoption of biosimilar EPO products is further supporting market dominance. Manufacturers are increasingly investing in high-yield CHO cell lines to meet global demand, and the availability of various formulations, such as injectable and prefilled syringes, enhances patient accessibility. The strong clinical acceptance and established therapeutic profile of EPO maintain its leadership in the hormone market.

The FSH segment is anticipated to witness the fastest growth rate of 11.2% from 2025 to 2032, fueled by the rising prevalence of infertility and growing demand for assisted reproductive technologies (ART). CHO-expressed recombinant FSH offers precise glycosylation and enhanced bioactivity, making it ideal for IVF treatments. The increasing adoption of personalized fertility therapies and rising investments in reproductive healthcare infrastructure in emerging markets are contributing to growth. In addition, partnerships between biopharma companies and fertility clinics are facilitating better market penetration and product availability.

- By Cell Line

On the basis of cell line, the CHO hormones market is segmented into CHO-K1, CHO-S, CHO-DG44, CHO-DXB11, and Other CHO cell line systems. The CHO-K1 segment dominated the market in 2024, accounting for the largest revenue share, due to its robust growth characteristics, high protein expression levels, and ability to maintain consistent post-translational modifications. CHO-K1 cell lines are widely adopted in commercial-scale production of erythropoietin, gonadotropins, and growth hormones. Their adaptability to both serum-free and suspension culture systems allows for cost-effective, large-scale manufacturing. Regulatory familiarity with CHO-K1-based processes further reinforces their market dominance, as they facilitate smoother biosimilar approvals. The reliability and historical success of CHO-K1 in producing clinically approved biologics continue to drive its preference among manufacturers.

The CHO-S segment is expected to witness the fastest growth from 2025 to 2032, driven by its enhanced transfection efficiency, faster doubling time, and suitability for high-density suspension cultures. CHO-S lines are increasingly used for producing biosimilars and novel recombinant hormones, offering improved scalability and flexibility in bioprocessing. Emerging biopharma companies and CMOs prefer CHO-S for cost-effective and rapid development cycles. Continuous advancements in vector design and process optimization are further boosting its adoption across regions, particularly in Asia-Pacific and North America.

- By Product Form

On the basis of product form, the CHO hormones market is segmented into glycosylated hormones, non-glycosylated hormones, lyophilized, and liquid form. The Glycosylated Hormones segment dominated the market with the largest share in 2024 due to their critical role in ensuring therapeutic efficacy and stability. CHO cells naturally perform human-such as glycosylation, making these hormones ideal for complex biologics such as EPO, FSH, and hCG. Glycosylated hormones exhibit improved half-life, reduced immunogenicity, and better clinical performance, supporting widespread clinical adoption. The segment benefits from strong regulatory acceptance and high demand in chronic and reproductive disorder treatments. Pharmaceutical companies continue to invest in improving glycosylation profiles to maintain efficacy and safety standards, reinforcing market leadership.

The Liquid Form segment is expected to witness the fastest growth rate during 2025–2032, driven by patient preference for ready-to-use formulations, ease of administration, and reduced preparation errors. Liquid CHO-derived hormones are increasingly preferred in fertility clinics, hospitals, and outpatient settings for their convenience and reduced storage complexity. The growing trend of prefilled syringes and pen devices for injectable hormones is supporting market growth. Rapid urbanization and the expansion of healthcare infrastructure in emerging regions are also increasing the adoption of liquid hormone formulations.

- By Therapeutic Application

On the basis of therapeutic application, the CHO hormones market is segmented into anemia treatment, reproductive disorders, growth disorders, thyroid disorders, and other endocrine disorders. The Anemia Treatment segment dominated the market with the largest revenue share of 42.3% in 2024, primarily driven by the widespread use of CHO-derived erythropoietin in chronic kidney disease, chemotherapy-induced anemia, and other hematologic conditions. The clinical effectiveness, safety profile, and growing biosimilar availability reinforce its dominance. Hospitals and dialysis centers are major end-users, and ongoing R&D efforts to develop long-acting EPO analogs are boosting product adoption. Rising prevalence of renal and hematologic disorders globally continues to maintain strong demand.

The Reproductive Disorders segment is anticipated to witness the fastest growth rate of 10.8% from 2025 to 2032, propelled by increasing infertility rates and growing adoption of ART procedures. CHO-expressed gonadotropins, including FSH and LH, are critical for IVF treatments due to their high bioactivity and consistent glycosylation. Rising awareness, government initiatives to support fertility treatments, and increasing disposable incomes in emerging markets are accelerating growth. The segment also benefits from innovation in recombinant formulations, prefilled pens, and patient-centric delivery systems.

Chinese Hamster Ovary (CHO) Hormones Market Regional Analysis

- North America dominated the CHO hormones market with the largest revenue share of 42.1% in 2024, driven by the strong presence of leading biopharmaceutical manufacturers, advanced bioprocessing infrastructure, and supportive regulatory frameworks promoting biologics and biosimilar development

- Healthcare providers in the region highly prioritize CHO-derived hormones due to their high efficacy, human-such as glycosylation, and regulatory approval for treating anemia, reproductive, and growth disorders

- This widespread adoption is further supported by substantial R&D investments, favorable regulatory frameworks for biologics and biosimilars, and increasing demand for chronic disease management, establishing CHO hormones as a preferred therapeutic solution across hospitals, clinics, and fertility centers

U.S. Chinese Hamster Ovary (CHO) Hormones Market Insight

The U.S. CHO hormones market captured the largest revenue share of 78% in 2024 within North America, fueled by the strong presence of leading biopharmaceutical companies and advanced bioprocessing infrastructure. Healthcare providers increasingly prioritize CHO-derived hormones for their high efficacy, human-such as glycosylation, and clinical reliability in treating anemia, reproductive, and growth disorders. The growing adoption of biosimilars and innovative recombinant formulations further propels the market. Moreover, regulatory support, robust R&D investment, and increasing prevalence of chronic and endocrine disorders are significantly contributing to market expansion.

Europe Chinese Hamster Ovary (CHO) Hormones Market Insight

The Europe CHO hormones market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising demand for biosimilars and strict regulatory standards for biologics production. The increasing prevalence of anemia, infertility, and growth disorders, coupled with the adoption of advanced biomanufacturing technologies, is fostering market growth. European healthcare providers are increasingly using CHO-derived hormones in hospitals, clinics, and fertility centers. The region also benefits from strong pharmaceutical infrastructure and a focus on innovative, high-quality therapeutics.

U.K. Chinese Hamster Ovary (CHO) Hormones Market Insight

The U.K. CHO hormones market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising infertility rates and the growing use of assisted reproductive technologies (ART). Healthcare providers are adopting CHO-derived gonadotropins and other recombinant hormones for their superior bioactivity and safety profiles. In addition, government initiatives supporting fertility treatments and chronic disease management are encouraging broader adoption. The U.K.’s robust pharmaceutical R&D ecosystem and increasing awareness among healthcare professionals are expected to continue stimulating market growth.

Germany Chinese Hamster Ovary (CHO) Hormones Market Insight

The Germany CHO hormones market is expected to expand at a considerable CAGR during the forecast period, fueled by rising demand for recombinant hormones in anemia and endocrine disorder treatment. Germany’s well-developed healthcare infrastructure and emphasis on innovative biopharmaceutical solutions promote the adoption of CHO-derived hormones. The integration of advanced bioprocessing and continuous manufacturing technologies is increasing production efficiency and product availability. Healthcare providers show strong preference for high-quality, clinically validated CHO hormone therapies.

Asia-Pacific Chinese Hamster Ovary (CHO) Hormones Market Insight

The Asia-Pacific CHO hormones market is poised to grow at the fastest CAGR of 11.5% from 2025 to 2032, driven by increasing prevalence of anemia, infertility, and growth disorders, coupled with expanding biotechnology infrastructure in countries such as China, India, and Japan. Rising healthcare spending, government initiatives promoting biopharmaceutical manufacturing, and growing adoption of recombinant hormones are driving market expansion. In addition, emerging CMOs and local production capabilities are making CHO-derived therapies more accessible and cost-effective.

Japan Chinese Hamster Ovary (CHO) Hormones Market Insight

The Japan CHO hormones market is gaining momentum due to the country’s advanced biotechnology sector, high healthcare standards, and increasing demand for infertility and anemia treatments. The adoption of CHO-derived hormones is supported by a strong focus on quality, safety, and efficacy. Integration of innovative recombinant formulations and prefilled delivery systems is fueling market growth. Moreover, Japan’s aging population is expected to drive higher demand for growth hormone and other hormone therapies in both clinical and outpatient settings.

India Chinese Hamster Ovary (CHO) Hormones Market Insight

The India CHO hormones market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding biotechnology industry, rising prevalence of endocrine disorders, and growing healthcare infrastructure. India is becoming a key hub for CHO hormone manufacturing and biosimilar production. The increasing awareness of fertility treatments, anemia management, and availability of affordable recombinant hormones are driving adoption. Government initiatives supporting biopharmaceutical innovation and domestic manufacturing capabilities are also propelling market growth in India.

Chinese Hamster Ovary (CHO) Hormones Market Share

The Chinese Hamster Ovary (CHO) Hormones industry is primarily led by well-established companies, including:

- Sartorius AG (Germany)

- Lonza (Switzerland)

- WuXi AppTec, (China)

- Samsung Biologics Co., Ltd. (South Korea)

- Boehringer Ingelheim International GmbH. (U.S.)

- CELLTRION, INC. (South Korea)

- GenScript (China)

- GE Healthcare (U.S.)

- Merck & Co., Inc., (Germany)

- Biogen (U.S.)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

What are the Recent Developments in Global Chinese Hamster Ovary (CHO) Hormones Market?

- In March 2025, researchers introduced a novel hormone delivery system utilizing hormone-filled microbeads embedded in hydrogels. This system aims to provide steady, extended release of hormones following monthly self-injections, addressing challenges related to poor adherence and inconsistent hormone delivery in traditional hormone replacement therapies

- In February 2025, LFB Biomanufacturing introduced its Generic CHO Platform, designed to streamline the production of various proteins, including monoclonal antibodies, enzymes, and hormones. This platform offers flexibility and efficiency in producing recombinant hormones using CHO cells, potentially reducing production costs and time. The platform's adaptability to different protein types makes it a valuable tool for hormone production in the biopharmaceutical industry

- In December 2024, Sartorius and the University of California, San Francisco (UCSF) announced a collaboration to co-develop advanced cell culture automation systems aimed at enhancing the production of stem cell therapies. While the primary focus is on stem cell applications, the technologies developed are expected to have broader implications for CHO cell-based hormone production, improving efficiency and scalability in biomanufacturing processes

- In January 2023, Anima Biotech and AbbVie announced a collaboration focused on developing mRNA biology modulators. This partnership aims to enhance the understanding and modulation of mRNA processes, potentially impacting the production of recombinant hormones in CHO cells. The collaboration leverages Anima Biotech's mRNA-targeted drug discovery platform and AbbVie's expertise in biopharmaceutical development

- In December 2023, a collaborative study explored the impact of heterologous signal peptides on the production of glycoprotein hormones such as LH, hCG, and thyroid-stimulating hormone (TSH) in CHO cells. By replacing natural signal peptides with those from human serum albumin, researchers observed a 2–2.5 times increase in hormone production. This advancement holds promise for improving the efficiency and yield of hormone therapies derived from CHO cell lines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.