Global Endocrine Testing Market

Market Size in USD Billion

CAGR :

%

USD

11.39 Billion

USD

17.99 Billion

2024

2032

USD

11.39 Billion

USD

17.99 Billion

2024

2032

| 2025 –2032 | |

| USD 11.39 Billion | |

| USD 17.99 Billion | |

|

|

|

|

Endocrine Testing Market Analysis

The endocrine testing market is witnessing significant growth, fueled by advanced diagnostic technologies and innovative testing methods. Automated immunoassays and chemiluminescent immunoassay (CLIA) techniques are increasingly being adopted for their precision and speed in detecting hormonal imbalances. In addition, liquid chromatography-tandem mass spectrometry (LC-MS/MS) has become a gold standard for accurate and sensitive hormone analysis, particularly for complex conditions such as adrenal insufficiency and thyroid disorders.

Wearable biosensors are emerging as revolutionary tools, allowing real-time monitoring of endocrine parameters such as glucose and cortisol levels. Telemedicine integration has further expanded access to endocrine testing, particularly in remote areas, enhancing early diagnosis and treatment outcomes.

Growth in this market is driven by rising endocrine-related conditions, such as diabetes, obesity, and thyroid dysfunction. The increasing prevalence of lifestyle disorders, coupled with growing awareness and technological adoption in emerging economies, supports market expansion. Government initiatives and strategic partnerships among healthcare providers also contribute to advancing endocrine diagnostics globally.

Endocrine Testing Market Size

The global endocrine testing market size was valued at USD 11.39 billion in 2024 and is projected to reach USD 17.99 billion by 2032, with a CAGR of 5.88% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Endocrine Testing Market Trends

“Rising Adoption of Home Testing Kits”

One specific trend driving growth in the endocrine testing market is the rising adoption of at home testing kits. These kits allow users to measure hormone levels such as cortisol, testosterone, and thyroid hormones conveniently at home, offering privacy and ease of use. Companies such as Everlywell and LetsGetChecked have developed accessible solutions with rapid results, catering to the growing preference for self-care and remote healthcare. The COVID-19 pandemic accelerated this trend as patients sought alternatives to in-clinic visits. Furthermore, advancements in technology, such as smartphone-integrated diagnostic devices, enhance the accuracy and usability of these kits, making endocrine testing more accessible and fostering market expansion globally.

Report Scope and Endocrine Testing Market Segmentation

|

Attributes |

Endocrine Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott (U.S.), DH Tech. Dev. Pte. Ltd. (Singapore), Biomedical Technologies Limited (U.K.), Agilent Technologies (U.S.), Beckman Coulter, Inc. (U.S.), bioMérieux SA (France), Bio-Rad Laboratories Inc. (U.S.), DiaSorin (Italy), F. Hoffmann-La Roche Ltd (Switzerland), Laboratory Corporation of America Holdings (U.S.), Quest Diagnostics Incorporated (U.S.), Hologic, Inc. (U.S.) Ortho Clinical Diagnostics (U.S.), QIAGEN (Germany), and American Chemistry Council, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Endocrine Testing Market Definition

Endocrine testing evaluates the function of the endocrine system, which includes glands such as the thyroid, adrenal, pancreas, and pituitary. These tests measure hormone levels in blood, urine, or saliva to diagnose conditions such as diabetes, thyroid disorders, adrenal insufficiency, and hormonal imbalances. Common tests include thyroid function tests (TSH, T3, T4), glucose tolerance tests for diabetes, and cortisol measurements for stress response. Endocrine test is vital for identifying hormonal issues affecting metabolism, growth, reproduction, and overall health. Modern advancements in testing technology ensure accurate and early diagnosis, aiding effective treatment and management of endocrine-related disorders.

Endocrine Testing Market Dynamics

Drivers

- Rising Prevalence of Endocrine Disorders

The rising prevalence of endocrine disorders, such as diabetes, thyroid dysfunction, and adrenal disorders, significantly drives the demand for endocrine testing. For instance, the World Health Organization (WHO) reports that diabetes is affecting over 400 million people worldwide, with many undiagnosed cases leading to a growing need for diagnostic tests to monitor blood sugar and hormone levels. Similarly, thyroid diseases, particularly hypothyroidism, are on the rise, especially in older adults. These conditions require regular testing to manage hormone imbalances effectively. As a result, the increasing diagnosis rates for these disorders have spurred demand for accurate, accessible, and timely endocrine testing across healthcare settings globally, fueling market growth.

- Expansion of Diagnostic Laboratories

The expansion of diagnostic lab chains, especially in developing regions, significantly contributes to the growth of the endocrine testing market. In countries such as India and Brazil, an increasing number of diagnostic centers are emerging, making endocrine testing more accessible and affordable. For instance, Labcorp and Quest Diagnostics, major players in the U.S., are expanding internationally to meet the growing demand for hormone testing. In India, diagnostic companies such as Dr. Lal PathLabs and Thyrocare are expanding their presence in both urban and rural areas, providing affordable endocrine testing services. This accessibility increases patient awareness and facilitates early detection, boosting the demand for diagnostic tests globally.

Opportunities

- Growing Awareness of Hormonal Imbalances

The increasing public awareness of hormonal imbalances has created significant opportunities in the endocrine testing market. Educational campaigns and health programs, especially those targeting conditions such as thyroid dysfunction, diabetes, and polycystic ovary syndrome (PCOS), have empowered individuals to recognize symptoms and seek timely testing. For instance, the American Thyroid Association’s initiatives have raised awareness of thyroid disorders, leading to higher testing rates. As people become more proactive in managing their health, there is a growing demand for hormone level assessments, offering a lucrative opportunity for companies providing advanced diagnostic solutions. This trend is expected to drive market growth in the coming years.

- Integration of Artificial Intelligence

The integration of Artificial Intelligence (AI) in endocrine testing presents a significant opportunity for the market by enhancing the precision and efficiency of diagnostics. AI-powered platforms are capable of analyzing complex hormone test results faster and more accurately than traditional methods, which can improve diagnostic accuracy and treatment outcomes. For instance, AI algorithms can detect patterns in data from thyroid function tests, such as TSH, T3, and T4 levels, to identify early signs of thyroid disorders such as hypothyroidism or hyperthyroidism. This not only reduces human error but also speeds up diagnosis, making it an attractive option for healthcare providers. As a result, AI’s growing adoption in healthcare offers substantial growth potential in the endocrine testing market.

Restraints/Challenges

- High Price of Testing

The advanced testing procedures and specialized equipment required for accurate endocrine testing can be prohibitively expensive. This presents a significant challenge, particularly in low-income regions and healthcare settings with limited budgets. The high costs not only restrict access to these vital tests for many patients but also place a burden on healthcare providers, forcing them to prioritize other essential services. As a result, the demand for endocrine testing may remain low in underserved areas, slowing the overall market growth. The financial barriers further exacerbate health disparities, limiting the ability of many individuals to undergo timely diagnostic tests for endocrine disorders.

- Lack of Standardization

The lack of standardization in the endocrine testing market presents a significant challenge. Variability in testing methods, equipment, and protocols across different regions or institutions results in inconsistent testing procedures, leading to discrepancies in results. This lack of uniformity complicates the interpretation of test outcomes, potentially impacting diagnostic accuracy and patient care. Furthermore, without standardized practices, it becomes difficult to compare results from different laboratories, hindering the development of universal treatment guidelines. These inconsistencies create uncertainty in the reliability of tests, which can deter healthcare providers and patients from fully embracing endocrine testing, ultimately limiting market growth and adoption.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Endocrine Testing Market Scope

The market is segmented on the basis of test, technology and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test

- Thyroid Test

- Insulin Test

- Dehydroepiandrosterone sulfate (DHEAS)

- Human Chorionic Gonadotropin Test

- Human Chorionic Gonadotropin (HCG)

- Follicle Stimulating (FSH)

- Prolactin Test

- Luteinizing Hormone Test

- Progesterone Test

- Others

Technology

- Immunoassay

- Monoclonal and Polyclonal Antibody Technologies

- Clinical Chemistry Technologies

- Tandem Mass Spectroscopy

- Sensor Technology

- Others

End-User

- Hospitals

- Clinical Laboratories

- Others

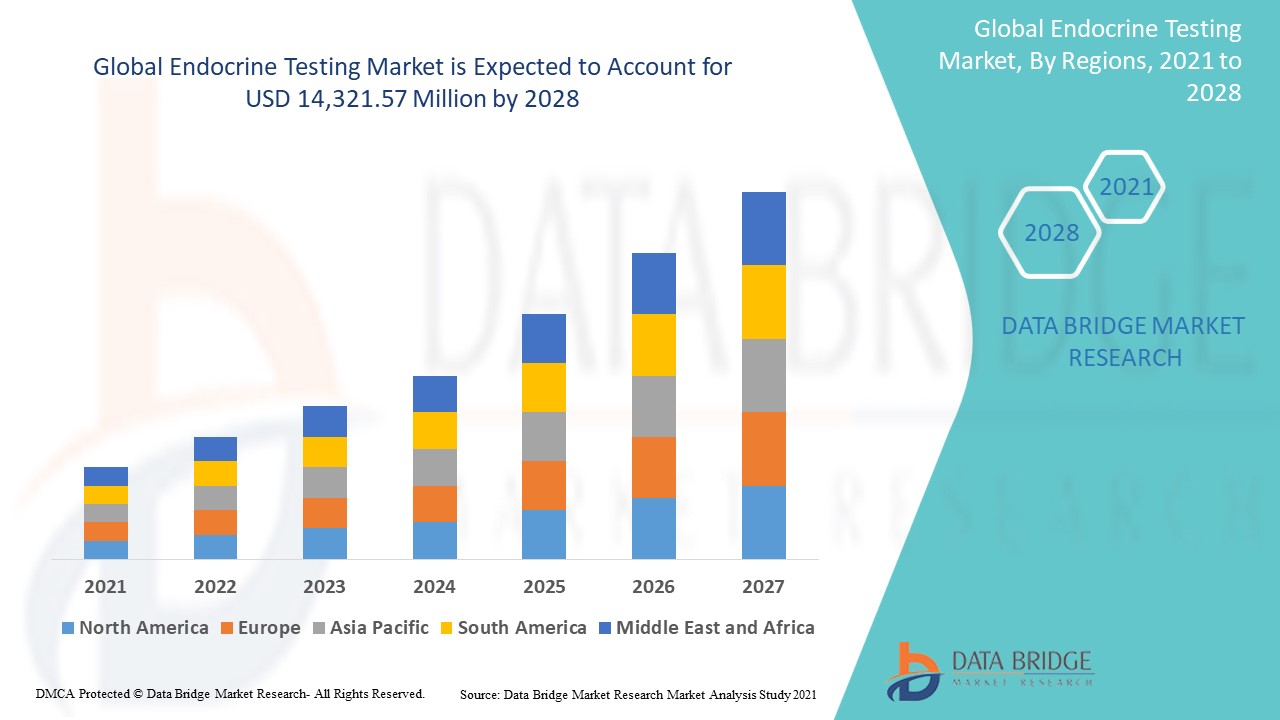

Endocrine Testing Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, test, technology and end users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America is expected to dominate the endocrine testing market due to the high prevalence of obesity, increasing awareness about endocrine disorders, and advancements in diagnostic technologies. In addition, the development of innovative, easy-to-operate test kits contributes significantly to the region's market growth.

Asia-Pacific is expected to show growth in the endocrine testing market during the forecast period due to the rising prevalence of endocrine disorders. In addition, government initiatives aimed at enhancing healthcare facilities and increasing patient awareness are driving demand for advanced diagnostic solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Endocrine Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Endocrine Testing Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- DH Tech. Dev. Pte. Ltd. (Singapore)

- Biomedical Technologies Limited (U.K.)

- Agilent Technologies (U.S.)

- Beckman Coulter, Inc. (U.S.)

- bioMérieux SA (France)

- Bio-Rad Laboratories Inc. (U.S.)

- DiaSorin (Italy)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Laboratory Corporation of America Holdings (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Hologic, Inc. (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- QIAGEN (Germany)

- American Chemistry Council, Inc. (U.S.)

Latest Developments in Endocrine Testing Market

- In November 2023, The FDA approved Eli Lilly’s Zepbound (tirzepatide) injection as the first obesity treatment targeting both GIP and GLP-1 hormone receptors. This groundbreaking drug is indicated for adults with obesity or overweight, particularly those with related medical conditions. When combined with a reduced-calorie diet and increased physical activity, Zepbound aids in significant weight loss, offering a novel solution for managing obesity

- In October 2023, Eli Lilly and Company presented results from two Phase 3 trials, LIBRETTO-431 and LIBRETTO-531, at the ESMO Congress 2023. These trials evaluated Retevmo (selpercatinib) in RET fusion-positive non-small cell lung cancer (NSCLC) and RET-mutant medullary thyroid cancer (MTC). In both cases, Retevmo demonstrated promising efficacy, outperforming chemotherapy and multi-kinase inhibitors, making it a promising treatment for these advanced cancers

- In April 2023, Eli Health raised USD 3.6 million to develop saliva-based continuous hormone monitoring technology. Initially focusing on menopause, fertility, and general health, the technology aims to empower women with real-time insights into their hormonal health. Future expansion plans include addressing contraception and endocrine diseases once regulatory approvals and clinical validations are completed, potentially transforming women's health monitoring

- In August 2022, The FDA approved the Mira Ovum Wand, an over-the-counter device that detects follicle-stimulating hormone (FSH) levels in urine. This tool enables women to monitor their fertility at home with ease and accuracy. The Mira Ovum Wand offers a new, accessible option for women tracking ovulation, helping with family planning and improving overall reproductive health management

- In May 2022, Inne.io, based in Berlin, secured an additional EUR 9.3 million to expand its hormone-tracking technology. This funding aims to help women better understand and manage their reproductive health. The company focuses on providing accessible hormone tracking solutions, with plans to eventually broaden its offerings to include other areas such as fertility and contraception, potentially revolutionizing the way women track their hormonal health

- In March 2021, Abbott Laboratories launched the Alinity m Diagnostics System, a high-throughput, automated platform for immunoassay testing. The system enables rapid and accurate diagnostic testing for endocrine-related conditions and other medical tests. With its quick turnaround time and advanced technology, the Alinity m system significantly improves diagnostic efficiency, enhancing Abbott’s position in the medical diagnostics market and contributing to improved patient care

- In February 2021, Siemens Healthineers introduced the Atellica Solution for Endocrinology, a comprehensive, fully automated immunoassay system. Designed for endocrinology testing, this system provides precise and reliable results for a broad spectrum of hormone markers. The launch of the Atellica Solution bolstered Siemens’ product portfolio, enhancing its ability to meet the growing demand for accurate, automated testing solutions in the healthcare sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.