Global Customer Information System Cis Market

Market Size in USD Billion

CAGR :

%

USD

123.50 Billion

USD

270.56 Billion

2024

2032

USD

123.50 Billion

USD

270.56 Billion

2024

2032

| 2025 –2032 | |

| USD 123.50 Billion | |

| USD 270.56 Billion | |

|

|

|

|

Customer Information System (CIS) Market Size

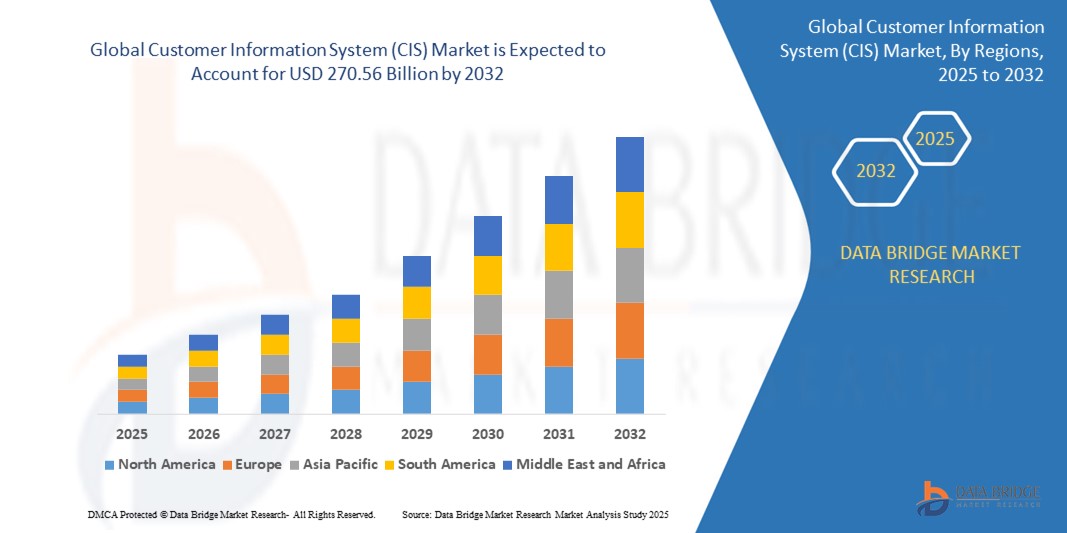

- The global customer information system (CIS) market size was valued at USD 123.5 billion in 2024 and is expected to reach USD 270.56 billion by 2032, at a CAGR of 10.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for integrated customer data platforms and the rising adoption of digital technologies across utilities and service sectors

- Growing emphasis on customer-centric strategies and real-time analytics is driving utilities and enterprises to adopt advanced CIS solutions for better service personalization and operational efficiency

Customer Information System (CIS) Market Analysis

- The customer information system market is witnessing steady expansion as utilities and service providers increasingly adopt digital tools to improve customer data management and billing efficiency

- Integrated platforms are becoming popular for offering centralized customer insights that enhance user experience and support faster service delivery

- North America leads the customer information system market with the largest revenue share of 38.5% in 2024, driven by widespread digital transformation across utilities and growing demand for integrated customer management solutions

- The Asia-Pacific region is expected to witness the highest growth rate in the global customer information system (CIS) market, driven by rapid urbanization, expanding utility infrastructure, and increased government focus on digital transformation

- The solution segment holds the largest market revenue share in 2024, driven by the demand for integrated software platforms that streamline billing, customer management, and data analytics. Organizations prioritize robust CIS solutions for their ability to improve operational efficiency and customer engagement

Report Scope and Customer Information System (CIS) Market Segmentation

|

Attributes |

Customer Information System (CIS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Customer Information System (CIS) Market Trends

“Growing Shift Toward Cloud-Based Customer Information Systems”

- Rising adoption of cloud-based customer information systems is improving scalability and flexibility for utility and telecom sectors, as seen with Duke Energy’s migration to Oracle’s cloud CIS

- Preference for cost-effective, real-time platforms that support remote operations and enhance disaster recovery capabilities

- Integration with mobile apps and digital tools enables better customer engagement and service personalization

- Companies seek faster implementation and seamless connectivity with existing systems, prompting a shift from legacy platforms

- For instance, Salesforce’s Energy & Utilities Cloud, adopted by National Grid, is gaining traction for offering AI-powered, customizable customer insights and streamlined data management

Customer Information System (CIS) Market Dynamics

Driver

“Digital Transformation and Rising Demand for Enhanced Customer Experience”

- Accelerating digital transformation across utility, telecom, and public sectors is boosting the adoption of customer information systems for integrated data management

- Rising focus on customer-centric strategies drives the demand for real-time data access, seamless service delivery, and personalized interactions

- CIS platforms help organizations analyze customer behavior data for predictive maintenance, service optimization, and issue resolution

- The adoption of smart technologies and IoT devices increases data volume, making advanced CIS solutions essential for effective processing and decision-making

- For instance, many utility providers are implementing smart meters that depend on CIS platforms to deliver usage insights and personalized recommendations

Restraint/Challenge

“Data Security and Integration Complexities”

- Rising concerns over data security hinder the adoption of customer information systems as they handle sensitive customer data such as billing history and personal identification

- Cybersecurity threats such as data breaches and ransomware attacks can damage customer trust and expose organizations to regulatory consequences

- Integrating CIS solutions with legacy systems remains a challenge due to complex IT environments and the technical difficulty of synchronization across platforms

- The need to align customer data across ERP, CRM, and service management tools often leads to costly and time-consuming implementations

- For instance, large utility companies with outdated IT infrastructure frequently struggle to integrate new CIS platforms without significant delays and budget overruns

Customer Information System (CIS) Market Scope

The market is segmented on the basis of component and application.

- By Component

On the basis of component, the customer information system market is segmented into solution and services. The solution segment holds the largest market revenue share in 2024, driven by the demand for integrated software platforms that streamline billing, customer management, and data analytics. Organizations prioritize robust CIS solutions for their ability to improve operational efficiency and customer engagement.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing adoption of consulting, system integration, and support services. These services help utilities and other sectors implement, customize, and maintain CIS platforms effectively, ensuring seamless operations and minimizing downtime.

- By Application

On the basis of application, the customer information system market is segmented into water and wastewater management, electricity and power management, and utility gas management. The electricity and power management segment dominates the largest market revenue share in 2024, due to extensive smart grid initiatives and rising demand for accurate metering and billing.

The water and wastewater management segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in infrastructure upgrades and the need for efficient resource management. Utility gas management also shows steady growth, supported by growing urbanization and industrial demand for gas utilities.

Customer Information System (CIS) Market Regional Analysis

- North America leads the customer information system market with the largest revenue share of 38.5% in 2024, driven by widespread digital transformation across utilities and growing demand for integrated customer management solutions

- The region benefits from advanced IT infrastructure, high adoption of cloud technologies, and increasing investments in smart grid and utility modernization projects

- Utilities and telecom sectors in North America are focusing on improving customer experience and operational efficiency, contributing to strong CIS adoption in both residential and commercial segments

U.S. Customer Information System Market (CIS) Insight

The U.S. holds the largest revenue share of 79% within North America in 2024, propelled by extensive smart grid initiatives and regulatory mandates for improved customer data management. The rise in cloud-based CIS platforms and integration with advanced analytics and IoT devices are enhancing service delivery and billing accuracy. Increased focus on digital customer engagement and real-time data access further supports market expansion.

Europe Customer Information System Market (CIS) Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent regulatory frameworks requiring utilities to enhance transparency and customer service. The region’s emphasis on sustainable energy and smart infrastructure investments fuels CIS adoption. Utilities across countries such as Germany, France, and the U.K. are increasingly implementing CIS solutions to optimize billing, outage management, and customer support.

U.K. Customer Information System Market (CIS) Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, supported by government initiatives promoting smart utilities and digital transformation. Heightened customer expectations for transparency and quick service response are driving utilities to adopt advanced CIS platforms. The integration of CIS with renewable energy management and smart metering solutions is becoming prevalent.

Germany Customer Information System Market (CIS) Insight

The Germany’s market is expanding due to growing digitalization in the energy sector and rising investments in smart grid infrastructure. The focus on energy efficiency and compliance with EU regulations encourages utilities to adopt sophisticated CIS platforms. Demand is increasing for solutions that enable real-time data processing and support for decentralized energy resources.

Asia-Pacific Customer Information System Market (CIS) Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rapid urbanization, increasing utility modernization, and government initiatives in countries such as China, India, and Australia. The rising adoption of cloud-based solutions and the growing need for efficient customer management in expanding utility networks support market growth.

China Customer Information System Market (CIS) Insight

The China leads the Asia-Pacific CIS market with the largest revenue share, driven by extensive smart city projects and large-scale utility upgrades. The government’s focus on digital infrastructure and energy efficiency is accelerating CIS implementation. Domestic vendors are also innovating to offer cost-effective, scalable CIS solutions suitable for the country’s diverse utility landscape.

Customer Information System (CIS) Market Share

The Customer Information System (CIS) industry is primarily led by well-established companies, including:

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Advanced Utility Systems (U.S.)

- Cayenta (Canada)

- Fluentgrid Limited (India)

- Gentrack (New Zealand)

- Hansen Technologies (Australia)

- Itineris (U.K.)

- Milestone Utility Services (U.S.)

Latest Developments in Global Customer Information System (CIS) Market

- In September 2024, KUBRA formed a partnership with Advanced Utility Systems to integrate KUBRA’s customer experience management solutions with Advanced Utility Systems’ Infinity Customer Information System. This collaboration aims to improve the efficiency and quality of utility customer service operations, enhancing user experience and driving innovation in customer engagement

- In April 2024, Hansen Technologies entered a strategic collaboration with AWS to integrate its customer management solutions with AWS’s cloud infrastructure. This partnership is set to boost scalability and performance for utility clients by leveraging advanced cloud technologies

- In August 2023, IBM acquired Apptio, a leading technology business management software company. This acquisition strengthens IBM’s portfolio with enhanced IT financial management, advanced analytics, and financial planning tools, broadening its offerings in the customer information system market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.