Global Fusion Beverage Market

Market Size in USD Billion

CAGR :

%

USD

7.22 Billion

USD

11.68 Billion

2024

2032

USD

7.22 Billion

USD

11.68 Billion

2024

2032

| 2025 –2032 | |

| USD 7.22 Billion | |

| USD 11.68 Billion | |

|

|

|

|

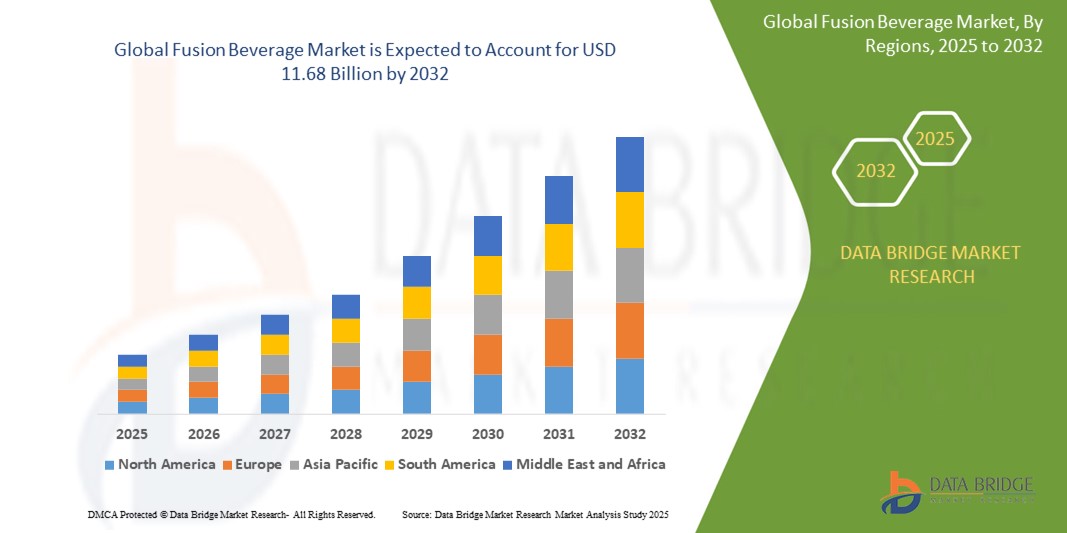

What is the Global Fusion Beverage Market Size and Growth Rate?

- The global fusion beverage market size was valued at USD 7.22 billion in 2024 and is expected to reach USD 11.68 billion by 2032, at a CAGR of 6.20% during the forecast period

- The fusion beverage market is experiencing robust growth, driven by evolving consumer preferences for unique and innovative flavor combinations

- The segment encompasses a wide range of drinks, including non-alcoholic options such as flavored teas and smoothies, as well as creative cocktails that blend traditional spirits with exotic ingredients.

What are the Major Takeaways of Fusion Beverage Market?

- Recent developments in the market include the rising demand for health-conscious fusion beverages, which incorporate functional ingredients such as adaptogens, probiotics, and superfoods. For instance, brands are increasingly launching drinks that combine traditional beverages such as kombucha with tropical flavors or herbal infusions, appealing to health-oriented consumers seeking both taste and wellness benefits

- In addition, advancements in food technology and flavor extraction techniques have enabled companies to create more complex and appealing flavor profiles, further enhancing product offerings

- As the fusion beverage market continues to evolve, it presents exciting opportunities for innovation, allowing companies to capture the interest of adventurous drinkers seeking new taste experiences

- North America dominated the global fusion beverage market with a dominant revenue share of 54.65% in 2024, supported by strong consumer demand for functional drinks, clean-label nutrition, and fitness-oriented formulations

- Asia-Pacific is projected to register the fastest CAGR of 12.36% from 2025 to 2032, fueled by rapid urbanization, rising income levels, and growing awareness of functional and wellness beverages

- The Fruit Juices segment dominated the market with the largest revenue share of 28.9% in 2024, driven by growing consumer preference for natural fruit blends combined with added vitamins, minerals, and functional extracts

Report Scope and Fusion Beverage Market Segmentation

|

Attributes |

Fusion Beverage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fusion Beverage Market?

“Personalized Nutrition and Functional Formulations”

- A central trend in the fusion beverage market is the growing demand for customized nutritional solutions enriched with functional ingredients such as adaptogens, nootropics, collagen, and botanical extracts

- In February 2024, PepsiCo expanded its KeVita line with functional fusion beverages combining probiotics, electrolytes, and green tea extracts tailored for digestive health and energy support

- Consumers increasingly seek clean-label, organic, and allergen-free products, driving innovation in plant-based and low-sugar fusion beverages

- Companies such as Nestlé and Glanbia are investing in AI platforms to formulate goal-specific beverages based on fitness, hydration, or relaxation needs

- This trend is enhancing consumer trust, diversifying product offerings, and expanding fusion beverages into mainstream wellness and sports nutrition segments

What are the Key Drivers of Fusion Beverage Market?

- Health-conscious lifestyles post-pandemic are driving the adoption of beverages that combine hydration with added benefits such as vitamins, amino acids, or plant-based enhancers

- In March 2024, Coca-Cola launched its Ayataka Wellness line in Asia, combining green tea with ginseng and adaptogens to target cognitive and metabolic health

- The rise of e-commerce, direct-to-consumer (DTC) models, and personalized subscription services are making fusion drinks more accessible and increasing brand engagement

- Premiumization trends and rising disposable income are supporting the uptake of functional fusions in emerging markets, especially among Gen Z and millennials

- Innovations in RTD (ready-to-drink) formats and smart packaging are further elevating convenience and boosting on-the-go consumption

- These drivers are pushing the fusion beverage market into both functional food and personalized wellness ecosystems

Which Factor is challenging the Growth of the Fusion Beverage Market?

- One major challenge is consumer skepticism due to exaggerated health claims and inconsistent labeling, which affects trust and leads to brand switching

- A 2023 study by the Functional Beverage Alliance found that 31% of consumers were unsure if fusion drinks deliver on their claimed benefits, posing a barrier to long-term loyalty

- Regulatory complexity, especially regarding the approval of functional ingredients and health claims, slows innovation and market entry for new formulations

- Cost sensitivity remains an issue in price-sensitive markets where premium fusion drinks may be perceived as luxury or non-essential items

- There is also growing concern around sustainability and ingredient sourcing, with consumers demanding eco-friendly packaging and transparent supply chains

- To sustain growth, the industry must focus on scientifically-backed claims, third-party certifications, and inclusive product lines that cater to broader dietary needs

How is the Fusion Beverage Market Segmented?

The market is segmented on the basis of type and distribution channel.

• By Type

On the basis of type, the fusion beverage market is segmented into Carbonated Drinks, Fused Tea and Coffee, Fruit Juices, Fusion Alcoholic Beverage, Energy Drinks, Sports Drinks, and Others. The Fruit Juices segment dominated the market with the largest revenue share of 28.9% in 2024, driven by growing consumer preference for natural fruit blends combined with added vitamins, minerals, and functional extracts. Their appeal as a healthy, on-the-go refreshment option positions them strongly in both wellness and casual consumption categories.

The Fused Tea and Coffee segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the rising trend of caffeinated wellness beverages that offer antioxidant benefits, adaptogens, or nootropics. These hybrid drinks are gaining traction among millennials and Gen Z looking for alternatives to traditional sodas or plain coffee.

• By Distribution Channel

On the basis of distribution channel, the fusion beverage market is categorized into Off-Trade and On-Trade. The Off-Trade segment held the largest revenue share of 61.4% in 2024, supported by widespread availability across supermarkets, hypermarkets, convenience stores, and online platforms. The convenience of home consumption and bulk buying options contribute to its dominance.

Meanwhile, the On-Trade segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for fusion beverages in cafes, bars, fitness centers, and quick-service restaurants. Premium positioning, experiential consumption, and innovative mixology are key factors fueling this segment’s growth.

Which Region Holds the Largest Share of the Fusion Beverage Market?

- North America dominated the global fusion beverage market with a dominant revenue share of 54.65% in 2024, supported by strong consumer demand for functional drinks, clean-label nutrition, and fitness-oriented formulations

- The growth is driven by the popularity of hybrid beverages that combine hydration with protein, adaptogens, and vitamins, especially among fitness enthusiasts and wellness-focused consumers

- The presence of major players such as PepsiCo (KeVita), Glanbia Nutritionals, and Nestlé Health Science, along with a well-established sports nutrition infrastructure, boosts innovation and product accessibility

U.S. Fusion Beverage Market Insight

The U.S. remains the largest contributor within North America, driven by increasing demand for on-the-go, goal-specific beverages such as energy-infused waters, protein coffee, and recovery drinks. Rising health consciousness, personalized wellness goals, and DTC subscription services are fueling market expansion. Fusion beverages that cater to popular trends such as low-carb, high-protein, and plant-powered are gaining traction across age groups, including older consumers seeking anti-aging and mobility benefits.

Europe Fusion Beverage Market Insight

Europe is witnessing steady growth, backed by regulatory encouragement for functional food innovation and a strong preference for organic, low-lactose, and natural beverages. Consumers in countries such as Germany, France, and the U.K. increasingly favor beverages enriched with probiotics, herbal extracts, and sustainable ingredients. European brands are emphasizing clean labels and ethical sourcing, aligning with the region’s eco-conscious consumer base.

U.K. Fusion Beverage Market Insight

U.K. market is thriving due to rising demand for low-sugar, fortified, and plant-enhanced beverages supporting weight management and metabolic health. Government initiatives promoting healthy lifestyle choices have led to reformulated drinks that are high in protein and free from artificial additives. Urban youth and fitness communities are driving consumption of RTD (ready-to-drink) fusion shakes, vitamin waters, and infused plant-milk blends.

Germany Fusion Beverage Market Insight

In Germany, demand for high-purity, lactose-free, and clean-label beverages is driving the expansion of the fusion beverage segment. Consumers prefer drinks that combine protein, immunity boosters, and functional herbs, especially in convenient formats such as single-serve bottles and sachets. The aging population and growing interest in clinical nutrition and sustainable living are supporting demand for premium functional drinks.

Which Region is the Fastest Growing in the Fusion Beverage Market?

Asia-Pacific is projected to register the fastest CAGR of 12.36% from 2025 to 2032, fueled by rapid urbanization, rising income levels, and growing awareness of functional and wellness beverages. Increasing adoption of fitness and sports nutrition, coupled with the expansion of digital retail, is making fusion beverages more accessible in key markets such as China, India, and Japan. The region's youthful population and focus on preventive health are accelerating demand for adaptogen-infused, vitamin-rich, and RTD functional drinks.

Japan Fusion Beverage Market Insight

In Japan, consumer preferences are shifting toward compact, clean, and multifunctional beverages, aligning with the country’s focus on longevity, minimalism, and well-being. Collagen-rich and electrolyte-infused beverages are gaining traction, along with anti-fatigue and cognitive-support drinks tailored to working professionals and seniors. Japan’s affinity for premium quality and convenience supports the growth of functional fusion beverages in single-serve formats.

China Fusion Beverage Market Insight

China emerged as the largest contributor in Asia-Pacific in 2024, driven by a large health-conscious demographic and strong growth in the functional drinks and protein-based snacks segment. The rise of millennials and Gen Z consumers adopting fitness lifestyles and digital wellness platforms is boosting sales of flavored fusion drinks and immunity-boosting shots. Local and international players are leveraging TCM-inspired ingredients and AI-backed personalization tools to expand market reach and meet evolving consumer expectations.

Which are the Top Companies in Fusion Beverage Market?

The fusion beverage industry is primarily led by well-established companies, including:

- The Coca-Cola Company (U.S.)

- PepsiCo (U.S.)

- Danone (France)

- ZICO Rising, Inc. (U.S.)

- Otsuka Holdings Co., Ltd. (Japan)

- Lucozade Ribena Suntory Limited (U.K.)

- Fusion Formulations (U.S.)

- Nutricane Beverages Pvt. Ltd. (India)

- The Kraft Heinz Company (U.S.)

- Unilever (U.K./Netherlands)

- Monster Energy Company (U.S.)

- MYX DRINKS (U.S.)

- Barry Callebaut (Switzerland)

- Organicobeverages (U.S.)

What are the Recent Developments in Global Fusion Beverage Market?

- In February 2024, the Taiwanese fusion beverage brand Milksha inaugurated a new outlet inside Taipei 101, the tallest skyscraper in Taiwan. This strategic expansion aims to increase brand visibility and capture foot traffic from both locals and international tourists. This move strengthens Milksha’s presence in premium urban locations and aligns with its strategy of upscale market positioning

- In August 2023, Jupiter Wellness, Inc. finalized the acquisition of Safety Shot, a U.S.-based company. Through this deal, it gained control of GBB Drink Lab Inc.’s assets, including the patented formula and clinical data for Safety Shot, the world’s first fast-acting blood alcohol detox drink. The acquisition supports Jupiter Wellness’s entry into the functional beverage space with a unique, scientifically-backed product

- In June 2023, Canadian brand Tim Hortons launched a creative summer fusion beverage collection featuring bold, unconventional mixes—such as Red Bull paired with cucumber syrup—designed to refresh and energize. This product innovation reflects the brand’s commitment to exploring unique flavor profiles to attract younger, trend-driven consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fusion Beverage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fusion Beverage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fusion Beverage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.