Global Chlorella Market

Market Size in USD Million

CAGR :

%

USD

330.57 Million

USD

538.92 Million

2024

2032

USD

330.57 Million

USD

538.92 Million

2024

2032

| 2025 –2032 | |

| USD 330.57 Million | |

| USD 538.92 Million | |

|

|

|

|

Chlorella Market Size

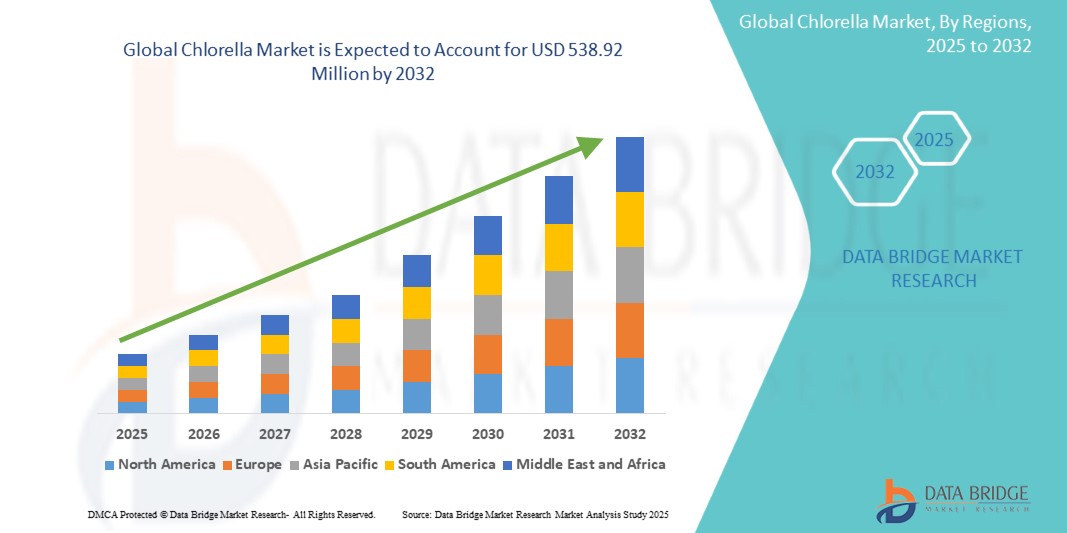

- The global chlorella market was valued at USD 330.57 million in 2024 and is expected to reach USD 538.92 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.30%, primarily driven by increasing consumer awareness of health and wellness

- This growth is driven by rising demand for plant-based protein, and expanding applications in nutraceuticals, pharmaceuticals, and cosmetics

Chlorella Market Analysis

- The chlorella market has experienced substantial growth due to increasing consumer demand for high-protein, plant-based, and nutrient-dense superfoods. The rising popularity of vegan and vegetarian diets, coupled with growing awareness of chlorella’s health benefits, is driving its adoption in functional foods, dietary supplements, and pharmaceuticals. In addition, advancements in microalgae cultivation and sustainable production techniques are enhancing product quality and availability, further attracting health-conscious consumers

- The market is primarily driven by the expanding use of chlorella in dietary supplements, natural cosmetics, and animal feed, alongside increasing investment in algae-based protein research. In addition, technological innovations in extraction methods, microalgae farming, and bioprocessing are improving the nutritional profile and bioavailability of Chlorella-based products, making them more appealing for mainstream consumption

- Asia-Pacific dominates the chlorella market, with countries such as Japan, South Korea, and China leading due to strong consumer preference for algae-based nutrition, well-established aquaculture industries, and growing demand for natural health supplements. The region’s dominance is further reinforced by government support for algae research, the rising trend of functional foods, and the expansion of plant-based protein alternatives

- For instance, in Japan, chlorella has been widely integrated into functional beverages and dietary supplements, with companies continuously innovating new product formulations to cater to the health-conscious population

- Globally, chlorella is emerging as a key ingredient in premium wellness products, fortified foods, and sustainable aquafeed solutions. Innovations such as organic chlorella powders, high-protein chlorella extracts, and algae-based bioactive compounds are reshaping industry trends, supporting sustainability efforts, and driving long-term market expansion.

Report Scope and Chlorella Market Segmentation

|

Attributes |

Chlorella Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Chlorella Market Trends

“Rising Adoption of Chlorella in Functional Foods and Beverages”

- The increasing consumer focus on health and wellness is driving the incorporation of chlorella into functional foods and beverages, as it is rich in proteins, antioxidants, vitamins, and minerals that support immune health, detoxification, and overall well-being

- Food and beverage companies are launching chlorella-enriched smoothies, protein bars, energy drinks, and plant-based dairy alternatives to cater to the growing demand for clean-label, superfood-based nutrition products

- Advancements in microalgae processing and formulation techniques are enhancing chlorella’s bioavailability, taste, and shelf stability, making it a viable ingredient in fortified snacks, dairy-free products, and functional wellness drinks

For instance,

- In March 2024, Sun Chlorella launched a new line of organic chlorella-infused plant-based protein powders, targeting fitness enthusiasts and health-conscious consumers

- In November 2023, a leading beverage company introduced chlorella-fortified green smoothies in major retail stores, promoting their benefits for gut health and detoxification

- In August 2023, a European dairy-alternative brand released chlorella-enriched oat milk, offering consumers a plant-based milk with enhanced protein and antioxidant content

- As consumer demand for plant-based, nutrient-dense, and functional food products continues to rise, chlorella will play a crucial role in the next generation of health-focused foods and beverages, shaping the market’s future with its superfood status and diverse applications

Chlorella Market Dynamics

Driver

“Expanding Use of Chlorella in Nutraceuticals and Dietary Supplements”

- The growing consumer awareness of natural and plant-based supplements is driving demand for chlorella-based nutraceuticals, as it is rich in proteins, essential amino acids, vitamins, and antioxidants that support immune health, detoxification, and energy metabolism

- Pharmaceutical and nutraceutical companies are incorporating chlorella into capsules, tablets, powders, and liquid extracts, promoting its anti-inflammatory, detoxifying, and anti-aging properties to health-conscious consumers

- The rise of vegan, organic, and clean-label supplements is further boosting chlorella adoption, as consumers seek chemical-free, non-GMO, and sustainably sourced functional ingredients

For instance,

- In March 2024, a leading nutraceutical brand launched chlorella-infused immunity-boosting supplements, targeting consumers looking for natural detox and gut health solutions

- In October 2023, a pharmaceutical company introduced chlorella-based antioxidant capsules, promoting their ability to reduce oxidative stress and enhance skin health

- In July 2023, a wellness brand expanded its product portfolio with chlorella-enriched protein powders, catering to the growing demand for plant-based sports nutrition

- As the nutraceutical and dietary supplement industry continues to expand, chlorella will play a key role in next-generation functional health products, driving sustained market growth and innovation in natural wellness solutions

Opportunity

“Rising Demand for Chlorella in Functional Foods and Beverages”

- The increasing consumer focus on health and wellness is driving demand for chlorella-based functional foods and beverages, as it is a rich source of protein, antioxidants, and essential nutrients that support immune function, digestion, and energy metabolism

- Food and beverage manufacturers are incorporating chlorella into smoothies, protein bars, health drinks, and plant-based dairy alternatives, appealing to fitness enthusiasts, athletes, and health-conscious consumers seeking nutrient-dense products

- The rise of clean-label, organic, and non-GMO ingredients is further accelerating the adoption of chlorella as a functional superfood, meeting consumer demand for natural, minimally processed, and sustainable nutrition solutions

For instance,

- In March 2024, a leading beverage brand introduced a chlorella-infused green juice, targeting consumers looking for natural detox and energy-boosting drinks

- In October 2023, a sports nutrition company launched chlorella-based protein bars, catering to the growing demand for high-protein, plant-based snacks

- In July 2023, a functional food startup developed chlorella-enriched dairy-free yogurts, positioning them as gut-health-supporting superfoods

- As functional foods and beverages gain mainstream popularity, chlorella will play a crucial role in the next generation of health-focused products, driving sustained market expansion and innovation in the wellness industry

Restraint/Challenge

“High Production Costs Hindering Chlorella Market Expansion”

- The high costs associated with chlorella cultivation, processing, and extraction are a major challenge for manufacturers, making it difficult to achieve cost-competitive production compared to other protein sources

- Factors such as specialized cultivation conditions, controlled light and temperature environments, and expensive harvesting techniques contribute to elevated operational expenses, limiting the affordability of chlorella-based products

- In addition, the high cost of R&D for improving strain efficiency, scaling production, and enhancing nutrient bioavailability poses a financial burden on companies aiming to commercialize chlorella for mainstream consumption

For instance,

- In January 2024, a European biotech company delayed its large-scale chlorella production plans, citing high operational costs and technological barriers in scaling up sustainable microalgae farming

- To mitigate high production costs, industry players must focus on technological advancements, process optimization, and government support to enhance cost efficiency and drive wider accessibility of chlorella-based products in global markets

Chlorella Market Scope

The market is segmented on the basis of source, type, technology, product, distribution channel, and application.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Application |

|

|

By Technology |

|

|

By Product |

|

|

By Distribution Channel |

|

Chlorella Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Chlorella Market”

- The rising demand for plant-based protein sources and superfoods is driving the widespread adoption of chlorella in the region, particularly in functional foods, dietary supplements, and aquaculture feed

- Countries such as China, Japan, and South Korea are leading producers and consumers of chlorella, benefiting from advanced algae cultivation techniques and increasing consumer awareness of health benefits

- Government initiatives supporting microalgae research, sustainable agriculture, and food security are further accelerating market growth across Asia-Pacific

For instance,

- In March 2024, China’s Ministry of Agriculture announced funding for large-scale chlorella cultivation projects, promoting its use in health foods and pharmaceuticals

- In October 2023, Japan’s leading supplement brand, Sun Chlorella, expanded its product line with new chlorella-based protein powders and energy bars, targeting health-conscious consumers

- In June 2023, South Korea’s aquaculture industry adopted chlorella-enriched feed formulations to enhance fish growth and improve sustainability in seafood production

- As Asia-Pacific continues to embrace functional nutrition and sustainable food sources, chlorella will remain a key ingredient in health, wellness, and aquaculture industries, reinforcing the region’s dominance in the global market

“North-America is projected to register the Highest Growth Rate”

- The rising consumer preference for plant-based nutrition, dietary supplements, and functional foods is fueling the rapid expansion of the chlorella market in North America

- Increasing investments in microalgae production technologies, sustainable food alternatives, and biopharmaceutical applications are accelerating market growth across the U.S. and Canada

- Favorable regulatory policies, growing research in algae-based nutrition, and expanding aquaculture feed applications are further driving chlorella adoption in the region

For instance,

- In January 2024, the U.S. Food and Drug Administration (FDA) approved chlorella-based protein formulations for use in plant-based meat alternatives

- In September 2023, Canada’s Nutra Algae Inc. launched a new line of organic chlorella powders and tablets, catering to the rising demand for clean-label supplements

- In May 2023, the U.S. Department of Agriculture (USDA) funded research projects exploring the use of chlorella as a sustainable protein source in animal and aquaculture feed

- As health-conscious consumers, regulatory support, and technological advancements continue to drive the market, North America is set to witness the fastest growth in the global chlorella industry, positioning itself as a key player in nutraceuticals and sustainable food innovation

Chlorella Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GONG BIH ENTERPRISE CO., LTD. (Taiwan)

- E.I.D. - Parry (India) Limited (India)

- Far East Bio-Tec Co., Ltd. (Taiwan)

- Yaeyama Shokusan Co., Ltd. (Japan)

- Fuqing King Dnarmsa Spirulina Co., Ltd. (China)

- Tianjin Norland Biotech Co., Ltd. (China)

- Stauber USA (U.S.)

- Sure Chemical Co., Ltd. (China)

- Green Source Organics (U.S.)

- SUN CHLORELLA CORP. (U.S.)

- Fareast Metal International Co., Ltd. (Taiwan)

- Taiwan Chlorella Manufacturing Company (Taiwan)

- Yaeyama Shokusan Co., Ltd. (Japan)

- KSHIPRA BIOTECH PRIVATE LIMITED (India)

- Kuber Impex Ltd. (India)

- Divyagro (India)

Latest Developments in Global Chlorella Market

- In May 2023, the EU H2020-funded projects GIANT LEAPS and LIKE-A-PRO joined the Horizon4Proteins project in response to the rising demand for alternative plant-based proteins. This collaboration emphasizes the growing focus on sustainable plant-based protein solutions in Europe, setting a precedent for future projects

- In June 2022, Taiwan Chlorella Manufacturing Company announced that all its products are iodine-free, strengthening customer trust. This move highlights the company's commitment to consumer health and safety, solidifying its reputation in the market.

- In March 2022, the Profuture project developed light microalgae for plant-based protein without a fishy taste, introducing improved microalgae strains with enhanced flavor profiles. This development marks a significant breakthrough in the plant-based protein industry, paving the way for better consumer acceptance of algae-based products

- In December 2020, Sun Chlorella was named The Official Superfood of the Brooklyn Nets and New York Liberty, becoming the presenting sponsor of Nets Training Camp and participating in upcoming Nets health and wellness virtual events, while also offering exclusive promotions to Nets season ticket holders. This partnership demonstrates the increasing integration of superfoods into mainstream sports culture, enhancing the brand’s visibility and market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CHLORELLA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CHLORELLA MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.6.1 KEY PLAYERS

2.6.2 DISRUPTORS

2.6.3 NICHE PLAYERS

2.6.4 PROSPECT LEADERS

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 TOP TO BOTTOM ANALYSIS

2.11 STANDARDS OF MEASUREMENT

2.12 VENDOR SHARE ANALYSIS

2.13 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.14 DATA POINTS FROM KEY SECONDARY DATABASES

2.15 GLOBAL CHLORELLA MARKET : RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTE PRODUCTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.6 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 GLOBAL CHLORELLA MARKET, BY SOURCE, 2021-2030, (USD MILLION)

9.1 OVERVIEW

9.2 CHLORELLA VULGARIS

9.2.1 CHLORELLA VULGARIS, BY PRODUCT TYPE

9.2.1.1. POWDER

9.2.1.2. TABLETS

9.2.1.3. EXTRACTS

9.2.1.4. CAPSULES

9.2.1.5. OTHERS

9.3 CHLORELLA PYRENOIDOSA

9.3.1 CHLORELLA PYRENOIDOSA, BY PRODUCT TYPE

9.3.1.1. POWDER

9.3.1.2. TABLETS

9.3.1.3. EXTRACTS

9.3.1.4. CAPSULES

9.3.1.5. OTHERS

9.4 CHLORELLA ELLIPSOIDEA

9.4.1 CHLORELLA ELLIPSOIDEA, BY PRODUCT TYPE

9.4.1.1. POWDER

9.4.1.2. TABLETS

9.4.1.3. EXTRACTS

9.4.1.4. CAPSULES

9.4.1.5. OTHERS

9.5 OTHERS

10 GLOBAL CHLORELLA MARKET, BY NATURE, 2021-2030, (USD MILLION)

10.1 OVERVIEW

10.2 ORGANIC

10.3 INORGANIC

11 GLOBAL CHLORELLA MARKET, BY PRODUCT TYPE, 2021-2030, (USD MILLION)

11.1 OVERVIEW

11.2 POWDER

11.3 TABLETS

11.4 EXTRACTS

11.5 CAPSULES

11.6 OTHERS

12 GLOBAL CHLORELLA MARKET, BY APPLICATION, 2021-2030, (USD MILLION)

12.1 OVERVIEW

12.2 FOOD INDUSTRY

12.2.1 FOOB INDUSTRY, BY TYPE

12.2.1.1. BAKERY

12.2.1.1.1. BAKERY, BY TYPE

12.2.1.1.1.1 BREAD & ROLLS

12.2.1.1.1.2 BISCUIT & COOKIES

12.2.1.1.1.3 CROISSANTS

12.2.1.1.1.4 OTHERS

12.2.1.2. PASTA

12.2.1.3. CONFECTIONARY

12.2.1.4. FROZEN DAIRY PRODUCTS

12.2.1.4.1. FROZEN DAIRY PRODUCTS, BY TYPE

12.2.1.4.1.1 YOGURTS

12.2.1.4.1.2 PUDDING

12.2.1.4.1.3 OTHERS

12.2.1.5. OTHERS

12.3 PHARMACEUTICAL INDUSTRY

12.3.1 PHARMACEUTICAL INDUSTRY, BY TYPE

12.3.1.1. SUPPLEMENTARY FOODS

12.3.1.2. DIETARY SUPPLEMENTS

12.3.1.3. SPORTS SUPPLEMENT

12.3.1.4. OTHERS

12.4 COSMETIC INDUSTRY

12.4.1 COSMETIC INDUSTRY, BY TYPE

12.4.1.1. SKIN CARE

12.4.1.2. HAIR CARE

12.5 OTHERS

13 GLOBAL CHLORELLA MARKET, BY PACKAGING, 2021-2030, (USD MILLION)

13.1 OVERVIEW

13.2 POUCHES

13.3 BOTTLES

13.3.1 BOTTLES, BY TYPE

13.3.1.1. GLASS

13.3.1.2. PLACSTIC

13.4 CANS

13.5 OTHERS

14 GLOBAL CHLORELLA MARKET, BY DISTRIBUTION CHANNEL, 2021-2030, (USD MILLION)

14.1 OVERVIEW

14.2 DIRECT

14.3 INDIRECT

14.3.1 STORE-BASED RETAILING

14.3.1.1. SUPERMARKETS/HYPERMARKETS

14.3.1.2. MONO-BRANDED STORES

14.3.1.3. MULTIBRANDED STORES

14.3.1.4. CONVENIENCE STORES

14.3.1.5. OTHERS

14.3.2 NON-STORE RETAILING

14.3.2.1. THIRD-PARTY WEBSITE

14.3.2.2. COMPANY WEBSITE

15 GLOBAL CHLORELLA MARKET, BY GEOGRAPHY, 2021-2030, (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 SWITZERLAND

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 AUSTRALIA

15.3.10 NEW ZEALAND

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 UNITED ARAB EMIRATES

15.5.4 SAUDI ARABIA

15.5.5 REST OF MEA

16 GLOBAL CHLORELLA MARKET , COMPANY LANDSCAPE, 2021-2030, (USD MILLION)

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS & PARTNERSHIP

16.8 REGULATORY CHANGES

17 GLOBAL CHLORELLA MARKET , SWOT & DBMR ANALYSIS

18 GLOBAL CHLORELLA MARKET , COMPANY PROFILE

18.1 SUN CHLORELLA CORP.

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 VEDAN BIOTECHNOLOGY CO., LTD.

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 FEMICO

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 GREEN WAYS S.R.O.

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 TAIWAN CHLORELLA MANUFACTURING COMPANY

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 SUN CHLORELLA

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 REDSUN SINGAPORE PTE. LTD.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 PURITAN'S PRIDE, INC.

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 NOW FOODS

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EVOLUTION INTERNATIONAL

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 NUTRIQAFOODS INTERNATIONAL

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 Z NATURAL FOODS

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 ORGANIC NATURALS INDIA PRIVATE LIMITED

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 ENERGYBITS INC.

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 OKAMI BIO.

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 DR. BEHR GMBH

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 GREEN NUTRITIONALS

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SOURCE NATURALS, INC.

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 YAEYAMACHLORELLA.JP

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 ECHLORIAL

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

NOTE: THE LIST OF COMPANIES IS A TENTATIVE AND THIS CAN BE MODIFIED ACCORDING TO THE CLIENT’S REQUEST AND SUGGESTION.

19 RELATED REPORTS

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.