Global High Pulsed Power Market

Market Size in USD Billion

CAGR :

%

USD

4.80 Billion

USD

45.60 Billion

2024

2032

USD

4.80 Billion

USD

45.60 Billion

2024

2032

| 2025 –2032 | |

| USD 4.80 Billion | |

| USD 45.60 Billion | |

|

|

|

|

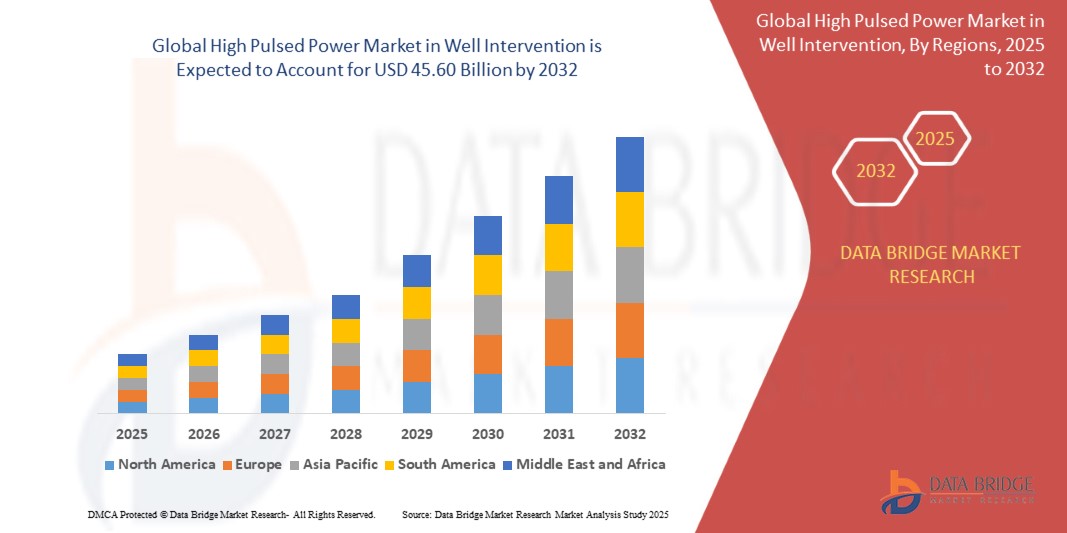

High Pulsed Power Market in Well Intervention Size

- The global high pulsed power market in well intervention was valued at USD 4.80 billion in 2024 and is expected to reach USD 45.60 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 32.50%, primarily driven by increasing demand for efficient and cost-effective oil and gas extraction technologies

- This growth is driven by advancements in pulse power systems for enhanced wellbore stimulation and the growing need for reservoir optimization

High Pulsed Power Market in Well Intervention Analysis

- The high pulsed power market in well intervention is experiencing significant growth as the oil and gas industry seeks advanced technologies for enhanced well performance and efficiency. This market is witnessing increased adoption due to technological advancements in pulsed power systems, growing demand for cost-effective well stimulation techniques, and the need for environmentally sustainable intervention solutions

- Market expansion is driven by factors such as rising deep water and offshore drilling activities, increased focus on optimizing well productivity, and the development of high-energy pulsed power solutions for hydraulic fracturing, perforation, and reservoir stimulation

- For instance, major oilfield service companies are investing in high-energy pulsed power technology to improve perforation techniques, enhance wellbore cleaning, and optimize production efficiency in challenging reservoir conditions

- Although the high pulsed power market in well intervention is still evolving, its potential is vast. While developed regions lead in adopting high-energy pulsed power systems, emerging markets are increasingly recognizing their value in enhancing oil recovery and extending the operational life of aging wells

Report Scope and High Pulsed Power Market in Well Intervention Segmentation

|

Attributes |

Urban Air Mobility Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

High Pulsed Power Market in Well Intervention Trends

“Growing Adoption of Pulsed Power Technology for Precision Perforation”

- A significant trend in the high pulsed power market in well intervention is the increasing use of pulsed power technology for precision perforation, improving well productivity and reducing formation damage. This technology enables controlled energy release, optimizing fracture initiation and reservoir connectivity

- Companies are leveraging high-energy pulsed power systems to enhance wellbore cleaning, minimize rock fragmentation issues, and improve hydrocarbon flow efficiency, leading to better well stimulation outcomes and cost savings

- For instance, in 2024, leading oilfield service providers such as SLB and Halliburton expanded their adoption of pulsed power-based perforation systems, improving well completion efficiency and reducing environmental impact

- This trend is reshaping the well intervention industry by offering safer, more effective, and energy-efficient perforation techniques, addressing the growing demand for sustainable and high-performance oil and gas recovery solutions

High Pulsed Power Market in Well Intervention Dynamics

Driver

“Increasing Demand for Efficient Well Stimulation Technologies”

- The growing need for efficient and cost-effective well stimulation technologies is driving the expansion of the high pulsed power market in well intervention. As oil and gas reservoirs become more complex, companies seek innovative pulsed power solutions to enhance well productivity and extend asset life

- Pulsed power systems are proving effective in reservoir stimulation, wellbore cleaning, and formation fracturing, providing a non-invasive and energy-efficient alternative to conventional intervention methods

- The push for higher production rates and reduced operational costs is prompting oilfield service providers to invest in advanced pulsed power technologies, improving hydrocarbon recovery while minimizing environmental impact

For instance,

- In March 2024, Halliburton launched a next-generation pulsed power perforation system, designed to improve well stimulation efficiency and minimize formation damage

- In December 2023, Baker Hughes partnered with a leading technology firm to integrate AI-driven pulsed power systems, optimizing well intervention strategies and enhancing operational safety

- In October 2023, ADNOC Drilling expanded its use of pulsed power technology for deepwater well stimulation, improving hydrocarbon flow efficiency and reducing intervention time

- The adoption of high-energy pulsed power solutions is expected to increase significantly, as oil and gas operators prioritize cost-effective, high-performance well stimulation technologies to maximize recovery and ensure long-term well integrity

Opportunity

“Growing Adoption of High Pulsed Power Technologies for Deepwater and Unconventional Wells”

- The increasing demand for efficient and non-invasive intervention techniques in deepwater and unconventional oil and gas reservoirs is creating significant growth opportunities for the high pulsed power market in well intervention

- As the industry shifts towards more complex and harder-to-reach reserves, pulsed power technologies are emerging as a cost-effective alternative for well stimulation, perforation, and reservoir enhancement, reducing reliance on conventional hydraulic fracturing methods

- Advancements in high-energy pulse generation, electromagnetic stimulation, and plasma-based interventions are enabling oil and gas companies to enhance production efficiency while minimizing environmental impact

For instance,

- In March 2024, SLB introduced a next-generation pulsed power stimulation system designed for deepwater applications, improving well performance with minimal formation damage

- In November 2023, Halliburton announced a collaboration with ExxonMobil to deploy pulsed power-assisted perforation techniques in unconventional shale formations, enhancing hydrocarbon recovery

- In September 2023, Baker Hughes expanded its portfolio of high-energy pulsed power solutions, focusing on sustainable intervention techniques for offshore and ultra-deepwater reservoirs

- As oil and gas companies continue to explore challenging geological formations, the adoption of high pulsed power technologies is expected to accelerate, offering a sustainable and high-efficiency alternative for well intervention and reservoir stimulation

Restraint/Challenge

“High Initial Investment and Cost Barriers in High Pulsed Power Technology”

- The high pulsed power market in well intervention faces significant cost challenges due to the high initial investment required for advanced pulsed power equipment, specialized infrastructure, and skilled workforce training

- Manufacturing, integration, and maintenance costs for high-energy pulsed power systems are substantial, making it difficult for small and mid-sized oilfield service providers to adopt these technologies at scale

- The lack of widespread cost-effective solutions and limited financial incentives further slows market penetration, as companies prioritize proven, lower-cost well intervention techniques over expensive high pulsed power alternatives

For instance,

- In January 2024, a leading oil and gas services provider postponed plans for high pulsed power adoption due to budget constraints and high operational expenses

- In November 2023, an offshore drilling company in the North Sea reported financial difficulties in deploying high pulsed power tools, citing high procurement and maintenance costs

- In September 2023, a major energy research institute highlighted concerns over the cost-benefit ratio of pulsed power well stimulation compared to conventional methods, delaying broader industry adoption

- Overcoming cost-related barriers through technological innovations, economies of scale, and financial incentives will be crucial to making high pulsed power solutions more accessible and commercially viable for widespread well intervention applications.

High Pulsed Power Market in Well Intervention Scope

The market is segmented on the basis of components, well types, power ranges, and applications.

|

Segmentation |

Sub-Segmentation |

|

By Components

|

|

|

By Well Types |

|

|

By Power Ranges |

|

|

By Applications |

|

High Pulsed Power Market in Well Intervention Regional Analysis

“Asia-Pacific is the Dominant Region in the High Pulsed Power Market in Well Intervention”

- Asia-Pacific leads the global high pulsed power market in well intervention, driven by increasing oil and gas exploration activities, rising energy demand, and technological advancements in well stimulation techniques

- China and India are at the forefront of market expansion, with significant investments in unconventional oil and gas resources, alongside the adoption of high-energy pulsed power technologies for enhanced well productivity

- The region's dominance is further strengthened by government initiatives, a growing focus on energy security, and the integration of advanced well intervention methods to optimize hydrocarbon recovery

“North America is projected to register the Highest Growth Rate”

- North America is expected to witness the highest growth in the high pulsed power market in well intervention, driven by increasing shale gas exploration and the adoption of advanced well stimulation technologies

- The region’s investments in enhanced oil recovery (EOR) techniques and government support for domestic energy production will accelerate market expansion

- Major players in North America are focusing on high-energy pulsed power solutions to improve well efficiency and reduce operational costs, with rapid technological advancements and favorable regulatory frameworks driving growth

High Pulsed Power Market in Well Intervention Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SLB (U.S.)

- Halliburton Company (U.S.)

- China Oilfield Services Limited (China)

- Weatherford (Switzerland)

- Baker Hughes Company (U.S.)

- Vallourec (France)

- NOV (U.S.)

- Scientific Drilling International (U.S.)

- Oceaneering International, Inc. (U.S.)

- Expro Group (U.K.)

- Hunting PLC (U.K.)

- Archer Ltd (Norway)

- Welltec A/S (Denmark)

- TechnipFMC plc (U.K.)

- OneSubsea (U.S.)

- GE Vernova (U.S.)

- Blue Spark Energy Inc. (U.S.)

- Stangenes Industries Inc. (U.S.)

- Pulsed Power Japan Laboratory Ltd. (Japan)

- APELC (U.S.)

- Ness Engineering Ltd (U.S.)

- AEG Power Solutions (Germany)

- Dale Power Solutions (U.K.)

- Galaxy Wire & Cable, Inc. (U.S.)

- HELUKABEL USA, Inc. (U.S.)

- Lapp Tannehill (U.S.)

Latest Developments in Global High Pulsed Power Market in Well Intervention

- In December 2024, SLB signed an advanced technology framework agreement with OAO Gazprom to enhance hydrocarbon exploration and development efficiency. This collaboration includes forming a Joint Working Group to identify and implement technology projects while providing training for Gazprom personnel

- In September 2024, SLB partnered with ADNOC Drilling to accelerate the U.A.E.'s unconventional oil and gas program, aiming to complete 144 wells by the end of 2025. This joint venture focuses on integrated drilling solutions and digital capabilities to enhance operational efficiency

- In May 2024, SLB OneSubsea and Subsea7 entered a long-term strategic collaboration agreement with Equinor for the Wisting and Bay Du Nord projects. This partnership facilitates early engagement throughout the project cycle to enhance economic viability and efficiency in subsea developments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.