Global Functional Dyspepsia Market

Market Size in USD Billion

CAGR :

%

USD

1.28 Billion

USD

1.69 Billion

2024

2032

USD

1.28 Billion

USD

1.69 Billion

2024

2032

| 2025 –2032 | |

| USD 1.28 Billion | |

| USD 1.69 Billion | |

|

|

|

|

Functional Dyspepsia Market Size

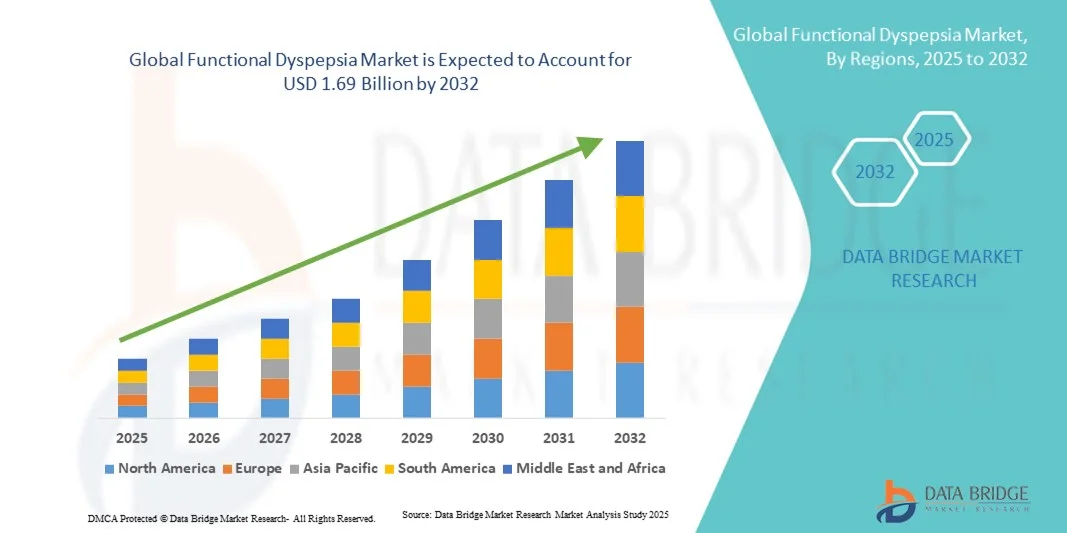

- The global functional dyspepsia market size was valued at USD 1.28 billion in 2024 and is expected to reach USD 1.69 billion by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely driven by the increasing prevalence of gastrointestinal disorders, growing awareness of digestive health, and advancements in diagnostic and therapeutic solutions for functional dyspepsia

- Furthermore, rising patient preference for effective, safe, and targeted treatment options, along with increasing investment by pharmaceutical companies in R&D for novel therapies, is positioning functional dyspepsia treatments as a key segment within gastrointestinal care. These factors are collectively propelling market adoption, thereby significantly enhancing the industry’s growth

Functional Dyspepsia Market Analysis

- Functional dyspepsia, characterized by recurring upper abdominal discomfort without an identifiable organic cause, is increasingly recognized as a significant gastrointestinal disorder affecting quality of life in both developed and developing regions due to its high prevalence and chronic nature

- The escalating demand for functional dyspepsia treatments is primarily fueled by growing awareness of digestive health, increasing prevalence of gastrointestinal disorders, and rising patient preference for effective, non-invasive, and targeted therapies

- North America dominated the functional dyspepsia market with the largest revenue share of 39.3% in 2024, supported by high healthcare expenditure, advanced healthcare infrastructure, early adoption of novel therapeutics, and strong presence of leading pharmaceutical companies focusing on R&D for innovative treatment

- Asia-Pacific is expected to be the fastest growing region in the functional dyspepsia market during the forecast period due to increasing population, rising healthcare awareness, and expanding access to modern diagnostic and therapeutic option

- Prokinetics agents segment dominated the functional dyspepsia market with a market share of 41.9% in 2024, driven by its established efficacy in managing gastric motility-related symptoms and widespread clinical adoption

Report Scope and Functional Dyspepsia Market Segmentation

|

Attributes |

Functional Dyspepsia Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Functional Dyspepsia Market Trends

Rising Preference for Non-Invasive and Targeted Therapies

- A significant and accelerating trend in the global functional dyspepsia market is the growing adoption of non-invasive, targeted therapies that improve symptom management while minimizing adverse effects. This shift is enhancing patient adherence and quality of life

- For Instance, the launch of acotiamide in several regions has provided patients with a prokinetic option that specifically targets gastric motility, reducing bloating and discomfort effectively. Similarly, herbal and gut microbiome-based therapies are being integrated into treatment plans, offering alternative solutions for symptom relief

- Advancements in personalized treatment approaches, such as symptom-based stratification and biomarker-guided therapy selection, enable more precise management of functional dyspepsia, reducing trial-and-error prescriptions and improving therapeutic outcomes. Instance, some gastroenterology clinics now use symptom profiling to tailor prokinetic or acid-suppressing therapy

- Integration of digital health tools, such as mobile symptom trackers and telemedicine consultations, facilitates better monitoring of patient response, adherence, and early identification of exacerbations. Through these tools, physicians can adjust treatment regimens efficiently and provide more continuous care

- This trend towards patient-centric, precise, and technology-assisted treatment is fundamentally reshaping expectations in functional dyspepsia management. Consequently, companies such as Zeria Pharmaceutical and Takeda are developing therapies and patient support platforms that leverage digital monitoring and symptom-guided interventions

- The demand for functional dyspepsia treatments that offer targeted efficacy, minimal side effects, and integration with patient-centric digital tools is growing rapidly across both developed and emerging markets, as patients increasingly prioritize effective and convenient therapeutic solutions

Functional Dyspepsia Market Dynamics

Driver

Increasing Prevalence of Gastrointestinal Disorders and Awareness of Digestive Health

- The rising prevalence of functional dyspepsia and other gastrointestinal disorders, coupled with growing awareness of digestive health, is a significant driver for the heightened demand for effective treatment options

- For Instance, in 2024, Takeda Pharmaceuticals highlighted the increasing incidence of dyspeptic symptoms globally and expanded its marketing and educational initiatives for acotiamide and related therapies. Such strategies by key companies are expected to drive functional dyspepsia market growth in the forecast period.

- As patients become more aware of symptom management options and seek therapies that improve quality of life, pharmaceutical companies are introducing novel prokinetics, acid suppressants, and gut-targeted formulations, offering a compelling alternative to traditional treatments

- Furthermore, increasing access to healthcare facilities and gastroenterology specialists in urban and semi-urban areas is making functional dyspepsia diagnosis and treatment more widespread, supporting adoption of modern therapies

- Awareness campaigns by professional associations and patient advocacy groups, combined with the convenience of telemedicine consultations, enable patients to seek timely diagnosis and treatment, further propelling market growth in both developed and emerging regions

Restraint/Challenge

Side Effects, Treatment Adherence, and Regulatory Hurdles

- Concerns regarding treatment-related side effects and the complexity of chronic management of functional dyspepsia pose significant challenges to broader market penetration. Long-term adherence to prokinetics or acid-suppressing therapies can be limited due to gastrointestinal discomfort or mild adverse reactions

- For Instance, reports of mild headache or diarrhea in some patients receiving acotiamide have made adherence a concern, requiring physicians to closely monitor treatment plans

- Addressing these challenges through development of therapies with improved safety profiles, patient education on adherence strategies, and monitoring tools is crucial for sustaining market growth. Companies such as Zeria Pharmaceutical emphasize clinical data and patient support programs to encourage compliance and mitigate side effects concerns

- In addition, regulatory approval timelines for new therapies in functional dyspepsia can be lengthy due to the need for rigorous clinical trials, which can delay product launches and restrict early adoption in certain regions

- Overcoming these challenges through safer formulations, patient engagement programs, and expedited regulatory pathways will be vital for driving long-term growth in the functional dyspepsia market

Functional Dyspepsia Market Scope

The market is segmented on the basis of treatment, drug type, diagnosis, symptoms, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the functional dyspepsia market is segmented into medications and behavioral therapy. The medications segment dominated the market with the largest revenue share in 2024, driven by widespread adoption of pharmacological interventions such as prokinetics, proton pump inhibitors, and H2-receptor blockers. Patients often prefer medications due to their rapid symptom relief, established clinical efficacy, and ease of administration. The dominance is supported by high R&D investments and extensive availability in hospitals, clinics, and pharmacies. In addition, medications are often considered first-line therapy by gastroenterologists for both acute and chronic symptom management. High patient compliance and consistent physician recommendations reinforce the segment’s sustained growth.

The behavioral therapy segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of gut-brain axis disorders and patient preference for non-pharmacological, holistic approaches. Techniques such as cognitive behavioral therapy, stress management, and hypnotherapy are gaining popularity as adjunctive or standalone treatments. Integration of telemedicine platforms for behavioral interventions is improving accessibility and adherence. Rising clinical evidence supporting efficacy in symptom reduction further encourages adoption. The trend towards personalized, patient-centric care contributes to the rapid growth of this segment.

- By Drug Type

On the basis of drug type, the functional dyspepsia market is segmented into H-2 receptor blockers, antacids, proton pump inhibitors (PPIs), prokinetic agents, selective serotonin reuptake inhibitors (SSRIs), antibiotics, and others. The prokinetic agents segment dominated the market in 2024 with a market share of 41.9%, driven by their efficacy in improving gastric motility and alleviating bloating, nausea, and postprandial fullness. Prokinetics are widely prescribed as first-line treatment for motility-related symptoms and are preferred due to their favorable safety and efficacy profile. Broad clinical adoption in hospitals, clinics, and pharmacies supports sustained revenue. Physician familiarity and guideline recommendations reinforce their dominance. In addition, ongoing R&D for enhanced formulations contributes to continued market leadership.

The SSRIs segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by recognition of central nervous system modulation in functional dyspepsia. SSRIs are increasingly prescribed for patients with comorbid anxiety or depression, common in chronic gastrointestinal disorders. Instance, clinical studies have shown SSRIs improve symptom perception and quality of life. Growing physician awareness and patient demand for comprehensive management options accelerate adoption. Integration with behavioral therapies further strengthens market potential.

- By Diagnosis

On the basis of diagnosis, the functional dyspepsia market is segmented into blood tests, breath tests, stool tests, and others. The blood tests segment dominated the market in 2024, owing to accessibility, low cost, and routine use for detecting H. pylori infection, nutrient deficiencies, and inflammatory markers. Blood tests are widely conducted in hospitals and diagnostic centers as part of standard screening. Their non-invasive nature and ease of use reinforce high adoption. Clinical familiarity and insurance coverage further enhance utilization. Blood tests provide quick results, supporting timely treatment decisions. Physician recommendations continue to sustain the dominance of this segment.

The breath tests segment is expected to witness the fastest growth rate from 2025 to 2032, driven by adoption of non-invasive, rapid, and highly accurate urea breath tests for H. pylori detection. Breath tests are patient-friendly and preferred for outpatient or community-based diagnostics. Increasing awareness of non-invasive options contributes to rising uptake. Integration with telehealth and remote monitoring platforms enhances accessibility. Rising prevalence of functional dyspepsia in emerging markets also supports growth. Clinicians increasingly recommend breath tests for early detection and monitoring, boosting adoption rates.

- By Symptoms

On the basis of symptoms, the functional dyspepsia market is segmented into bloating, belching, nausea, burning, and others. The bloating segment dominated the market in 2024, as it is among the most common and disruptive symptoms affecting functional dyspepsia patients. Effective management of bloating drives treatment demand. Physicians often prioritize bloating relief to improve patient quality of life. Both pharmacological and non-pharmacological interventions target this symptom. High prevalence and chronicity reinforce the segment’s dominance. Awareness campaigns by healthcare providers further enhance patient demand for bloating-specific therapies.

The nausea segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing prevalence of postprandial nausea and related gastrointestinal discomfort. Patients are seeking therapies specifically targeting nausea for improved quality of life. Prokinetics and antiemetics are increasingly prescribed for this symptom. Telemedicine consultations enable early symptom reporting and intervention. Rising awareness of symptom-specific management among physicians accelerates adoption. Market expansion in emerging regions supports rapid growth of the nausea segment.

- By End-Users

On the basis of end-users, the functional dyspepsia market is segmented into hospitals, diagnostic centers, clinics, and others. The hospitals segment dominated the market in 2024, driven by high patient inflow, availability of specialized gastroenterology departments, and access to a wide range of therapeutic and diagnostic options. Hospitals are primary points for diagnosis, treatment, and follow-up, ensuring steady demand. Integration with hospital pharmacies enhances patient convenience. Physician trust and established treatment protocols reinforce market share. Hospitals’ adoption of both pharmacological and behavioral therapies further consolidates dominance. High infrastructure investment enables advanced functional dyspepsia management.

The clinics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rise of specialized gastroenterology clinics and outpatient centers focusing on functional gastrointestinal disorders. Clinics provide personalized care and shorter consultation times, enhancing patient experience. Telemedicine-enabled clinics expand reach to underserved areas. Rising patient preference for outpatient care supports growth. Clinics often integrate behavioral therapy and digital monitoring for holistic management. Increasing establishment of gastroenterology-focused clinics in emerging markets accelerates segment expansion.

- By Distribution Channel

On the basis of distribution channel, the functional dyspepsia market is segmented into direct tender, hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market in 2024, supported by direct dispensing of prescription medications during hospital visits. Hospitals ensure ready availability of prokinetics, PPIs, and other therapies, facilitating adherence. Integration with hospital management systems streamlines procurement and distribution. Physician prescriptions directly link to hospital pharmacies, reinforcing dominance. High patient footfall in hospitals sustains consistent demand. Established supply chains and insurance coverage further support segment growth.

The online pharmacy segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing e-commerce adoption and patient preference for home delivery. Online pharmacies provide convenience, privacy, and access to a wide range of treatments. Digital prescription management enhances patient adherence. Expansion into remote and underserved areas fuels market growth. Increasing smartphone penetration and awareness campaigns encourage online purchases. Collaboration with healthcare providers and telemedicine platforms supports rapid adoption of online pharmacy channels.

Functional Dyspepsia Market Regional Analysis

- North America dominated the functional dyspepsia market with the largest revenue share of 39.3% in 2024, supported by high healthcare expenditure, advanced healthcare infrastructure, early adoption of novel therapeutics, and strong presence of leading pharmaceutical companies focusing on R&D for innovative treatment

- Patients and healthcare providers in the region highly value the availability of effective pharmacological therapies, access to specialized gastroenterology care, and integration of diagnostic tools for timely and accurate disease management

- This widespread adoption is further supported by high healthcare expenditure, strong presence of leading pharmaceutical companies, and increasing investment in R&D for novel therapies, establishing North America as a key region for functional dyspepsia treatment in both hospitals and outpatient settings

U.S. Functional Dyspepsia Market Insight

The U.S. functional dyspepsia market captured the largest revenue share of 42% in 2024 within North America, driven by the high prevalence of gastrointestinal disorders and increasing awareness of digestive health. Patients are increasingly prioritizing effective symptom management through pharmacological and non-pharmacological therapies. The growing adoption of advanced diagnostic tools, coupled with accessibility to specialized gastroenterology care, further propels the market. Moreover, continuous investment in R&D for novel therapies by key pharmaceutical companies is significantly contributing to market expansion. The integration of patient support programs and telemedicine platforms is also enhancing treatment adherence and outreach.

Europe Functional Dyspepsia Market Insight

The Europe functional dyspepsia market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising gastrointestinal disorder prevalence and growing awareness of early diagnosis and treatment. The increase in healthcare access, combined with demand for advanced therapeutics, is fostering market adoption. European patients are also drawn to personalized treatment options and minimally invasive therapies. The region is experiencing significant growth across hospitals, clinics, and diagnostic centers, with functional dyspepsia management being incorporated into both routine care and specialized gastroenterology services. Government initiatives promoting digestive health awareness further support market growth.

U.K. Functional Dyspepsia Market Insight

The U.K. functional dyspepsia market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising patient awareness, increasing gastrointestinal disorder incidence, and the demand for effective management solutions. In addition, the prevalence of comorbid conditions such as anxiety and depression is encouraging patients to seek comprehensive treatment options, including SSRIs and behavioral therapies. The U.K.’s advanced healthcare infrastructure, alongside strong telemedicine adoption and digital prescription platforms, is expected to continue to stimulate market growth. Physician-driven awareness campaigns and patient education programs further contribute to adoption.

Germany Functional Dyspepsia Market Insight

The Germany functional dyspepsia market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digestive health and rising demand for innovative, patient-centric therapies. Germany’s well-established healthcare system, emphasis on clinical research, and high per capita healthcare expenditure promote the adoption of functional dyspepsia treatments, particularly in hospitals and outpatient clinics. Integration of diagnostic tools with treatment regimens is becoming increasingly prevalent, with strong preference for evidence-based, safety-focused therapies aligning with local patient expectations. Ongoing clinical trials and new product launches further drive market growth.

Asia-Pacific Functional Dyspepsia Market Insight

The Asia-Pacific functional dyspepsia market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by increasing prevalence of gastrointestinal disorders, rising healthcare awareness, and expanding healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination toward early diagnosis and patient-centric management is driving treatment adoption. Furthermore, government initiatives promoting digestive health, increasing healthcare expenditure, and expanding access to specialized gastroenterology services are boosting market growth. Rising disposable incomes and enhanced availability of advanced therapies also support the market’s rapid expansion.

Japan Functional Dyspepsia Market Insight

The Japan functional dyspepsia market is gaining momentum due to the country’s aging population, high healthcare standards, and increasing focus on gastrointestinal wellness. Japanese patients place significant emphasis on symptom management, driving demand for both pharmacological and behavioral therapies. The integration of digital health platforms, such as telemedicine consultations and mobile symptom trackers, is fueling market growth. Moreover, Japan’s focus on precision medicine and adoption of novel prokinetics and SSRIs enhances treatment effectiveness. Increased patient awareness campaigns and early diagnosis initiatives further stimulate market demand in residential and clinical settings.

India Functional Dyspepsia Market Insight

The India functional dyspepsia market accounted for the largest revenue share in Asia Pacific in 2024, attributed to rising gastrointestinal disorder prevalence, rapid urbanization, and increased healthcare access. India stands as one of the fastest-growing markets for functional dyspepsia therapies, with high demand in hospitals, clinics, and diagnostic centers. Government programs promoting digestive health awareness and initiatives for early disease detection are accelerating adoption. Affordability of therapies, expanding telemedicine services, and growing patient awareness are key factors propelling the market. The presence of domestic pharmaceutical manufacturers and increasing availability of novel treatments further support market expansion.

Functional Dyspepsia Market Share

The Functional Dyspepsia industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- ZERIA Pharmaceutical Co.,Ltd (Japan)

- NeurAxis, Inc. (U.S.)

- Shionogi & Co., Ltd. (Japan)

- Astellas Pharma Inc. (Japan)

- AbbVie (U.S.)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson and its affiliates (U.S.)

- Novartis AG (Switzerland)

- Sanofi (France)

- Ferring Pharmaceuticals (Switzerland)

- Ironwood (U.S.)

- Alfasigma S.p.A. (Italy)

- Nestlé Health Science (Switzerland)

- Danone S.A. (France)

- Olympus Corporation (Japan)

- Medtronic (Ireland)

- Cook (U.S.)

- Enterome SA (France)

What are the Recent Developments in Global Functional Dyspepsia Market?

- In May 2025, NeurAxis received FDA 510(k) clearance for IB-Stim, a noninvasive neuromodulation device, for treating pediatric functional abdominal pain (FAP) and associated nausea in patients aged 8–21. This marks the first FDA-approved device for pediatric FD, expanding treatment options for a previously underserved population

- In February 2025, a randomized, placebo-controlled trial commenced in Indonesia to evaluate DLBS2411, a botanical-based therapy, for FD treatment. The study aims to assess the efficacy and safety of DLBS2411, potentially introducing a novel treatment modality for FD in the region

- In October 2024, a pilot study conducted by the Mayo Clinic demonstrated that virtual reality (VR) could safely and effectively reduce symptoms of functional dyspepsia. This innovative approach offers a non-invasive treatment option for patients, particularly given the absence of FDA-approved medications for FD. The study's findings suggest that VR could become a viable treatment modality for functional gastrointestinal disorders

- In August 2024 review published in Frontiers in Microbiology summarized changes in the duodenal microbiota of functional dyspepsia patients and their relationship with gut-brain interaction dysregulation. The study found alterations in specific microbial communities, which may contribute to the onset and exacerbation of FD symptoms

- In June 2024, Zeria Pharmaceutical Co., Ltd. and Agastra-Lab s.r.l. signed an exclusive agreement to develop and market acotiamide hydrochloride hydrate as a treatment for functional dyspepsia in Europe, the United States, and Canada. Acotiamide, the active ingredient in ACOFIDE® tablets, is the first FD treatment approved in Japan in 2013. This collaboration aims to expand the availability of acotiamide to a broader patient population

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.