Global Greek Yogurt Market

Market Size in USD Billion

CAGR :

%

USD

8.60 Billion

USD

19.82 Billion

2024

2032

USD

8.60 Billion

USD

19.82 Billion

2024

2032

| 2025 –2032 | |

| USD 8.60 Billion | |

| USD 19.82 Billion | |

|

|

|

|

What is the Global Greek Yogurt Market Size and Growth Rate?

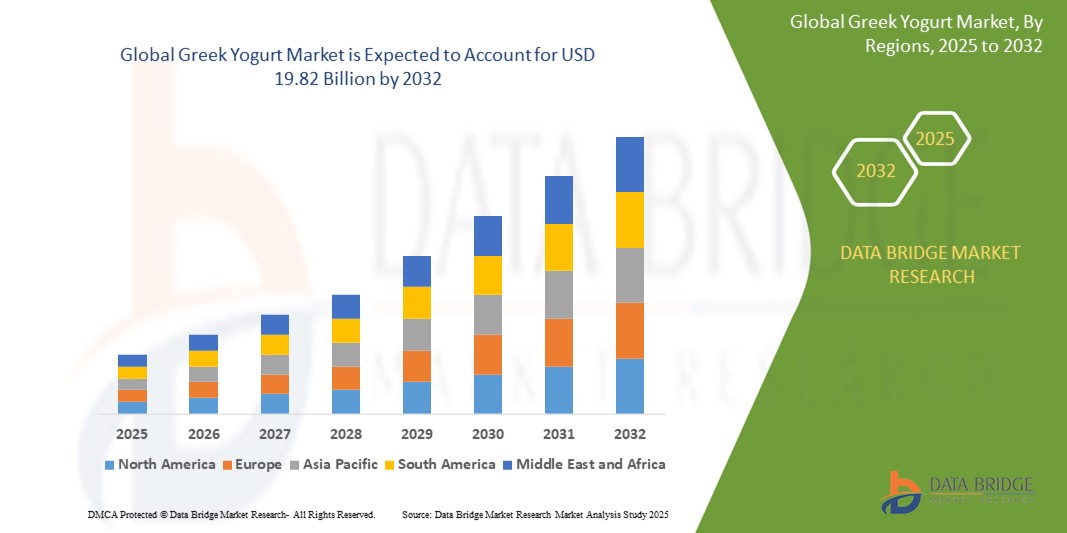

- The global greek yogurt market size was valued at USD 8.60 billion in 2024 and is expected to reach USD 19.82 billion by 2032, at a CAGR of 11.00% during the forecast period

- Consumer preferences are changing, and a high demand for clean-label foods is driving market growth. The growing focus on health and wellness has led consumers to choose Greek yogurt as a nutritious snack or meal option

- The popularity of Mediterranean and Middle Eastern diets, where yogurt is a staple, has contributed to the increasing demand for greek yogurt. Companies in the yogurt industry have been introducing new flavors, packaging, and product formulations to attract consumers

What are the Major Takeaways of Greek Yogurt Market?

- One of the key factors driving the market is a shift in consumer health consciousness and dietary preferences toward healthy and nutrient-rich food products. Greek yoghurt has grown in popularity among consumers as the consumption of fat-free and weight-management products has increased

- Greek yoghurt is widely used in the meal preparation and as a sweet snack mixed with fruits in countries such as the U.S., Mexico, and Canada

- Europe dominated the greek yogurt market with the largest revenue share of 37.8% in 2024, driven by high consumer demand for protein-rich, health-focused dairy products and the region's long-standing preference for yogurt as a daily dietary staple

- Asia-Pacific greek yogurt market is projected to grow at the fastest CAGR of 22.4% from 2025 to 2032, fueled by rising health awareness, rapid urbanization, and increasing disposable incomes in countries such as China, India, and Japan

- The Full-Fat Greek Yogurt segment dominated the greek yogurt market with the largest market revenue share of 48.7% in 2024, driven by its rich texture, creamy taste, and higher satiating capacity

Report Scope and Greek Yogurt Market Segmentation

|

Attributes |

Greek Yogurt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Greek Yogurt Market?

“Innovative Product Development with Functional Health Benefits”

- A significant and accelerating trend in the global greek yogurt market is the continuous innovation in product formulations to incorporate functional health benefits beyond basic nutrition. Manufacturers are developing greek yogurts enriched with probiotics, protein, vitamins, and plant-based ingredients to cater to the rising demand for wellness-oriented dairy products

- For instance, Chobani launched its “Complete” range of greek yogurt fortified with essential amino acids and probiotics, designed to support digestive health and muscle recovery. Similarly, Danone’s Oikos Pro line offers high-protein greek yogurt targeting fitness-conscious consumers seeking convenient nutrition

- Many greek yogurt products are now positioned as functional foods addressing health concerns such as gut health, immunity, and weight management. For instance, yogurts fortified with specific probiotic strains or added vitamins appeal to health-conscious demographics, while low-sugar, high-protein options cater to consumers following specific diets such as keto or high-protein regimen

- This trend is further fueled by growing awareness of the link between diet and overall well-being, especially post-pandemic. Consumers are increasingly seeking convenient, nutrient-dense snack options that align with their health goals, making functional Greek Yogurt products a preferred choice

- As demand for multifunctional food grows, brands such as FAGE, Chobani, and Danone are investing heavily in R&D to introduce novel Greek Yogurt variants with enhanced nutritional profiles and functional benefits, driving product differentiation and premiumization within the market

- The push towards functional, better-for-you greek yogurt offerings is expected to significantly reshape consumer expectations, with product innovation and health-focused positioning becoming critical for market competitiveness

What are the Key Drivers of Greek Yogurt Market?

- The increasing consumer focus on health, wellness, and protein-rich diets is a primary driver for the growing popularity of greek yogurt, renowned for its high protein content, probiotic benefits, and nutritional density

- For instance, in March 2024, General Mills’ Yoplait introduced New Greek yogurt products with added fiber and reduced sugar content, tapping into the rising demand for healthier snacking options. Such strategic product launches are expected to propel market growth in the forecast period

- Furthermore, the surge in demand for convenient, on-the-go nutritious snacks, particularly among urban, working populations, is fueling the adoption of greek yogurt, available in single-serve formats ideal for busy lifestyles

- The expanding availability of plant-based greek yogurt alternatives, catering to lactose-intolerant, vegan, and flexitarian consumers, is also contributing to market expansion. Brands such as Silk and Alpro have introduced plant-based Greek-style Yogurts made from almond, coconut, or soy, broadening consumer appeal

- Growing consumer education on the benefits of gut health, immunity, and protein intake is further stimulating greek yogurt consumption across diverse demographics, from fitness enthusiasts to health-conscious families

Which Factor is challenging the Growth of the Greek Yogurt Market?

- The premium pricing associated with greek yogurt compared to traditional yogurt products poses a challenge to market penetration, especially in price-sensitive regions or among lower-income consumer groups

- For instance, in emerging markets, the relatively high cost of imported or branded greek yogurt often limits its accessibility to affluent urban populations, restricting overall market growth. Local production initiatives are underway to address this but scaling remains a challenge

- In addition, supply chain fluctuations, including the rising costs of dairy inputs, transportation, and packaging materials, have contributed to elevated retail prices for greek yogurt products, further impacting affordability for some consumers

- Another hurdle is the consumer perception of greek yogurt’s taste and texture, with some individuals finding it too thick or tangy compared to traditional yogurt. Overcoming these sensory barriers through product reformulation and flavor innovations is essential to widen consumer adoption

- While product affordability is gradually improving with private-label and local brand offerings, overcoming pricing concerns, enhancing sensory appeal, and expanding distribution in developing regions will be critical for unlocking the full growth potential of the greek yogurt market

How is the Greek Yogurt Market Segmented?

The market is segmented on the basis of product, flavor, category, and application.

- By Product

On the basis of product, the greek yogurt market is segmented into Full-Fat Greek Yogurt, De-Fat Greek Yogurt, and Fat-Free Greek Yogurt. The Full-Fat Greek Yogurt segment dominated the Greek Yogurt market with the largest market revenue share of 48.7% in 2024, driven by its rich texture, creamy taste, and higher satiating capacity. Full-Fat Greek Yogurt is popular among consumers following low-carb or keto diets, as well as those seeking indulgent yet protein-rich snack options. The presence of healthy fats in full-fat varieties also appeals to health-conscious consumers looking for minimally processed, nutrient-dense products.

The Fat-Free Greek Yogurt segment is expected to witness the fastest growth rate of 19.5% from 2025 to 2032, fueled by rising demand from calorie-conscious consumers and individuals managing weight or cardiovascular health. The low-calorie, high-protein profile of fat-free greek yogurt makes it a preferred option for fitness enthusiasts and those seeking healthier dairy alternatives without compromising on protein intake.

- By Flavor

On the basis of flavor, the greek yogurt market is segmented into Unflavored, Vanilla, Strawberry, Blueberry, Raspberry, Blends, and Others. The Unflavored segment accounted for the largest market revenue share of 41.3% in 2024, driven by its versatility and preference among health-conscious consumers who use Greek Yogurt as a base for both sweet and savory dishes. unflavored greek yogurt is also widely used in culinary applications such as dips, marinades, and sauces, further boosting demand.

The Blends segment is projected to witness the fastest CAGR from 2025 to 2032, supported by innovation in flavor combinations that appeal to evolving consumer palates. Blended greek yogurts, featuring combinations of fruits, nuts, and natural sweeteners, cater to consumers seeking variety, indulgence, and added nutritional benefits, driving segment growth.

- By Category

On the basis of category, the greek yogurt market is segmented into Organic and Conventional. The Conventional segment dominated the greek yogurt market with the largest market revenue share of 67.8% in 2024, owing to its widespread availability, competitive pricing, and established consumer base. Conventional greek yogurt is readily accessible across supermarkets, convenience stores, and foodservice outlets, making it the preferred choice for mainstream consumers.

The Organic segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by rising health awareness, clean label trends, and growing demand for dairy products free from synthetic additives, hormones, and GMOs. The premium positioning of organic greek yogurt appeals to health-conscious and environmentally aware consumers, contributing to market expansion.

- By Application

On the basis of application, the greek yogurt market is segmented into Children and Adults. The Adults segment accounted for the largest market revenue share of 76.4% in 2024, fueled by high protein demand, fitness trends, and the growing popularity of Greek Yogurt as a meal replacement or healthy snack among working adults and gym-goers. The versatility of greek yogurt in breakfast, smoothies, and cooking further boosts consumption among this demographic.

The Children segment is expected to witness the fastest growth rate of 17.9% from 2025 to 2032, supported by rising parental focus on nutrition, the introduction of child-friendly packaging, and product innovations with appealing flavors. Greek Yogurt enriched with probiotics and essential nutrients is increasingly being marketed as a convenient, healthy snack option for children, promoting segment growth.

Which Region Holds the Largest Share of the Greek Yogurt Maret?

- Europe dominated the greek yogurt market with the largest revenue share of 37.8% in 2024, driven by high consumer demand for protein-rich, health-focused dairy products and the region's long-standing preference for yogurt as a daily dietary staple

- Consumers across Europe increasingly value the nutritional benefits, digestive health support, and convenience offered by greek yogurt products, particularly amid growing health awareness and wellness trends

- The region’s mature dairy industry, coupled with widespread product availability across supermarkets, specialty stores, and foodservice channels, further strengthens the market's position. In addition, the rising popularity of organic and plant-based greek yogurt alternatives contributes to sustained market expansion across key European markets

Germany Greek Yogurt Market Insight

The Germany greek yogurt market accounted for the largest revenue share in Europe in 2024, fueled by the country's strong health-conscious consumer base and preference for high-protein, functional foods. German consumers show increasing interest in clean-label, probiotic-rich Greek Yogurt products that support digestive health and active lifestyles. The expanding retail presence of both domestic and international Greek Yogurt brands, coupled with demand for organic and environmentally sustainable dairy options, further supports market growth.

U.K. Greek Yogurt Market Insight

The U.K. greek yogurt market is anticipated to grow at a significant CAGR during the forecast period, supported by the increasing demand for convenient, nutritious snacks, and the influence of fitness and wellness trends. The market benefits from strong product innovation, with an emphasis on low-sugar, high-protein, and plant-based Greek Yogurt variants catering to diverse dietary preferences. The expansion of Greek Yogurt offerings across major retailers and foodservice outlets is further driving consumer accessibility and market growth.

France Greek Yogurt Market Insight

The France greek yogurt market is expected to witness steady growth, driven by the country's rich dairy heritage and increasing consumer preference for authentic, high-quality yogurt products. French consumers show a growing inclination towards protein-rich, indulgent snacks with health benefits, making Greek Yogurt a preferred option. The rise of organic and locally sourced dairy products aligns with evolving consumer expectations, promoting further market expansion.

Which Region is the Fastest Growing in the Greek Yogurt Market?

Asia-Pacific greek yogurt market is projected to grow at the fastest CAGR of 22.4% from 2025 to 2032, fueled by rising health awareness, rapid urbanization, and increasing disposable incomes in countries such as China, India, and Japan. The demand for protein-rich, convenient, and functional food options is rising across the region, driving Greek Yogurt consumption among health-conscious and urban consumers. In addition, the expanding availability of affordable Greek Yogurt products through supermarkets and e-commerce platforms further accelerates adoption.

China Greek Yogurt Market Insight

The China greek yogurt market accounted for the largest revenue share within Asia Pacific in 2024, supported by the country's expanding middle-class population, growing health consciousness, and the influence of Western dietary trends. Greek Yogurt is gaining popularity among Chinese consumers seeking high-protein, low-sugar dairy products for digestive health and weight management. The strong presence of domestic manufacturers and the increasing penetration of imported premium brands contribute to market growth.

India Greek Yogurt Market Insight

The India greek yogurt market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and heightened consumer focus on protein intake and digestive health. The market benefits from growing product availability across retail chains and online platforms, alongside aggressive marketing by domestic dairy companies and multinational brands. The emergence of flavored and functional Greek Yogurt options tailored to local preferences further propels consumer demand.

Japan Greek Yogurt Market Insight

The Japan greek yogurt market is gaining momentum, supported by the country's aging population, high awareness of health and wellness, and strong preference for convenient, nutrient-dense snacks. Japanese consumers value Greek Yogurt for its digestive benefits, high protein content, and suitability as part of a balanced diet. Product innovations featuring probiotics, low sugar content, and unique flavors are contributing to sustained market expansion across the country.

Which are the Top Companies in Greek Yogurt Market?

The greek yogurt industry is primarily led by well-established companies, including:

- NutraDry (Australia)

- Batory Foods (U.S.)

- Kanegrade (U.K.)

- Paradise Fruits (Germany)

- Aarkay Food Products Ltd (India)

- FutureCeuticals (U.S.)

- NutriBotanica Institutional (Brazil)

- La Herbal (India)

- Saipro Biotech Private limited (India)

- International Flavors & Fragrances Inc (U.S.)

- Iprona SpA (Italy)

- Schilling Ltd (Denmark)

- The Australian Superfood Co (Australia)

What are the Recent Developments in Global Greek Yogurt Market?

- In October 2024, Chobani unveiled its new Chobani High Protein range of Greek yogurt cups and drinks, made with real fruit and natural ingredients, completely free from added sugar. The yogurt cups deliver 20 grams of protein, while the drinks come in 15, 20, and 30-gram options. All products are lactose-free and contain no protein powders, preservatives, or concentrates. The yogurt cups were launched across U.S. retailers in November, followed by the drinks in January 2025. This product expansion is expected to strengthen Chobani's position in the high-protein, health-focused dairy market

- In September 2024, Hain Celestial Group introduced a wide range of seasonal, better-for-you snacks and beverages in the U.S. for the fall season, including Garden Veggie Snacks Apple Straws, Earth's Best Sunny Days Snack Bars, and Greek Gods Honey Yogurt, among others. These products were rolled out across major retailers such as Walmart, Amazon, Target, and specialty stores. This strategic launch reinforces the company's commitment to healthier snacking and dairy choices for consumers

- In November 2022, TWO GOOD, a leading player in the food and beverage sector, launched a new range of on-the-go cultured dairy drinks made from real fruit puree, containing no artificial sugars. The smoothies were introduced in three flavors: peach, strawberry-banana, and mixed berry. This launch reflects TWO GOOD's dedication to offering healthier, convenient dairy alternatives

- In July 2022, CP-Meiji expanded its product portfolio in Thailand by introducing a unique spoonable yogurt infused with nata de coco and flavored with orange. This product combines refreshing citrus notes with the chewy texture of coconut jelly, offering consumers a distinct and satisfying yogurt experience. The new product is widely available at convenience stores such as 7-Eleven, enhancing accessibility for Thai consumers seeking innovative dairy products

- In February 2022, Starbucks South Korea debuted its first plant-based yogurt beverage, the Pine Coco Green Yogurt Blended, marking a significant milestone in its vegan product lineup. The company announced plans to expand the availability of its vegan yogurt-based offerings to around 1,500 locations across South Korea. This initiative aligns with Starbucks' broader sustainability goals and growing consumer demand for plant-based alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Greek Yogurt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Greek Yogurt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Greek Yogurt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.