Global Fava Beans Market

Market Size in USD Billion

CAGR :

%

USD

4.23 Billion

USD

5.00 Billion

2024

2032

USD

4.23 Billion

USD

5.00 Billion

2024

2032

| 2025 –2032 | |

| USD 4.23 Billion | |

| USD 5.00 Billion | |

|

|

|

|

What is the Global Fava Beans Market Size and Growth Rate?

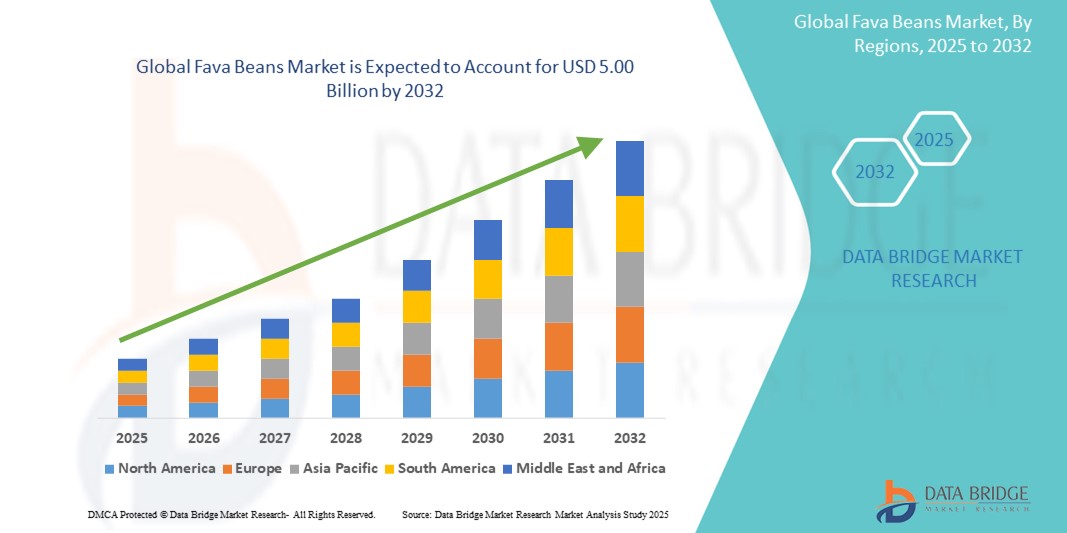

- The global fava beans market size was valued at USD 4.23 billion in 2024 and is expected to reach USD 5.00 billion by 2032, at a CAGR of 2.10% during the forecast period

- In the food industry, fava beans serve as versatile ingredients, offering nutritional benefits and culinary diversity. They are commonly used in various cuisines worldwide, appearing in dishes such as salads, soups, stews, and side dishes

- Fava beans are valued for their high protein and fiber content, making them suitable for vegetarian and vegan diets as well as health-conscious consumers. They can be processed into flour, purees, or added whole to enhance texture and flavor in ready-to-eat meals, snacks, and bakery products

What are the Major Takeaways of Fava Beans Market?

- Fava beans are high in protein, fiber, vitamins (such as folate and vitamin K), and minerals (iron and manganese), making them attractive to health-conscious consumers. These nutrients contribute to various health benefits, including improved digestion, cholesterol management, and support for heart health. As consumers become more informed about the importance of balanced diets and seek plant-based protein sources, fava beans emerge as a natural choice

- Their versatility in culinary applications, from salads to protein-rich dishes, further enhances their appeal in meeting dietary preferences and health goals, driving sustained demand and market growth

- North America dominated the fava beans market, accounting for the largest revenue share of 33.47% in 2024, driven by the increasing demand for plant-based protein sources, growing interest in sustainable agriculture, and rising health-conscious consumer behavior

- Asia-Pacific fava beans market is projected to grow at the fastest CAGR of 8.47% from 2025 to 2032, driven by increasing demand for affordable protein sources, rising urbanization, and expanding health-conscious middle class in countries such as China, India, and Japan

- The human nutrition segment dominated the fava beans market with the largest market revenue share of 67.4% in 2024, driven by the increasing demand for plant-based proteins, rising vegan and vegetarian population, and the expanding functional food and nutritional supplements industry

Report Scope and Fava Beans Market Segmentation

|

Attributes |

Fava Beans Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fava Beans Market?

“Rising Popularity of Plant-Based Protein Sources”

- A significant trend shaping the global fava beans market is the increasing consumer demand for plant-based protein, driven by health consciousness, sustainability concerns, and the shift towards vegan or flexitarian diets. Fava beans are emerging as a favored alternative due to their high protein content, low allergenicity, and environmental benefits

- Fava beans are being incorporated into various meat substitutes, protein-enriched snacks, dairy alternatives, and nutritional supplements. Their functional properties, including emulsification and water-binding, make them suitable for a wide range of food applications

- For instance, Roquette Frères launched its NUTRALYS® Fava S900M fava bean protein isolate in 2023, focusing on clean-label, allergen-free ingredients for use in plant-based foods and beverages

- The growing consumer preference for clean-label and non-GMO products is further driving the demand for minimally processed fava bean ingredients. Moreover, manufacturers are innovating with fava bean protein concentrates and flours for use in gluten-free and fortified food applications

- This trend is opening new product innovation avenues and encouraging large food companies to invest in sustainable sourcing and contract farming of fava beans

- As health and sustainability continue to influence purchasing decisions, the trend toward plant-based diets is expected to keep fueling the growth of the fava beans market globally

What are the Key Drivers of Fava Beans Market?

- The increasing demand for sustainable protein sources and the rising awareness of the health benefits associated with fava beans are major growth drivers of the market

- For instance, in March 2024, AGT Foods expanded its fava bean processing capacity to meet the growing demand for plant-based protein in North America and Europe, indicating a strong industry shift towards sustainable agriculture

- Fava beans are rich in protein, fiber, and micronutrients such as iron and magnesium, making them attractive for both human and animal nutrition. Their nitrogen-fixing ability also enhances soil fertility, promoting their use in regenerative farming systems

- The growing use of fava beans in functional foods, sports nutrition, and bakery products along with their role as a soy or pea protein alternative—is further accelerating their uptake by health-focused consumers and food producers

- In addition, government support for sustainable crops and dietary guidelines promoting plant-based eating habits are expected to positively influence market growth. The rapid rise of veganism and flexitarian diets in regions such as Europe and North America is expanding the consumer base for fava bean products

Which Factor is challenging the Growth of the Fava Beans Market?

- One of the major challenges for the fava beans market is the bitterness caused by vicine and convicine, anti-nutritional compounds present in the beans, which can impact taste and limit their acceptance in certain food applications

- For instance, food developers often need to invest in processing techniques such as de-bittering or enzyme treatments to make fava beans more palatable, especially in snacks and dairy alternatives. These added steps can increase processing costs and limit scalability

- Moreover, G6PD deficiency, a genetic disorder prevalent in parts of Africa, the Middle East, and Asia, can lead to favism an adverse reaction to fava bean consumption. This limits the product’s marketability in certain regions

- Supply chain limitations, such as seasonal cultivation and dependency on limited growing regions, pose risks to consistent quality and availability. Climate impacts, such as drought or flooding, can also affect crop yield and pricing

- Overcoming these challenges requires investment in breeding low-vicine varieties, advancing taste-enhancing technologies, and improving consumer education around the nutritional and environmental benefits of fava beans to drive broader adoption

How is the Fava Beans Market Segmented?

The market is segmented on the basis of product, application and distribution channel.

- By Product

On the basis of product, the fava beans market is segmented into whole fava beans, fava bean flour, fava bean protein isolate, fava bean protein concentrate, and others.

The Fava bean flour segment dominated the fava beans market with the largest market revenue share of 72.5% in 2024. As health consciousness rises globally, more individuals seek nutritious food options that provide substantial health benefits. Fava bean flour is recognized for its high protein, fiber, and mineral content, making it an attractive choice for those looking to enhance their diets with nutrient-dense ingredients. This increasing awareness about the nutritional advantages of fava beans, including their role in maintaining blood pressure and improving overall health, drives demand for fava bean flour in various culinary applications.

The whole fava beans segment is projected to grow at a CAGR of 4.3% from 2025 to 2032. A key driver of this growth is the rising popularity of vegetarian and vegan lifestyles. As more people shift toward plant-based diets motivated by ethical considerations, environmental sustainability, and the health advantages of reducing meat intake fava beans are emerging as an essential source of plant-based protein.

- By Application

On the basis of application, the fava beans market is segmented into human nutrition and animal feed. The human nutrition segment dominated the fava beans market with the largest market revenue share of 67.4% in 2024, driven by the increasing demand for plant-based proteins, rising vegan and vegetarian population, and the expanding functional food and nutritional supplements industry. Fava beans are rich in protein, fiber, and essential micronutrients, making them an ideal ingredient in meat alternatives, protein powders, and ready-to-eat meals. The clean-label movement and consumer inclination towards sustainable and health-conscious diets further support segment dominance.

The animal feed segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for high-protein feed ingredients, especially in poultry and aquaculture. Fava beans serve as a cost-effective, digestible protein source, and their non-GMO nature appeals to premium feed formulations. Increasing livestock production in developing economies and the shift towards alternative feed sources to reduce reliance on soy are contributing factors to this growth.

- By Distribution Channel

On the basis of distribution channel, the fava beans market is segmented into online and offline channels. The offline segment held the largest market revenue share in 2024, accounting for 71.9%, due to the established network of supermarkets, hypermarkets, specialty food stores, and wholesalers. These traditional channels ensure product visibility, allow bulk buying, and appeal to consumers seeking physical product inspection before purchase. Offline availability also benefits from institutional buyers such as food processors and feed manufacturers.

The online segment is expected to register the fastest CAGR during the forecast period (2025–2032), driven by the growing popularity of e-commerce platforms, increased smartphone penetration, and consumer preference for convenience. Online channels offer access to a wider range of Fava Bean-based products and competitive pricing, while also enabling direct-to-consumer distribution by emerging health and plant-based food brands.

Which Region Holds the Largest Share of the Fava Beans Market?

- North America dominated the fava beans market, accounting for the largest revenue share of 33.47% in 2024, driven by the increasing demand for plant-based protein sources, growing interest in sustainable agriculture, and rising health-conscious consumer behavior

- Consumers in the region are rapidly adopting fava beans in various forms whole, split, or flour for use in protein snacks, meat substitutes, soups, and health supplements

- Strong supply chain infrastructure, rising investments in pulse crop processing, and supportive government policies for legume cultivation are reinforcing North America’s leading position in the global market

U.S. Fava Beans Market Insight

The U.S. held the largest revenue share in the North American fava beans market in 2024, fueled by robust consumer demand for high-protein, gluten-free, and fiber-rich food products. The market benefits from increasing popularity of plant-based diets, innovations in fava bean-based protein isolates, and incorporation in food formulations by leading health food brands. Government initiatives supporting pulse farming and R&D in crop genetics are also contributing to the growth and competitiveness of the U.S. Fava Beans industry.

Europe Fava Beans Market Insight

The Europe fava beans market is expected to expand at a significant CAGR during the forecast period, driven by heightened focus on sustainable agriculture, rising vegan population, and protein diversification efforts. Countries such as France, Germany, and the U.K. are investing in domestic fava bean production to reduce dependence on imported soy and to meet the rising demand for non-GMO ingredients. Adoption is growing in functional foods, meat substitutes, and bakery applications, with Europe’s green protein strategy supporting long-term market expansion.

U.K. Fava Beans Market Insight

The U.K. fava beans market is projected to grow at a noteworthy CAGR, driven by rising health awareness, clean-label trends, and demand for local, plant-based protein alternatives. British consumers are increasingly adopting fava bean products in ready meals, snacks, and high-protein flours. The country’s strong retail network and plant-based food innovation ecosystem make it a lucrative market for fava bean processors and food manufacturers.

Germany Fava Beans Market Insight

The Germany fava beans market is poised to register strong growth through 2032, backed by a thriving plant-based food sector and focus on climate-resilient crops. German consumers favor organic, sustainable ingredients, boosting demand for fava beans in health food and vegan products. Public-private initiatives to promote legume cultivation and reduce greenhouse gas emissions from agriculture are supporting local production and market penetration.

Which Region is the Fastest Growing in the Fava Beans Market?

Asia-Pacific fava beans market is projected to grow at the fastest CAGR of 8.47% from 2025 to 2032, driven by increasing demand for affordable protein sources, rising urbanization, and expanding health-conscious middle class in countries such as China, India, and Japan. Governments in the region are supporting pulse cultivation for food security, while consumers are shifting toward protein-rich, plant-based diets due to changing lifestyles and economic growth. Local food companies are innovating with fava bean flour and snacks, creating broader awareness and accelerating adoption.

Japan Fava Beans Market Insight

The Japan fava beans market is expanding rapidly, supported by an aging population seeking nutrient-dense diets, and rising demand for clean-label, locally sourced ingredients. Japanese food producers are increasingly using fava beans in soups, rice mixes, and protein snacks. A strong culture of functional foods and government backing for sustainable crop alternatives are further enhancing the growth trajectory.

China Fava Beans Market Insight

The China fava beans market captured the largest revenue share in Asia-Pacific in 2024, driven by the rapid growth of plant-based food products and government initiatives promoting domestic protein crop production. Fava beans are widely used in traditional Chinese dishes, and their use is now expanding into modern food products and packaged snacks. The presence of large-scale pulse processing facilities and emerging plant-protein startups is reinforcing China’s dominance in the regional market.

Which are the Top Companies in Fava Beans Market?

The fava beans industry is primarily led by well-established companies, including:

- Assa Abloy (Sweden)

- Allegion (Ireland)

- Kwikset (U.S.)

- Yale (Sweden)

- August Home (U.S.)

- Schlage (U.S.)

- Level Lock (U.S.)

- Lockly (U.S.)

- U-tec (U.S.)

- TP-Link (China)

- Eufy Security (China)

- Aqara (China)

- Nuki (Austria)

- Danalock (Denmark)

- Samsung SmartThings (South Korea)

- Honeywell (U.S.)

- Brinks Home (U.S.)

- Vivint (U.S.)

- ZKTeco (China)

- Tesa (Spain)

What are the Recent Developments in Global Fava Beans Market?

- In January 2023, Tesco PLC, in collaboration with fava bean processor AB Mauri and its own-brand suppliers such as Samworth Brothers, initiated trials of fava beans across various product lines in the UK. This partnership aims to integrate fava beans into different food products, potentially increasing demand due to enhanced consumer exposure and product innovation

- In September 2021, The University of Sydney introduced a new fava bean variety named FBA Ayla, tailored for cultivation in northern New South Wales and southern Queensland, Australia. This variety is designed to improve yield and adaptability to local growing conditions, potentially boosting production and supply in the region

- In January 2021, The Chongqing Academy of Agricultural Sciences, in collaboration with Qinghai University and Chongqing Agricultural Technology Extension Station, developed the Doumei 1 fava bean variety. This variety serves dual purposes in horticulture and as a food source, highlighting advancements in agricultural research aimed at enhancing both crop productivity and nutritional value

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.