Global Citronellol Market

Market Size in USD Billion

CAGR :

%

USD

1.51 Billion

USD

2.06 Billion

2024

2032

USD

1.51 Billion

USD

2.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.51 Billion | |

| USD 2.06 Billion | |

|

|

|

|

Citronellol Market Size

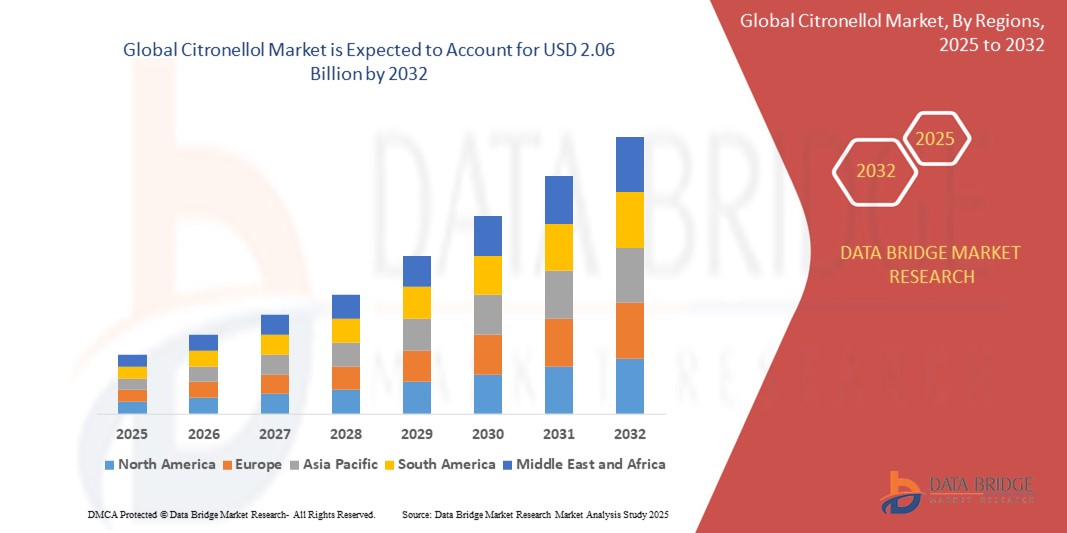

- The global citronellol market size was valued at USD 1.51 billion in 2024 and is expected to reach USD 2.06 billion by 2032, at a CAGR of 3.95% during the forecast period

- The market growth is largely fuelled by the rising demand for natural ingredients in cosmetics, personal care products, and fragrances, along with the increasing use of citronellol in aromatherapy and homecare applications

- The shift towards sustainable and plant-derived chemicals in food additives, insect repellents, and detergents is also boosting market expansion

Citronellol Market Analysis

- The citronellol market is experiencing stable growth due to its versatility as a fragrance and flavoring agent, particularly in the cosmetics, food and beverage, and household care sectors

- Increasing consumer inclination toward clean-label and plant-based products has driven manufacturers to incorporate natural compounds such as citronellol into formulations

- Asia-Pacific dominated the citronellol market with the largest revenue share of 41.8% in 2024, fuelled by growing demand for natural ingredients in personal care, home care, and fragrance applications, along with expanding manufacturing capabilities across the region

- Europe region is expected to witness the highest growth rate in the global citronellol market, driven by the increasing adoption of sustainable, natural ingredients in cosmetics, fragrances, and household care products, along with strong regulatory support and consumer awareness

- The more than 94% purity segment dominated the market with the largest market revenue share in 2024, owing to its widespread use in high-quality fragrances and personal care formulations. Products in this segment are favored by manufacturers aiming for superior scent performance and low impurity levels, which are essential in luxury and premium-grade cosmetic and homecare products. The high purity also ensures greater consistency in formulation, making it a preferred choice for global fragrance houses and essential oil producers

Report Scope and Citronellol Market Segmentation

|

Attributes |

Citronellol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Organic and Plant-Based Personal Care Products • Expansion of Citronellol Applications in Homecare and Aromatherapy Products |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Citronellol Market Trends

“Growing Adoption of Citronellol in Sustainable Fragrance Formulations”

- Consumers are increasingly choosing products with naturally derived scents as awareness grows about the long-term health and environmental risks of synthetic chemicals. This shift is prompting fragrance brands to prioritize clean-label transparency and plant-based alternatives like citronellol in their formulations

- Citronellol, extracted from essential oils such as rose, geranium, and citronella, is being adopted by formulators looking for biodegradable and nature-identical scent compounds. Its mild floral aroma and compatibility with natural ingredients make it ideal for clean beauty and eco-conscious fragrance development

- Regulatory authorities across regions, including the U.S. and European Union, are pushing for increased use of sustainable and traceable raw materials in fragrances. This regulatory pressure is reinforcing the market shift toward plant-based compounds like citronellol, which comply with emerging eco-label standards

- Advancements in sustainable sourcing such as carbon-neutral extraction methods and the upcycling of botanical waste are positioning citronellol as a hero ingredient. These innovations allow manufacturers to align with environmental goals while maintaining fragrance performance and product appeal

- For instance, Firmenich has expanded its Naturals Together program by offering eco-friendly scent formulations featuring citronellol from sustainably cultivated plant sources. This initiative demonstrates how major fragrance houses are incorporating ethical sourcing and traceability into their product innovation strategies

Citronellol Market Dynamics

Driver

“Rising Demand for Natural Ingredients in Cosmetics and Personal Care Products”

• Consumers are becoming more ingredient-conscious and demanding transparency, leading brands to favor botanically sourced ingredients like citronellol in skincare and haircare lines. This demand is driving innovation in natural personal care products that balance performance, safety, and sustainability

• Citronellol offers a soft floral scent and blends well with other essential oils, making it a preferred choice in aromatherapeutic formulations and plant-based perfumery. Its versatility has led to its use in everything from facial moisturizers to natural deodorants and sulfate-free shampoos

• A growing number of regions have placed bans or limitations on specific synthetic fragrance compounds, accelerating the shift toward natural scent agents. Citronellol, being naturally derived and well-studied, is becoming a go-to option for formulators complying with these evolving regulatory frameworks

• The surge in demand for wellness-driven products and holistic care rituals is boosting citronellol usage in essential oils, candles, and spa-grade skincare. This trend aligns with consumer preferences for calming, nature-derived scents that support both physical and mental well-being

• For instance, L’Oréal’s Botanicals Fresh Care product line showcases citronellol in its formulations to reflect its clean beauty philosophy. The brand highlights its use of vegan, cruelty-free, and responsibly sourced ingredients to appeal to environmentally aware consumers

Restraint/Challenge

“Potential Allergenic Properties and Regulatory Restrictions”

- Despite its natural origin, citronellol is classified as a potential allergen and must be declared on product labels when used above threshold levels. This requirement limits its inclusion in hypoallergenic or baby care products and compels companies to carefully manage concentration levels

- In markets such as the European Union, strict cosmetic regulations mandate full disclosure of allergenic substances like citronellol. Brands are required to reformulate or relabel products if concentrations exceed legal thresholds, adding to compliance burden and operational costs

- Increasing consumer sensitivity toward allergens and skin reactions is influencing purchase behavior, especially in sensitive skin or dermatology-backed product categories. This is causing brands to adopt cautious approaches and, in some cases, seek out alternative scent compounds with a lower allergenic profile

- Reformulating products to minimize or eliminate citronellol content requires additional testing, reformulation cycles, and stability studies. This extends product development timelines and increases expenses, particularly for companies focused on clean-label and allergy-safe formulations

- For instance, under the EU Cosmetics Regulation, any leave-on product containing more than 0.001% citronellol must declare it on the label. Brands like Nivea have responded by designing allergen-aware products that clearly indicate citronellol content for sensitive skin consumers

Citronellol Market Scope

The market is segmented on the basis of purity, application, and type.

- By Purity

On the basis of purity, the citronellol market is segmented into more than 94%, between 85% and 87%, and less than or equal to 85%. The more than 94% purity segment dominated the market with the largest market revenue share in 2024, owing to its widespread use in high-quality fragrances and personal care formulations. Products in this segment are favored by manufacturers aiming for superior scent performance and low impurity levels, which are essential in luxury and premium-grade cosmetic and homecare products. The high purity also ensures greater consistency in formulation, making it a preferred choice for global fragrance houses and essential oil producers.

The between 85% and 87% purity segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and suitability in mass-market applications. This range of purity is commonly used in industrial fragrance blends, air fresheners, and fabric care products where ultra-high purity is not a strict requirement. The growing demand for affordable and scalable fragrance solutions, especially in emerging markets, is expected to fuel the expansion of this segment over the forecast period.

- By Application

On the basis of application, the citronellol market is segmented into flavour and fragrance, personal care, fabric care, home care, and others. The flavour and fragrance segment held the largest market share in 2024, primarily due to the widespread use of citronellol in perfumes, colognes, and aroma blends. Its pleasant floral scent and natural origin make it a preferred component in fragrance compositions across various industries. The segment benefits from strong demand in both luxury and mass-market product lines, supported by continued innovation in olfactory experiences.

The personal care segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing consumer interest in natural, plant-derived ingredients. Citronellol is commonly found in moisturizers, deodorants, and hair care products, where its scent and mild antimicrobial properties enhance product appeal. The rise of clean beauty trends and transparency in cosmetic formulations is likely to further boost its inclusion in personal care offerings globally.

- By Type

On the basis of type, the citronellol market is segmented into natural and synthesis. The natural segment accounted for the largest market revenue share in 2024, driven by the rising consumer preference for eco-friendly and sustainably sourced ingredients. Derived from essential oils such as citronella, rose, and geranium, natural citronellol is in high demand for clean-label formulations across personal care and fragrance applications. Increased regulatory support for natural additives and sustainable sourcing practices also contribute to this segment’s dominance.

The synthesis segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its affordability, consistent quality, and scalable production. Synthetic citronellol serves as a reliable alternative for manufacturers aiming to control costs while maintaining fragrance integrity. Its application is particularly notable in fabric care and industrial air fresheners, where cost efficiency and volume production are critical factors.

Citronellol Market Regional Analysis

• Asia-Pacific dominated the citronellol market with the largest revenue share of 41.8% in 2024, fuelled by growing demand for natural ingredients in personal care, home care, and fragrance applications, along with expanding manufacturing capabilities across the region

• Consumers in Asia-Pacific are increasingly drawn to plant-based, eco-friendly products, and the rising adoption of ayurvedic, herbal, and wellness-focused brands is accelerating the use of natural aroma compounds such as citronellol

• The region’s growth is further supported by rising disposable incomes, government initiatives promoting sustainable ingredients, and a flourishing cosmetics and household care industry, making Asia-Pacific a key hub for citronellol consumption and production

China Citronellol Market Insight

The China citronellol market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrialization, strong demand for natural fragrance ingredients, and a booming personal care sector. Citronellol is increasingly used in perfumes, lotions, and homecare products across both domestic and export-focused brands. The country’s expanding middle class, coupled with government incentives for green chemistry and local production, is further enhancing the market outlook. Prominent manufacturers in China are leveraging citronellol to align with the rising preference for sustainable and plant-derived ingredients.

Japan Citronellol Market Insight

The Japan citronellol market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's strong demand for high-quality, natural fragrance ingredients across cosmetics and homecare products. Japanese consumers place high value on minimalistic, clean-label formulations with proven safety and sensory appeal, making citronellol a suitable choice for both traditional and modern product lines. The country's advanced R&D capabilities and preference for wellness-oriented solutions further drive innovation in formulations containing citronellol. In addition, integration with traditional Japanese botanicals and essential oils is reinforcing the use of citronellol in niche fragrance blends and skin-friendly formulations.

North America Citronellol Market Insight

The North America citronellol market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for clean-label, allergen-aware, and plant-based formulations in personal care and homecare categories. Consumers across the region are increasingly drawn to products that incorporate natural fragrances such as citronellol, often as part of a broader shift toward wellness and eco-conscious living. Growing aromatherapy trends and the expansion of sustainable product lines across major retailers are further boosting market penetration. The region also benefits from a well-established regulatory framework supporting the use of bio-based ingredients.

U.S. Citronellol Market Insight

The U.S. citronellol market is expected to witness the fastest growth rate from 2025 to 2032, driven by the popularity of organic and natural personal care products, as well as increasing consumer awareness of product ingredients. Citronellol is commonly used in premium skincare, natural perfumes, and environmentally friendly cleaning products. The growing emphasis on cruelty-free, vegan, and non-toxic product certifications is supporting citronellol’s inclusion in multiple formulations. Leading U.S. brands are also incorporating citronellol into aromatherapy and wellness ranges to meet consumer demand for functional and sensorial benefits.

Europe Citronellol Market Insight

The Europe citronellol market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict regulations on synthetic chemicals and growing preference for sustainable alternatives. Citronellol’s popularity is rising in premium fragrance lines and certified organic personal care products. European consumers are highly conscious of allergens, ingredients, and product safety, making citronellol an appealing solution when used within regulated limits. The region also benefits from the presence of leading fragrance houses, which are increasingly focused on expanding their natural ingredient portfolios.

Germany Citronellol Market Insight

The Germany citronellol market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of clean beauty and a strong demand for natural fragrance components in skincare and household products. Germany’s advanced cosmetic manufacturing sector, coupled with strict regulatory compliance and consumer demand for green formulations, supports the use of citronellol. Companies are reformulating products to meet eco-conscious preferences, and citronellol plays a vital role in providing both aromatic appeal and mild antimicrobial properties in formulations.

U.K. Citronellol Market Insight

The U.K. citronellol market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for sustainable, allergen-conscious, and naturally fragranced personal care and homecare products. Citronellol is increasingly utilized in the country’s expanding range of vegan and eco-certified beauty brands, particularly in perfumes, bath products, and lotions. The growing emphasis on transparent labelling and allergen disclosures aligns with citronellol’s regulated but valuable role in clean beauty offerings. The U.K.'s strong online retail landscape and consumer awareness campaigns around ingredient safety are also fostering greater market traction.

Citronellol Market Share

The citronellol industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Privi Speciality Chemicals Limited (India)

- Crescent Fragrances Private Limited (India)

- Bo International (India)

- International Flavours & Fragrances Inc. (U.S.)

- Capot Chemical Co., Ltd (China)

- K. K. Enterprise (India)

- Shiv Shakti Trading Corporation (India)

- Takasago International Corporation (Japan)

- Jayshree Aromatics Pvt. Ltd (India)

- Emerald Performance Materials (U.S.)

- Kao Corporation (Japan)

- Robertet SA (France)

- Symrise AG (Germany)

- Treatt plc (U.K.)

- Givaudan SA (Switzerland)

- Vigon International Inc (U.S.)

Latest Developments in Global Citronellol Market

- In June 2024, International Flavors & Fragrances Inc. released a new line of natural Citronellol-based fragrance ingredients. Produced using advanced biotechnology, these ingredients meet the increasing demand for natural and sustainable options in the fragrance industry, supporting the trend toward eco-conscious consumer choices

- In March 2024, BASF SE introduced a new range of natural citrus flavors and fragrances, including Citronellol. Utilizing advanced biotechnology, these products address the rising consumer preference for natural ingredients in the flavor and fragrance sector, meeting the industry's growing demand for more sustainable options

- In August 2022, Kao Corporation launched a new line of natural fragrances, including Citronellol. Leveraging advanced biotechnology, these products cater to the growing trend for sustainable and natural offerings in the fragrance industry, aligning with increasing consumer preference for eco-friendly products

- In April 2022, Treatt plc unveiled its Citrus Zest Treattarome product line, featuring Citronellol among other natural ingredients. This launch targets the increasing consumer desire for clean label products in the food and beverage industry, emphasizing natural and transparent ingredient sourcing

- In 2021, Robertet SA introduced a new range of natural flavors and fragrances, featuring Citronellol. These products, made from sustainable and natural ingredients, address the rising consumer demand for clean label products, reflecting a broader industry trend towards transparency and environmental responsibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Citronellol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Citronellol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Citronellol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.